Automotive Lighting Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Lighting Market Report Overview

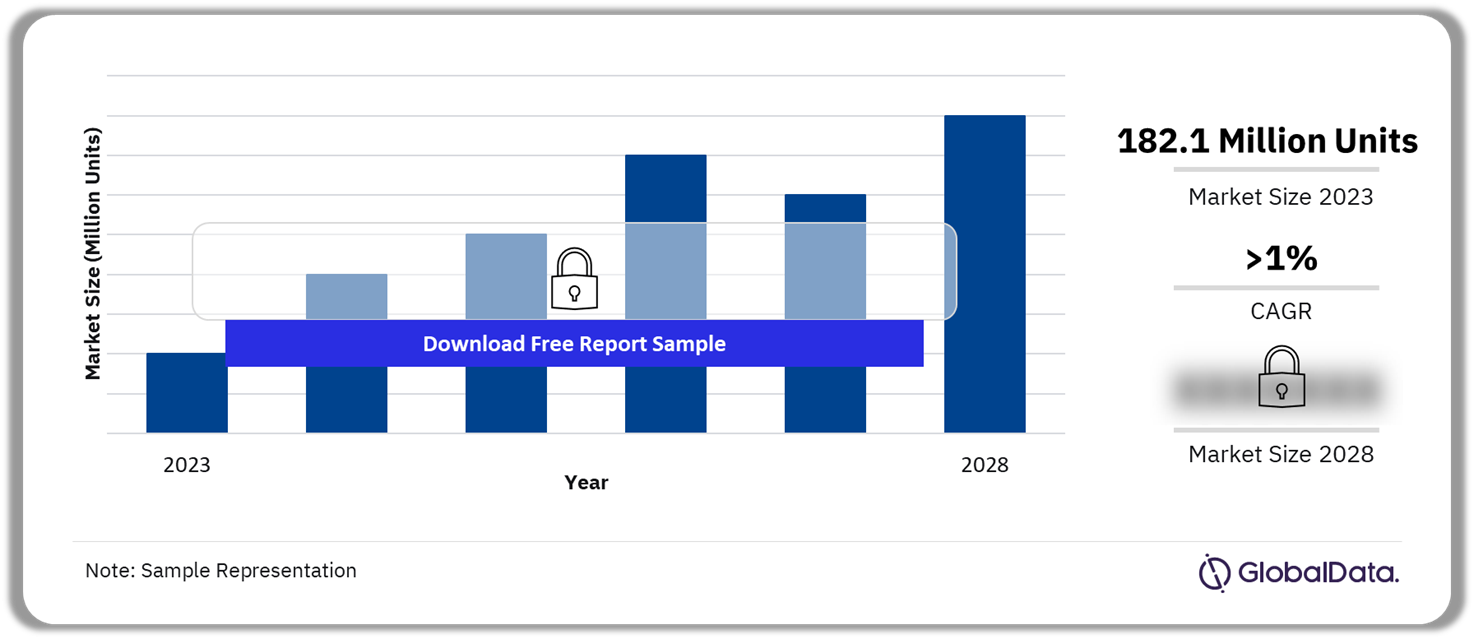

The automotive lighting market size was 182.1 million units in 2023. The market will grow at a CAGR of more than 1% during 2023-2028. Government and business associations have established regulations and standards for automotive lighting systems. Lighting performance must meet the standards in terms of brightness, color, and beam patterns according to those laws. In 2023, Asia-Pacific accounted for a significant share of the market.

Automotive Lighting Market Outlook, 2023-2028 (Million Units)

Buy the Full Report for More Insights into the Automotive Lighting Market

The automotive lighting market research report provides a comprehensive overview of the automotive lighting market trends and drivers. The report also provides a detailed overview of technological developments and PESTER analysis. Furthermore, evaluate strategic initiatives taken by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings in the sector across regions, countries, and top applicants.

| Market Size (2023) | 182.1 million units |

| CAGR (2023-2028) | >1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | Koito Manufacturing, Valeo, Hella, Stanley Electric, and Marelli |

| Key Sectors | Lighting-Front LED, Lighting-Front Halogen, and Lighting-Front HID Xenon |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Lighting Market Trends

The key trends impacting the automotive lighting market are evolution of the lighting technology, the use of human-centric lighting, and the practice of stringent safety regulations for lighting systems.

Human-centric lighting: The skill of producing lighting that resembles the natural daylight powering life and all body functions is known as “human-centric lighting.” It enhances people’s general well-being, performance, comfort, and health. The interior lighting of vehicles adjusts to the passenger’s mood when it interacts with human-centric lighting.

Buy the Full Report for More Trend Insights into the Automotive Lighting Market

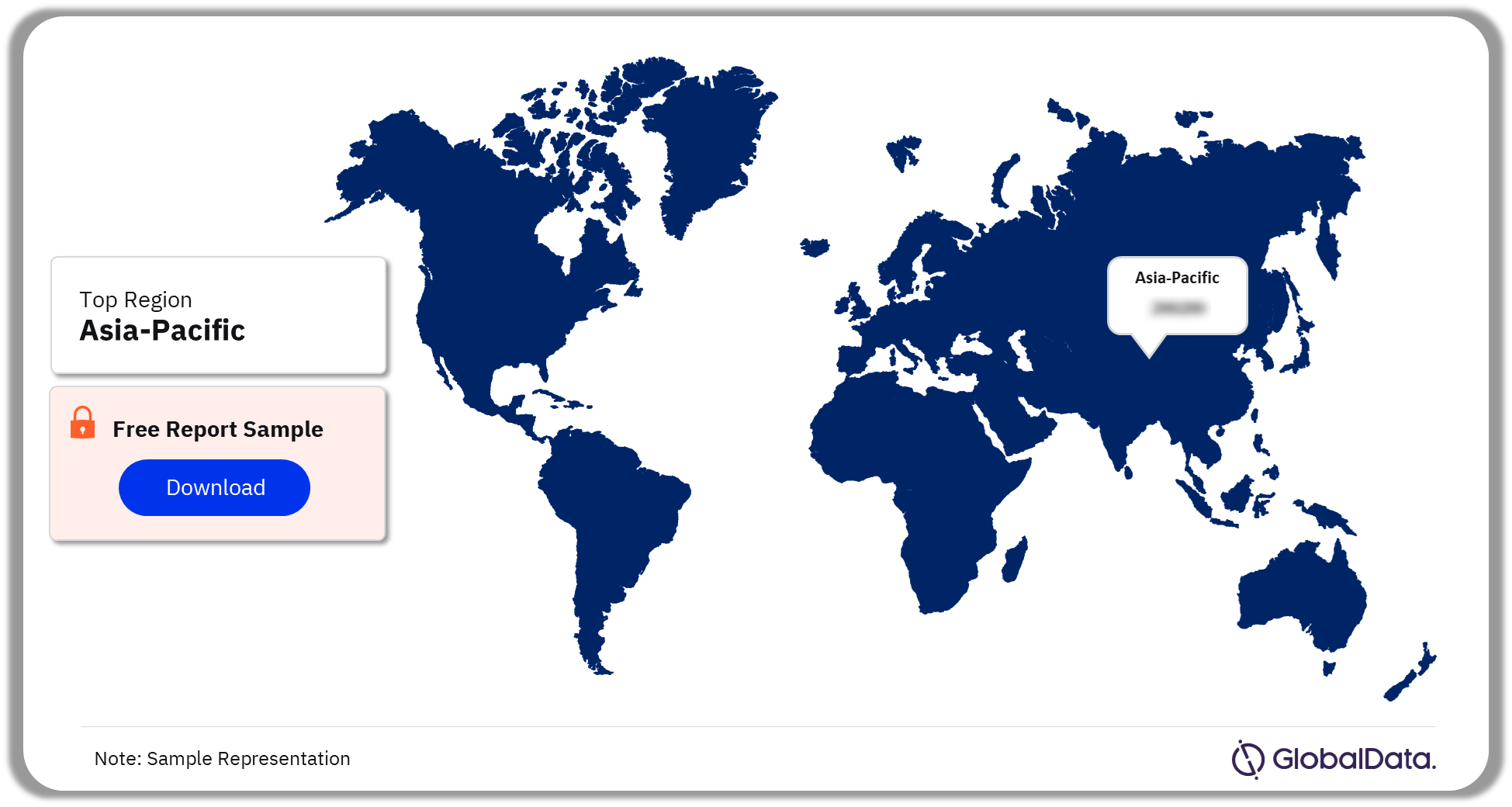

Automotive Lighting Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest automotive lighting market share among all the regions

The key regions in the automotive lighting market are Asia-Pacific, Europe, North America, South America, and MEA. In APAC, Japan has been the fastest-changing market as well as the quickest to adopt new technologies concerning the automotive lighting market. Meanwhile, India, China, and Russia still use basic halogen lighting for their vehicles.

Automotive Lighting Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Lighting Market

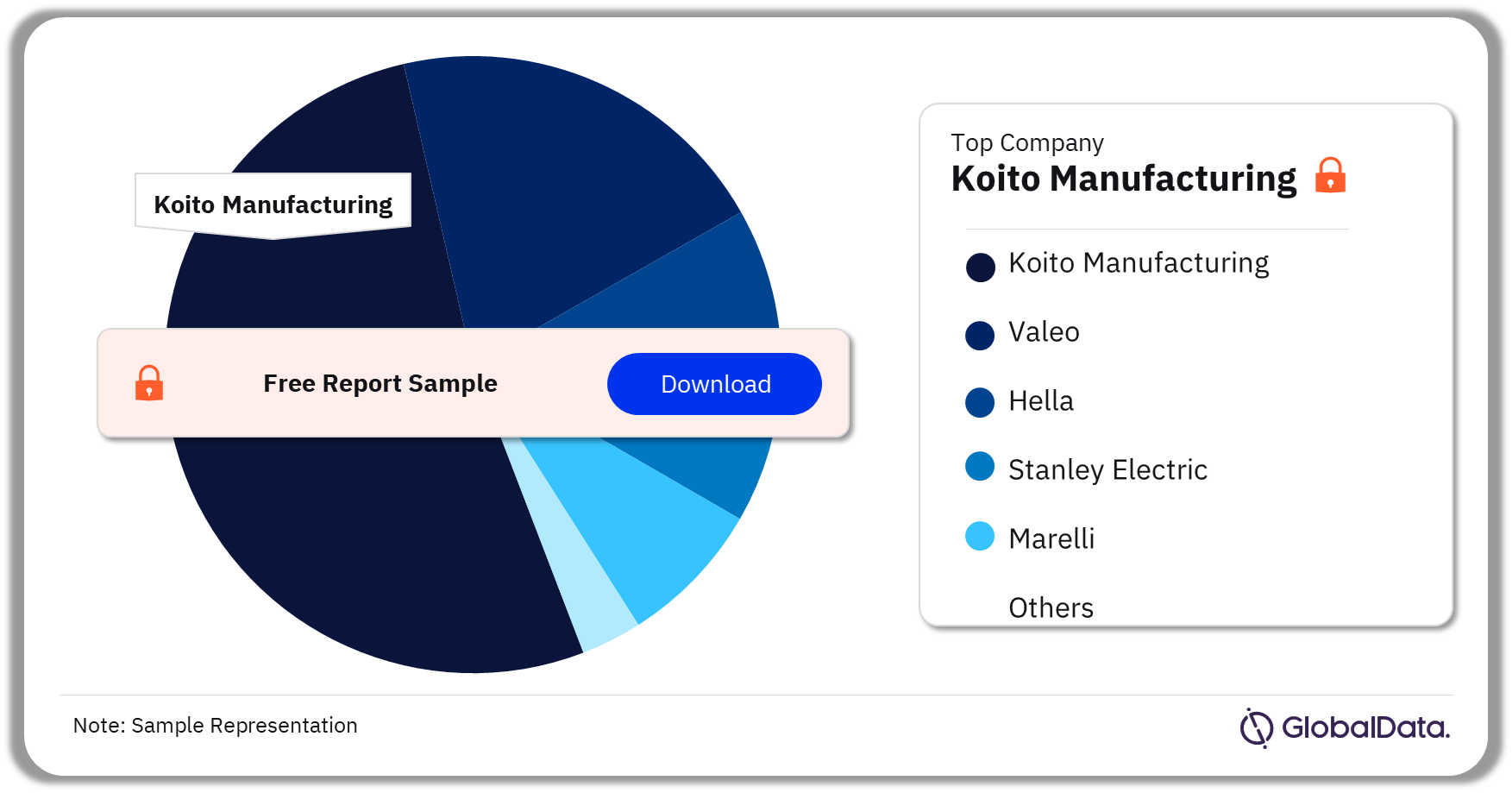

Automotive Lighting Market - Competitive Landscape

Koito Manufacturing accounted for the highest market share in 2022

A few of the top companies operating in the market are:

- Koito Manufacturing

- Valeo

- Hella

- Stanley Electric

- Marelli

Koito introduced the unique single LED Bi-Function headlamp on the recent Toyota Prius. This headlamp utilizes less power, is tinier, and weighs less than the previous technology.

Koito is also taking strategic actions to aid the growth of the automotive lighting market. On October 28, 2023, the company declared that it is creating solid-state lighting, or SSL, for use in automobiles.

Automotive Lighting Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Lighting Market Companies

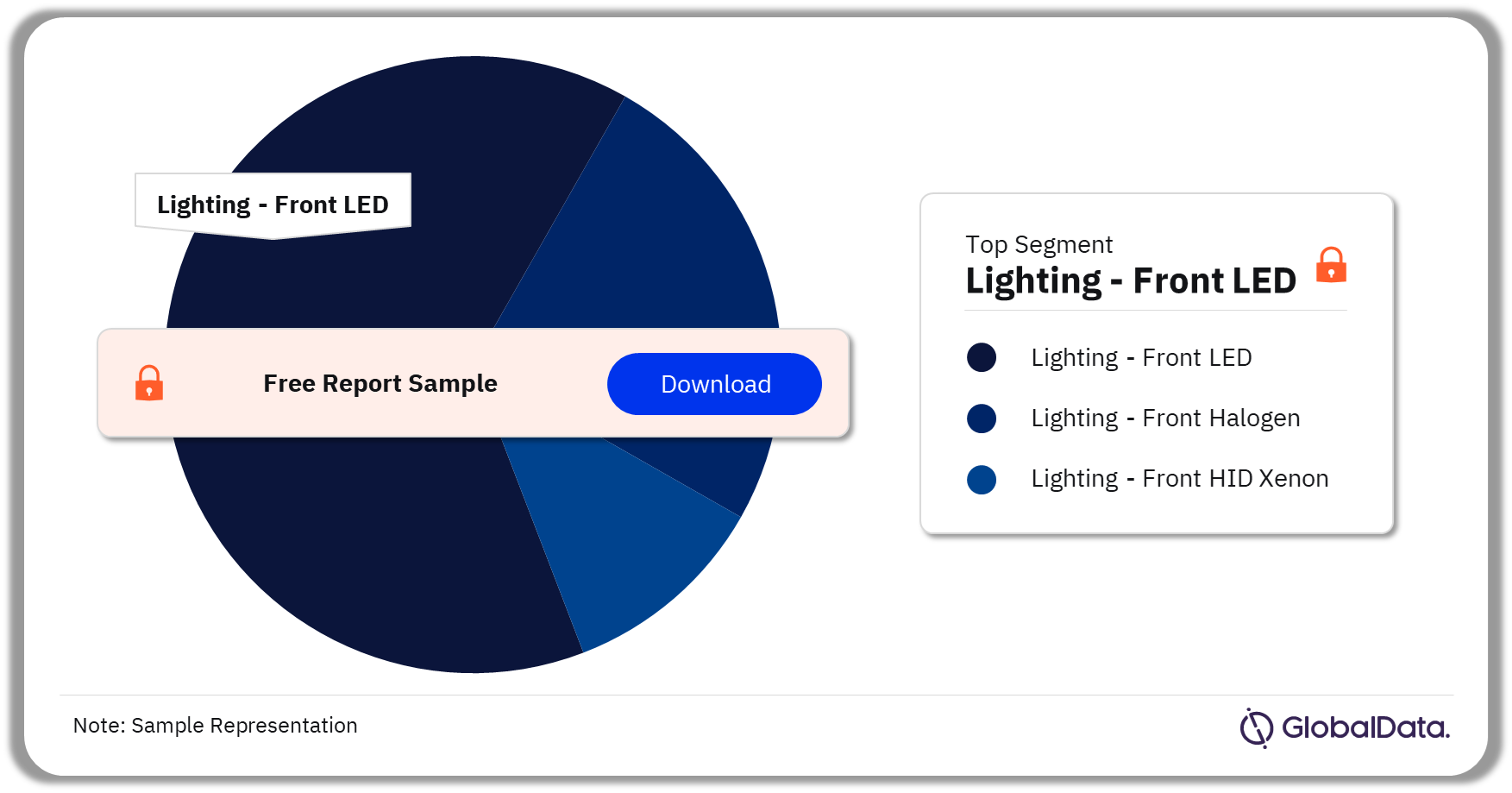

Automotive Lighting Market Segmentation by Sectors

The key sectors in the automotive lighting market are lighting-front LED, lighting-front halogen, and lighting-front HID xenon. In 2023, lighting-front LED was the dominant sector in the market. Asian countries are at the forefront of front LED adoption. This phenomenon, in turn, drives the demand for the automotive lighting sector

Automotive Lighting Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Lighting Market

Automotive Lighting Market - Latest Developments

A few of the latest developments in the automotive lighting market are as follows:

- 25th January 2024: Automotive interiors specialist Antolin has created NightSight Assist utilizing a lighting system designed to enhance the driver’s pupil diameter. This technology mitigates the negative impacts of low light conditions, resulting in improved visibility for the user.

- 21st December 2023: At CES 2024, Marelli showcased its Intelligent Social Display, intended to facilitate vehicle-to-x communication and offer diverse possibilities for lighting and communication through light. This innovative display introduces novel ways of using light for communication both on and around the vehicle.

Buy the Full Report to Know More about the Latest Developments in the Automotive Lighting Market

Segments Covered in the Report

Automotive Lighting Sector Outlook (Value, Million Units, 2018-2028)

- Lighting-Front LED

- Lighting-Front Halogen

- Lighting-Front HID Xenon

Automotive Lighting Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Scope

- Trends & Drivers: Provides an overview of the current key trends and drivers that will influence the sector’s growth in the future.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of political, economic, social, technological, environmental, and regulatory factors impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018-2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions highlighting sector size and growth drivers.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- The report provides OEMs and component suppliers’ latest information on market evolution to help formulate sales and marketing strategies.

- The report provides authentic market data with a high level of detail to help gain a competitive edge in the market.

- The report provides its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector.

- The report analyzes regions and competitive landscape that can help companies gain insight into the region-specific nuances.

- The report assesses the key trends that drive customer choice and the future opportunities that can be explored in the region. Actionable insights on trends can help companies in revenue expansion.

- The report helps gain competitive intelligence about leading component suppliers in the region with information about their market share and growth rates.

Valeo

Hella

Stanley Electric

Marelli.

Table of Contents

Table

Frequently asked questions

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.