14 Jul, 2021 JP Morgan and Goldman Sachs were top M&A financial advisers by value and volume in North America for H1 2021, finds GlobalData

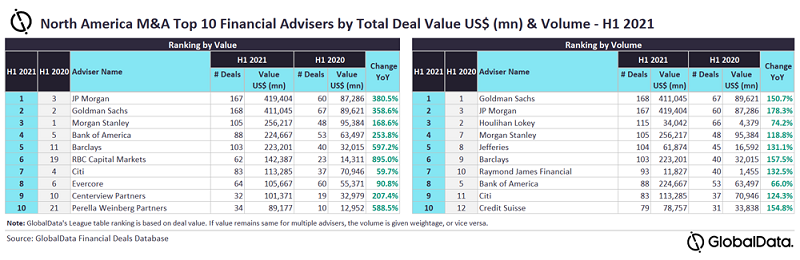

Posted in Business FundamentalsJP Morgan and Goldman Sachs were the top mergers and acquisitions (M&A) financial advisers in North America for H1 2021 by value and volume, respectively. JP Morgan advised on 167 deals worth US$419.4bn, which was the highest value among all the advisers. Meanwhile, Goldman Sachs led in volume terms having advised on 168 deals worth US$411bn. A total of 7,982 M&A deals were announced in the region during H1 2021, according to GlobalData, a leading data and analytics company.

According to GlobalData’s report, ‘Global and North America M&A Report Financial Adviser League Tables H1 2021’, deal value for the region increased by 258% from US$298bn in H1 2020 to US$1.1 trillion in H1 2021.

Aurojyoti Bose, Lead Analyst at GlobalData, comments: “Competition for the top position was very close both in terms of value as well as volume, as JP Morgan and Goldman Sachs were the only two firms that managed to advise on more than 150 deals, with deal value also crossing US$400bn. Moreover, both firms also advised on more than 60 deals, which were valued more than or equal to US$1bn.

“Interestingly, JP Morgan, apart from leading by value, also occupied the second position by volume. Goldman Sachs led by volume and occupied the second position by value.”

Morgan Stanley occupied the third position in GlobalData’s ranking of financial advisers for M&As in North America by value with 105 deals worth US$256.2bn, followed by Bank of America with 88 deals worth a total US$224.7bn and Barclays with 103 deals worth US$223.2bn.

Houlihan Lokey occupied the third position by volume with 115 deals worth US$34bn, followed by Morgan Stanley. Jefferies occupied the fifth position by volume with 104 deals worth US$61.9bn.