Canada Baby Food Market Size by Categories, Distribution Channel, Market Share and Forecast, 2022-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Canada Baby Food Market Report Overview

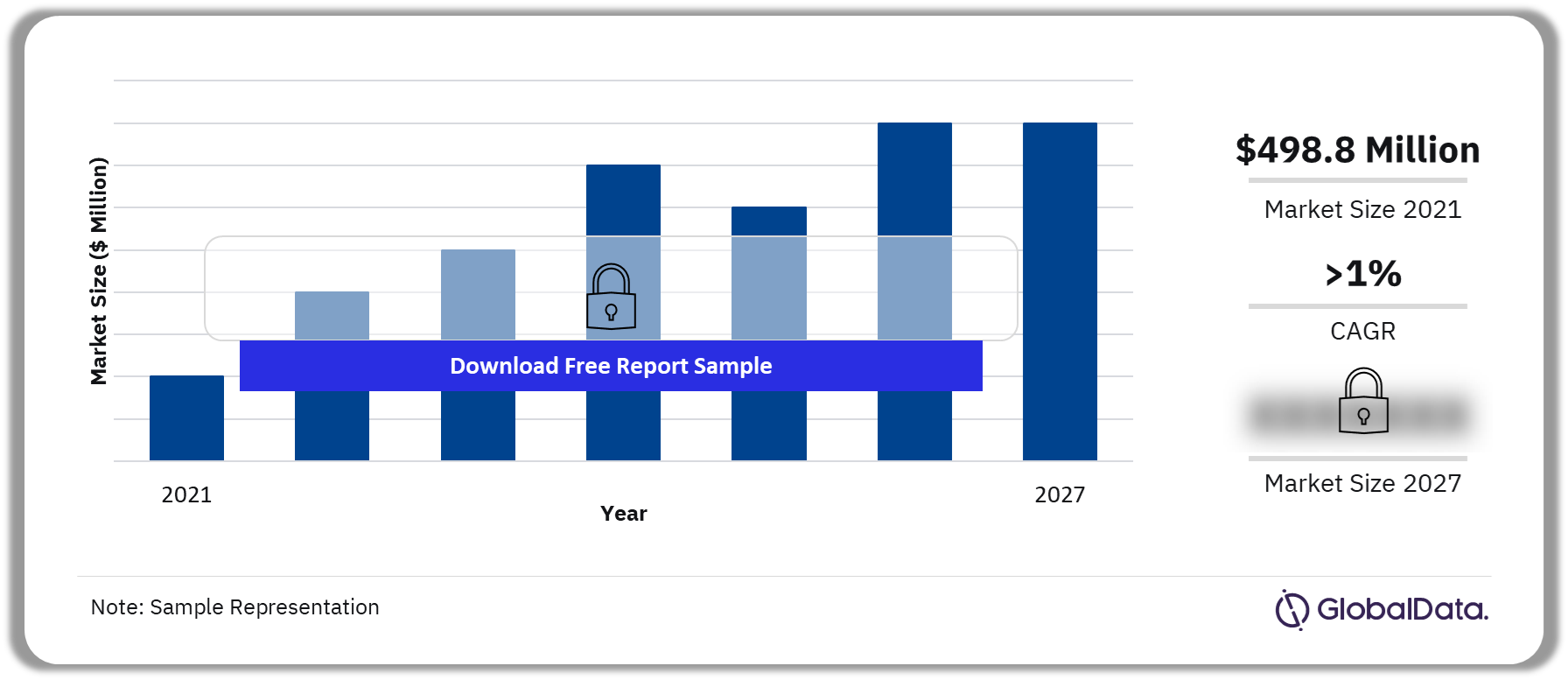

Canada baby food market size was $498.8 million in the year 2021 and will grow at a CAGR of more than 1% during 2021-2027.

Canada Baby Food Market Outlook, 2021-2027 ($ Million)

Buy the Report for More Insights into the Canada Baby Food Market Forecast

Canada baby food market research report provides consumption data based upon a unique combination of industry research, fieldwork, market sizing work, and our in-house expertise to offer extensive data about the trends and dynamics affecting the industry.

| Market Size 2021 | $498.8 Million |

| CAGR % (2021-2027) | >1% |

| Leading Categories | · Baby Milk

· Baby Cereals & Dry Meals · Baby Wet Meals & Others |

| Key Distribution Channels | · Hypermarkets & Supermarkets

· Drugstores & Pharmacies · Convenience Stores · E-Retailers |

| Key Competitors | · Mead Johnson (Reckitt Benckiser)

· Abbott Laboratories, Nestlé · The Kraft Heinz Company · Hero Group, Love Child Organics · Danone Group |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Canada Baby Food Market Dynamics

The crude birth rate in Canada declined during 2008–21. Young Canadian parents are extremely concerned about their babies’ health and are willing to pay for premium health products. However, millennials focus more on time and portability and appreciate products that are convenient and time-saving.

A study conducted by Canadian Healthy Infant Longitudinal Development (CHILD) in 2015 to identify the average age at which Canadian parents introduced allergens to their babies’ diets found that most parents delayed the introduction of eggs in babies’ diets until their babies were six months old, while almost half of babies were introduced to cow’s milk before the age of six months.

Buy the Report for More Insights into the Canada Baby Food Market Dynamics

Key Categories in the Canada Baby Food Market

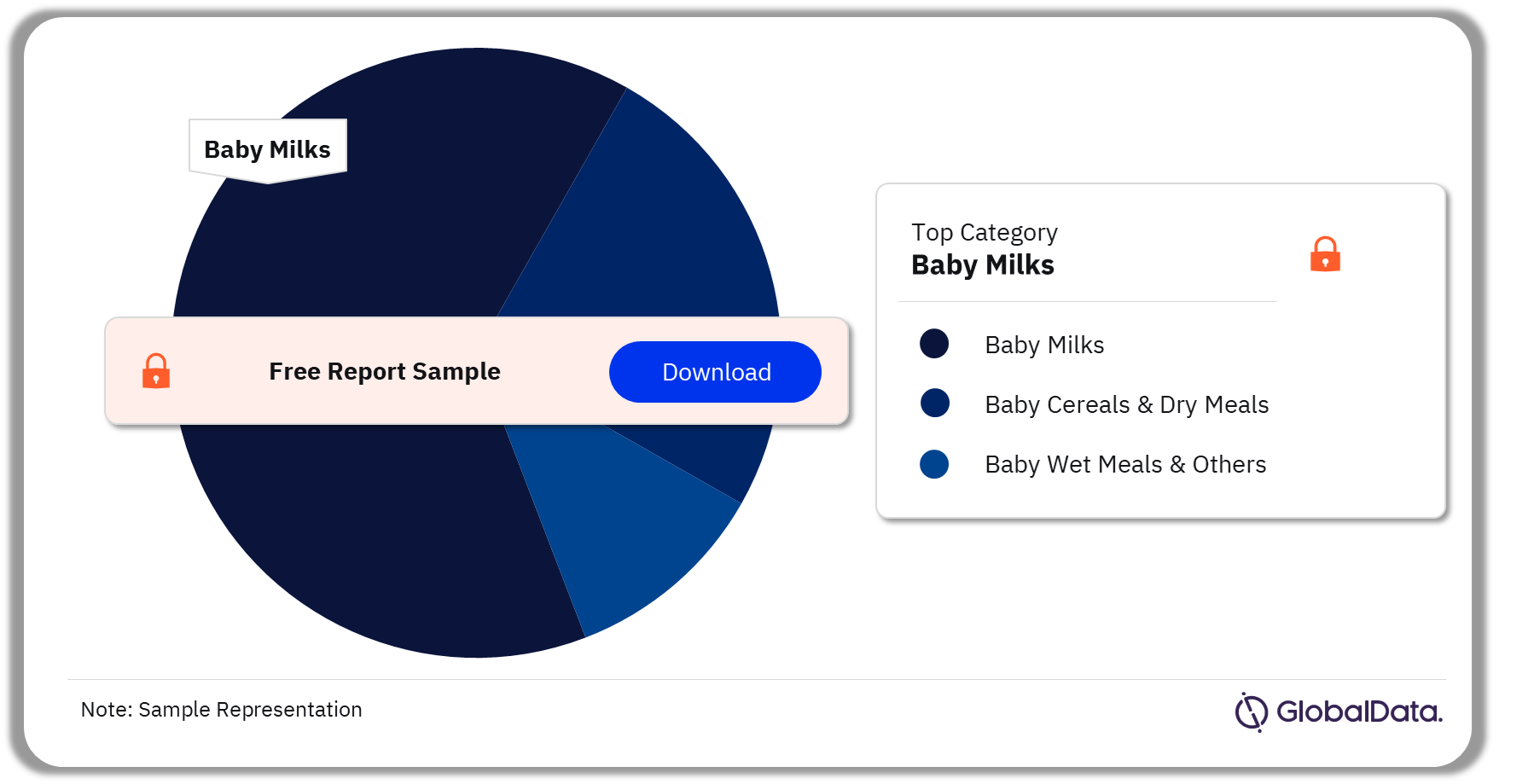

The leading categories in the Canada baby food market are baby milk, baby cereals & dry meals, and baby wet meals & others. In 2021 baby milk had the highest market share.

Canada Baby Food Market, by Leading Categories

Buy the Report for More Insights into the Canada Baby Food Market Leading Categories

Key Distribution Channels in the Canada Baby Food Market

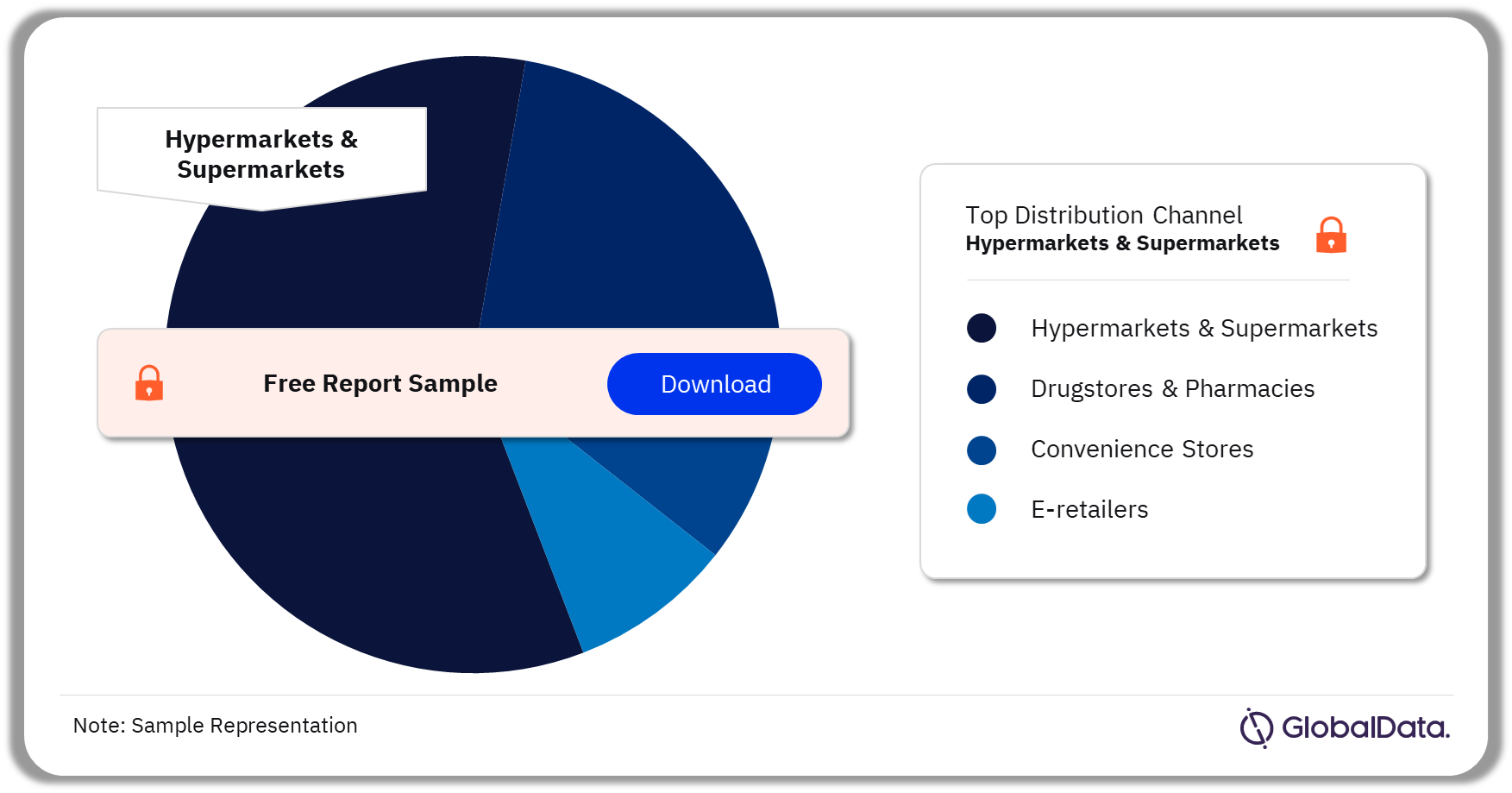

The key distribution channels in the Canada baby food market are hypermarkets & supermarkets, drugstores & pharmacies, convenience stores, and e-retailers. Hypermarkets & supermarkets were the leading distribution channel for baby food in 2021.

Canada Baby Food Market, by Distribution Channels

Buy the Report for More Insights into the Canada Baby Food Market Distribution Channel

Key Competitors in the Canada Baby Food Market

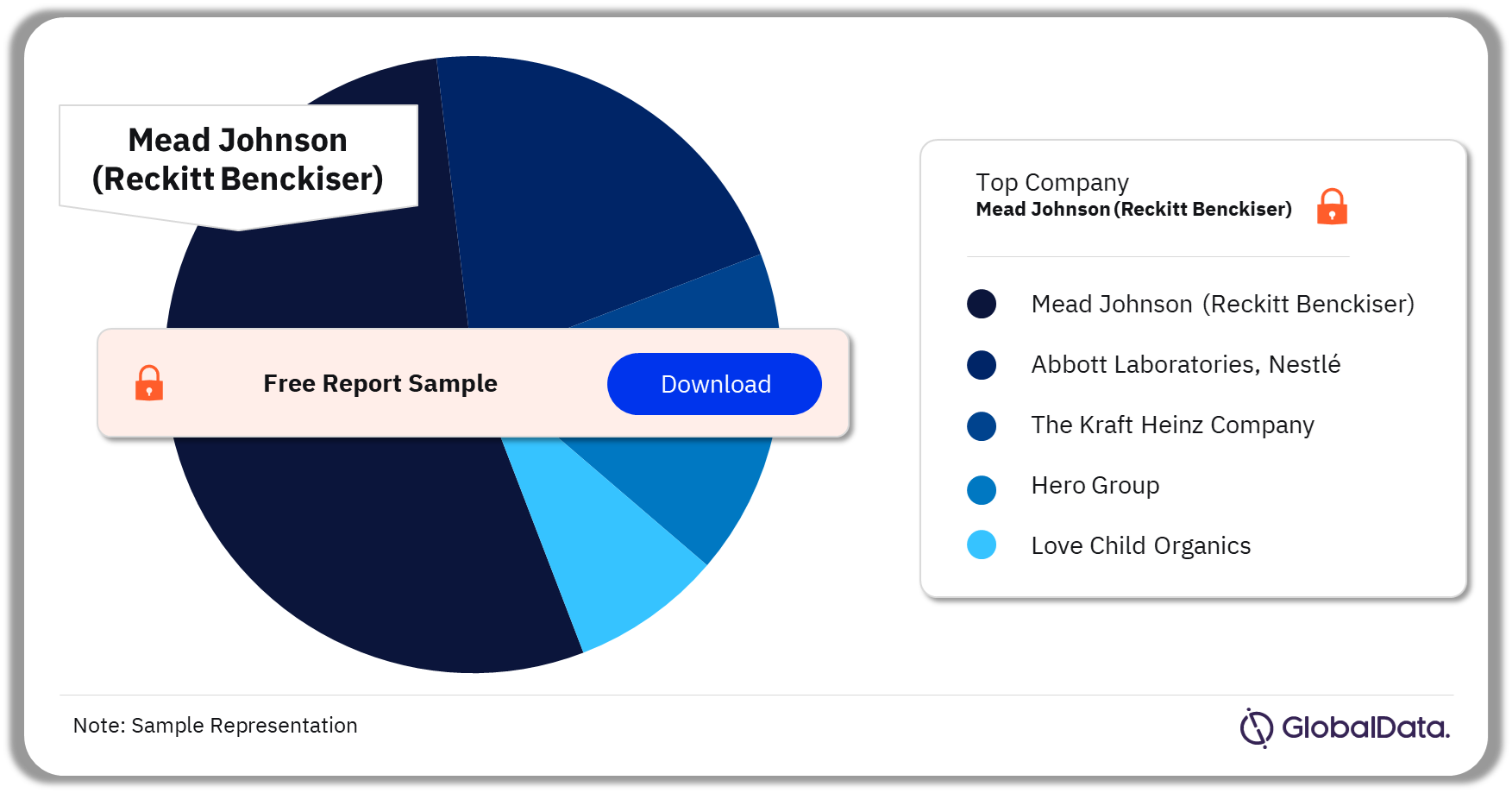

The key competitors in the Canada baby food market are Mead Johnson (Reckitt Benckiser), Abbott Laboratories, Nestlé, The Kraft Heinz Company, Hero Group, Love Child Organics, Danone Group, and others. In 2021, Mead Johnson led the Canada baby food sector in both value and volume terms.

Canada Baby Food Market, by Competitors

Buy the Report for More Insights into the Canada Baby Food Market Leading Companies

Scope

- Consumption data based upon a unique combination of industry research, fieldwork, market sizing work and our in-house expertise to offer extensive data about the trends and dynamics affecting the industry.

- Detailed profile of the companies operating and new companies considering entry in the industry along with their key focus product sectors.

- Market profile of the various product sectors with the key features & developments, segmentation, per capita trends and the various manufacturers & brands.

- Overview of baby food retailing with a mention of the major retailers in the country along with the distribution channel.

- Future projections considering various trends which are likely to affect the industry.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyse current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Detailed understanding of consumption by individual product categories in order to align your sales and marketing efforts with the latest trends in the market.

- Investigates which categories are performing the best and how this is changing market dynamics.

Abbott Laboratories

Nestlé

The Kraft Heinz Company

Hero Group

Love Child Organics

Danone Group

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Canada baby food market size in the year 2021?

The Canada baby food market was valued at $498.8 million in the year 2021.

-

What is the Canada baby food market growth rate?

The baby food market in Canada is expected to grow at a CAGR of more than 1% during the period 2021-2027.

-

What are the leading categories in the Canada baby food market?

The leading categories in the Canada baby food market are baby milks, baby cereals & dry meals, and baby wet meals & others.

-

What are the key distribution channels in the Canada baby food market?

The key distribution channels in the Canada baby food market are hypermarkets & supermarkets, drugstores & pharmacies, convenience stores, and e-retailers.

-

Who are the key competitors in the Canada baby food market?

The key competitors in the Canada baby food market are Mead Johnson (Reckitt Benckiser), Abbott Laboratories, Nestlé, The Kraft Heinz Company, Hero Group, Love Child Organics, Danone Group, and others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.