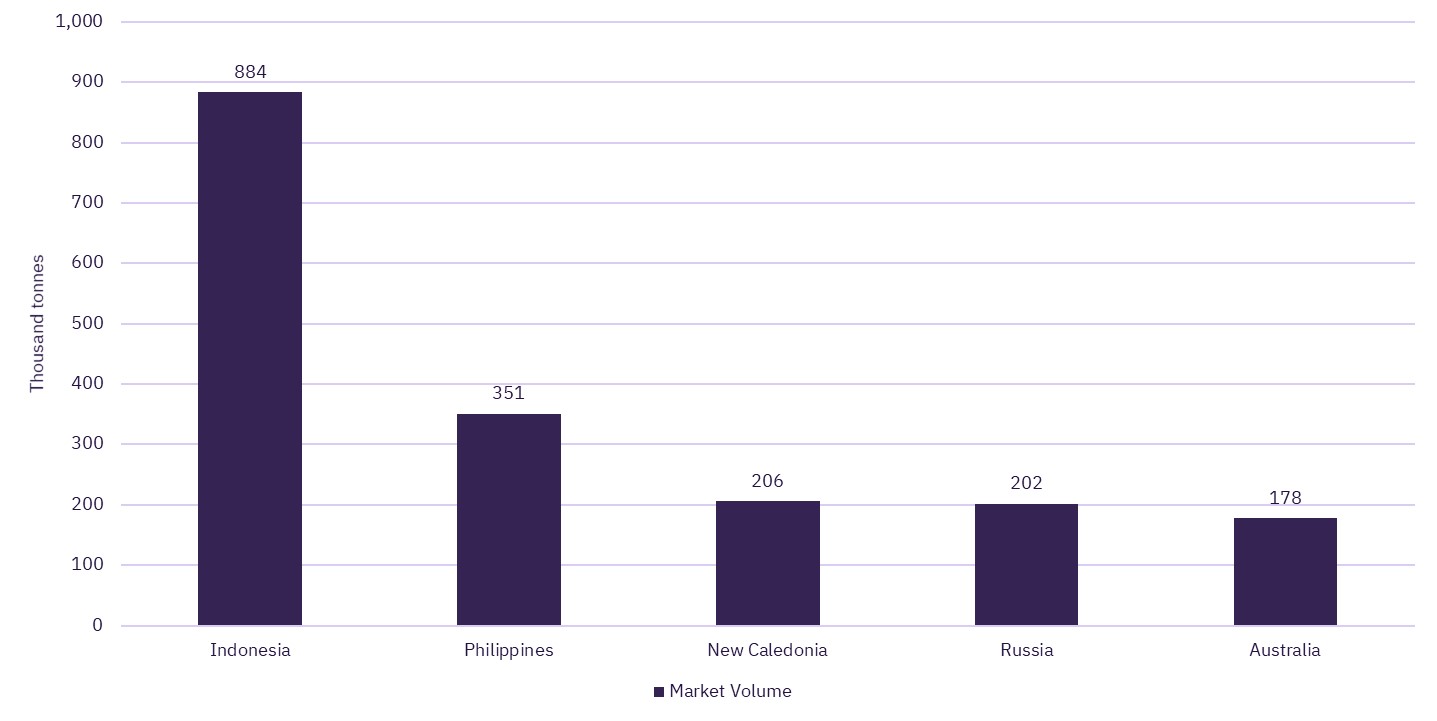

Top Five Nickel Producing Countries (Thousand Tonnes, 2021)

-

Indonesia, Philippines, New Caledonia, Russia, and Australia were the top five Nickel producing countries (by volume) in 2021

-

Indonesia was the leading Nickel producing country (by volume) in 2021, with a Nickel production of 883.8 thousand tonnes, up 16.3% YoY

-

Philippines ranked second (by volume in 2021) with a Nickel production of 351.1 thousand tonnes (up 5.1% YoY), with the other three countries (New Caledonia, Russia, and Australia) cumulatively produced 586.3 thousand tonnes of Nickel in 2021

Top Five Nickel Producing Countries (Thousand Tonnes, 2021)

Increasing energy demands worldwide pose a greater threat towards the climate and the Paris Agreement’s goal of reaching climate neutral world by 2050. Combatting climate change forces, the world to switch to low-carbon sources of energy. To achieve the climate-neutral target, companies are reducing operating emissions, reducing coal output, increasing investment in low-carbon metals like copper, cobalt, nickel, and lithium. Nickel is primarily used for stainless production, which is used in the construction, automotive, and consumer goods sectors.

Global nickel mine production reached 2,427.4 thousand tonnes (kt) in 2021, up by 6.8% over 2020, after registering an estimated 4.2% decline that year, amid the COVID-19 pandemic. In 2021, the top five nickel-producing countries were Indonesia, the Philippines, New Caledonia, Russia, and Australia.

Indonesia is the leading contributor to the global supply in 2021, primarily due to the expansion of the domestic nickel industry and the development of the high-pressure acid leaching (HPAL) projects in the country. This will be followed by the Philippines, which lifted the ban on new mineral agreements in April 2021, which was imposed in 2012 for environmental violations. This is expected to pave the way for new mining projects and encourage more investments in the mining industry.

Australia’s production increased by 4.8%, supported by the ramp-up of First Quantum Minerals’ Ravensthorpe mine, which has been on care and maintenance since late 2017 and recommenced in the first quarter of 2020, amid low nickel prices. However, in Russia, production declined in 2021, which can be attributed to lower production from MMC Norilsk Nickel – the country’s largest nickel producer.

Looking ahead, nickel production over the forecast period is expected to grow at a compound annual growth rate (CAGR) of 3.0%, to reach 2,730.6 kt in 2025. Indonesia, Russia, Canada, and the Philippines will be the key contributors to this growth. Combined production in these countries is expected to increase from a forecasted 1,607kt in 2021 to 1,818.4 kt in 2025.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward