Auto OEMs Turn to Vertical Integration for Electric Vehicle Batteries

-

In 2020, there were 9.1 million advanced battery fitments, while electric vehicle production stood at 2.7 million

-

Despite the struggles it faced during the pandemic, the automotive industry reported a staggering annual increment of 50% in 2020 in both EV sales & Battery fitments

-

LG Energy Solutions and CATL are leading the battery technology sector, while companies such as QuantumScape are attempting to disrupt

Auto OEMs Turn to Vertical Integration for Electric Vehicle Batteries

In 2021, the automotive sector had an opportunity to redefine its products. Closing net-zero targets, stringent fuel efficiency requirements, and government encouraging green transportation led to an increasing focus on electric vehicles.

The auto industry is moving increasingly to vertical integration in the wake of the recent challenges, including the current shortage of semiconductors. While motor production is primarily handled in-house by OEMs, the production of battery cells for electric vehicles is carried out through joint ventures and partnerships with suppliers. Recently, there has been a flurry of activity on this front. SsangYong Motor, a South Korean automaker, partnered with BYD Co Ltd, a new-age battery tech company backed by Warren Buffet. Daimler’s Mercedes-Benz brought equity stake in Automotive Cells Company, a joint venture set up by Stellantis and TotalEnergies.

Growing Market Adoption of EVs

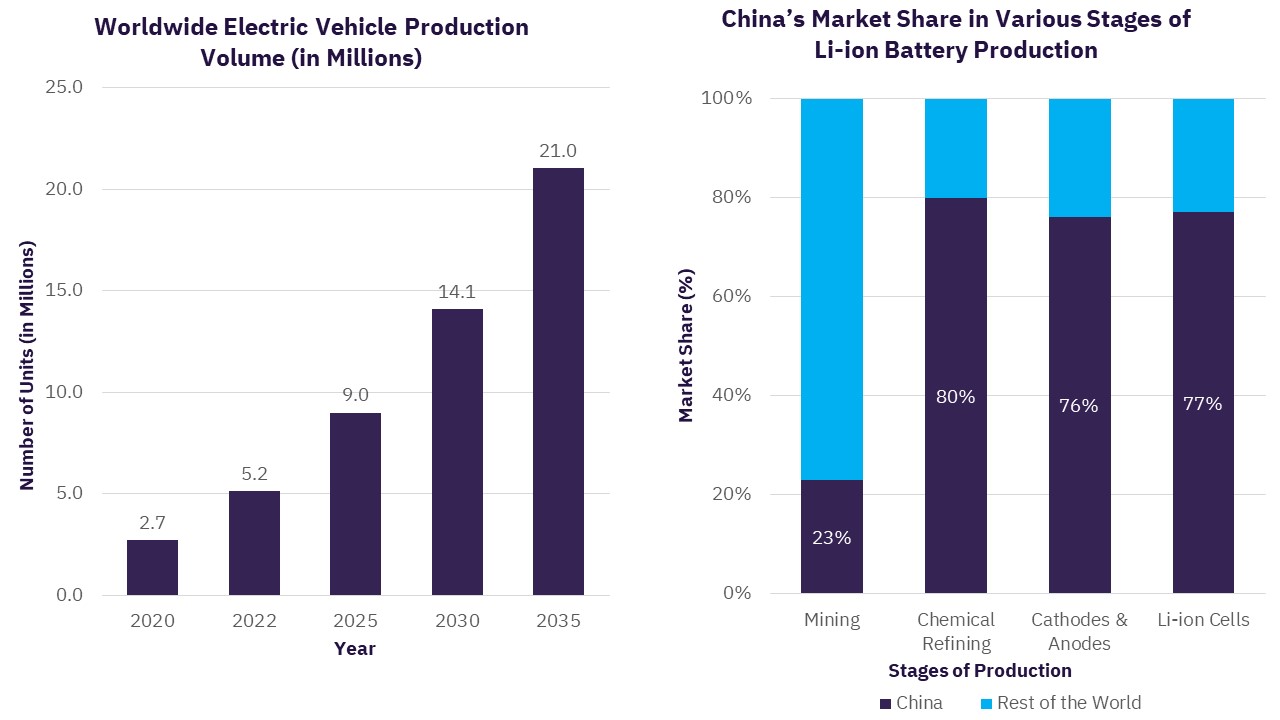

The global unit sales of electric vehicles in 2020 increased 50% compared with that in 2019. GlobalData estimates that global electric vehicle production will increase four-fold by 2025 to more than 10.6 million units and reach 23.6 million units by 2030, accounting for 22.1% of the total light electric vehicle market. Increasing demand, fuel prices, and various government initiatives continue to nudge people toward electric vehicle adoption, which will increase the need for performance improvement and securing sufficient supplies.

Battery Technology – Piggybacking the EV market

GlobalData estimates the worldwide fitment of advanced batteries to jump from 9.1 million units in 2020 to nearly 73 million by 2035. The major players in electric battery technology are LG Energy Solution, CATL, Panasonic, BYD Co Ltd., and Samsung SDI.

LG Energy Solution – Traditional South Korean Conglomerate Leading New Business

LG Energy Solution has a robust technology and chemical footprint, a critical factor in its leading global battery technology position. The automotive industry considers LG a reliable battery supplier, evident in its strategic partnerships. Next-generation General Motors redefines itself in EV space, and it has LG as a leading battery supplier. Honda also joined LG’s battery venture. Hyundai Motor Group and LG Energy solutions started constructing new plants in Indonesia for battery manufacturing. It also has a presence in Tesla’s supply chain as one of the two suppliers and CATL.

CATL – China’s Quintessential Battery Leader

Contemporary Amperex Technology Co., Ltd is the largest Chinese lithium-ion battery manufacturer and the second-largest behind LG Energy Solution. CATL’s production capacity in 2020 stood at 109 GWh. It has several critical OEM supply relationships, including Daimler, BMW, Toyota, Tesla, and Chinese automakers, including FAW, Geely, BAIC, Dongfeng, and SAIC.

The Chinese leadership in the electric vehicle supply chain market has another dimension. China has the largest electric vehicle fleet with 4.5 million vehicles and dominates lithium-ion battery production. Owing to its government’s determination that battery electric vehicles are strategically important, China moved ahead of other countries to secure the necessary supply of raw materials and production capacity.

Other Major Players

Countries such as South Korea, China, and Japan have a high concentration of the major players in the battery sector. Toyota & Tesla Inc have secured Japanese battery manufacturer Panasonic as a supplier. Volkswagen, Stellantis & BMW have a coeval presence of Samsung SDI in value chains, making it one of the critical suppliers of batteries. Daimler, Volvo, Honda, and Toyota have special deals with BYD, an emerging Chinese battery player, enhancing its stature worldwide.

Support from firms such as Berkshire Hathaway to BYD highlights the growth potential of start-ups such as QuantumScape, Solid Power, SES, and Blue Solutions trying to disrupt the market with next-generation cell technology, including solid-state batteries. Apart from investing heavily in the joint-ventures and partnerships to ensure supplies, OEMs such as Tesla, Volkswagen, Stellantis, General Motors, and Ford are also expanding through multi-billion dollar investments to insource hundreds gigawatt-hours of cells annually. These investments will help lower costs and exert more control over quality and performance. In the years ahead, the path for traditional battery manufacturers appears optimistic, but with these challenges and unfolding developments, it will be a bumpy ride.

Related Data & Insights

Related Companies

Germany

Japan

Netherlands

United States of America

Germany

Germany

South Korea

China

United States of America

Germany

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward