04 Sep, 2019 Utility-linked smart thermostats to account for 36% of $75bn automated home market by 2025

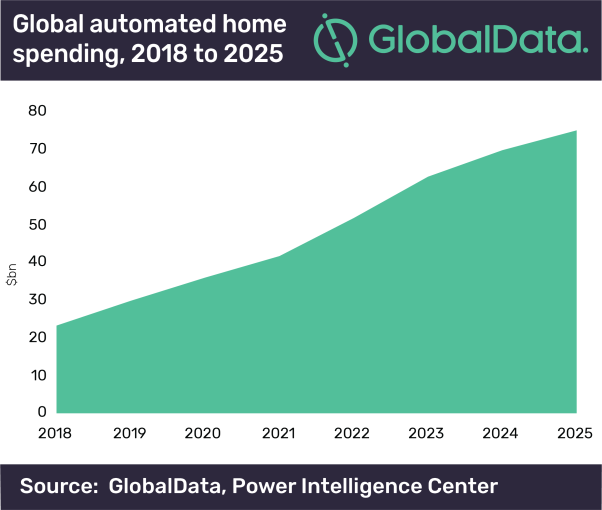

Posted in PowerThe automated home market exceeded $23bn in 2018 and is expected to reach $75bn by 2025, at an impressive compound annual growth rate (CAGR) of 18%, according to GlobalData, a leading data and analytics company.

GlobalData’s latest theme report, ‘Thematic Research: Automated Home and Utilities’, states that growth will mostly be driven by smart thermostats, which are becoming increasingly common as consumers and governments look to control energy consumption. In fact, over $7bn of the 2018 figure was that of smart thermostats, and both the home automation market and the share of utility-linked smart thermostats are estimated to increase during the forecast period.

Utilities and electricity retailers have been attempting to enter the automated home market the same way telecom and cable companies have done so, by leveraging their large existing customer base.

Harshavardhan Reddy Nagatham, Senior Power Analyst at GlobalData, comments: “Utilities have slowly moved from passively supplying electricity to consumers to innovating new business avenues and offering a wide array of energy and other products and services to existing customers. They have already entered the home rooftop solar and storage market and the energy management systems market. The automated home is a new market that a few utilities including Xcel Energy, Georgia Power, and EDF have started to explore.”

Utilities have a huge opportunity to exploit the home automation business. The biggest advantage is that utilities have a huge existing base of customers and do not need to spend capital and resources on customer acquisition.

Nagatham explains: “There are several routes utilities can take to enter the home automation market, but the most efficient one is forming strategic partnerships with home automation device makers, as this can prove to be a mutually beneficial arrangement for both parties involved. The device makers get access to the huge customer base of the utility, and the utility, through the use of these devices by the customers, gains access to the consumption related data of the customers.

Utilities and electric retailers have already tested the waters by supplying a few batches of their customers with Energy Management Systems (EMS) and smart thermostats. Both devices are connected to the utility and are integrated into the smart meters in order to use the thermostats in the most optimal manner and maximize energy savings.”

Nagatham adds: “Utilities that sway consumers to install smart meters also gather and process data from them in order to better match demand and supply. Through the ownership of this data, the utilities are at an advantage as other contenders in the automated home market do not have access to this data. Players such as smart home device manufacturers and service providers would be keen to partner with utilities in order to not only reach their existing customer base, but also use the utilities’ historic smart meter data in order to better program or calibrate their devices.”