BRIC Countries (Brazil, Russia, India, China) Car Manufacturing Market Summary, Competitive Analysis and Forecast, 2017-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

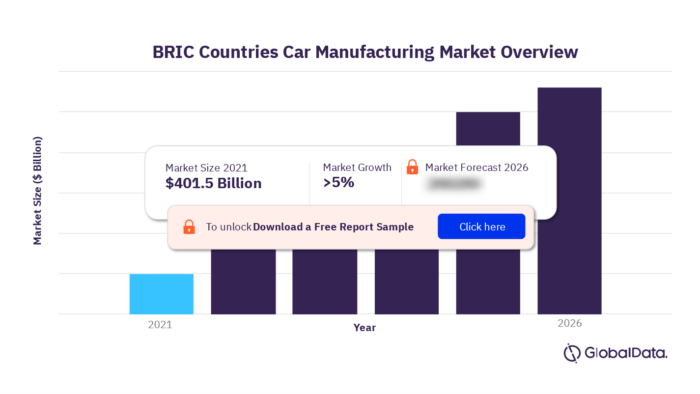

The BRIC countries, which include Brazil, Russia, India, and China, contributed $401.5 billion to the global car manufacturing industry in 2021 and are expected to accelerate at a CAGR of more than 5% over the 2021-26 period. The BRIC countries (Brazil, Russia, India, and China) car manufacturing market research report provides top-line qualitative and quantitative summary information including market share, industry size (value and volume 2017-21, and forecast to 2026). The profile also contains descriptions of the leading players including key financial metrics and an analysis of competitive pressures within the industry.

For more insights, download a free report sample

BRIC Countries Car Manufacturing Market Outlook

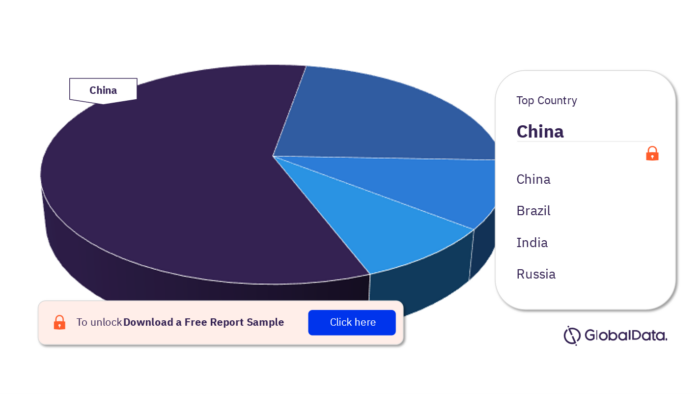

The BRIC countries include Brazil, Russia, India, and China. China led the BRIC car manufacturing industry in terms of revenue in 2021.

Brazil

The Brazilian car manufacturing industry has fluctuated between growth and decline in recent years, with the steepest decline being seen in 2020 amid the COVID-19 pandemic. 2021 saw a surge in the industry value, with manufacturing output also registering a healthy increase. The forecast period looks promising in both value and volume terms.

The Brazilian car manufacturing industry is expected to follow a strong growth trajectory over the forecast period. Pent-up demand is expected to drive growth, while the improving macroeconomic environment brought about by the end of the pandemic should support spending over the coming years.

China

Growth in this industry has been hindered by environmental concerns in China. High pollution levels in the major urban cities have led the government to encourage consumers to revert to non-fossil fuel-burning substitutes such as bicycles. This return to bicycles has been boosted by the emergence of bike-sharing start-ups such as Ofo, Bluegogo, and Mobike, which now operate millions of bicycles across the country. On top of this, many of the younger consumers in the Chinese industry increasingly see bicycles as trendy, much like their counterparts do in Amsterdam or Copenhagen.

India

The Indian car manufacturing industry has fluctuated between growth and decline in value and volume terms in recent years. The industry suffered a particularly steep decline in 2020 amid the COVID-19 pandemic. 2021 saw a considerable recovery in the industry in both value and volume terms. The industry is set to follow a strong growth trajectory over the forecast period given that the macroeconomic environment will continue to improve.

Russia

The Russian car manufacturing industry had been growing at a good rate in value terms before 2020. However, the industry declined in both value and volume terms in 2020 amid the COVID-19 pandemic. While forecasts suggest the industry could follow a positive growth trajectory in the coming years, Russia’s invasion of Ukraine has the potential to significantly disrupt the industry.

BRIC Countries Car Manufacturing Market, by Regions

For more regional insights, download a free report sample

Key Companies in the BRIC Countries Car Manufacturing Market

There are many companies in the BRIC in car manufacturing such as Stellantis NV, Volkswagen AG, Renault SA, Toyota Motor Corporation, General Motors Company, Zhejiang Geely Holding Group Co Ltd, Suzuki Motor Corporation, Tata Motors Limited, and Hyundai Motor Company.

Stellantis NV

Stellantis NV (Stellantis), formerly Fiat Chrysler Automobiles NV, is an automotive company, formed because of a merger with PSA Group. Stellantis is headquartered in Amsterdam, Netherlands.

Volkswagen AG

Volkswagen AG (Volkswagen or ‘the group’) is an automobile manufacturer and car manufacturer in Europe. The company is headquartered in Wolfsburg, Germany.

Toyota Motor Corporation

Toyota Motor Corporation (Toyota or the company) is a manufacturer and seller of motor vehicles. The company is headquartered in Toyota City, Aichi, Japan.

General Motors Company

General Motors Company (GM or the company) is engaged in the design, development, production, and marketing of cars, trucks, and automobile parts. The company is headquartered in Detroit, Michigan, US.

Market Report Overview

| Key Countries | Brazil, Russia, India, and China |

| Market Size 2021 | $401.5 billion |

| CAGR % (2021-2026) | >5% |

| Key Companies | Stellantis NV, Volkswagen AG, Renault SA, Toyota Motor Corporation, General Motors Company, Zhejiang Geely Holding Group Co Ltd, Suzuki Motor Corporation, Tata Motors Limited, and Hyundai Motor Company |

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the BRIC car manufacturing industry

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the BRIC car manufacturing industry

- Leading company profiles reveal details of key car manufacturing industry players’ BRIC operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the BRIC car manufacturing industry with five year forecasts by both value and volume

- Compares data from Brazil, Russia, India, and China, alongside individual chapters on each country

Reasons to Buy

- The size of the BRIC car manufacturing industry by value in 2021

- The size of the BRIC car manufacturing industry in 2026

- Factors are affecting the strength of competition in the BRIC car manufacturing industry

- The industry performance over the last five years

- The top competitors in the BRIC car manufacturing industry

Volkswagen AG

Renault SA

Toyota Motor Corporation

General Motors Company

Zhejiang Geely Holding Group Co Ltd

Suzuki Motor Corporation

Tata Motors Limited

Hyundai Motor Company

Table of Contents

Table

Figures

Frequently asked questions

-

What are the key countries in the BRIC car manufacturing market?

The BRIC countries are Brazil, Russia, India, and China.

-

What was the market size of the BRIC countries car manufacturing market in 2021?

The market size of the BRIC countries car manufacturing market was $401.5 billion in 2021.

-

What is the growth rate of the BRIC countries in the car manufacturing market?

The BRIC countries car manufacturing is expected to accelerate at a CAGR of more than 5% over 2021-26.

-

What are the key companies in the BRIC countries car manufacturing market?

There are many companies in the BRIC manufacturing market such as Stellantis NV, Volkswagen AG, Renault SA, Toyota Motor Corporation, General Motors Company, Zhejiang Geely Holding Group Co Ltd, Suzuki Motor Corporation, Tata Motors Limited, and Hyundai Motor Company.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.