Angina (Angina Pectoris) Drugs in Development by Stages, Target, MoA, RoA, Molecule Type and Key Players, 2022 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Angina Pectoris Pipeline Drugs Market Report Overview

Angina (Angina Pectoris) is a term that describes chest pain caused by myocardial ischemia. Angina generally is a symptom of coronary artery disease. Some of the most common symptoms of Angina include anxiety, increased or irregular heart rate, paleness, cold sweat, and a feeling of doom. Risk factors include smoking, a sedentary lifestyle, high blood fat or cholesterol, and hypercholesterolemia.

The Angina pipeline drugs market research report provides comprehensive information on the Angina Pectoris targeted therapeutics, complete with analysis by indications, stage of development, mechanism of action (MoA), route of administration (RoA), and molecule type. The report also reviews key players involved in Angina Pectoris targeted therapeutics development with respective active and dormant or discontinued projects.

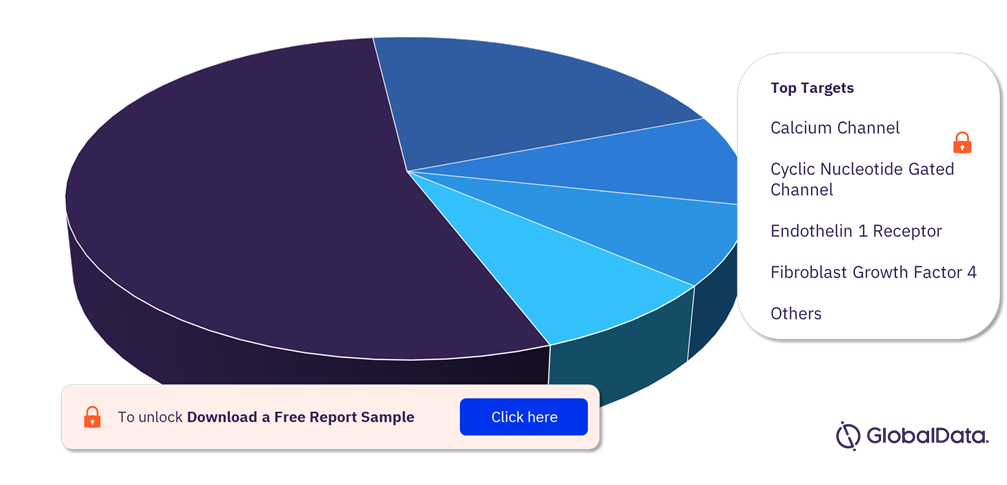

Angina Pectoris Pipeline Drugs Market Segmentation by Target

The key targets of the Angina Pectoris pipeline drugs market are Calcium Channel, Cyclic Nucleotide Gated Channel, Endothelin 1 Receptor, Fibroblast Growth Factor 4, Integrin Alpha 2b, and Others.

Angina Pectoris Pipeline Drugs Market Analysis, by Target

For more Angina Pectoris pipeline drugs market target insights, download a free report sample

For more Angina Pectoris pipeline drugs market target insights, download a free report sample

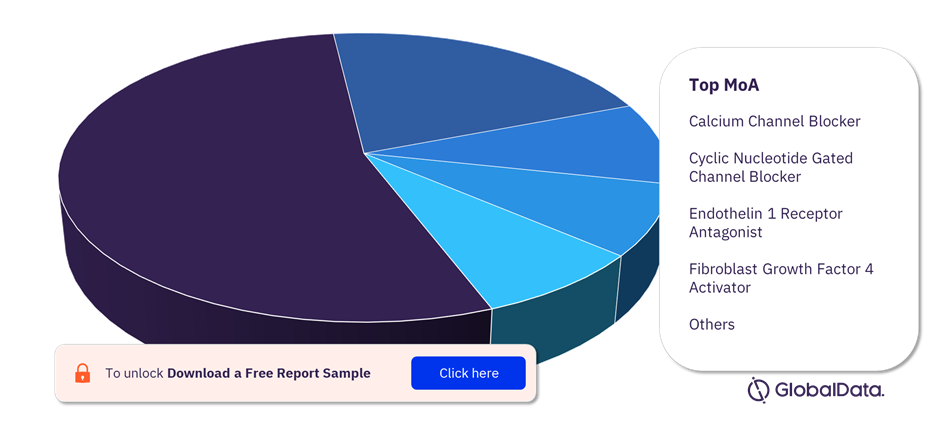

Angina Pectoris Pipeline Drugs Market Segmentation by Mechanisms of Action

The key mechanisms of action of the Angina Pectoris pipeline drugs market are Calcium Channel Blocker, Cyclic Nucleotide Gated Channel Blocker, Endothelin 1 Receptor Antagonist, Fibroblast Growth Factor 4 Activator, Integrin Alpha 2b Antagonist, and Others.

Angina Pectoris Pipeline Drugs Market Analysis, by Mechanisms of Action

For more Angina Pectoris pipeline drugs market mechanisms of action insights, download a free report sample

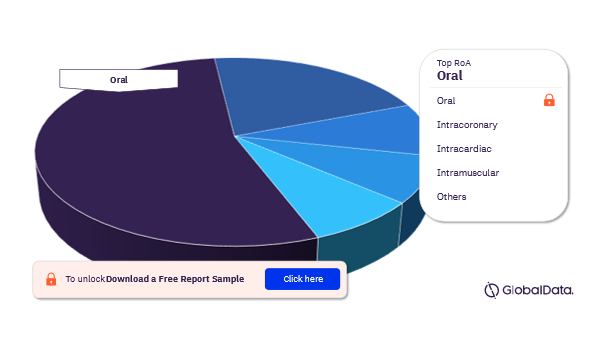

Angina Pectoris Pipeline Drugs Market Segmentation by Routes of Administration

The key routes of administration in the GBS pipeline drugs market are oral, intracoronary, intracardiac, intramuscular, intravenous, nasal, parenteral, sublingual, and transdermal. The oral RoA led the Angina Pectoris pipeline drugs market in 2022.

Angina Pectoris Pipeline Drugs Market Analysis, by Routes of Administration

For more Angina Pectoris pipeline drugs market routes of administration insights, download a free report sample

For more Angina Pectoris pipeline drugs market routes of administration insights, download a free report sample

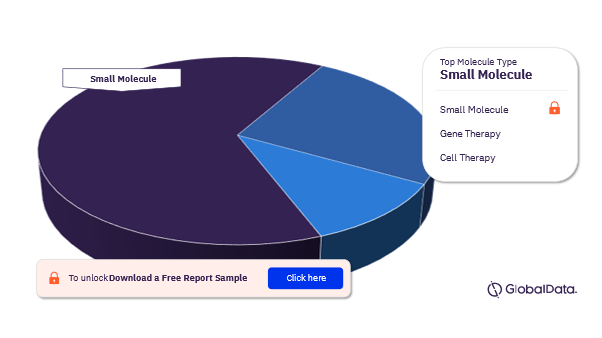

Angina Pectoris Pipeline Drugs Market Segmentation by Molecule Types

The key molecule types in the Angina Pectoris pipeline drugs market are small molecule, gene therapy, and cell therapy. Small molecule dominated the market in 2022.

Angina Pectoris Pipeline Drugs Market Analysis, by Molecule Types

To know more about the molecule types in the Angina Pectoris pipeline drugs market, download a free report sample

To know more about the molecule types in the Angina Pectoris pipeline drugs market, download a free report sample

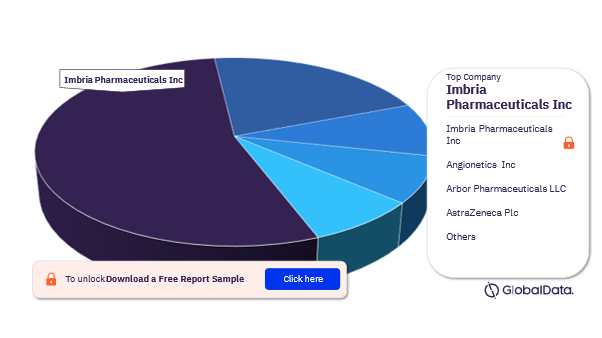

Angina Pectoris Pipeline Drugs Market - Competitive Landscape

The leading companies in the Angina Pectoris pipeline drugs market are Imbria Pharmaceuticals Inc, Angionetics Inc, Arbor Pharmaceuticals LLC, AstraZeneca Plc, Caladrius Biosciences Inc, Coeurative Inc, Hemostemix Inc, and Others. Imbria Pharmaceuticals Inc accounted for the most number of Angina Pectoris drugs in development in 2022.

Angina Pectoris Pipeline Drugs Market Analysis, by Companies

To know more about the leading Angina Pectoris pipeline drugs market players, download a free report sample

To know more about the leading Angina Pectoris pipeline drugs market players, download a free report sample

Angina Pectoris Pipeline Drugs Market Overview

| Key Targets | Calcium Channel, Cyclic Nucleotide Gated Channel, Endothelin 1 Receptor, Fibroblast Growth Factor 4, Integrin Alpha 2b, and Others |

| Key Mechanisms of Action | Calcium Channel Blocker, Cyclic Nucleotide Gated Channel Blocker, Endothelin 1 Receptor Antagonist, Fibroblast Growth Factor 4 Activator, Integrin Alpha 2b Antagonist, and Others |

| Key Routes of Administration | Oral, Intracoronary, Intracardiac. Intramuscular, Intravenous, Nasal, Parenteral, Sublingual, and Transdermal |

| Key Molecule Types | Small Molecule, Gene Therapy, And Cell Therapy |

| Leading Companies | Imbria Pharmaceuticals Inc, Angionetics Inc, Arbor Pharmaceuticals LLC, AstraZeneca Plc, Caladrius Biosciences Inc, Coeurative Inc, Hemostemix Inc, and Others |

Scope

- The report provides a snapshot of the global therapeutic landscape for Angina (Angina Pectoris)

- The report reviews Angina (Angina Pectoris) targeted therapeutics under development by companies and universities/research institutes based on information derived from company and industry-specific sources

- The report covers pipeline products based on various stages of development ranging from pre-registration to discovery and undisclosed stages

- The report features descriptive drug profiles for the pipeline products which includes product description, descriptive MoA, R&D brief, licensing and collaboration details & other developmental activities

- The report reviews key players involved in Angina (Angina Pectoris) targeted therapeutics and enlists all their major and minor projects

- The report assesses Angina (Angina Pectoris) targeted therapeutics based on mechanism of action (MoA), route of administration (RoA), and molecule type

- The report summarizes all the dormant and discontinued pipeline projects

- The report reviews the latest news and deals related to Angina (Angina Pectoris) targeted therapeutics

Reasons to Buy

- Gain strategically significant competitor information, analysis, and insights to formulate effective R&D strategies.

- Identify emerging players with the potentially strong product portfolio and create effective counterstrategies to gain competitive advantage.

- Identify and understand the targeted therapy areas and indications for Angina (Angina Pectoris). Identify the use of drugs for target identification and drug repurposing.

- Identify potential new clients or partners in the target demographic.

- Develop strategic initiatives by understanding the focus areas of leading companies.

- Plan mergers and acquisitions effectively by identifying key players and their most promising pipeline therapeutics.

- Devise corrective measures for pipeline projects by understanding Angina (Angina Pectoris) development landscape.

- Develop and design in-licensing and out-licensing strategies by identifying prospective partners with the most attractive projects to enhance and expand business potential and scope.

Arbor Pharmaceuticals LLC

AstraZeneca Plc

Caladrius Biosciences Inc

Chong Kun Dang Holdings Corp

Coeurative Inc

Eight Plus One Pharmaceutical Co Ltd

G. Pohl-Boskamp GmbH & Co KG

Hemostemix Inc

Imbria Pharmaceuticals Inc

Innovative Pharmacology Research

Jiangsu Hengrui Medicine Co Ltd

Kuhnil Pharmaceutical Co Ltd

Merck & Co Inc

Milestone Pharmaceuticals Inc

Signal Pharma Ltd

Trizell Ltd

TSH Biopharm Corporation Ltd

VasThera Co Ltd

XyloCor Therapeutics Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What are the key targets of the Angina Pectoris pipeline drugs market?

The key targets of the Angina Pectoris pipeline drugs market are Calcium Channel, Cyclic Nucleotide Gated Channel, Endothelin 1 Receptor, Fibroblast Growth Factor 4, Integrin Alpha 2b, and Others.

-

What are the key mechanisms of action of the Angina Pectoris pipeline drugs market?

The key mechanisms of action of the Angina Pectoris pipeline drugs market are Calcium Channel Blocker, Cyclic Nucleotide Gated Channel Blocker, Endothelin 1 Receptor Antagonist, Fibroblast Growth Factor 4 Activator, Integrin Alpha 2b Antagonist, and Others.

-

What are the key routes of administration in the Angina Pectoris pipeline drugs market?

The key routes of administration in the Angina Pectoris pipeline drugs market are oral, intracoronary, intracardiac, intramuscular, intravenous, nasal, parenteral, sublingual, and transdermal.

-

What are the key molecule types in the Angina Pectoris pipeline drugs market?

The key molecule types in the Angina Pectoris pipeline drugs market are small molecule, gene therapy, and cell therapy.

-

Which are the leading companies in the Angina Pectoris pipeline drugs market?

Some of the leading companies in the Angina Pectoris pipeline drugs market are Imbria Pharmaceuticals Inc, Angionetics Inc, Arbor Pharmaceuticals LLC, AstraZeneca Plc, Caladrius Biosciences Inc, Coeurative Inc, Hemostemix Inc, and Others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Cardiovascular reports