Australia Power Market Size and Trends by Installed Capacity, Generation, Transmission, Distribution, and Technology, Regulations, Key Players and Forecast, 2022-2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Australia Power Market Report Overview

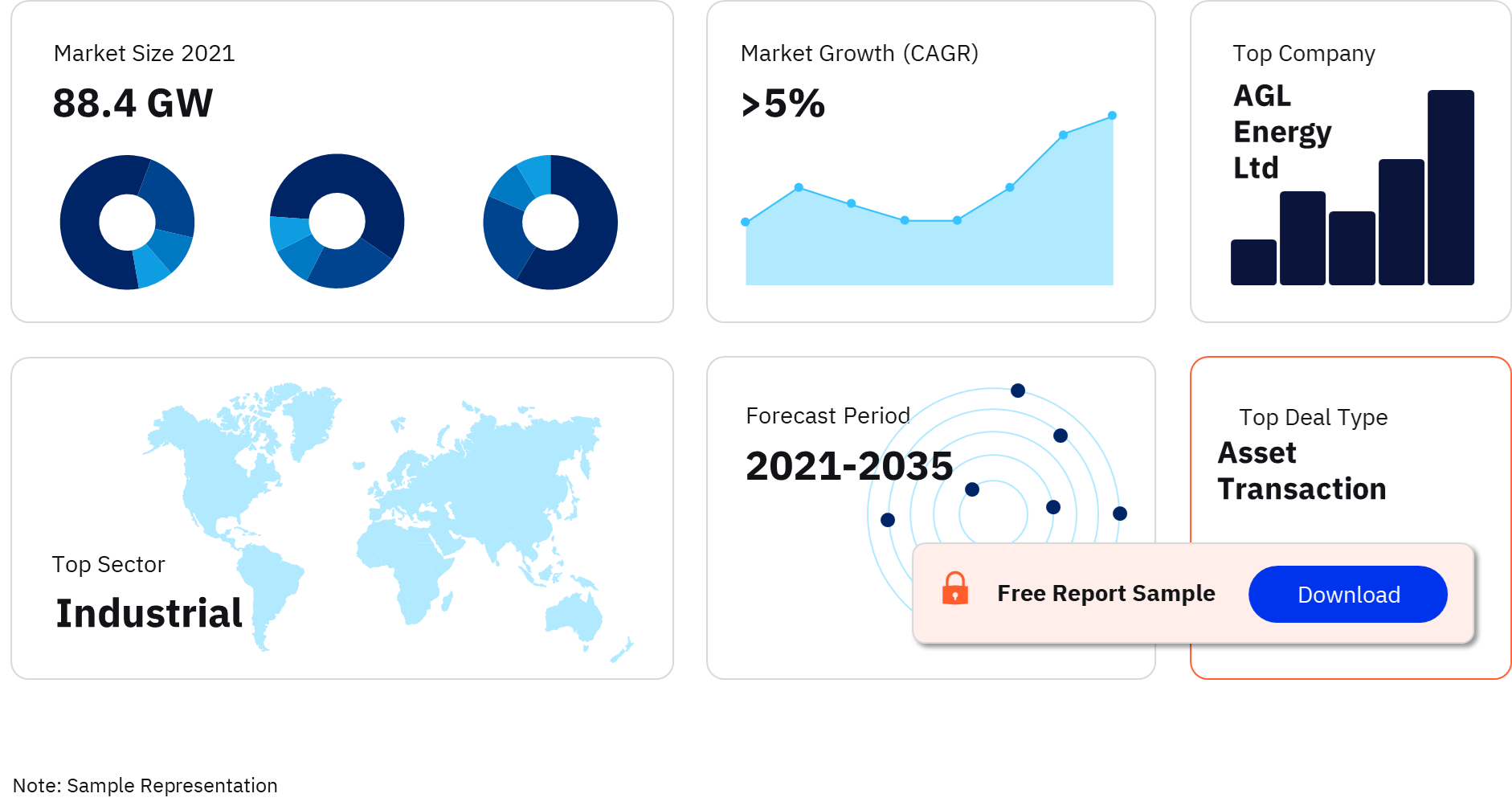

The Australia power market cumulative installed capacity was 88.4 GW in 2021. The market is expected to achieve a CAGR of more than 5% during 2021-2035.

Australia Power Market Analysis, 2022 – 2035

Buy Full Report For More Information on The Australia Power Market Forecast, Download a Free Report Sample

The Australia power market research report discusses the power market structure of Australia and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential. An analysis of the deals in the country’s power sector is also included in the report.

| Cumulative Installed Capacity (2021) | 88.4 GW |

| CAGR (2021-2035) | >5% |

| Key Sectors | Industrial, Commercial, Residential, Transport, and Others |

| Key Deal Types | Asset Transactions, Debt Offerings, Equity Offerings, Partnerships, Venture Financing, and Private Equity |

| Leading Companies | AGL Energy Ltd, Origin Energy Ltd, Snowy Hydro Ltd, EnergyAustralia Pty Ltd., Stanwell Corp Ltd., and Hydro Tasmania |

Australia Power Market Analysis

The primary regulating body in the country’s power market is Australian Energy Market Commission (AEMC). The National Electricity Market (NEM) operates as a wholesale market. It interconnects five regional market jurisdictions – Queensland, New South Wales (including the Australian Capital Territory), Victoria, South Australia, and Tasmania. Western Australia and the Northern Territory are not connected to the NEM. Electricity in Western Australia is supplied through the Wholesale Electricity Market (WEM).

The Australian power sector is faced with the challenge of phasing out its aging coal-based fleet and replacing it with renewable power generation assets. The government’s emphasis on renewable power generation has resulted in a manifold increase in renewable power generation. However, the phasing out of the old coal-based plants has not occurred at the pace originally outlined in the country’s energy policy, mainly due to policy uncertainty. This has led to surplus generation capacity, in turn leading to cascading effects of depressed wholesale electricity prices, and reduced investment inflow in the power sector, especially for renewables.

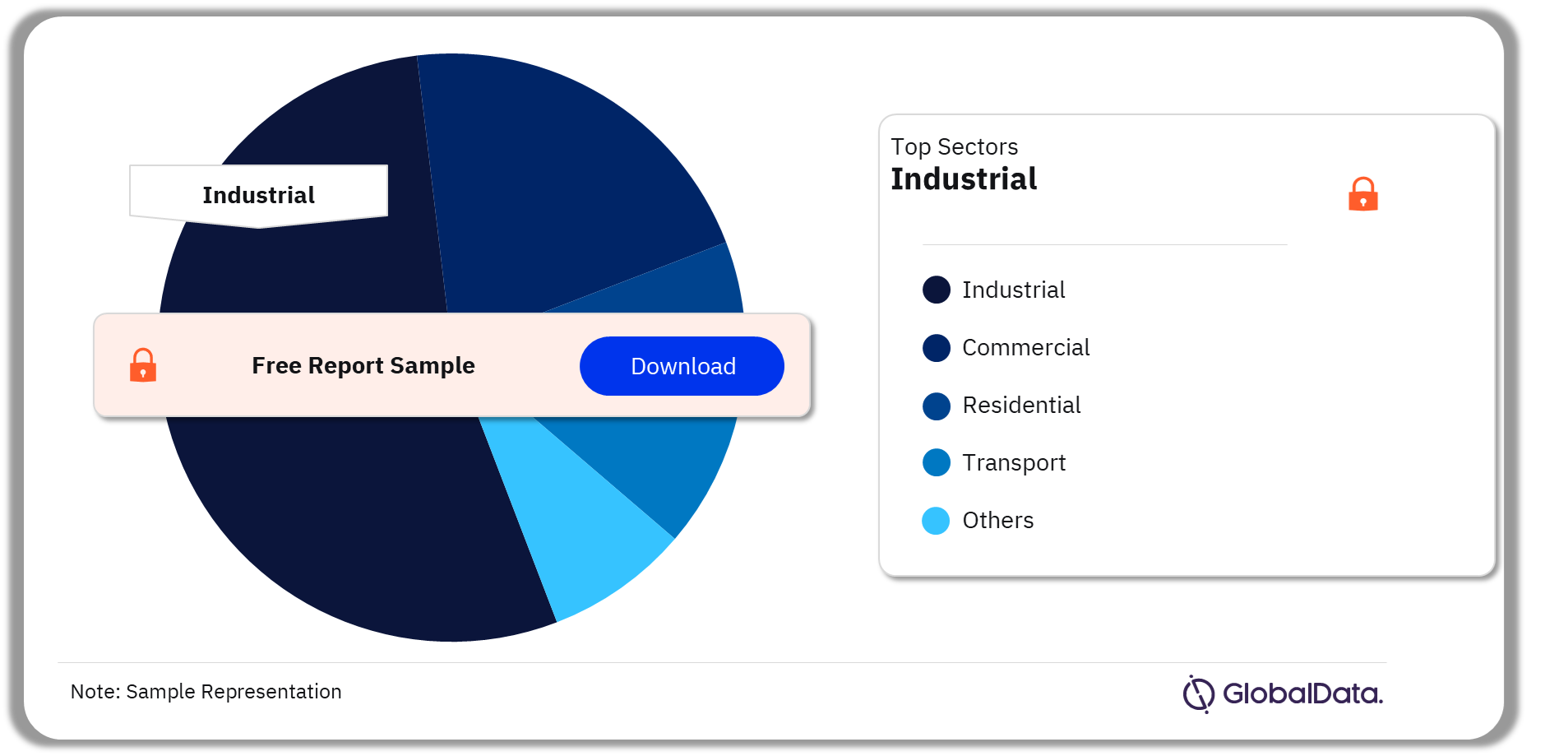

Australia Power Market Segmentation by Sectors

The key sectors in the Australian power market are industrial, commercial, residential, transport, and others. The industrial sector had the dominant share in power consumption, followed by residential and transport.

Australia Power Market Analysis by Sectors, 2021 (%)

For more information on the Australia power market sectors, download a free report sample

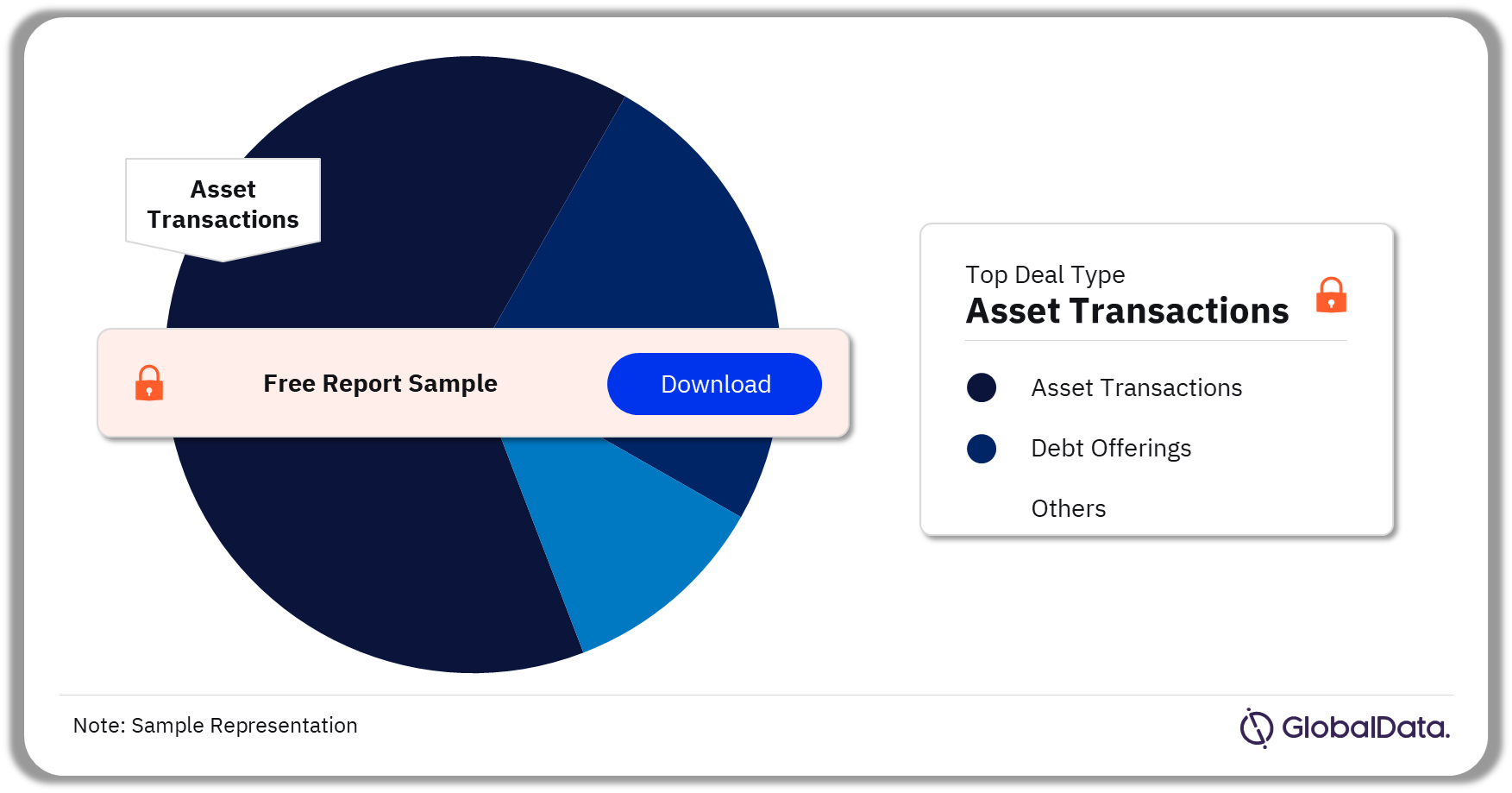

Australia Power Market Segmentation by Deal Types

The key deal types in the Australian power market are asset transactions, debt offerings, equity offerings, partnerships, venture financing, and private equity among others. Asset transactions accounted for nearly a quarter of the financial deals, followed by debt offerings and equity offerings.

Australia Power Market Analysis, by Deal Types, 2021 (%)

For more information on Australia power market financial deals, download a free report sample

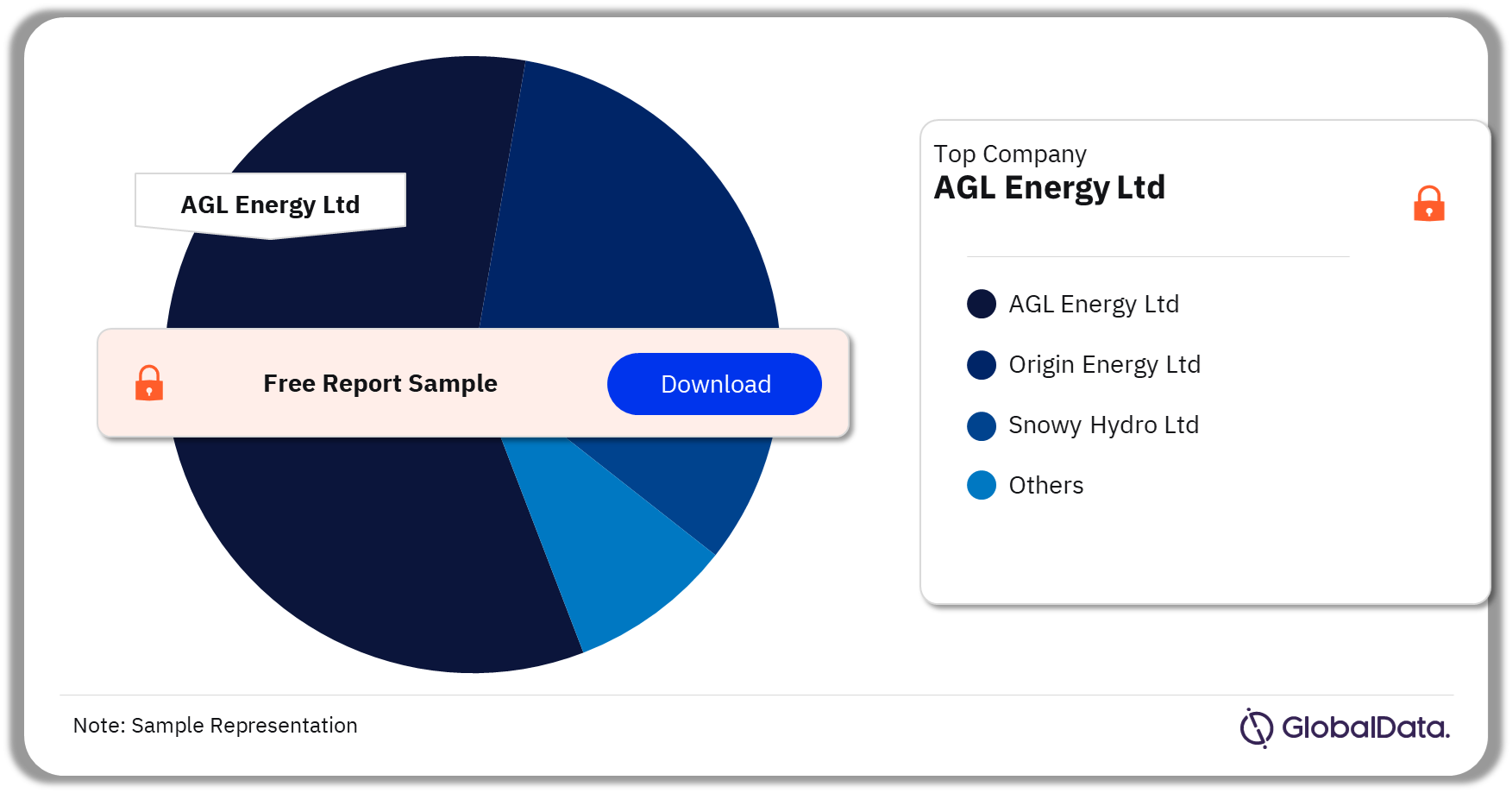

Competitive Landscape

The leading companies in the Australia power market are AGL Energy Ltd, Origin Energy Ltd, Snowy Hydro Ltd, EnergyAustralia Pty Ltd., Stanwell Corp Ltd., and Hydro Tasmania among others

AGL Energy Ltd: AGL is an integrated energy company that owns, operates and develops energy assets and provides natural gas, electricity, solar photovoltaic solutions and related products and services. The company’s power generation portfolio includes coal, gas, hydro, wind, solar, landfill and biomass-based power generation facilities.

Origin Energy Ltd: Origin Energy is an integrated energy company, which generates, supplies, and distributes electricity; explores and develops natural gas reserves; and produces and sells gas. The company generates electricity from natural-gas fired, coal-fired, wind, solar, pumped water storage, and cogeneration plants.

Snowy Hydro Ltd: Snowy Hydro is an integrated energy utility. It has presence in the entire energy cycle, including production, supply, trading, and retail of electricity in the National Electricity Market, and providing risk management financial hedge contracts to wholesale customers.

Australia Power Market Analysis, by Companies, 2021 (%)

For more information on leading companies in the Australia power market, download a free report sample

Latest Developments

- In May 2022, a new government was formed, and the country’s new Prime Minister stated that Australia will soon become a ‘renewables superpower’ and cater to the needs of South Asian countries. The labor party has pledged in its manifesto to cut the country’s GHG emissions by more than 42% by 2030.

- The new governmet has also promised renewable friendly policies including a more than $13 billion investment in the country’s transmission network.

Scope

- Snapshot of the country’s power sector across parameters – macroeconomics, supply security, generation infrastructure, transmission infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential of the power sector.

- Statistics for installed capacity, generation, and consumption from 2010 to 2021, and forecast for the next 14 years to 2035

- Capacity, generation, and major power plants by technology

- Data on leading active and upcoming power plants

- Information on transmission and distribution infrastructure, and electricity imports and exports

- Policy and regulatory framework governing the market

- Detailed analysis of top market participants, including market share analysis and SWOT analysis

Reasons to Buy

- Identify opportunities and plan strategies by having a strong understanding of the investment opportunities in the country’s power sector

- Identify key factors driving investment opportunities in the country’s power sector

- Facilitate decision-making based on strong historic and forecast data

- Develop strategies based on the latest regulatory events

- Position yourself to gain the maximum advantage of the industry’s growth potential

- Identify key partners and business development avenues

- Identify key strengths and weaknesses of important market participants

- Respond to your competitors’ business structure, strategy, and prospects

Origin Energy Ltd.

Snowy Hydro Ltd.

EnergyAustralia Pty Ltd (CLP Holding)

Stanwell Corp Ltd.

Hydro Tasmania

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Australia power market cumulative installed capacity in 2021?

The cumulative installed capacity in the Australia power market was 88.4 GW in 2021.

-

What is the Australia power market growth rate?

The power market in Australia is expected to achieve a CAGR of more than 5% during 2021-2035.

-

What are the key sectors in the Australia power market?

The key sectors in the Australia power market are the industrial sector, commercial sector, residential sector, and transport sector among others.

-

What are the key deal types in the Australia power market?

The key deal types in the Australia power market are asset transactions, debt offerings, equity offerings, partnerships, venture financing, and private equity.

-

Which are the leading companies in the Australia power market?

Some of the leading companies in the Australia power market are AGL Energy Ltd, Origin Energy Ltd, Snowy Hydro Ltd, EnergyAustralia Pty Ltd., Stanwell Corp Ltd., and Hydro Tasmania.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.