Cloud Computing in Aerospace, Defense and Security (ADS) Sector – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Cloud Computing in Aerospace, Defense, and Security (ADS) Sector Report Overview

Cloud computing has transformed the way companies operating in the aerospace, defense, and security (ADS) sector consume IT resources. This technology has enabled shared IT infrastructure and services, which create a flexible, scalable, and on-demand IT environment. This approach is significantly more resource efficient and cost-effective than traditional IT, where companies had to invest heavily in on-premise IT infrastructure.

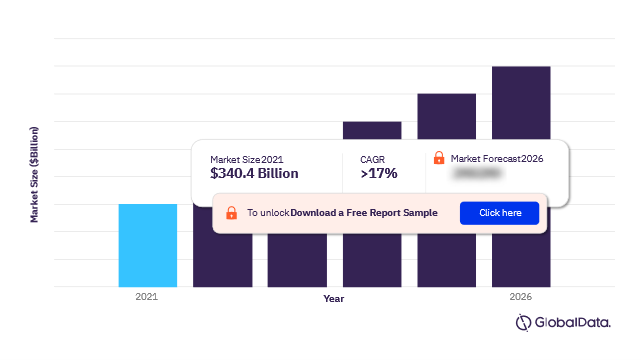

The enterprise spending on cloud services in 2021 amounted to $340.4 billion and is expected to grow at a compound annual growth rate (CAGR) of more than 17% between 2021 and 2026.

This cloud computing in Aerospace, Defense, and Security (ADS) sector report provides an overview of the cloud computing theme, outlining advances in technology and key programs, highlighting emerging market trends and providing insight into current procurement or research trends. The report also covers case studies showcasing how companies in the ADS sector are adopting cloud.

Cloud Computing Market Outlook 2021-2026 ($ Billion)

For more insights on the cloud computing market forecasts, download a free sample report

Cloud Computing in the Aerospace, Defense, and Security (ADS) Sector – Value Chain Insights

The main components in the cloud computing value chain comprise of cloud computing stack and cloud professional services. The cloud computing stack comprises of cloud services including Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS). Cloud professional services, on the other hand, include cloud brokerage, cloud integration, and managed cloud services.

Cloud services (PaaS and IaaS): In the IaaS and PaaS markets, traditional IT stack infrastructure vendors, specializing in everything from databases and operating systems to virtualization, computing, storage, and networking, face competition from public cloud service providers. The latter use subscription-based, pay-as-you-use business models to offer a full portfolio of IT infrastructure, as well as tools and platforms for application developers.

Cloud Computing in Aerospace, Defense, and Security (ADS) Sector – Value Chain Insights

For more insights on the cloud computing market value chain insights, download a free sample report

Cloud Computing in the Aerospace, Defense, and Security (ADS) Sector – Market Dynamics

Cloud computing in ADS Sector Drivers: The sector’s largest companies and prime contractors such as Boeing, Raytheon Technologies, and Northrop Grumman should consider investing in almost all components of the cloud value chain as they continue to develop their information services business units. This allows them to invest in cloud technology within their own business while offering cloud services to other companies in the sector. Meanwhile, smaller subcontractors, suppliers, and end-users (such as militaries) should invest in cloud technology for their own operations. However, these companies should seek partnerships with technology vendors for the cloud services to have fewer resources allocated to this.

Cloud computing in ADS Sector Challenges: Cloud computing has been influential in solving the key challenges faced by the ADS sector. Some of the most common limitations to the growth of cloud computing in the ADS sector includes the adverse impact of competing budgets, COVID-19, data deluge, geopolitics, and ESG. Although cloud technology offers cost advantages in these aspects, cloud migration and integration with existing systems can be significant expenses for ADS players. For example, the sensitive nature of ADS companies’ data has tended to create siloes. While this increases security, it can make cloud migration a costly process.

Cloud Computing in the Aerospace, Defense, and Security (ADS) Sector – Industry Analysis

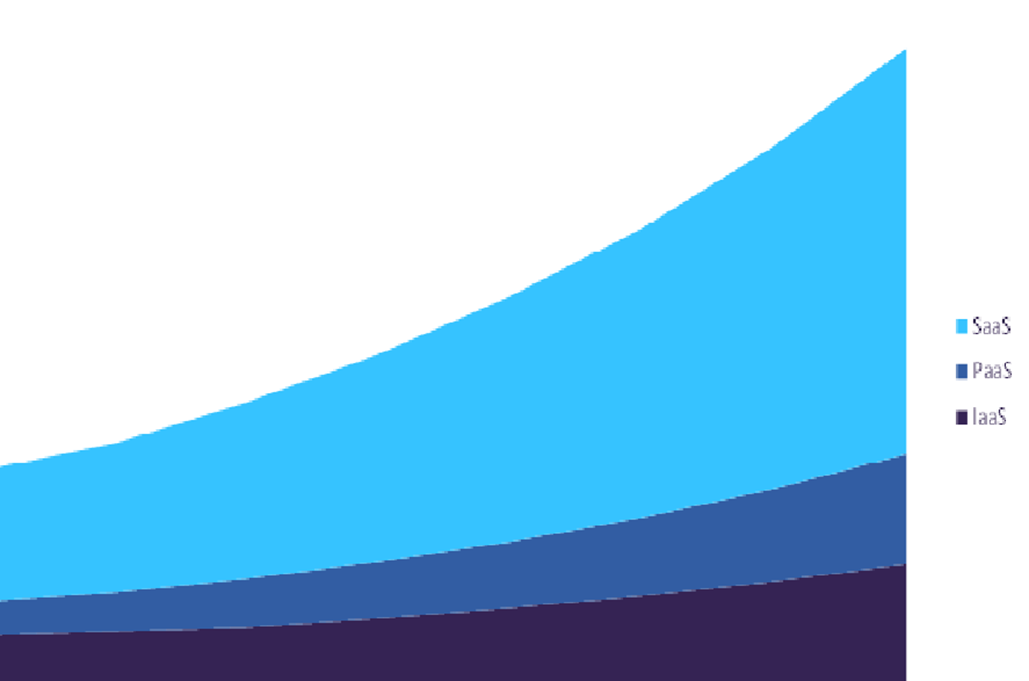

The total global spending by enterprises on IaaS, PaaS, and SaaS in 2021 amounted to $340.4 billion. The enterprise spending on cloud services is expected to grow at a CAGR of more than 17% during 2021-2026. SaaS cloud services will remain the highest revenue-generating services. On the cloud infrastructure front, global spending by enterprises on private cloud services will be dominant during the projected period.

The cloud computing in Aerospace, Defense, and Security (ADS) sector analysis also covers –

- Mergers and acquisitions

- Patent trends

- Company filing trends

- Hiring trends

- Cloud computing timeline

Cloud Computing in Aerospace, Defense, and Security (ADS) Segments

For additional insights on the cloud computing in Aerospace, Defense, and Security (ADS) sector scope coverage, download a free sample

Cloud Computing in Aerospace, Defense, and Security (ADS) Sector – Competitor Analysis

Leading cloud computing adopters in ADS: The key organizations and militaries adopting and deploying cloud computing are the US Department of Defense, the US Air Force, the US Army, rge US Navy, NASA, the UK Ministry of Defence, the UK Royal Air Force, British Army, the UK Royal Navy, and the French General Directorate for Armament (GDA).

Leading cloud computing vendors: Some of the key leading cloud computing vendors are Alibaba, Alphabet, Amazon, Cisco, Cloud Software Group, Dell Technologies, Docker, DXC Technology, Huawei, Inspur, Kyndryl, Microsoft, Oracle, Progress Software, Rackspace, SAP, and VMware among others.

Specialist cloud computing vendors in ADS: Some of the specialist cloud computing vendors in the ADS sector are Atos, Fujitsu, IBM, Leidos, Northrop Grumman, Sopra Steria, and Thales among others.

For more insights on the leading cloud computing adopters and vendors, download a free sample report

Defense Sector Scorecard

The defense sector scorecard ranks companies based on overall leadership in top themes through a thematic screen, a valuation screen, and a risk screen.

For more insights in the cloud computing in Aerospace, Defense, and Security (ADS) sector scorecard, download a free sample report

Cloud Computing in S Overview

| Page Count | 51 |

| Value Chain | Cloud Computing Stack and Cloud Professional Services |

| Leading Cloud Computing Adopters in Aerospace, Defense, and Security (ADS) Sector | The US Department of Defense, the US Air Force, the US Army, rge US Navy, NASA, the UK Ministry of Defence, the UK Royal Air Force, British Army, the UK Royal Navy, and the French General Directorate for Armament (GDA) |

| Leading Cloud Computing Vendors | Alibaba, Alphabet, Amazon, Cisco, Cloud Software Group, Dell Technologies, Docker, DXC Technology, Huawei, Inspur, Kyndryl, Microsoft, Oracle, Progress Software, Rackspace, SAP, and VMware |

| Specialist Cloud Computing Vendors in Aerospace, Defense, and Security (ADS) Sector | Atos, Fujitsu, IBM, Leidos, Northrop Grumman, Sopra Steria, and Thales |

Scope

- This report provides an overview of cloud in aerospace, defense, and security.

- This report explains why cloud will continue to grow in importance for the aerospace, defense, and security industry.

- This report outlines how the correct cloud strategy can enhance militaries’ ability to draw insights from an increasingly large volume of data sets across a variety of military domains, allowing for more timely decision making.

- The investment opportunities for commercial and defense applications in the cloud value chain are covered.

- The report also provides an overview of cloud activity in relating to the sector, including tech vendors and industry adopters.

Reasons to Buy

- Determine potential investment companies based on trend analysis and market projections.

- Gaining an understanding of the market challenges and opportunities surrounding the drone technologies theme.

Adobe

AECOM

Airbus

Alibaba

Alphabet

Amazon

Aribus

Atos

Australian Department of Defense

BAE Systems

Bell Textron

Boeing

Bombardier

Booz Allen Hamilton

Box

British Army

Cisco

Cognizant

Datadog

Devo

Dropbox

DXC Technology

Elbit Systems

Embraer

Envitia

Fluor

French Ministry of Armed Forces

Fujitsu

General Dynamics

General Electric

Hadean

Hanwha

HCL

Heathrow Airport

Honeywell

Huawei

IBM (Red Hat)

Infor

Informatica

Infosys

Intuit

Israel Aerospace Industries

Jacobs

Kyndryl

Leidos

LeoLabs

Leonardo

Lockheed Martin

Mantech International

Maxar Technologies

Microsoft

NASA

Netcompany

New Relic

New Zealand Space Agency

Northrop Grumman

NTT

OpenNebula

Oracle

Oshkosh

Palantir

Perspecta

Raytheon Technologies

Rolls Royce

Royal Navy

Saab

Salesforce

Salesforce (Heroku)

SAP

Second Front Systems

ServiceNow

Sopra Steria

SpaceX

ST Engineering

TCS

Tencent

Thales

tlmNexus

UK Ministry of Defense

UK National Air Traffic Services

US Air Force

US Army

US Department of Defense

US Department of Navy

Vectrus

VMware (Pivotal)

Wipro

Workday

Xero

Zondesk

Table of Contents

Frequently asked questions

-

What are the key value chain components in the cloud computing in Aerospace, Defense, and Security (ADS) sector?

Cloud computing stack and cloud professional services are some of the key value chain components in the cloud computing in Aerospace, Defense, and Security (ADS) Sector industry.

-

Which are the leading cloud computing adopters in Aerospace, Defense, and Security (ADS) theme?

The US Department of Defense, the US Air Force, the US Army, rge US Navy, NASA, the UK Ministry of Defence, the UK Royal Air Force, British Army, the UK Royal Navy, and the French General Directorate for Armament (GDA)are the leading cloud computing adopters in the Aerospace, Defense, and Security (ADS) sector.

-

Which are the leading cloud computing vendors?

Alibaba, Alphabet, Amazon, Cisco, Cloud Software Group, Dell Technologies, Docker, DXC Technology, Huawei, Inspur, Kyndryl, Microsoft, Oracle, Progress Software, Rackspace, SAP, and VMware are the leading cloud computing vendors.

-

Which are the leading specialist cloud computing vendors in Aerospace, Defense, and Security (ADS) sector?

Atos, Fujitsu, IBM, Leidos, Northrop Grumman, Sopra Steria, and Thales are some of the leading specialist cloud computing vendors in Aerospace, Defense, and Security (ADS) Sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports