UnitedHealth Group Acquires LHC Group for $5.4 Billion

-

UnitedHealth Group, the largest health insurer in the US, acquired LHC Group for $5.4 billion in cash

-

This acquisition is the largest M&A deal in the healthcare sector in the US for the first quarter of 2022

-

In 2021, a similar deal was made when Humana, the health insurance giant, acquired Kindred Healthcare for $5.7 billion

UnitedHealth Group Acquires LHC Group for $5.4 Billion

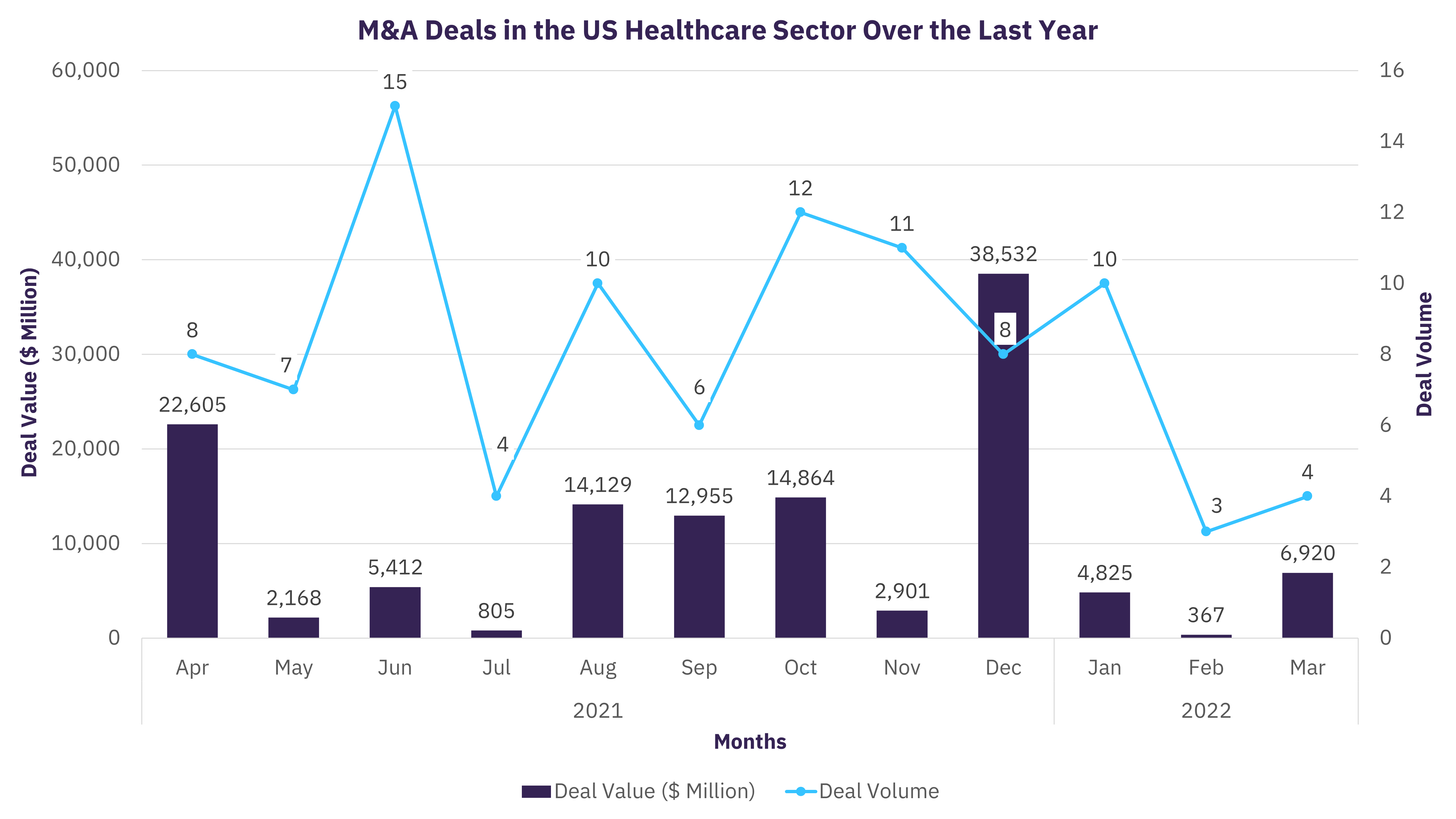

The largest US healthcare insurance company, UnitedHealth Group, will acquire home healthcare provider LHC Group for $5.4 billion in cash. UnitedHealth Group has two primary business units: the UnitedHealthcare platform, which provides health care coverage and benefits, and the Optum platform, which offers information technology-enabled health services. LHC Group is an in-house healthcare service provider. According to GlobalData's Deals database, the acquisition of LHC by UnitedHealth was the largest M&A deal in the healthcare sector in the US in the first quarter of 2022.

The acquisition is expected to be completed in the second half of 2022, subject to regulatory approval, shareholders' support, and other closing conditions. The acquisition of LHC Group and merging LHC's operations with population health-focused platform Optum indicates a strategic shift by UnitedHealth to home-based care since more and more health care services shifted to home as a result of the COVID-19 pandemic.

Humana's Acquisition of Kindred Healthcare

According to GlobalData's Deals database, in 2021, Humana, the other leading player in the US healthcare insurance sector, acquired Kindred Healthcare for $5.7 billion. Kindred Healthcare's brand Kindred at Home is now being merged with CenterWell, a Humana brand. Kindred at Home provides senior-focused primary care, home health, and other services. The acquisition ensures that Humana can provide in-home healthcare services such as personalized in-home care from clinicians and home-based care services. The CenterWell brand also aims at providing a better experience not only to patients and their families but also to frontline clinicians.

Owens & Minor Acquires Apria

In January 2022, the healthcare logistics company, Owens & Minor, announced that it would acquire Apria, a provider of home healthcare equipment and in-home clinical services, for $1.6 billion. With this acquisition, Owens & Minor intends to capitalize on its existing supply chain and market reach to create a single-source healthcare delivery for patients, as many seek to move away from conventional hospital care to in-home care.

Healthcare companies: Home Healthcare is the future

The acquisitions made by the major players in the healthcare industry in the US signal an unparalleled change in the way healthcare is delivered to the older generation, indicating that home-based care is on the rise yet again. As a result of the COVID-19 pandemic, more and more people have shifted to home-based care. The trend will likely continue in the years ahead with the delivery of these services such as home health, hospice, home- and community-based healthcare services. As other major industries have been subject to disruption following the pandemic, the healthcare industry is expected to undergo changes in the manner in which its business is carried out.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward