Blockchain Market Size, Share, Trends and Analysis by Application, Vertical, Region, and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Blockchain’ report can help you:

- Gain a valuable understanding of the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments.

- Identify competitors’ capabilities to stay ahead in the market.

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain.

- Anticipate changes in demand and adjust the business development strategies.

- Identify potential regions and countries for growth opportunities.

How is our ‘Blockchain’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 15 countries, including historical and forecast analysis for the period 2020-2030 for market assessment.

- It provides detailed segmentation by:

- Application – Supply Chain Management, Cross-Border Payments and Settlements, Lot Lineage/Provenance, Trade Finance & Post-Trade Settlements, Identity Management, Property Ownership Management, Energy Settlements, Others

- Vertical – BFSI, Transport and Logistics, Cross-sector, Retail, Healthcare, Government, Others

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market drivers and challenges impacting the blockchain market.

- The report also covers Mergers & Acquisitions (M&A), Venture Financing, Patent, Job, and Social Media activity dashboards.

- The report includes competitive positioning of key companies and company share analysis in the blockchain market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- It covers competitive profiling and benchmarking of leading companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest blockchain trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Companies offering blockchain services/solutions

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Blockchain Market Report Overview

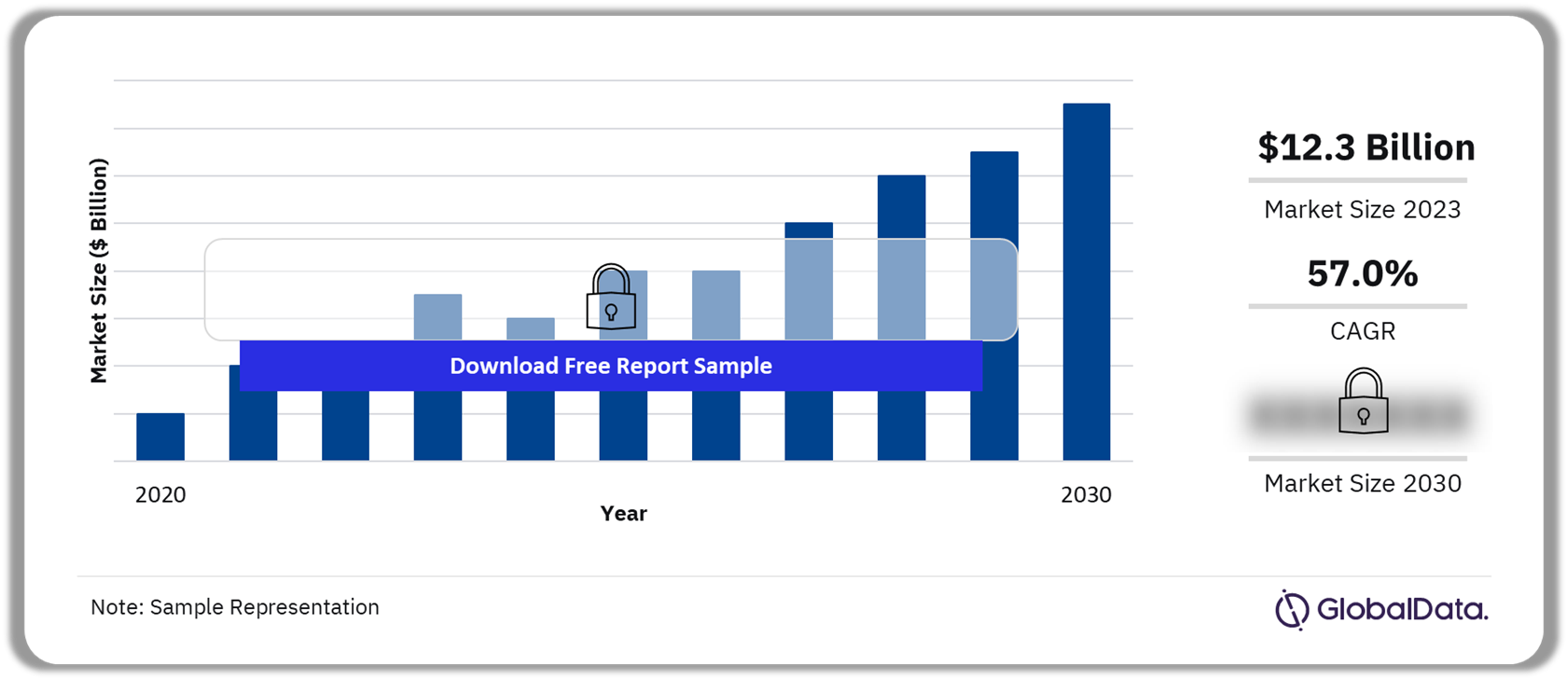

The global blockchain market size was valued at $12.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 57% over the forecast period. Blockchain technology will be driven by the increasing acceptance of cryptocurrencies across the globe and increasing use cases in the financial and retail sectors. The market growth will also be supported by services like Blockchain as a service (BaaS) through which small and medium-sized enterprises (SMEs) can explore blockchain applications and smart contracts without the cost and complexity of developing in-house expertise.

Blockchain Market Overview, 2020 – 2030

Buy the Full Report for Additional Insights on the Blockchain Market Forecasts, Download a Free Report Sample

Cryptocurrencies are the most well-known use case for blockchain technology. While most associate cryptocurrencies purely with Bitcoin, there are, in fact, over 20,000 cryptocurrencies. These include stablecoins, privacy coins, utility tokens, security tokens, and more, all with different functions and characteristics.

Cryptocurrencies fuel the adoption and development of blockchain technology as they serve as an incentive mechanism for blockchain infrastructure. Participants receive rewards such as Bitcoin for operating and updating the blockchain network. Moreover, cryptocurrencies fund and encourage the development, governance, and use of decentralized apps (DApps), thus shaping user behavior and supporting blockchain economies. As such, the rising popularity of cryptocurrencies is driving innovation in blockchain technology, leading to developments in scalability, privacy, and interoperability. Consequently, this progress is facilitating more diverse blockchain applications beyond cryptocurrencies.

However, the lack of a skilled workforce and indistinct regulatory clarity act as restraints for the blockchain market. Businesses such as digital identification, gambling, and supply chain management are taking advantage of Blockchain’s potential to increase security and transparency. Additionally, the use of cryptocurrencies has surged as more people and organizations increasingly invest in digital assets and utilize them for regular transactions. The need for blockchain developers has risen significantly in response to the growing demand for decentralized financial solutions and the integration of blockchain technology into a variety of industries. The nascent nature and complexity of blockchain means that a lack of skilled talent presents a barrier to executing initiatives.

| Market Size (2023) | $12.3 billion |

| CAGR (2023 – 2030) | 57% |

| Forecast Period | 2023-2030 |

| Historical Period | 2020-2022 |

| Application Segment | Supply Chain Management, Cross-Border Payments and Settlements, Lot Lineage/Provenance, Trade Finance & Post-Trade Settlements, Identity Management, Property Ownership Management, Energy Settlements, Others |

| Vertical Segment | BFSI, Transport and Logistics, Cross-Sector, Retail, Healthcare, and Government |

| Key Companies | Accenture Plc, Alibaba Group Holding Ltd., Amazon.com Inc., Chainalysis Inc., Consensys Inc., Infosys Ltd., Oracle Corp., Salesforce Inc., Tencent Holdings Ltd., Wipro Ltd. |

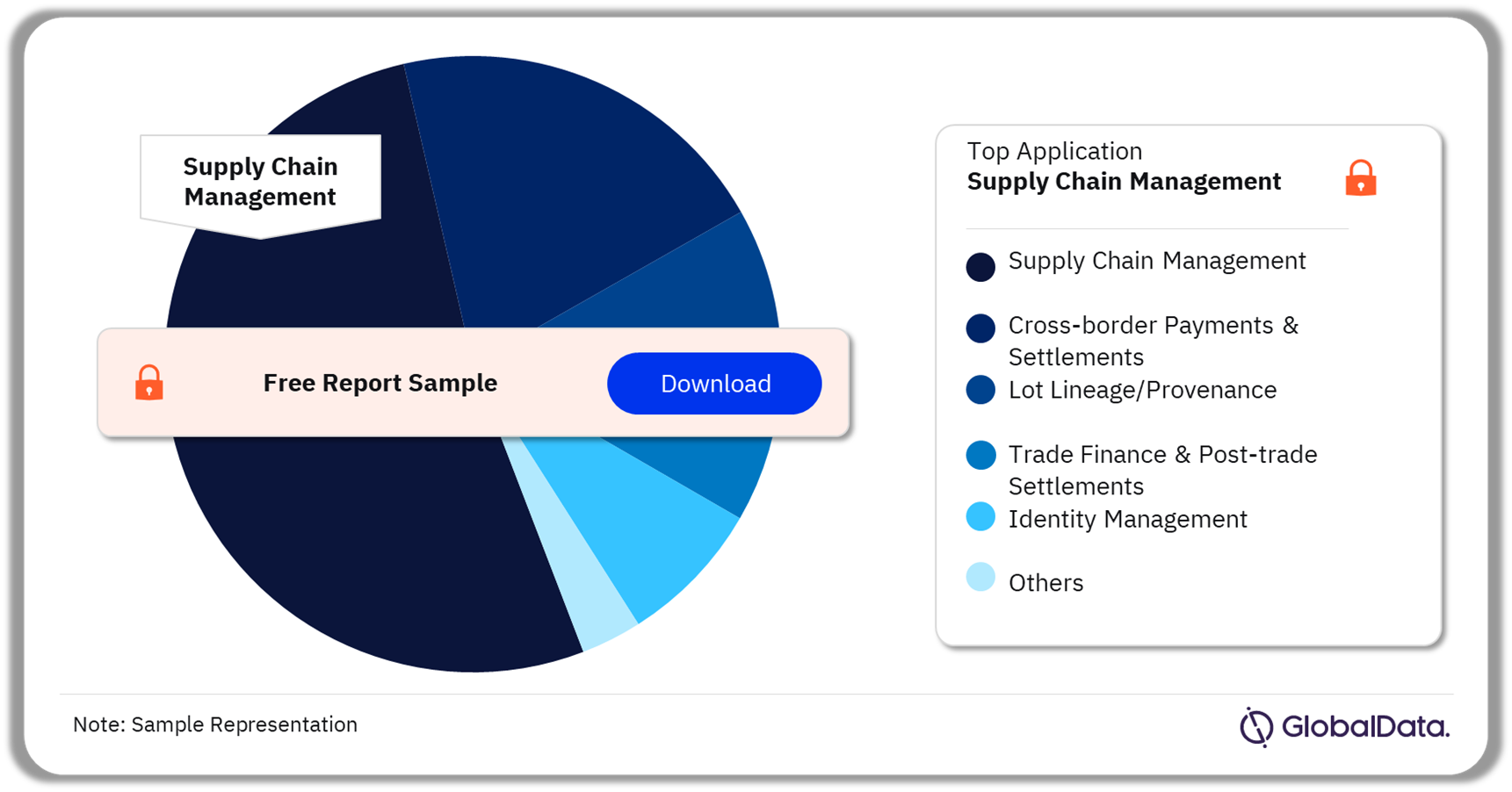

Blockchain Market Analysis by Application

The application categories include supply chain management, cross-border payments and settlements, lot lineage/provenance, trade finance & post-trade settlements, identity management, property ownership management, and energy settlements. Supply chain management and cross-border payments were the most prominent blockchain application markets in 2023.

The movement of goods across the globe depends on an extraordinarily complex set of processes and a vast array of regulations. Blockchain has a role in supporting the digitization of supply chains and increasing transparency and efficiency. Businesses are looking to blockchain to reduce the time and costs of moving products. Integration with other technologies, particularly IoT, will be crucial for getting the most out of blockchain in the supply chain.

While blockchain applications are found across industries today, much of the hype and appeal surrounding the technology is focused on the payments and settlements industry. Blockchain is increasingly used to speed up payments, improve transparency, eliminate intermediaries, and reduce costs. Cross-border payments via traditional payment methods are complex, expensive, and slow. Aside from facilitating faster and cheaper payments, smart contracts can, for example, be used for consumption-based payments and dispute resolution, facilitating chargebacks.

Blockchain Market Analysis by Application, 2023 (%)

Buy the Full Report for More Information on Blockchain Application Areas, Download a Free Report Sample

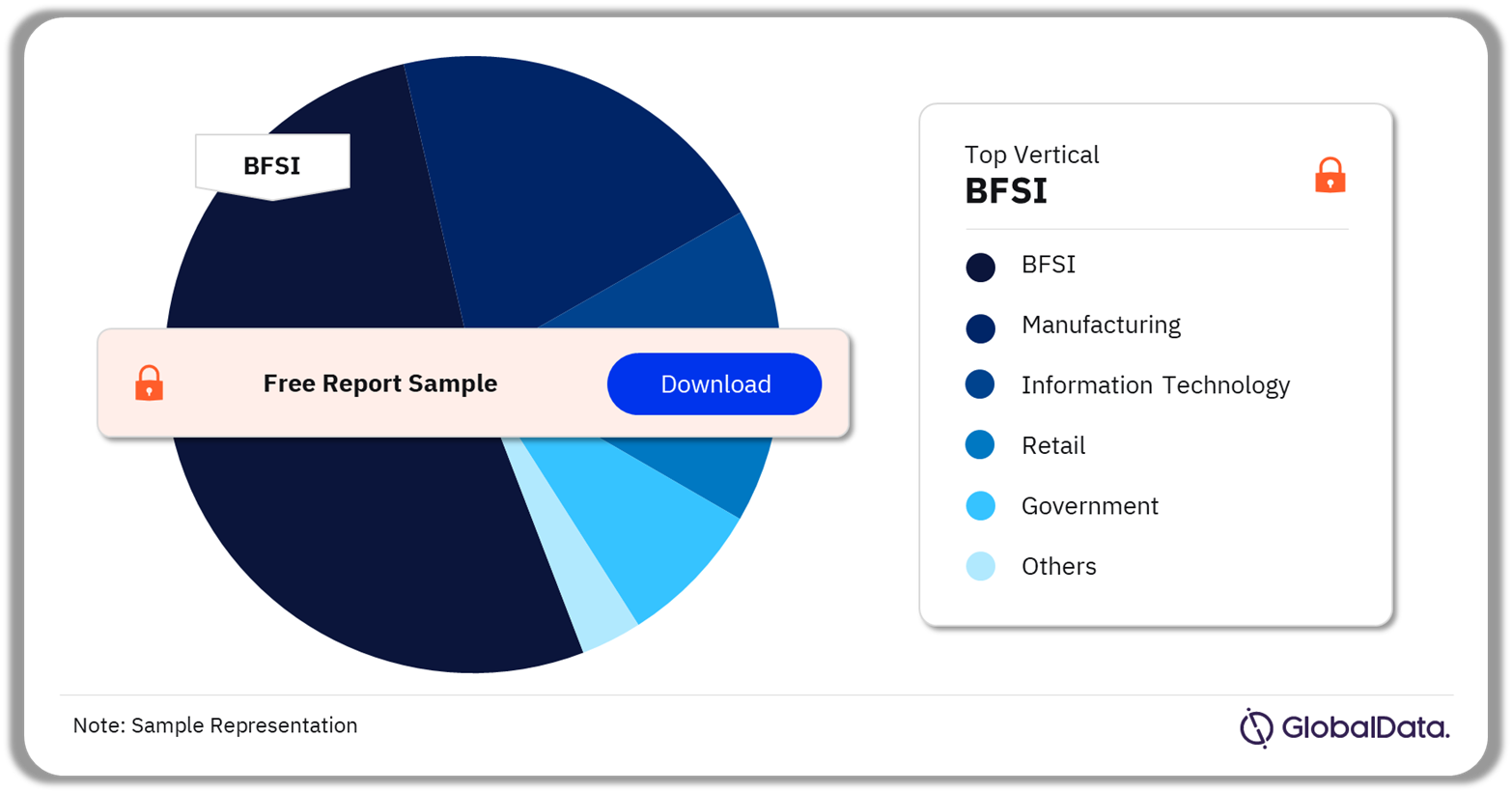

Blockchain Market Analysis by Vertical

Vertical categories include BFSI, transport and logistics, cross-sector, retail, healthcare, and government. In 2023, BFSI was the largest adopter, contributing over 40% of the overall blockchain revenue. Blockchain use cases in the banking and payments industry include cross-border payments and settlements, identity management, trade finance, post-trade settlement, and asset tracking.

Apart from the financial sector, blockchain is increasingly being adopted across multiple industries and application areas. Supply chain-related industries such as construction, retail, and foodservice hold prominent positions. These industries will use blockchain for transactions or tracking assets and goods, with supply chain quality and provenance control among the key use cases. Identifying use cases for a blockchain project is not always straightforward. Blockchains often function as a shared data platform that supports a wide range of use cases. They often evolve from having a narrow industry-specific focus to including other unrelated industries.

Blockchain can modernize the fragmented and efficient logistic industry. Blockchain technology is predicted to revolutionize multiple industries, including transport and logistics, despite being best known for its association with various cryptocurrencies such as bitcoin. The technology is widely applicable to many problems in numerous industries. Supply chains are becoming increasingly complex, with many companies requiring large numbers of contracts, payment tracking, and communications.

Blockchain Market Analysis by Vertical, 2023 (%)

Blockchain market outlook Report with detailed vertical analysis is available with Global Data Now! Make a Purchase Right Here! or Download a Free Sample

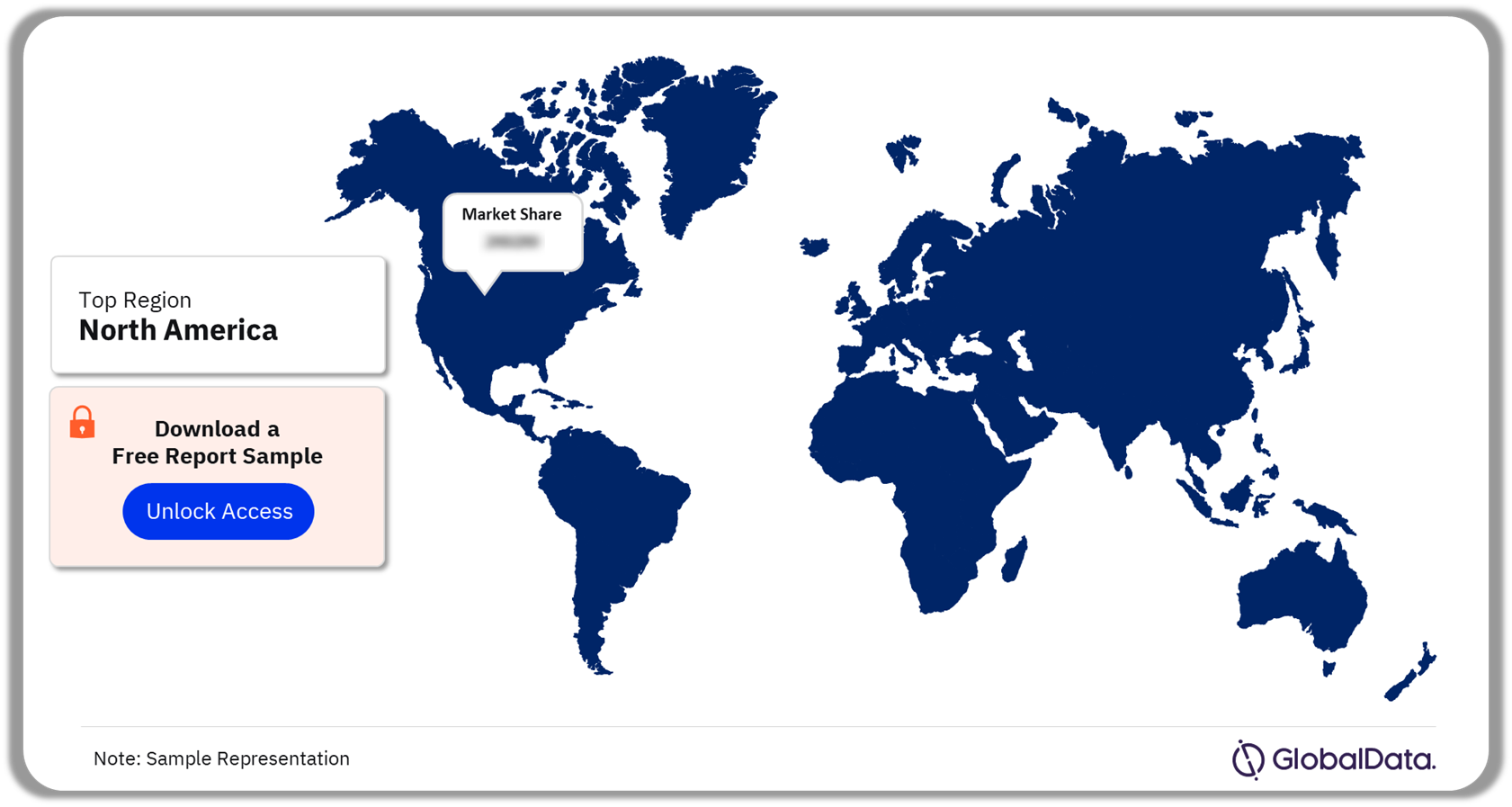

Blockchain Market Analysis by Region

North America, particularly the US, remains the dominant region in developing the technologies, accounting for more than 35% of its revenues in 2023. The US is home to most blockchain-related venture financing, with early adoption and the presence of major blockchain-native and Big Tech companies providing a competitive advantage. However, regulatory uncertainties in the US are prompting companies to explore expansion opportunities elsewhere, leading to an expected decrease in the US’s market share by 2030.

The South & Central America blockchain market is propelled by the growing number of small and medium enterprises, driven by their inclination towards digitization to enhance their IT infrastructure. This move aims at accelerating business growth and catering to customer demands efficiently. The growing ICT sector and the rising adoption of emerging technologies are spurring the blockchain market growth in South & Central America.

Blockchain is suitable where there is a desire to minimize the degree of trust required between participants. The main use case for blockchain is tracking items in complex supply chains (e.g., food, pharmaceuticals, shipping containers). With blockchain, supply chains become more transparent as it enables every party to trace the goods and ensure that they are not replaced or misused during the process. This can help verify the authenticity of the traded goods, preventing counterfeit goods from entering the supply chain.

Asia-Pacific is predicted to show the highest growth in the forecast period. Growth drivers include a favorable regulatory environment, strong government initiatives, and an expanding middle class that demands enhanced financial services. The Chinese government’s significant investment in blockchain technology, exemplified by initiatives like the Blockchain-based Service Network, is expected to significantly boost the region’s blockchain market.

Blockchain Market Share by Region, 2023 (%)

View Sample Report for Additional Insights on the Blockchain Adoption Market Size Projections, Download a Free Report Sample

Blockchain Market - Competitive Landscape

While the industry is highly fragmented, the growth of blockchain start-ups and new venture launches are gradually intensifying the competition. Key companies in this market include Accenture Plc, Alibaba Group Holding Ltd., Amazon.com Inc., Chainalysis Inc., Consensys Inc., Infosys Ltd., Oracle Corp., Salesforce Inc., Tencent Holdings Ltd., and Wipro Ltd., among others.

Several companies are entering into partnerships to enhance their product offerings. In January 2024, Alibaba Group announced a partnership between Alibaba Cloud and Mysten Labs, a key developer behind the Sui blockchain. The partnership was aimed to enhance the Sui blockchain ecosystem. Also, In Nov 2023, Tencent Cloud along with 17 other internet infrastructure companies, announced a partnership with Infura, the world’s leading web3 API provider developed by Consensys. The partnership was aimed to create Infura’s Decentralized Infrastructure Network (DIN), a decentralized RPC-as-a-service offering that aims to make Web3 more accessible, reliable, and efficient.

Leading Companies in the Blockchain Ecosystem

- Accenture Plc

- Alibaba Group Holding Ltd.

- com Inc.

- Chainalysis Inc.

- Consensys Inc.

- Infosys Ltd.

- Oracle Corp.

- Salesforce Inc.

- Tencent Holdings Ltd.

- Wipro Ltd.

Other Key Companies Mentioned

Ping An Insurance, JPMorgan Chase & Co., HSBC, AXONI, Figure Technologies, R3, Ripple Labs Inc., Kaleido, SAP SE, Intel Corp., Huawei Technologies Co Ltd., BitFury Holding BV, Chain Inc., BlockCypher, Solana, and LVMH

Scope

GlobalData Plc has segmented the overall market report by application, vertical, and region:

Blockchain Application Outlook (Revenue, $ Million, 2020-2030)

- Supply Chain Management

- Cross-Border Payments and Settlements

- Lot lineage/provenance

- Trade Finance & Post-Trade Settlements

- Identity management

- Property Ownership Management

- Energy Settlements

- Others

Blockchain Vertical Outlook (Revenue, $ Million, 2020-2030)

- BFSI

- Transport and Logistics

- Cross-sector

- Retail

- Healthcare

- Government

- Others

Blockchain Regional Outlook (Revenue, $ Million, 2020-2030)

- North America

- US

- Canada

- Europe

- Germany

- UK

- Italy

- France

- Spain

- The Netherlands

- Rest of Europe

- Asia Pacific

- South Korea

- Japan

- Singapore

- China

- Australia

- India

- Rest of APAC

- South & Central America

- Brazil

- Mexico

- Argentina

- Rest of South & Central America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Rest of Middle East & Africa

Key Highlights

The global blockchain market size was valued at $12.3 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 57% during 2023-2030. Blockchain technology will be driven by increasing acceptance of cryptocurrencies across the globe and increasing use cases in financial and retail sectors.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global blockchain market by application, vertical, region and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in blockchain market.

The report also highlights key application (supply chain management, cross-border payments and settlements, lot lineage/provenance, trade finance & post-trade settlements, identity management, property ownership management, energy settlements, and others)

The report also highlights key vertical segments (BFSI, transport and logistics, cross-sector, retail, healthcare, government, and others)

With more than 80 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in blockchain market.

The broad perspective of the report coupled with comprehensive, actionable detail will help blockchain stakeholders, service providers, and other blockchain players succeed in growing the blockchain market globally

Key Players

Accenture PlcAlibaba Group Holding Ltd.

Amazon.com Inc.

Chainalysis Inc.

Consensys Inc.

Infosys Ltd.

Oracle Corp.

Salesforce Inc.

Tencent Holdings Ltd.

Wipro Ltd.

Ping An Insurance

JPMorgan Chase & Co.

HSBC

AXONI

Figure Technologies

R3

Ripple Labs Inc.

Kaleido

SAP SE

Intel Corp.

Huawei Technologies Co Ltd.

BitFury Holding BV

Chain Inc.

BlockCypher

Solana

LVMH

Table of Contents

Table

Figures

Frequently asked questions

-

What was the global blockchain market size in 2023?

The global blockchain market size was valued at $12.3 billion in 2023.

-

What is the blockchain market growth rate?

The global blockchain market is expected to grow at a CAGR of 57% during the forecast period (2023-2030).

-

What are the key blockchain technology market drivers?

Growing adoption of blockchain as a service, increasing acceptance of cryptocurrency, investments in blockchain by financial industry are stimulating the growth of the market worldwide.

-

What are the key blockchain market segmentation?

Application Segments: supply chain management, cross-border payments and settlements, lot lineage/provenance, trade finance & post-trade settlements, identity management, property ownership management, energy settlements, and others

Vertical Segments: (BFSI, transport and logistics, cross-sector, retail, healthcare, government, and others)

-

Which are the leading blockchain solution provider companies globally?

The leading companies in the market are Accenture Plc, Alibaba Group Holding Ltd., Amazon.com Inc., Chainalysis Inc., Consensys Inc., Infosys Ltd., Oracle Corp., Salesforce Inc., Tencent Holdings Ltd., and Wipro Ltd.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Blockchain reports