The Impact of RegTech on Delivery of Financial Services

-

RegTech (Regulatory Technology) uses emerging technologies like artificial intelligence, big data, and machine learning, to cater to the increasing demands of compliance in the financial services industry

-

RegTech solutions are provided in regulatory reporting, identity management and control, and transaction monitoring, to name a few; to mitigate regulatory risks, reduce compliance costs, and increases investor confidence

-

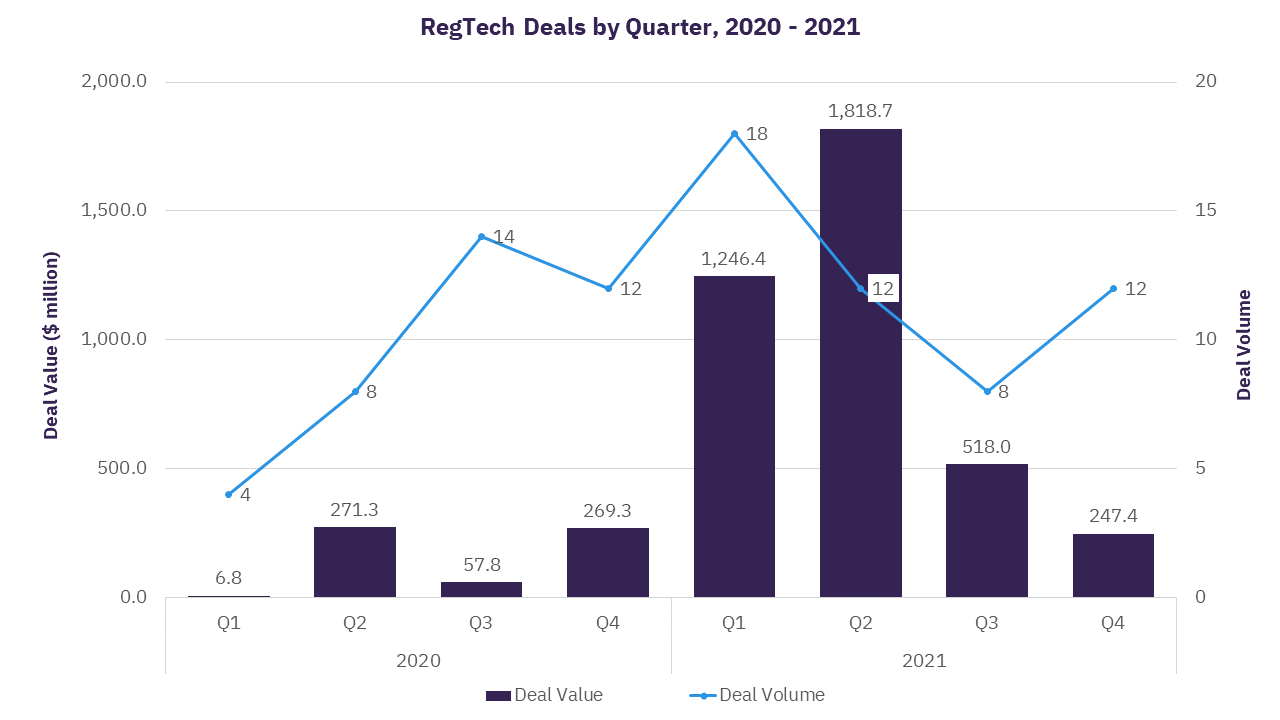

As per GlobalData, total deal value for RegTech increased to $3.8 billion in 2021, compared to $605 million in 2020, a growth of >500%

The Impact of RegTech on Delivery of Financial Services

In January 2022, the government of Australia allocated AUD 1.6 million of federal grants for proposals related to RegTech, which can reduce regulatory compliance costs. These grants were awarded as part of the latest round of the Business Research and Innovation Initiative (BRII), a pilot program aimed to drive innovation that addresses government policy and service delivery challenges.

To understand RegTech, it is important to understand fintech first. Fintech is a collective term for all technologies and innovations which aim to replace the traditional methods of delivering financial services. RegTech is a subset of fintech that focuses on technologies which could facilitate the delivery of regulatory and compliance requirements more effectively than current capabilities.

Need for RegTech

The massive growth in the volume and variety of financial instruments across asset classes has induced the development of technologies which can monitor and enhance compliance with regulations. These technologies are centered around aspects such as regulatory reporting, identity management and control, transaction monitoring, to name a few. By facilitating protection against regulatory risks, RegTech increases investor confidence.

In case of most RegTech offerings, the usage of automated intelligence to detect red flags and control regulatory reporting has reduced the incidence of manual error, thereby increasing investor confidence. For example, some RegTech offerings can be useful to banks for ensuring prohibition of money laundering and removing investor doubt in that regard. Another use case is the lowered possibility of fines and recurring expenditures in the form of legal consultations, while also avoiding the negative publicity associated with the breach of compliance, irrespective of corrective action. As a matter of fact, RegTech is being used by both institutions and regulators to address compliance requirements.

In January 2022, the Australian Securities and Investments Commission (ASIC) announced plans to work with five RegTech agencies - Bedrock AI Aus Pty Ltd, DigitalX Limited, Eastern Analytica Pty Ltd, Listcorp Pty Ltd and Pyxta Pty Ltd. ASIC is seeking to explore the potential of using technology to help identify and assess poor market disclosure by listed companies. Similarly, the Hong Kong Monetary Authority (HKMA) has been encouraging digital transformation of financial services and is looking to use RegTech for digitalization of bank supervision. Also, the HKMA is working on granular data from banks for a more bottom-up understanding of the banking business under its jurisdiction.

In January 2022, Fidelity Investments, a multinational financial services company, announced the launch of Saifr, a RegTech business offering human augmentation tools to help institutions create, review, and approve public communications to offset market, reputational and compliance risk. Around the same time, RegTech provider CUBE announced a partnership with LogicGate, a provider of risk, governance, and compliance solutions. The partnership seeks to transform manual compliance checks for customers through automated global regulatory intelligence, allowing compliance managers to focus on proactive risk management.

The Investment Landscape

As per GlobalData, there was a notable spike in the value of RegTech deals since the first quarter of 2021. In Q1 2021, the total deal value for RegTech was $1.2 billion, up from $269 million in Q4 2020, a growth of about 360%.

The spike in deal activity can be attributed to increased compliance requirements with respect to recently introduced regulations such as Markets in Financial Instruments Directive (MiFID) II, General Data Protection Regulation (GDPR), and Sustainable Finance Disclosure Regulation (SFDR), to name a few. The largest RegTech deal since 2020 was Astorg and Bridgepoint Acquiring Fenergo from Insight Partners in a deal valued at $1.5 billion. Fenergo is a company offering client data management, client life cycle management and anti-money laundering or KYC tax compliance solutions.

In terms of the overall investment landscape in RegTech since 2020, most of the deals are venture financing deals (45 out of 89) totaling almost $2.9 billion in deal value, followed by acquisitions and private equity deals.

Related Data & Insights

Related Companies

United States of America

United States of America

United States of America

United States of America

United States of America

United States of America

United States of America

Germany

China

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward