International Jewelers Shying away from Russian Diamonds

-

Richemont and Pandora have left the Responsible Jewellery Council as the group members failed to suspend the Russian company’s memberships over their role in the Russia-Ukraine conflict

-

Tiffany & Co., Chopard, and Signet have announced to stop buying diamonds from Russia as pressure was mounting on them to cut supplies from Russian companies

-

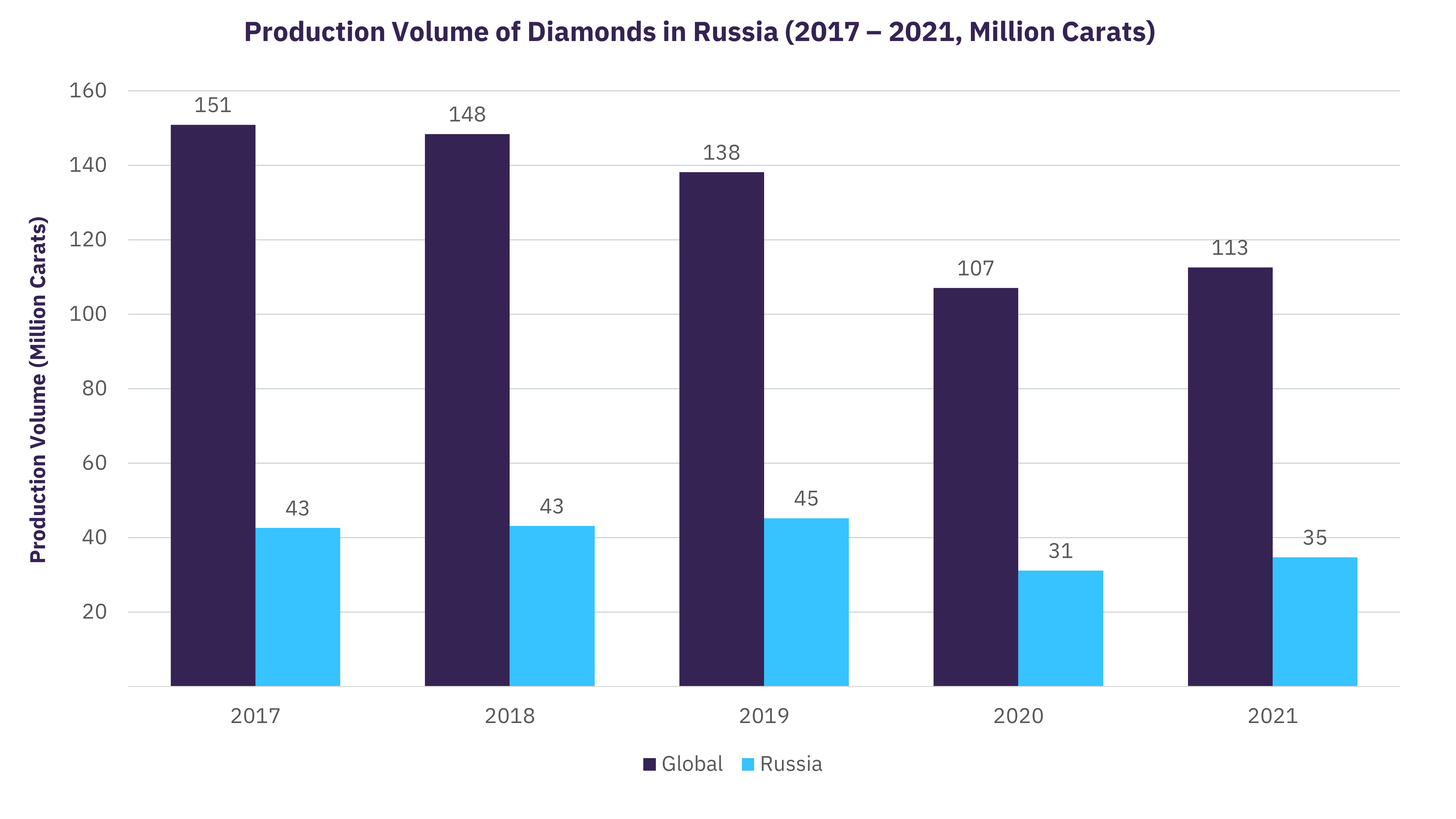

Almost one-third of global diamond production comes from Russia. In 2021, the market volume of diamond production in Russia was 35 million carats, a YoY increase of 13%

International Jewelers Shying away from Russian Diamonds

The world’s major luxurious diamond jewelry brands will not be buying Russian-origin diamonds following strict scrutiny over Russia's state-controlled diamond companies and their role in the Russia-Ukraine conflict. The move comes after the US government has banned imports of non-industrial diamonds of Russian origin.

Rising Questions on Responsible Jewellery Council

On March 30, 2022, Richemont, the maker of Cartier jewelry, and Pandora, a Danish jewelry manufacturer & retailer, have left the Responsible Jewellery Council (RJC), an international jewelry trade group, as the group members failed to suspend the Russian company’s memberships. Furthermore, Pandora has urged all its suppliers to avoid buying raw materials from Russia. RJC is a global membership and standards organization that promotes responsible jewelry throughout the supply chain, from mine to retail. Its members include Russian ALROSA world’s largest diamond miner in terms of volume.

Russian Dominance in the Diamond Market

Almost one-third of global diamond production comes from Russia. In 2021, the market volume of diamond production in Russia was 35 million carats, a YoY increase of 13%. ALROSA, a partially Russian state-owned company, is a global leader in diamond mining, with 22 operational mines mainly in Sakha, Arkhangelsk, Murmansk, and Irkutsk regions. Its revenue has increased by 50% to $4.5 billion in 2021. There were growing doubts that trading with partially state-owned Russian diamond miners would financially aid the Russian state and may be used to support Russia's invasion of Ukraine and the jewelers might avoid sanctions by importing processed Russian stones through India which imported pearl, precious stones, and semiprecious stones from Russia worth $671 million in 2021-22.

Top Luxury Jewelers avoiding Russian Diamond

Earlier, Tiffany & Co., Chopard, and Signet have announced to stop buying diamonds from Russia as pressure was mounting on them to cut supplies from Russian companies. Tiffany & Co. is a subsidiary of LVMH Moet Hennessy Louis Vuitton specialized in designing, manufacturing, and selling jewelry made of diamond, platinum, gold, and other precious metals. Its primary suppliers of rough diamonds are DeBeers, Rio Tinto, ALROSA, and Arctic Canadian Diamond Company, and will stop buying from ALROSA. Chopard, a Swiss watch and jewelry maker, has stated that to achieve sustainable luxury it should procure the stones from responsible sources. Signet, the world's largest retailer of diamond jewelry, said that it will source precious metals ethically and will avoid supplies from the sanctioned nations.

The move from the international jewelers will impact every step of the diamond supply chain which includes mining, cutting, polishing, and trading. Consequently, Russian diamond mining and India’s diamond cutting & polishing market would be hampered by the decisions. There would also be a surge in diamond prices given the speculated supply crunch. Moreover, it also raises the question of diamond traceability to ensure responsible practices at every stage.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward