Ukraine - Latest Country to Legalize Cryptocurrency

-

Ukraine recently announced the legalization of cryptocurrencies but has restricted their use as legal tender

-

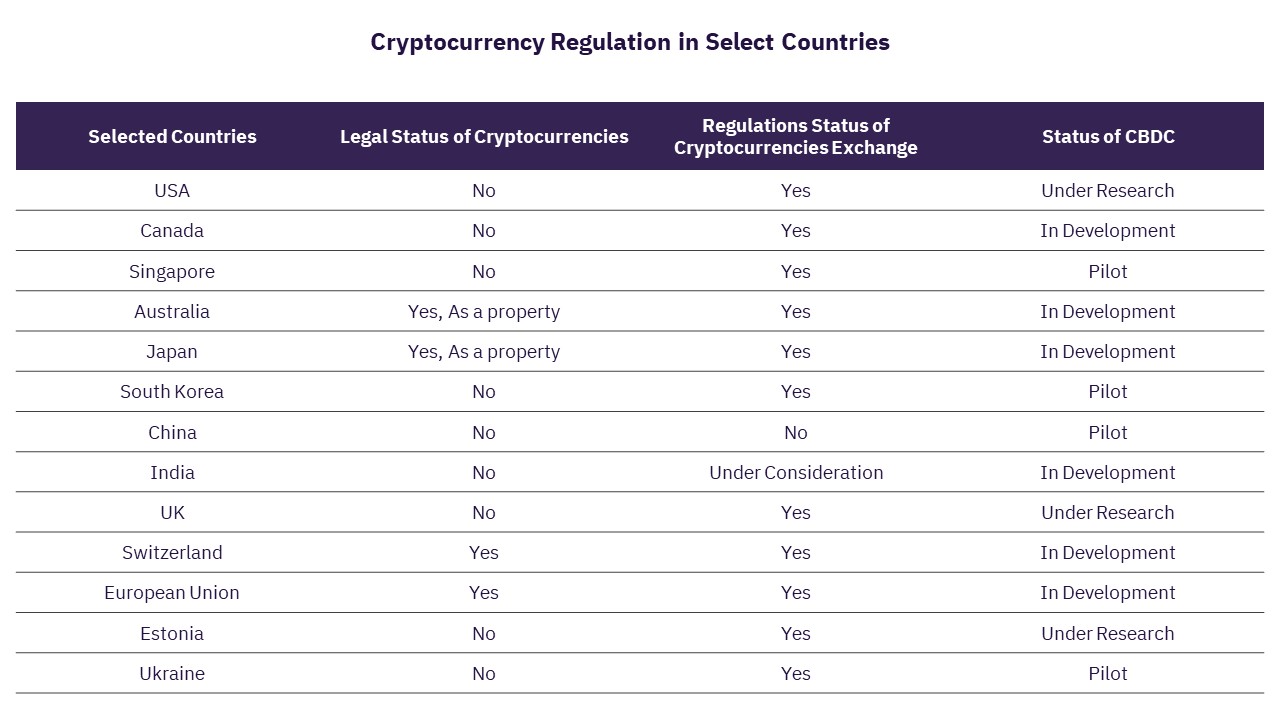

Different countries have taken different stances on cryptocurrency regulations, for instance, Australia and Japan legalized crypto as property, whereas the US, the UK, and Canada do not consider crypto as legal tender

-

India recently introduced taxation on cryptocurrencies and has announced the roll-out of digital currency or digital rupee regulated by RBI

Ukraine - Latest Country to Legalize Cryptocurrency

In 2009, bitcoin was introduced as a decentralized peer-to-peer system, which saw tremendous growth over the last decade. It led to the creation of a novel set of payment services known as "cryptocurrencies." Cryptocurrency and associated products and services witnessed phenomenal growth in recent years, from once obscure to now becoming mainstream. With the outbreak of the COVID-19 pandemic, the rise in digital payments and the growing demand for cryptocurrencies are forcing governments to take note of cryptocurrencies. On February 17, 2022, Ukraine became the latest country to legalize cryptocurrency. The recently passed bill protects businesses and investors against crypto-related fraud but does not recognize bitcoin or other forms of cryptocurrencies as legal tender.

Ukraine – A Crypto Leader

Ukraine is considered one of the leading hubs in the crypto market in Europe. According to Chainalysis, Ukraine ranks fourth on the Global Crypto Adoption Index, which measures the volume and value of crypto traded in a country. Furthermore, according to New York Times, Ukraine processes more transactions per day in cryptocurrency than in its fiat currency, hryvnia. Ukraine Parliament passed the bill to legalize cryptocurrencies to protect investors' assets from possible abuse or fraud. According to Ukraine Deputy Prime Minister and Minister for Digital Transformation Mykhailo Fedorov, "Market participants will receive legal protection and the opportunity to make decisions based on open consultations with government agencies. There will appear a transparent mechanism for investing in a new asset class."

Need for Regulation

Regulation of cryptocurrencies is essential as it safeguards investors against market manipulation, online fraud, and cybersecurity risk, and allows the government to monitor activities such as money laundering. Many countries have taken different stands on cryptocurrency regulations; for instance, Australia and Japan have already set up crypto exchanges. Banks in these countries, such as Commonwealth Bank in Australia, already started trading cryptocurrencies. On the contrary, countries such as India and China have not yet considered cryptocurrencies such as bitcoin and ethereum legal but have started taxing these digital assets, putting cryptocurrencies in a grey area.

Recently, IMF called for a global regulatory framework for crypto. According to the report, "Crypto's cross-sector and cross-border remit limits the effectiveness of national approaches. Countries are taking very different strategies, and existing laws and regulations may not allow for national approaches that comprehensively cover all elements of these assets. Importantly, many crypto service providers operate across borders, making the task of supervision and enforcement more difficult. Uncoordinated regulatory measures may facilitate potentially destabilizing capital flows."

Most countries are planning to introduce Central Bank Digital Currencies (CBDC) issued by respective central banks to have more control in implementing monetary policies to provide stability, control growth, manage inflation, and protect against volatilities in cryptocurrencies. India recently announced that it intends to introduce a CBDC named Digital Rupee, issued by the Reserve Bank of India. The US Fed and People's Bank of China also plan to introduce digital currency. Bahamas, Nigeria, and eastern Caribbean countries have already launched CBDCs mostly for retail purposes, while countries such as Canada, Brazil, and India are developing CBDCs. As the cryptocurrencies market is growing, so is the need to have regulations for these virtual assets.

Related Data & Insights

Related Companies

United States of America

China

United States of America

United States of America

France

Spain

China

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward