Meta Stock Price Decline

-

Recent annual results by Meta discussed multiple external risks factors that affected the stock price

-

Saturated markets, intense competition, operational dependencies, and user privacy are the major concerns for Meta

-

These concerns can also become an opportunity for Meta to make future decisions

Meta Stock Price Decline

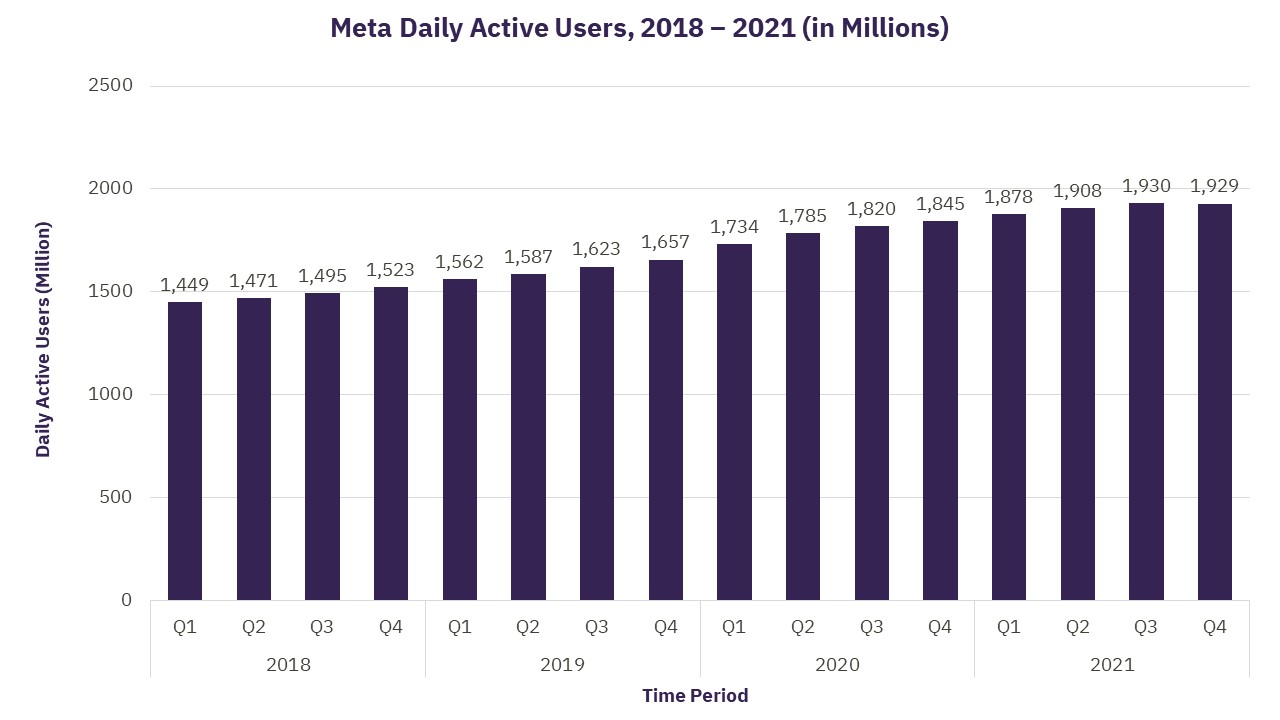

February 2022 was particularly not favorable for Meta. While 2021 ended on a high note, with Facebook rebranded as Meta and the launch of the Metaverse concept, the new year brought a series of unexpected downturns for the company. On February 3, 2022, Meta shares fell 26%, the worst one-day loss ever, after the company provided a weaker-than-expected revenue outlook. Now, with the evolving data protection regulations in Europe, Meta is rethinking its presence in Europe.

Slower Growth and Operational Dependency

Meta reported a stagnant daily active user growth rate in the fourth quarter of 2022. The company expects this rate to decline further as the active user base increases to the levels from where new user addition would look considerably smaller. Another major reason Meta attributes its slow growth to is the competition from new market entrants. Meta launched a short video product on its platforms to tackle the user growth stagnation, but it experienced fierce competition. TikTok (ByteDance), a short-video platform company, has already garnered 1 billion users on its short-video platform. YouTube Shorts, a short-video platform by tech giant YouTube, reached the milestone of 15 billion daily views in a year after launch. Meta has struggled to capture the market share of these players in short-video content territory.

Apple’s new privacy policy also affected the company’s revenue. According to the new privacy policy, Apple has made it harder for apps to track data for iPhone users. In the last earnings call, Meta estimated a loss of $10 billion in advertising revenue in 2022 due to the new policy by Apple. Given the new privacy policy, advertisers will be unable to track consumer digital habits and use this data to target them with ads for products they might be interested in. For context, advertising revenue accounted for 97% of the company’s revenue in 2021. This estimated revenue loss also underlined the high dependency of Meta platforms on other companies’ decisions.

User Privacy - A Constant Challenge

Meta has always encountered difficulties with user privacy. To deal with challenges surrounding user privacy, Meta created the Oversight Board, an independent body that oversees the content published on Facebook and Instagram. Recently, this body advised Meta to tighten rules on doxing, an act of publishing private or identifying information of an individual. As consumers are becoming aware of their data privacy, this suggestion can hamper the user perception if not addressed promptly.

The General Data Protection Regulation (GDPR), the European law that governs transatlantic data movement from Europe, forms a huge challenge for Meta. The GDPR created a set of guidelines for the collection and processing of personal data from individuals within the European Union. The European authorities are watchful of the data, as they consider it has the potential to become a national security issue or privacy issue for citizens. The individual countries within the EU are also developing regulations based on the GDPR. In 2020, Irish Data Protection Commission (IDPC) concluded that Meta’s contractual agreements for data use in Ireland do not align with GDPR and should be suspended. Meta foresees similar developments in various regions as the law evolves and amends. If the resulting changes are unfavorable for Meta, then it will affect its second-largest revenue-generating geography (~25% revenue in 2021).

However, these effects have also given Meta a helping hand. While the stock plunged, a few investors started considering Meta a “value” investment. While tech competitors such as Alphabet and Amazon showed growth in revenue, this collapse in Meta stock created a perception of value among investors. The crashed market capital might also help Meta to get out of the scope of the upcoming American antitrust bill for online platforms, which will keep a watch on high market capital companies and their practices to acquire competitors. At the same time, Meta can also focus on internal changes that are required. Apple’s policy has shown the company the importance of having its own ecosystem to reach the customer. This can decide Meta’s steps towards a futuristic metaverse project. These setbacks can act as a push for Meta to diversify its geographical concentration and create its ecosystem.

Related Data & Insights

Related Companies

United States of America

United States of America

United States of America

United States of America

United States of America

Germany

China

United States of America

China

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward