Amazon-MGM Deal Receives EU Antitrust Approval

-

EU antitrust approved the proposed $8.5 billion acquisition of MGM by Amazon, and Federal Trade Commission, the US antitrust agency, is expected to follow suit

-

Amazon's Prime Video service has more than 200 million subscribers globally

-

In terms of the number of subscribers, Netflix leads the OTT market

Amazon-MGM Deal Receives EU Antitrust Approval

On March 15, 2022, the EU antitrust approved the proposed $8.5 billion acquisition of Metro Goldwyn Mayer (MGM), one of the oldest Hollywood film studios, by Amazon Inc. (Amazon), a multinational technology company. After scrutinizing the agreement between Amazon and MGM, the EU antitrust regulators determined that it would not constitute a threat to competition due to the combined market shares being modest and the presence of strong competitors such as Netflix and Disney. The Federal Trade Commission, the US antitrust agency, is also likely to decide on the Amazon-MGM deal in the coming days.

Factors Influencing MGM Acquisition

MGM, also known for its iconic roaring lion logo, is one of the oldest film studios founded in April 1924. It had dominated the movie business with great hits such as "Gone with the Wind" and "Hamlet." MGM has the two most successful film franchises in cinema history: "James Bond" and "Rocky." The studio also produces content for television and owns the television network EPIX. "Vikings", "Shark Tank", and "The Voice" are some of the popular TV series produced by MGM.

Amazon will be able to show all the classic movies and popular TV shows from MGM on its video streaming platform Prime Video. By providing more diverse content to its subscribers, Amazon will be able to attract more subscribers to its platform. Prime Video has more than 200 million subscribers, almost close to its rival Netflix. Amazon aims to lead the streaming market by gaining a competitive advantage through acquisitions, getting licenses, and producing original content.

OTT Leaders

Currently, Netflix leads the US' over-the-top (OTT) subscription market with a 21% share of subscribers, followed by Amazon Prime Video (16%) and Disney+ (16%).

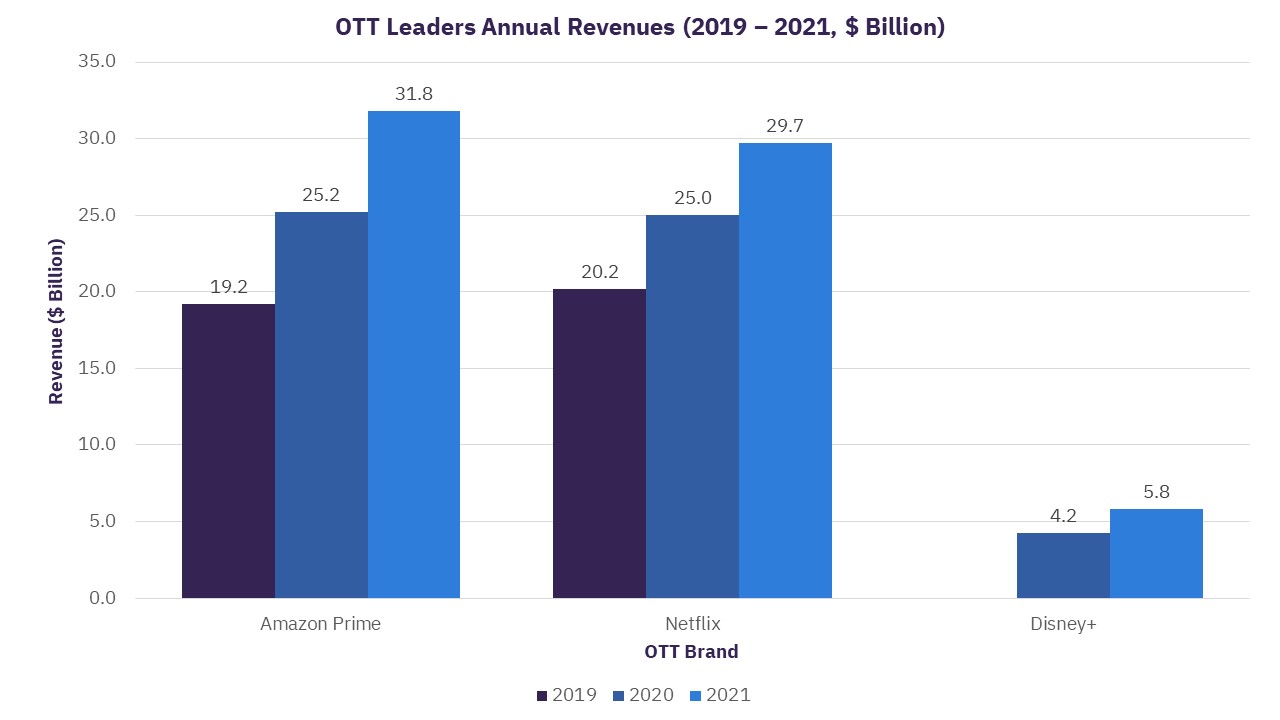

Amazon's Prime Video, an OTT platform, provides thousands of movies and TV shows in more than 200 countries with 100 channels such as HBO, SHOWTIME, and STARZ. It also has access to popular licenses such as a content deal with Warner Bros, a media and entertainment conglomerate, for several movies, including Batman, Conjuring, and Suicide Squad. In addition, it has self-published content under the name Amazon Originals. Prime Video service has more than 200 million subscribers globally, with revenue of $32 billion in 2021.

Netflix generated revenue of $30 billion in 2021 and operated in 190 countries, and the content is available in more than 30 languages. It includes internet entertainment services for watching movies and television shows. The company offers TV shows and films such as original series, documentaries, and feature films through an internet subscription on the TV, computer, and mobile devices. It licenses, acquires, and produces content, including original programming. In 2021, Netflix surpassed 200 million subscribers.

Disney+, a subsidiary of The Walt Disney Co, is a streaming platform that provides movies and shows from Disney, Pixar, Marvel, Star Wars, and National Geographic, among others. It is available in 64 countries and offers content in 21 languages. It has over 130 million subscribers globally, with $6 billion in revenue as of 2021.

Related Data & Insights

Related Companies

United States of America

Italy

United States of America

United States of America

United States of America

United Kingdom

United States of America

France

United States of America

France

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward