Automotive Autonomous Driving Systems Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The size of the global autonomous driving systems market was 212.5 mn units in 2023, recording a substantial annual growth of 15.2%. During 2018–23, the sector posted a CAGR of 5.1%. Over the forecast period, the sector is expected to record a CAGR of 5.2% to reach 274.2 mn units by 2028. In 2023 adaptive cruise control (ACC) garnered a share of 14.0%, radar -–long range garnered a share of 16.3%, radar-short/medium garnered a share of 27.7%, and GPS/GNSS unit garnered a share of 23.3%. In 2028, Adaptive Cruise Control (ACC) is expected to record a share of 14.4%, radar–long range is expected to record a share of 15.9%, radar-short/medium is expected to record a share of 23.9%, and GPS/GNSS unit is expected to record a share of 22.3%.

This report brings together multiple data sources to provide a comprehensive overview of the global ADAS and Autonomous Vehicles sector. It includes analysis on the following –

Trends & Drivers: Provides an overview of current sector scenario regarding the future outlook in terms of key trends and drivers of the sector.

Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

PESTER Analysis: Provides a detailed understanding of various factors such as political, economic, social, technological, environmental, and regulatory impacting the sector.

Sector Forecast: Provides deep-dive analysis of global market covering volume growth during 2018–2028, and spot estimates for 2023 and 2028. The analysis also covers regional overview across four regions-Asia-Pacific, Europe, North America, and South America and MEA-highlighting sector size, and growth drivers for the region.

Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

Patent Analysis: Provides an overview of patent filings in the sector across regions, countries and top applicants.

Automotive ADAS and Autonomous Vehicles Market Trends

The development of artificial chips is one of the key trends shaping the automotive advanced driver assistance systems and autonomous vehicles market. The adoption of legislation to facilitate autonomous vehicle development and deployment also helps in the market growth.

Adoption of legislation: Vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication serve as some of the foundational elements for the development of autonomous vehicles. Since 2009, the US, EU, and Japan have formed working groups to assist in developing the standards for V2I and V2V communication.

Buy the Full Report for More Trend Insights into the Automotive ADAS and Autonomous Vehicles Market

Automotive ADAS and Autonomous Vehicles Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest share among all the regions

The key regions in the automotive ADAS and autonomous vehicles market are Asia-Pacific, Europe, North America, South America, and MEA. The Japanese government collaborated with regional automakers, suppliers, and research centers from the Universities of Tokyo and Nagoya to permit autonomous vehicle testing on roads.

Automotive ADAS and Autonomous Vehicles Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive ADAS and Autonomous Vehicles Market

Automotive ADAS and Autonomous Vehicles Market - Competitive Landscape

A few of the top companies operating in the market are:

- Audi

- BMW

- Honda

- Mercedez-Benz

- ZF

In BMW, sensor technology in the assistance systems measures, assesses, and detects changes in the car’s immediate and surrounding environments. Currently, these sensors are used in traffic sign recognition, emergency braking assistance, dynamic stability control (DSC), and for other purposes.

BMW is also taking strategic actions to aid the growth of the automotive ADAS and autonomous vehicles market. In August 2023, BMW and Innoviz developed highly automated LiDAR imaging technology which will be incorporated into the BMW 7 Series in the future.

Automotive ADAS and Autonomous Vehicles Market Analysis by Companies

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive ADAS and Autonomous Vehicles Market Companies

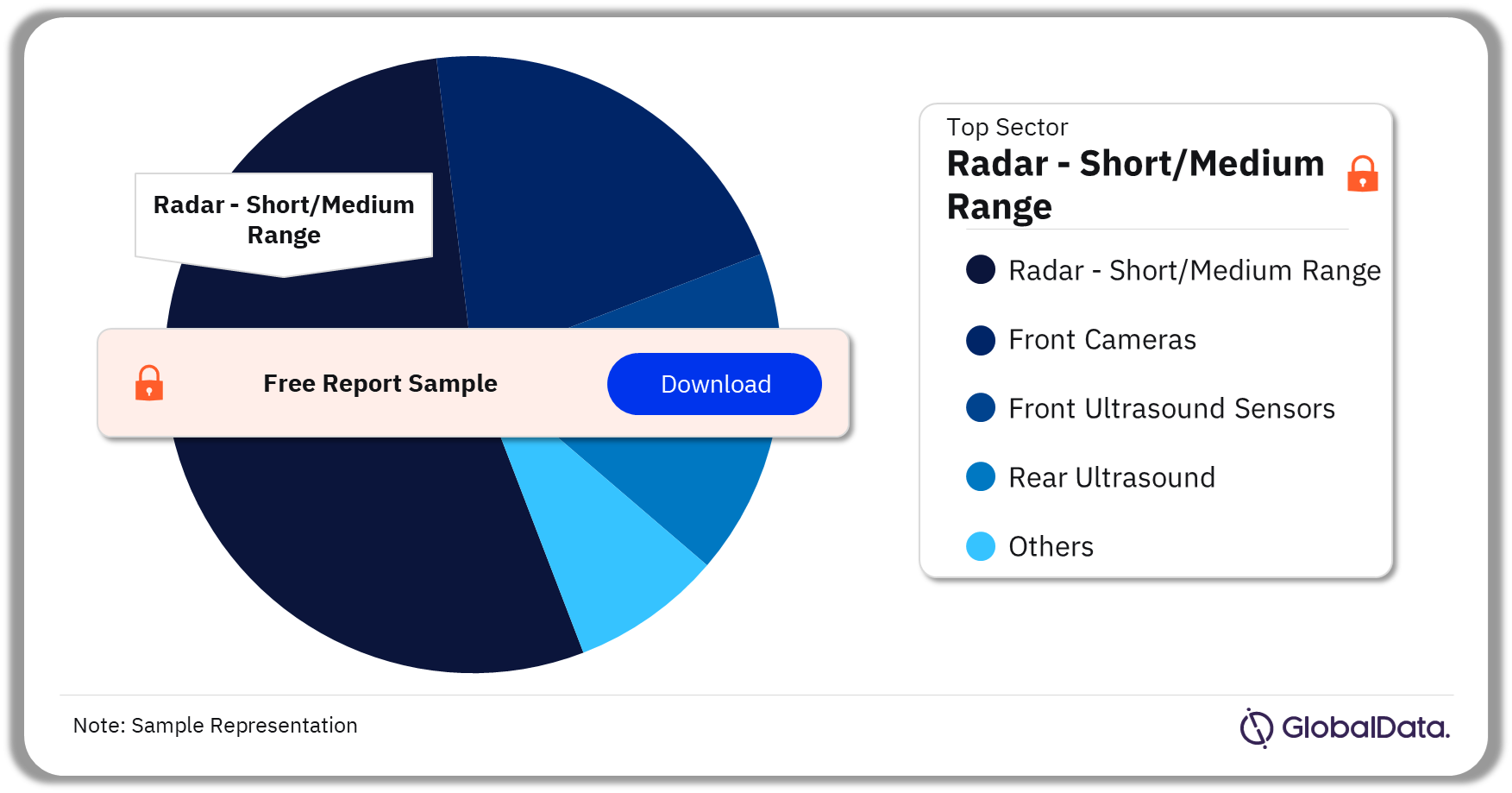

Automotive ADAS and Autonomous Vehicles Market Segmentation by Sectors

The key sectors in the automotive ADAS and autonomous vehicles market are front cameras, front ultrasound sensors, radar – short/medium range, and rear ultrasound. In 2023, radar – short/medium range was the dominant sector in the market.

Automotive ADAS and Autonomous Vehicles Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive ADAS and Autonomous Vehicles Market

Automotive ADAS and Autonomous Vehicles Market - Latest Developments

A few of the latest developments in the automotive ADAS and autonomous vehicles market are as follows:

- 5th September 2023: Mobileye and Valeo collaborated to supply imaging radars for automated driving and next-generation driver assistance capabilities. They announced this collaboration at the IAA Mobility in Munich.

- 4th September 2023: Samsung Electro-Mechanics Co. entered into an agreement with a US electric car manufacturer for the supply of camera modules for automobiles. People assume the US electric car manufacturer to be Tesla.

Buy the Full Report to Know More about the Latest Developments in the Automotive ADAS and Autonomous Vehicles Market

Segments Covered in the Report

Automotive ADAS and Autonomous Vehicles Sector Outlook (Value, Million Units, 2018-2028)

- Front Cameras

- Front Ultrasound Sensors

- Radar – Short/Medium Range

- Rear Ultrasound

Automotive ADAS and Autonomous Vehicles Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global autonomous driving systems sector. It includes an analysis of the following:

Trends & Drivers: Provides an overview of the current sector scenario regarding the future outlook in terms of key trends and drivers of the sector.

Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

PESTER Analysis: Provides a detailed understanding of various factors such as political, economic, social, technological, environmental, and regulatory impacting the sector.

Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018–2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions-Asia-Pacific, Europe, MEA, North America, and South America -highlighting sector size, and growth drivers for the region.

Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

Auto OEMs and component suppliers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region. The report provides a detailed analysis of the regions and competitive landscape that can help companies gain insight into the region-specific nuances. The analysts have also placed a significant emphasis on the key trends that drive customer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion. To gain competitive intelligence about leading component suppliers in the sector in the region with information about their market share and growth rates.

BMW

Bosch

ZF

Magna

Table of Contents

Table

Figures

Frequently asked questions

-

What was the automotive ADAS and autonomous vehicles market size in 2023?

The automotive ADAS and autonomous vehicles market size was 516.3 million units in 2023.

-

What is the growth rate of the automotive ADAS and autonomous vehicles market?

The ADAS and autonomous vehicles market is expected to record a CAGR of more than 6% during 2023-2028.

-

Which was the leading sector in the automotive ADAS and autonomous vehicles market in 2023?

Radar – short/medium range was the leading sector in the automotive ADAS and autonomous vehicles market in 2023.

-

Which was the leading region in the automotive ADAS and autonomous vehicles market in 2023?

Asia-Pacific was leading in the automotive ADAS and autonomous vehicles market in 2023.

-

Which are the key companies operating in the automotive ADAS and autonomous vehicles market?

The top companies operating in the automotive ADAS and autonomous vehicles market are Audi, BMW, Honda, Mercedez-Benz, and ZF, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.