Belgium Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Belgium Cards and Payments Market Report Overview

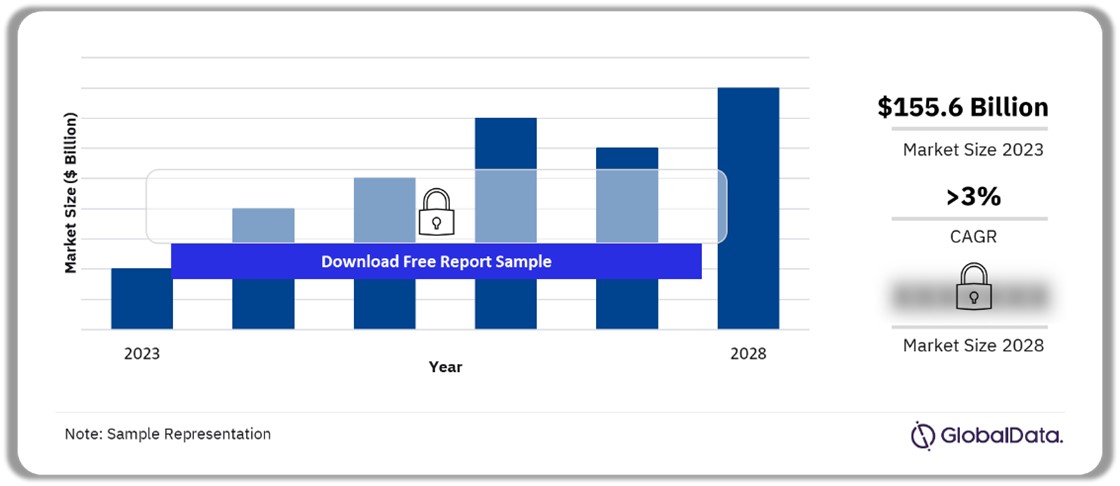

The annual value of card transactions in the Belgium cards and payments market was $155.6 billion in 2023. The value is expected to grow at a CAGR of more than 3% during 2024-2028. The Belgian payment card market is rapidly growing and continuously innovating. Persistent efforts from Belgian financial authorities and banks ensure a robust banked population. Furthermore, a high level of awareness of electronic payments, and an increasingly developing payment-acceptance infrastructure have been successful in encouraging consumers to use electronic payment methods for day-to-day transactions.

Belgium Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Belgium Cards and Payments Market Forecast Download a Free Sample Report

The Belgium cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Belgium cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $155.6 billion |

| CAGR (2024-2028) | >3% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Payment Instruments | · Cash

· Cards · Credit Transfers · Direct Debits · Checks |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments |

| Leading Players | · Apple Pay

· Google Pay · Bancontact Payconiq · PayPal · Paysafecard · Klarna · Click to Pay |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Belgium Cards and Payments Market Dynamics

Belgium has a well-established banking system and a high-banked adult population. The country is observing a gradual shift from traditional cash to electronic means of payment. To aid the development of digital payments, the European Payments Initiative (EPI) announced the launch of its mobile wallet solution Wero, in September 2023. The platform will be provided through EPI-associated member banks and mobile apps. During its first stage, the focus will be on P2P, and it will be subsequently expanded to include online and mobile payments before finally enabling payments at the POS. The mobile wallet is set to launch initially in France, Germany, and Belgium in mid-2024 before being expanded to other European countries.

Buy the Full Report to Get Additional Belgium Cards and Payments Market Dynamics

Download a Free Sample Report

Belgium Cards and Payments Market Segmentation by Payment Instruments

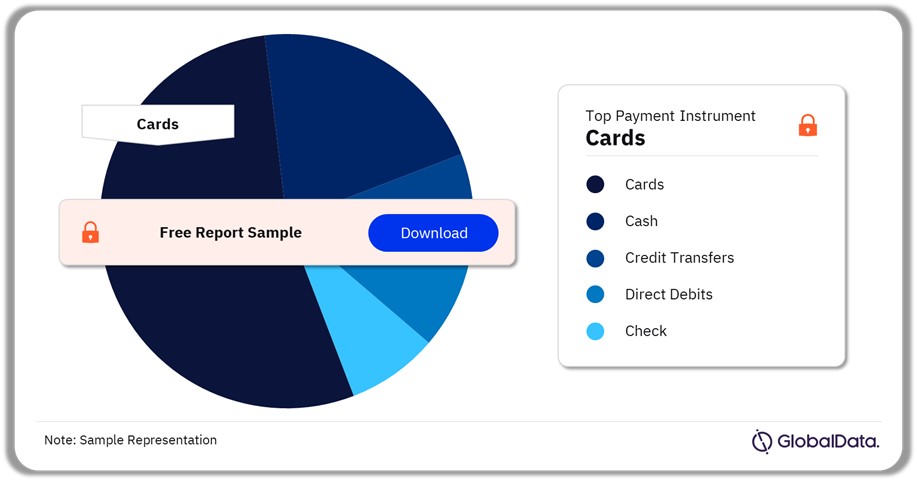

Cards had the highest share of payment transaction volume in 2023

The key payment instruments in the Belgium cards and payments market are cash, credit transfers, cards, direct debits, and checks. Belgians are gradually shifting their preference from cash-based payments to card-based payments. Growth in card payments can be attributed to government, bank, and other financial institution’s efforts to promote electronic payments. Meanwhile, the rising preference for contactless payments has also supported card payments

Belgium Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Belgium Cards and Payments Market

Download a Free Sample Report

Belgium Cards and Payments Market Segments

Food and drink leads e-commerce spending by transaction value in Belgium

The key segments in the Belgium cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

E-Commerce Payments: Food and drink is the leading category for online payments by transaction value, highlighting the high level of comfort consumers have buying everyday essentials online. This has helped drive the introduction of food ordering and delivery apps within the country. For example, in October 2023, online grocery delivery company Takeaway.com partnered with Carrefour, allowing its customers to order groceries online and collect them at Carrefour stores. The prevalence of smartphones, widespread internet penetration, the availability of secure online payment systems, and the increasing number of online shoppers all supported the market growth. Online shopping events such as Belgian Friday, Black Friday, and Cyber Monday also contributed to the market. Belgium’s e-commerce payments are expected to continue growing.

Buy the Full Report for More Market Segment Insights into the Belgium Cards and Payments Market

Download a Free Sample Report

Belgium Cards and Payments Market - Competitive Landscape

A few of the leading players in the Belgium cards and payments market are:

- Apple Pay

- Google Pay

- Bancontact Payconiq

- PayPal

- Paysafecard

Apple Pay: Apple Pay was launched in Belgium in November 2018. The solution allows in-store, online, and in-app payments. Apple Pay is available on all NFC-enabled smartphones. To make payments, users need to place the phone over the NFC terminal, which automatically detects the default card saved in Apple Pay. As of March 2024, 40 banks and financial institutions supported Apple Pay, including ING Bank, BNP Paribas Fortis, Hello bank!, bunq, N26, Revolut, Curve, Buy Way, Fintro, and Monese.

Belgium Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Belgium Cards and Payments Market Download a Free Sample Report

Belgium Cards and Payments Market – Latest Developments

- In September 2023, BICS, a communications platform firm, partnered with Bancontact Payconiq Company to deliver multi-factor authentication for the new Payconiq by Bancontact mobile app. The application uses multi-factor authentication to verify customers.

- In May 2022, Klarna introduced a livestream shopping service in Belgium and many other markets, giving online users an interactive, virtual in-store experience.

Segments Covered in the Report

Belgium Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2028)

- Cash

- Cards

- Credit Transfers

- Direct Debits

- Check

Belgium Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2028)

- Card-Based Payments

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data related to the Belgium cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in Belgium’s cards and payments industry.

- Assess the competitive dynamics in the Belgium cards and payments industry.

- Gain insights into marketing strategies used for various card types in Belgium.

- Gain insights into key regulations governing the Belgium cards and payments industry.

Belfius Bank

Credit Mutuel

KBC Bank

ING Bank

Argenta

bpost

AXA bank

Mastercard

Visa

American Express

Google Pay

Apple Pay

Paypal

Payconiq

Paysafecard

Riverty

Klarna

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Belgium cards and payments market in 2023?

The annual value of card transactions in the Belgium cards and payments market was $155.6 billion in 2023.

-

What will the Belgium cards market growth rate be during the forecast period?

The Belgium annual cards market value is expected to grow at a CAGR of more than 3% during 2024-2028.

-

Which was the leading payment instrument in the Belgium cards and payments market in 2023?

Card was the leading payment instrument in terms of transaction volume in the Belgium cards and payments market in 2023.

-

Which are the leading players in the Belgium cards and payments market?

A few of the leading players in the Belgium cards and payments market are Apple Pay, Google Pay, Bancontact Payconiq, PayPal, and Paysafecard.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports