28 Apr, 2020 Kirkland & Ellis is top legal adviser in consumer sector in Q1 2020

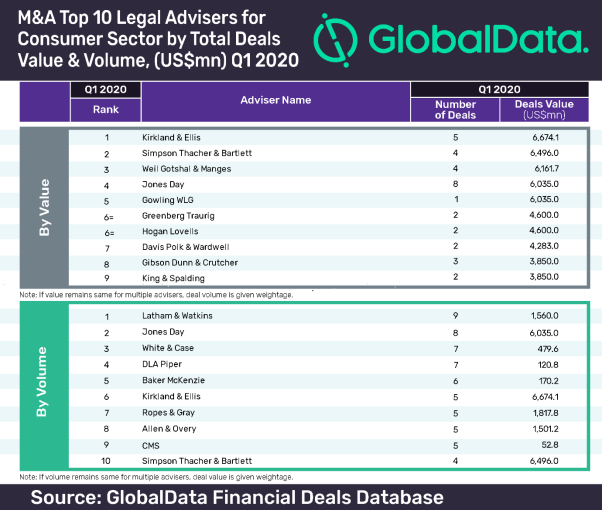

Posted in Business FundamentalsKirkland & Ellis has dominated the latest mergers and acquisitions (M&A) legal advisers league table based on deal value in Q1 2020, having advised on five deals worth US$6.7bn, according to GlobalData, a leading data and analytics company.

GlobalData, which tracks all M&A, private equity/venture capital and asset transaction activity around the world, confirmed that Simpson Thacher & Bartlett finished in second position with four deals worth US$6.5bn, followed by Weil Gotshal & Manges with four deals worth US$6.2bn.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, says: “Advising on big-ticket deals helped Kirkland & Ellis occupy the top spot, despite advising on fewer deals compared to other firms. It stood at sixth position in terms of volume. Only three out of the top 10 advisers by value also ranked in the list of top 10 advisers by volume.”

Kirkland & Ellis, which topped the consumer deals league table by value, stood at fifth position in GlobalData’s recently released global league table of top 20 M&A legal advisers.

Latham & Watkins leads by volume

Latham & Watkins occupied the top position in the latest global M&A legal advisers league table for the consumer sector based on deal volume in Q1 2020. The firm advised on nine deals worth US$1.6bn.

Jones Day occupied the second position with eight transactions worth US$6bn, followed by White & Case with seven deals worth US$479.6m.

Bose adds: “Latham & Watkins, though leading in terms of volume, lagged in terms of value and failed to make the list of top ten advisers by value. Akin to Latham & Watkins, most of the top advisors also lagged in terms of value. Only three out of the top 10 advisers by volume also ranked in the list of top 10 advisers by value.”

Global consumer deals market in Q1 2020

On the back the COVID-19 outbreak, deal activity remained sluggish and the consumer sector witnessed a decline of 26.96% in deal value from US$55.9bn in Q1 2019 to US$40.9bn in Q1 2020. Deal volume also decreased by 15.67% from 1,257 to 1,060.