15 Apr, 2020 Nike’s sentimental slump due to transitions and China store closures

Posted in RetailTransitions in South America coupled with store closures in China drove a decline in Nike’s margins and sentiments, says GlobalData, a leading data and analytics company.

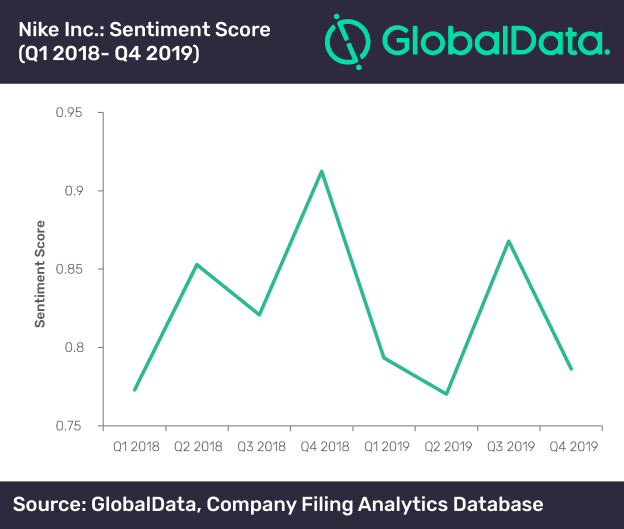

GlobalData’s Company Filing Analytics platform found that Nike’s overall sentiment score declined by 9.4% in Q4 2019 (ending February 29, 2020) compared to Q3 2019 (ending November 30, 2019).

Despite reporting a good quarterly revenue growth, Nike’s sentiments were affected due to the impact on its net income in the quarter. Transitions in the South American business, the coronavirus outbreak and rising North American tariffs resulted in a net income decline of 24% (quarter-on-quarter [Q-O-Q]) in Q4 2019. Also, year-on-year (YoY) growth rates across Q1-Q3 2019 were positive, while Q4 declined by 32% (YoY decline compared to Q4 2018).During the quarter, the company announced strategic distributor partnerships to focus on a more consumer driven approach in the region. Non-recurring charges related to the strategy amounted to US$425m.

Greater China has been a growth engine for the footwear and apparel giant in past quarters. In 2018, China generated 16% of the overall revenue. Sales in the mainland fell in Q4 2019 after posting double digit growth in the past 22 consecutive quarters.

Chinese sales fell 5% (year on year) in Q4 2019 despite a strong digital segment growth (30% year on year). Margins were affected by the closure of 5,000 Chinese stores during Q4 2019.

Aurojyoti Bose, Lead Analyst at GlobalData, says: “To mitigate the COVID-19 impact, Nike is focused on driving direct-to-consumer sales and increasing inventories by targeting digital sales, product launches and supply chain improvements.”

The coexistence of COVID-19 with incremental tariffs prompted Nike to slowly shift its resources to other countries such as Vietnam, to reduce over-reliance on China for production.

With the pandemic stabilizing in China, Nike reopened 80% of its stores in the country. Post the announcement, investor sentiments grew, as average share prices in the fourth week of March (ended 27 March 2020) were 11% higher when compared to the previous week.

Bose adds: “Nike expects to implement its Chinese business recovery strategy (focus on digital growth) in Europe and the US, where the company’s sales in upcoming quarters are likely be affected due to store closures.

“In the West, the company initially planned on reopening stores by 27 March, but prolonged disruptions forced the sportswear brand to consider store resumptions on a location-by-location basis.”