12 Oct, 2020 Canadian pipeline sector continues to adopt conservative strategies due to prolonged economic uncertainty, says GlobalData

Posted in Oil & GasThe COVID-19 pandemic has disrupted the oil and gas sector leading to a sharp fall in fuel prices coupled with an over-abundant supply of oil and gas. Pipeline operators in Canada have been forced to reduce their capital expenditure (capex) for the year 2020. Despite capex prioritization to conserve cash, Canadian pipeline operators might still look to analyze the current market conditions and build strategies around operational readiness, while seeking to capitalize on new business opportunities, says GlobalData, a leading data and analytics company.

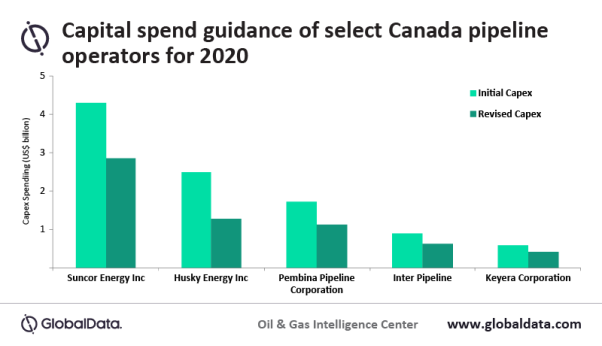

Haseeb Ahmed, Oil and Gas analyst at GlobalData, comments: “Suncor Energy, Pembina Pipeline Corp, Keyera Corp, and Inter Pipeline have all taken off around a third of their initially planned expenditure for this year.”

Pembina Pipeline Corp, has decided to put off the expansion plans of Pembina Peace Expansion VII, VIII and IX projects. Keyera Corp has delayed the construction schedule of its Key Access Pipeline System, likely pushing the start of the project by a year to 2023.

Ahmed concludes: “The oil and gas pipeline sector in Canada has encountered losses in a very short span due to the rise of pandemic that destabilized the demand and supply equilibrium. Merely reducing the expenditure or delaying upcoming projects to plug losses may well be a short-term solution but may not suffice to sustain business in the long run. As a result, the pipeline operators are expected to amend strategies or invest in disruptive technology that can save pipeline companies from going bankrupt and immunize them from any such challenges in future.”