19 Jun, 2020 Pandemic to push Western European metropolitan areas into recession

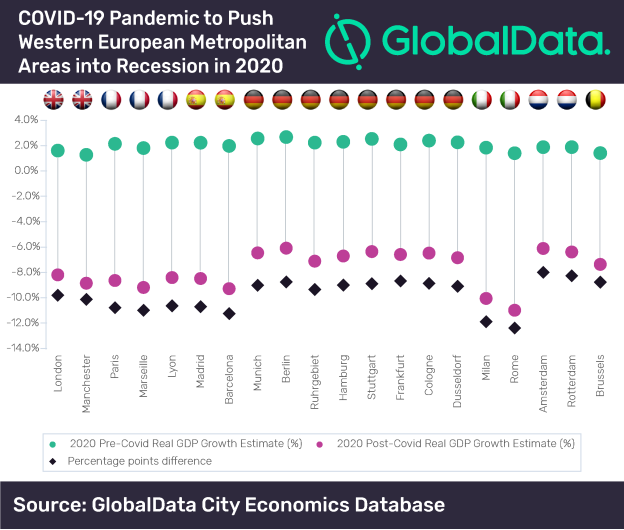

Posted in Business FundamentalsThe economic impact of the COVID-19 outbreak on Western European metropolitan areas could be greater than the financial crisis in 2008. The combined real GDP growth of the 20 largest metropolitan areas in Western Europe will contract by 8.1% in 2020, forecasts GlobalData, a leading data and analytics company.

The unprecedented collapse in economic activities due to lockdown and quarantine measures led to an economic freeze and huge job losses in European metropolitan areas. GlobalData revised its forecast for real GDP growth downward by 9.6% in 2020 for the 20 largest metropolitan areas in Western Europe as compared to pre-pandemic forecast.

Metropolitan areas in the most affected nations such as Italy, Spain and France are expected to witness steep decline in economic activity and the recovery process is projected to be slow and painful. According to data from National Statistical Offices in Q1, 2020, real GDP of Italy, Spain and France shrank by 4.7%, 5.2% and 5.8% respectively compared to Q4, 2019. According to GlobalData projections, Rome and Milan metropolitan areas in Italy are expected to contract by 9.41% and 8.98%, respectively; Madrid and Barcelona metropolitan areas in Spain are expected to decline by 7.95% and 8.15%; Paris and Lyon in France are expected to contract by 7.11% and 6.96% in 2020.

The aviation industry has been hit hard due to travel restrictions imposed by countries on foreigners and domestic travelers alike. This in turn has also affected the tourism industry in a significant way, forcing the shutdown of self-employed and small businesses. Investment activity in the real estate market is expected to suffer in the short term due to the level of uncertainties in the current economy. The International Labour Organization foresees the loss of 12 million full-time jobs in Europe in 2020.

Almost all governments at the central and local level have initiated economic recovery measures along with a plan to further reduce the spread of COVID-19. Governments have announced various monetary policies to lower long term bond yields through asset purchase programs; central banks have also implemented credit programs to ease liquidity and make money available to small and medium-sized enterprises (SMEs). Similarly, governments have announced various fiscal stimulus packages to arrest the decline in growth and provide momentum for economic revival.

Pranay Singh, Economic Research Analyst at GlobalData, says: “These measures will help in containing the social, health, fiscal and monetary damage in the next couple of quarters; however, different cities of the EU are not at the same stage of the pandemic, which could mean it might take longer for economies to function the way they were before the pandemic.”