Global Chip Shortage Looms Large

-

US companies that rely on semiconductors report less than five days’ worth of supplies, according to the US Commerce Department

-

According to the US Commerce Department Report and recent GlobalData survey, chip shortage is expected to continue until 2022

-

Semiconductor chip shortages hindered production in “critical industries”

Global Chip Shortage Looms Large

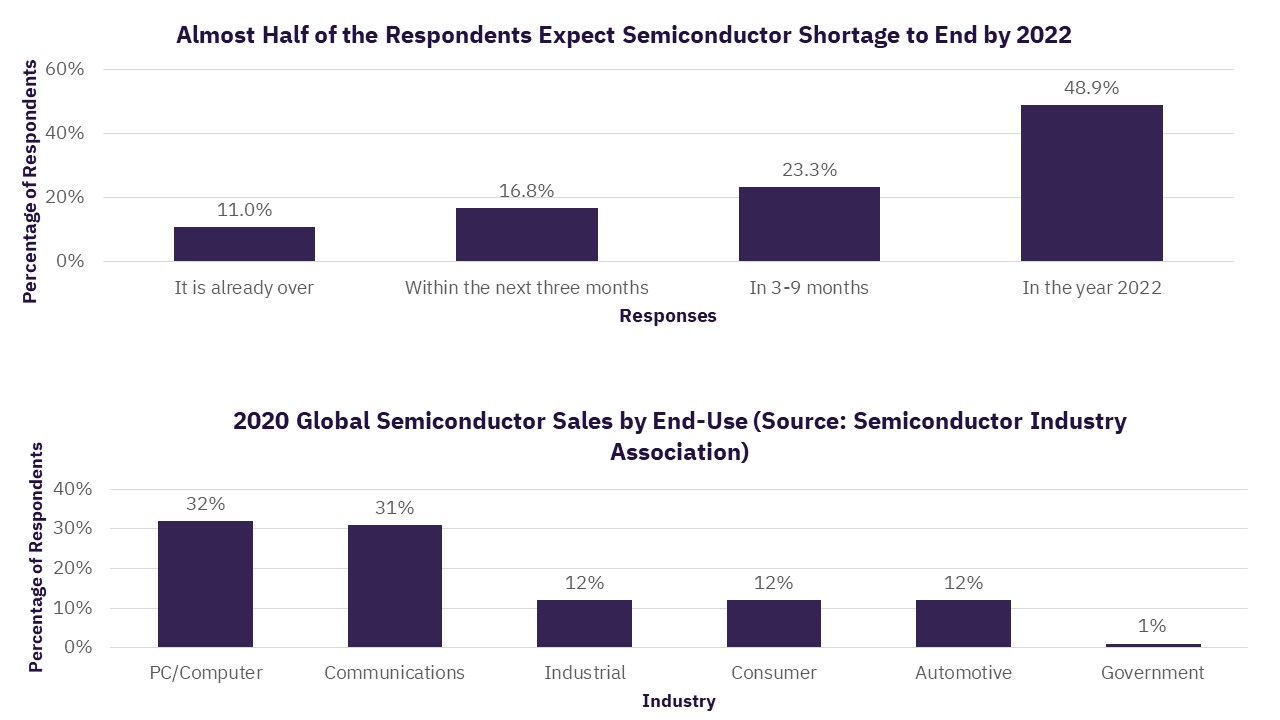

On January 25, 2022, the US Commerce Department published key findings from the Risks in the Semiconductor Supply Chain Request for Information (RFI) issued in September 2021. The RFI showed a massive gap between demand and supply of semiconductor chips, which is expected to continue at least for the next six months. It is also in line with the findings of a recent survey by GlobalData – nearly half of the respondents expect the shortage to be over by 2022.

However, according to recent earning calls, leading semiconductor chip manufacturers Intel, NVIDIA, and AMD suggested the shortage would continue until 2022 or 2023. The chip manufacturers have been facing raw material shortages even before 2020, but now the supply shortage has become critical. The findings based on 150 responses provided by major semiconductor and auto manufacturers show that the median chip inventory levels decreased from 40 days in 2019 to less than five days in 2021.

Causes of Semiconductor Chip Shortage

Global semiconductor chip shortages resulted from increased demand, which grew 17% in 2021 in comparison to that in 2019, while supply remained constrained. The demand has been spurred by the automotive and consumer electronics industries owing to consumer shift to semiconductor-intensive products such as electric vehicles, 5G, gaming PCs, graphic cards, and video game consoles.

COVID-19-related lockdowns resulted in the shutdown of manufacturing facilities that affected global inventories, fueled by the China-US trade war. In 2020, the US added China’s largest chip manufacturer Semiconductor Manufacturing International Corporation (SMIC) to the Entity List. The designation prevents Chinese acquisition of sensitive technology from the US. This restriction resulted in increased reliance on other companies such as Samsung and Taiwan Semiconductor Manufacturing Company Limited (TSMC), which are already operating at maximum capacity.

Extreme weather conditions also affected the supply. A winter storm in Texas in February 2021 forced a shutdown of production facilities owned by Samsung, NXP Semiconductors, and Infineon Technologies. Fire at Renesas Electronics Corporation’s semiconductor factory in Japan and energy shortages at TSMC also affected the supply.

“Critical Industries” Affected

According to the survey findings, the supply-demand mismatch is more concentrated around legacy logic chips, analog chips, and optoelectronic chips. These chips are used in “critical industries” such as automotive, medical devices, and broadband. The chip shortage has stymied production in these industries, with the automotive sector among the most affected. Despite strong demand, many OEMs slowed or delayed production.

Tackling the Shortage Issue

According to the findings, the semiconductor supply chain “remains fragile.” Since the shortage started in 2020, semiconductor manufacturers increased the use of their existing capacity significantly, operating at over 90% utilization in comparison to 80% in 2019. Already functioning at maximum capacity, the need for additional fab capacity remains the most significant constraint, which would require long-term solutions. Other restrictions include raw material shortages, assembly, and packaging capacity.

In recent times, the semiconductor industry witnessed increased investments. Intel announced a $20 billion expansion at its facility in Arizona. Texas Instruments plans to invest $30 billion to build four fabs. Samsung announced an investment of $17 billion for a new fab in Texas. Chip giant TSMC has planned to invest $100 billion over the next three years to increase capacity at its existing fabs. However, in the short term, the private sector is trying to solve challenges by improving supply chain management and using semiconductors optimally in production. There is a need to find creative solutions for the global chip shortage such as supply chain transparency, which will provide producers with a clear idea about the demand and assist consumers with the chip’s origination. As part of long-term partnerships, Ford and GlobalFoundries have established a collaboration to identify innovative methods to work on the future demand of chips.

To address the supply shortage over the long term, the US Commerce Department recommends bolstering the homegrown semiconductor chip manufacturing industry by urging the passage of the US Innovation and Competition Act. It includes the CHIPS Act, which provides $52 billion in subsidies for domestic semiconductor manufacturers.

Related Data & Insights

Related Companies

South Korea

Japan

Japan

United States of America

United States of America

United States of America

United States of America

United States of America

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward