19 May, 2020 Natural gas outlook remains bleak through 2020 and affects major gas-producing shale operators, says GlobalData

Posted in CoronavirusNatural gas prices have struggled in early 2020, hitting record lows due to US dry gas production being at a record high – which has impacted major shale plays such as the Appalachian basin. Although the reduction in associated gas from crude oil production across major oil basins has provided support to the natural gas market, it does not eliminate the fact that the market remains oversupplied. By assessing the readjustment of capex of 15 companies, which account for approximately 85% of total production from Marcellus and Utica Shale, GlobalData estimates a reduction of 1.45 billion cubic feet of natural gas per day (bcfd) in output from this group of companies as compared to the forecast for 2020 before the sector crisis happened

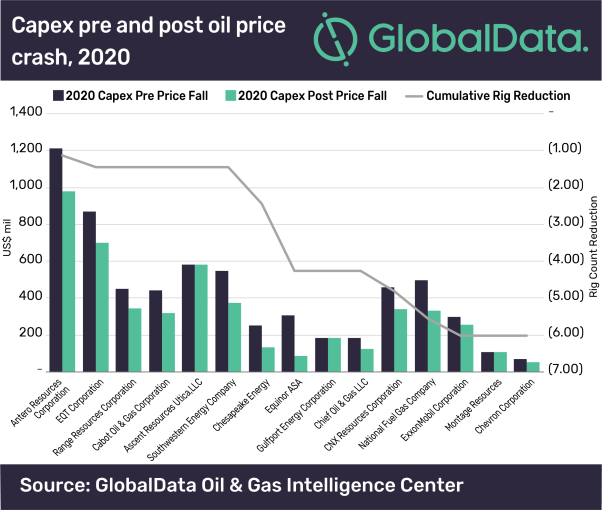

Steven Ho, Oil and Gas Analyst at GlobalData, comments: “From GlobalData’s analysis of 15 company positions, rig count is expected to drop by six rigs, from 41 as of the end of March 2020 to 35 rigs by the end of 2020. Overall, this reduction is a result of capex cuts summing up to approximately US$1.5bn reported by operators.”

Ho continues: “GlobalData took gas wells drilled between 2018 to date as the most representative sample set to determine the economic viability of future wells to be developed in Marcellus and Utica. The sample set consists of slightly more than 2,800 wells, of those less than 25% have breakeven below US$2.05 per thousand cubic feet (mcf).

“However, the slowdown is affecting the natural gas consumption over the next few months with the largest demand declines expected from commercial and industrial sector. Reduction in demand will be offset marginally by residential power usage with upcoming summer weather. Natural gas industry will not recover in the near term through 2020, with dry gas production expected to remain at approximately similar level as 2019, accompanied by high level of working natural gas inventory and reduced demand due to current economic slowdown.”