Netflix Reports Loss of Subscribers for the First Time in a Decade

-

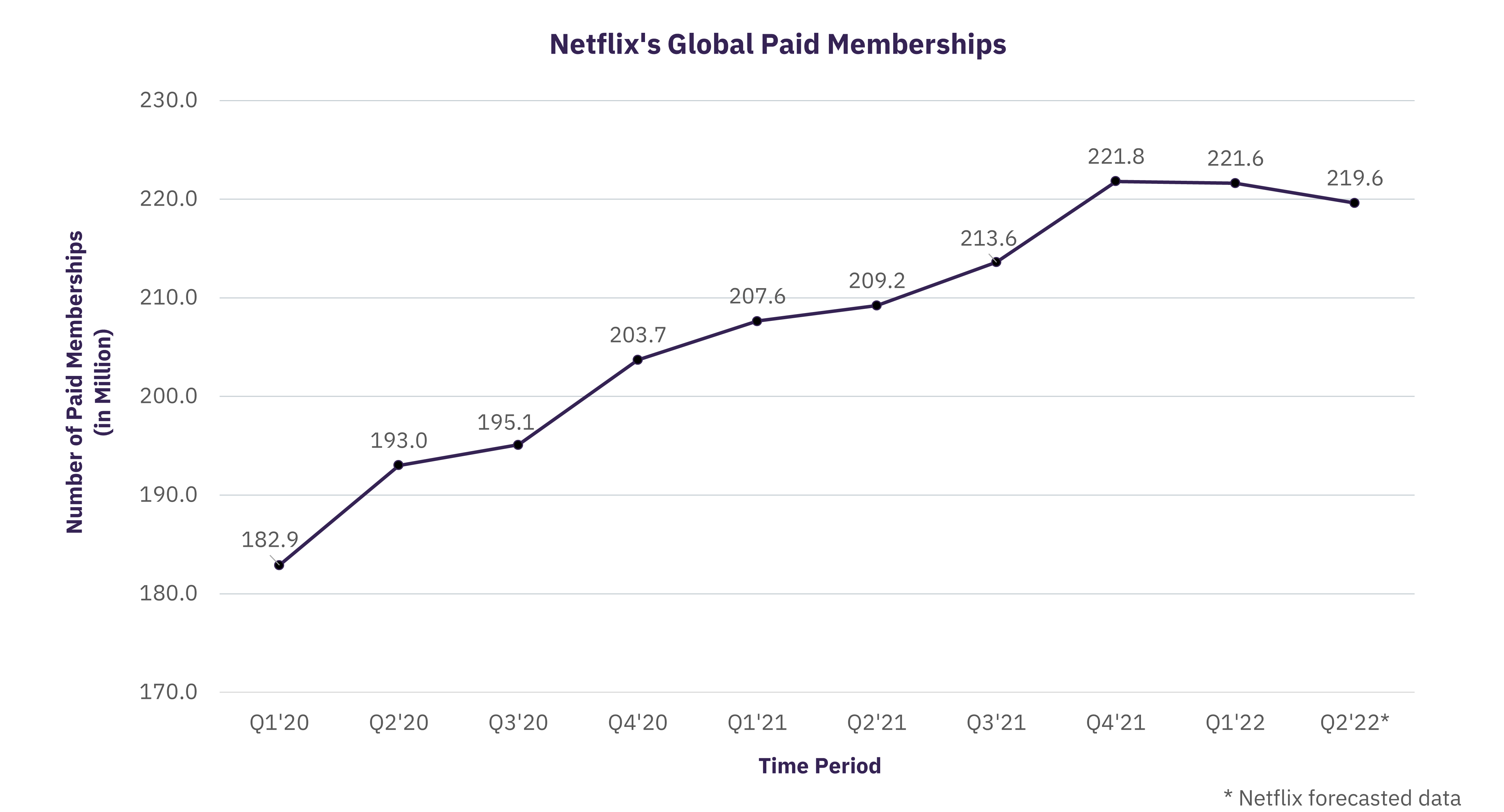

Netflix’s global paid memberships declined to 221.6 million, which amounted to a loss of 200,000 subscribers in the first quarter of 2022 due to rising inflation and growing competition.

-

The streaming industry is beset by the problem of sharing behavior with many paying subscribers sharing their accounts with friends and family. Though watched by about 322 million households, only 222 million households have Netflix membership.

-

Due to the Russian invasion of Ukraine, Netflix has suspended its service in Russia, which resulted in the loss of around 700,000 subscribers.

Netflix Reports Loss of Subscribers for the First Time in a Decade

On April 19th, 2022, Netflix reported a loss of 200,000 subscribers in the first quarter of 2022 and expects to lose 2 million subscribers in the next quarter. Rising inflation and growing competition in the streaming industry have resulted in the loss of subscribers.

Following the announcement, Netflix’s share price has fallen around 35% on Wednesday, April 20th. The news has also affected the share price of other entertainment-related stocks such as Walt Disney Co, which dropped 5.6% the same day.

Factors Influencing the Streaming Environment

Paying vs Sharing Households – The streaming market is affected by the practice of sharing as many paying subscribers share their accounts with their friends and family, which costs OTT service providers huge amounts. There are around 322 million households that have been using Netflix; however, only 222 million households have taken the subscription and the rest are using it free under account sharing. Netflix now plans to charge users for account sharing to increase the number of paid users. It is also considering the launch of an ad-supported version to lower the subscription fee.

Rising Competition – Amazon, Disney, and Hulu continue to give tough competition to Netflix in the streaming market through acquisitions, and by obtaining licenses and producing original content. Recently, Amazon acquired MGM, one of the oldest Hollywood film studios, for $8.5 billion, which will enable Amazon to show more diverse content on its video streaming platform, Prime. Netflix is also working on improving the quality of its content by getting personalized recommendations. Recently, it launched “double thumbs up” so that members can indicate which shows they liked.

Macroeconomic Factors – Slow economic growth, rising inflation, and geopolitical tensions such as Russia’s invasion of Ukraine have hampered the streaming market. From the US to India, inflation seems ubiquitous. According to the Bureau of Labor Statistics, inflation in the US increased to 7.5% in January 2022, which was the highest in the previous four decades. The rising inflation will pinch the consumer’s pocket and consequently, impede growth in OTT subscriptions. The war between Russia and Ukraine will further slow down the growth of the streaming market with Netflix closing its service in Russia, which resulted in the loss of around 700,000 Russian subscribers. Walt Disney Co, the parent of Disney+, already suspended its operations in Russia.

Digital Infrastructure – The growth of the streaming industry is dependent on the promotion of video-on-demand, broadband connections, smart televisions, and the price charged for internet usage. According to GlobalData, the US, China, Japan, the UK, and Germany are leading the video-on-demand (VOD) market. The market value of the VOD market in the US stood at $55 billion in 2021, which showed an increase of 20% over that in the previous year. China’s VOD market increased 35% to $18 billion in 2021. Overall, the VOD market has grown 20% and reached $124 billion in 2021, which indicates considerable growth in the market.

Related Data & Insights

Related Companies

United States of America

Italy

United States of America

United States of America

United States of America

United Kingdom

United States of America

France

United States of America

France

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward