Automotive Tyres and Wheels Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Tyres and Wheels Market Report Overview

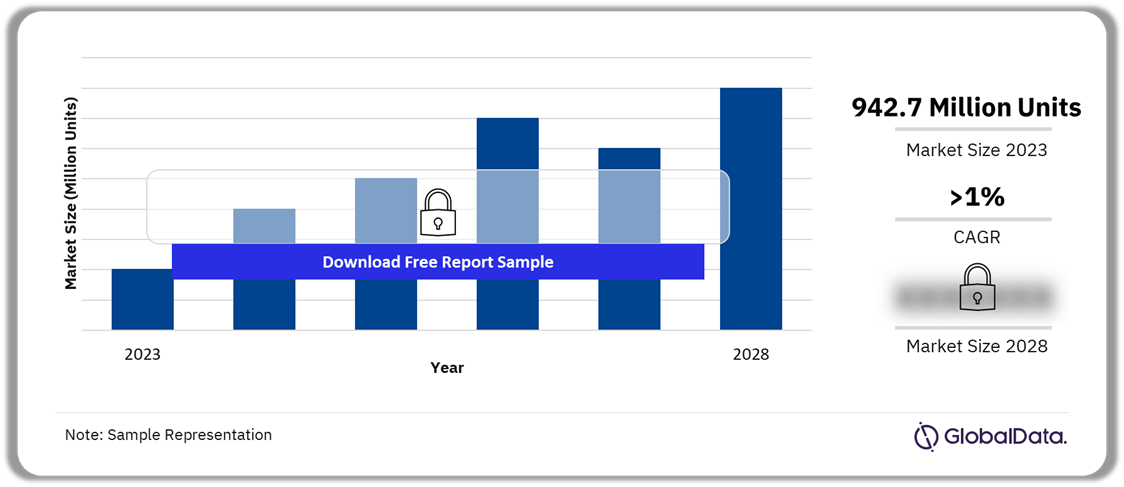

The tyres and wheels market size was 942.7 million units in 2023. The market will grow at a CAGR of more than 1% during 2023-2028. The rising number of EV adoption is driving the demand for specialized tyres while the increasing income of the middle class is significantly boosting passenger car sales. In 2023, Asia-Pacific accounted for a significant share of the automotive tyres and wheels market.

Automotive Tyres and Wheels Market Outlook, 2023-2028 (Million Units)

Buy the Full Report for More Insights on the Automotive Tyres and Wheels Market Report Forecast

The automotive tyres and wheels market research report provides a comprehensive overview of the market trends and drivers. The automotive tyres and wheels market also provides a detailed overview of technological developments and PESTER analysis. Furthermore, evaluate strategic initiatives by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings across sectors, regions, countries, and top applicants.

| Market Size (2023) | 942.7 million units |

| CAGR (2023-2028) | >1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | Goodyear, Bridgestone, Michelin, Continental, and Pirelli |

| Key Sectors | Tyres, Aluminium Wheels, Steel Wheels, and Tyre Pressure Monitoring Systems (TPMS) |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Tyres and Wheels Market Trends

The key trends shaping the automotive tyres and wheels market are the preference for larger-diameter wheels as well as the emergence of smart tyre technology and airless tyres.

Preference for larger-diameter wheels: Consumers prefer larger-diameter wheels due to aesthetics, especially stylish designs, and low-profile tyres. This demand surge is linked to the global popularity of SUVs and MPVs. Larger rims are favoured for appearance and perceived benefits such as improved stability and shorter braking distances.

Buy the Full Report for More Trend Insights into the Automotive Tyres and Wheels Market

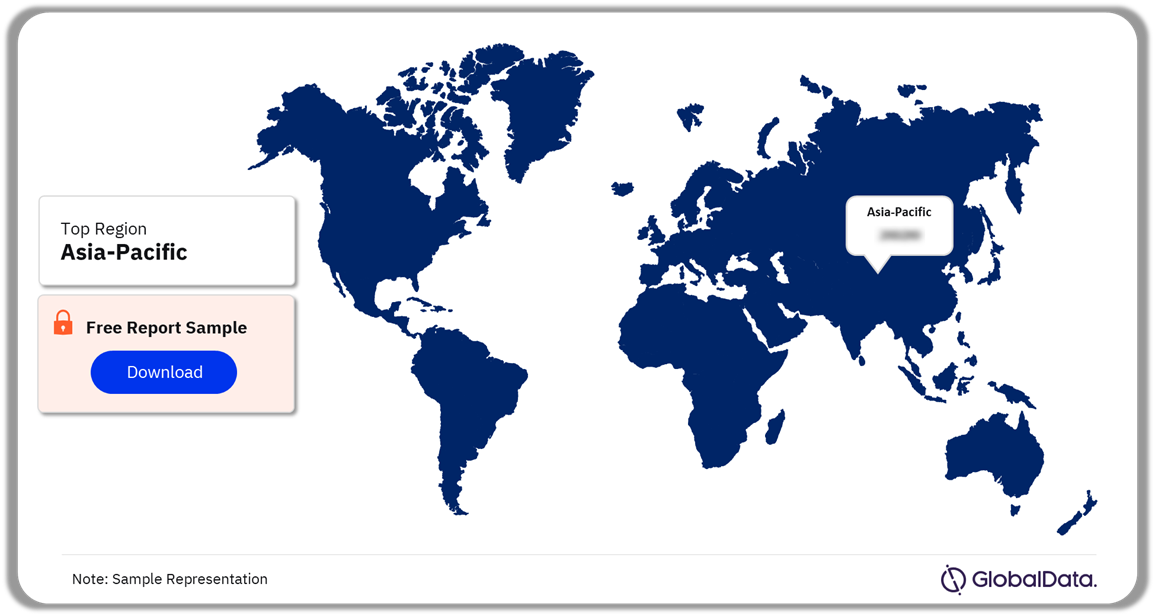

Automotive Tyres and Wheels Market Segmentation by Regions

In 2023, Asia-Pacific accounted for the highest automotive tyres and wheels market share among all the regions

The key regions in the automotive tyres and wheels market are Asia-Pacific, Europe, North America, South America, and MEA. The demand for tyres and wheels continues to rise in China, India, Japan, and South Korea due to the high production of vehicles in these countries. Additionally, the growing middle class and increasing disposable income in APAC are driving the demand for cars, which, in turn, is boosting the demand for automotive tyres and wheels.

Automotive Tyres and Wheels Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Tyres and Wheels Market

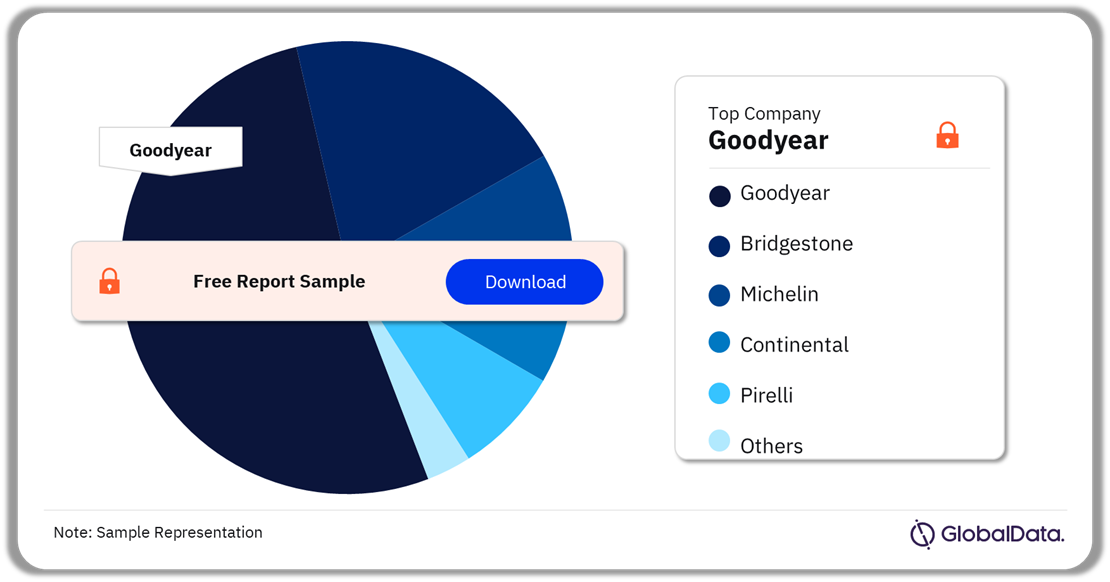

Automotive Tyres and Wheels Market – Competitive Landscape

Goodyear led the tyre market in 2022

A few of the top companies operating in the market are:

- Goodyear

- Bridgestone

- Michelin

- Continental

- Pirelli

The Assurance® WeatherReadyTM offers less road noise and traction in all weather conditions with its asymmetric tyre pattern. As the tyre ages, Evolving Traction® Grooves keep it traction-free, and 3D TreadLock® blades give dependable cornering in wet weather. For superior wet-road traction, sweeping tyre grooves direct water away, and zigzag biting edges provide strong traction in icy conditions.

Goodyear is also taking strategic actions to aid the automotive tyres and wheels market growth. In October 2023, The XUV300 received a new automatic gearbox sourced from Aisin. There is a likelihood that the new Aisin-sourced 6-speed automatic with a torque converter could replace the existing AMT gearbox. The decision to introduce this automatic gearbox is potentially influenced by consumer feedback, aiming to enhance the SUV’s positioning in the sub-4-meter compact SUV segment.

Tyre Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Tyres and Wheels Market Companies

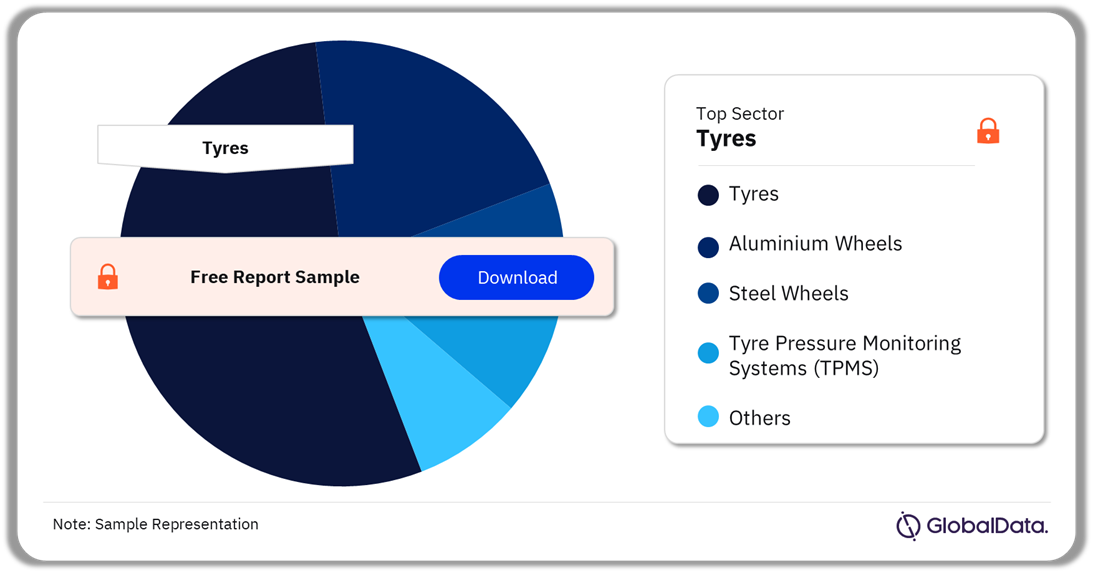

Automotive Tyres and Wheels Market Segmentation by Sectors

The key sectors in the automotive tyres and wheels market are tyres, aluminium wheels, steel wheels, and tyre pressure monitoring systems (TPMS), among others. In 2023, tyres accounted for the highest share of the automotive tyres and wheels market.

Automotive Tyres and Wheels Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Tyres and Wheels Market Download a Free Report Sample

Automotive Tyres and Wheels Market – Latest Developments

A few of the latest developments in the automotive tyres and wheels market are as follows:

- 29th February 2024: Titan International Inc. acquired Carlstar Group LLC. The purchase agreement wire transfers and stock consideration issuance needed to be completed before the transaction could be finalized. The acquisition will have an immediate impact on earnings per share and operating margins in 2024.

- 26th January 2024: Continental has recently announced that it will sell Finnish spikes specialist Tikka Spikes Oy, as part of a management buy-out. The acquisition will be made by Tikka Industrial Oy, a newly founded company owned by parts of Tikka’s current management team led by Juha Rautiainen. The deal is expected to be completed by March 1, 2024, and all of Tikka Spikes’ employees will be transferred to the new owners.

Buy the Full Report to Know More about the Latest Developments in the Automotive Tyres and Wheels Market

Segments Covered in this Report

Automotive Tyres and Wheels Regional Outlook (Value, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Automotive Tyres and Wheels Sector Outlook (Value, Million Units, 2018-2028)

- Tyres

- Aluminium Wheels

- Steel Wheels

- Tyre Pressure Monitoring Systems (TPMS)

Scope

- Trends & Drivers: Provides an overview of the current key trends and drivers that will influence the sector’s growth in the future.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of political, economic, social, technological, environmental, and regulatory factors impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018-2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions highlighting sector size and growth drivers for the region.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the companies’ recent product innovations and key strategic initiatives. taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- The report provides OEMs and component suppliers’ latest information on market evolution to help formulate sales and marketing strategies.

- The report provides authentic market data with a high level of detail to help gain a competitive edge.

- The report provides its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector.

Bridgestone

Michelin

Continental

Hankook

Pirelli.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the automotive tyres and wheels market size in 2023?

The automotive tyres and wheels market size was 942.7 million units in 2023.

-

What will the tyres and wheels market growth rate be during the forecast period?

The tyres and wheels market will grow at a CAGR of more than 1% during 2023-2028.

-

Which was the leading region in the automotive tyres and wheels market in 2023?

Asia-Pacific was leading the automotive tyres and wheels market in 2023.

-

Which was the leading sector of the automotive tyres and wheels market in 2023?

In 2023, tyres accounted for the highest share of the automotive tyres and wheels market.

-

Which are the key companies in the automotive tyres and wheels market?

The top companies operating in the automotive tyres and wheels market are Goodyear, Bridgestone, Michelin, Continental, and Pirelli, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.