China Nuclear Power Market Analysis by Size, Installed Capacity, Power Generation, Regulations, Key Players and Forecast to 2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

China Nuclear Power Market Report Overview

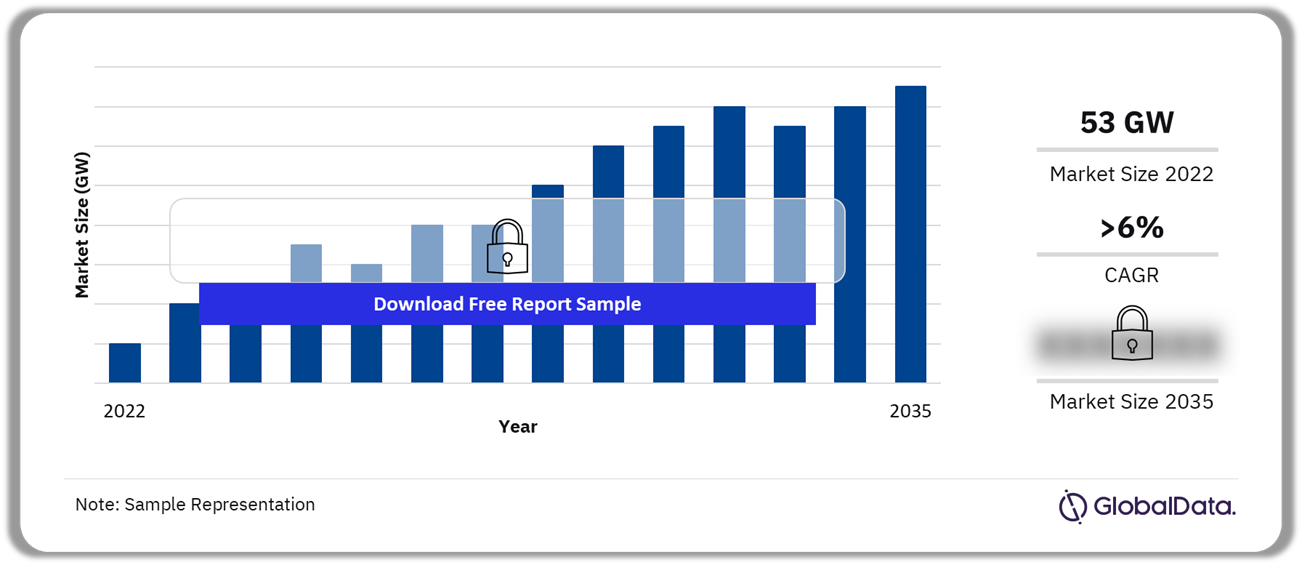

The cumulative capacity for nuclear power in China was 53 GW in 2022 and it will grow at a CAGR of more than 6% during 2022-2035.

China Nuclear Power Market Outlook, 2022-2035 (GW)

The report offers a comprehensive understanding of the nuclear power market in China. It also gives information on the different types of power sources available in the country.

| Cumulative Capacity (2022) | 53 GW |

| CAGR (2023-2035) | >6% |

| Historic Period | 2010-2022 |

| Forecast Period | 2023-2035 |

| Key Deals Type | · Debt Offerings

· Venture Financing · Equity Offerings · Partnerships · Private Equity |

| Key Active Reactors | · Taishan 1

· Taishan 2 · Sanmen 1 · Sanmen 2 · Haiyang 1 · Haiyang 2 · Fangchenggang Phase II (Hongsha) 3 · Fuqing 5 · Fuqing 6 · Tianwan 3 |

| Leading Players | · TBEA Co Ltd

· Shanghai Electric Group Co Ltd · China Nuclear Engineering & Construction Corp · China National Nuclear Power Co Ltd · CGN Power Co Ltd |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before purchasing. |

China Nuclear Power Policy

- The Chinese government holds nuclear power to be a key instrument in achieving clean energy.

- During their 13th Five-Year Plan period from 2016 to 2020, China built 20 new nuclear power plants with a total capacity of 23.4 GW.

Buy the Full Report For more insights into the Chinese Nuclear Power Policy, Download a Free Report Sample

China Nuclear Power Market - Competitive Landscape

TBEA Co Ltd, Shanghai Electric Group Co Ltd, China Nuclear Engineering & Construction Corp, China National Nuclear Power Co Ltd, and CGN Power Co Ltd. are a few of the key nuclear power plants in China.

TBEA Co Ltd: TBEA is a provider of power generation, power transmission, renewable energy, and other energy solutions. The company offers products such as transformers, electric wires and cables, integrated substation automation products, and others. It has expertise in the construction of power stations, mountain power stations, fishing-farming-solar complementary power stations, and commercial and residential roof power stations.

China Nuclear Power Market Analysis by Companies

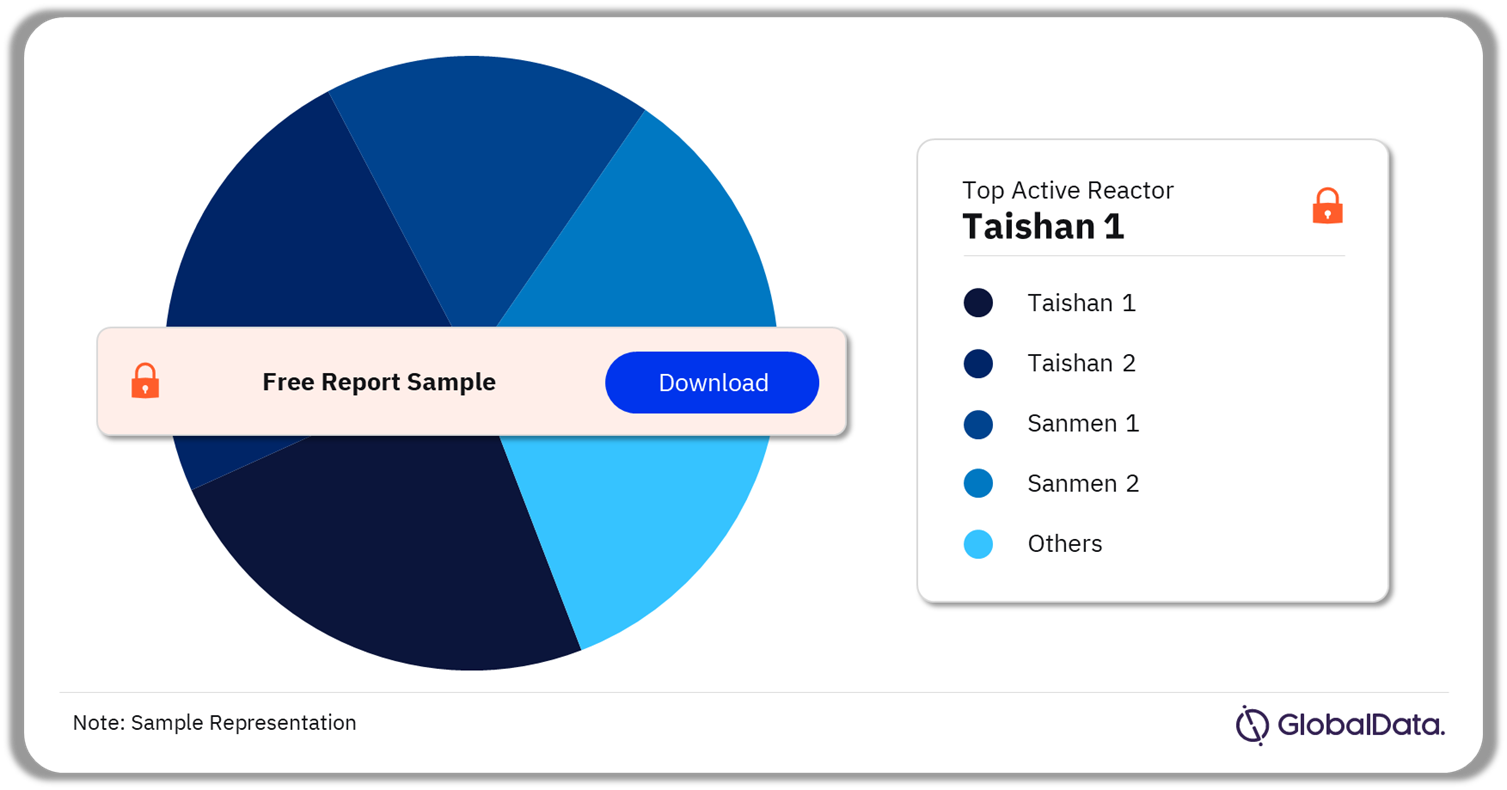

Major Active Reactors in the China Nuclear Power Market

Taishan 1 and Taishan 2, owned by China General Nuclear Power Corp Ltd; Electricite de France SA had the equal plant capacity as of 2023. The plants started operations in 2018 and 2019 respectively.

China Nuclear Power Market Analysis by Active Reactors, 2023 (%)

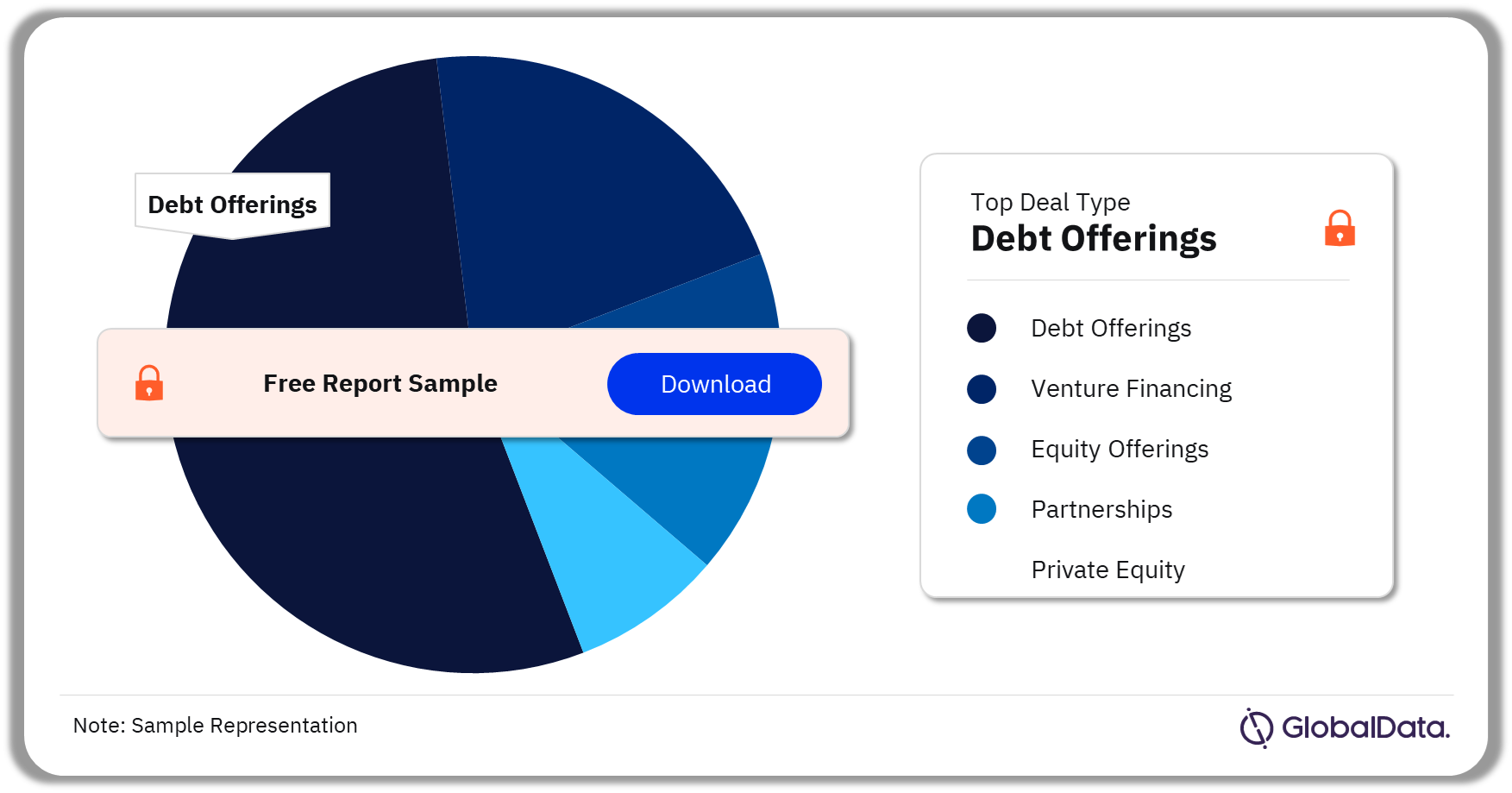

China Nuclear Power Market Segmentation by Deal Types

In 2022, most of the deals in the Chinese nuclear power market were closed via debt offerings, followed by venture financing.

China Nuclear Power Market Analysis by Deal Types, 2022 (%)

Segments Covered in the Report

China Nuclear Power Market Deal Type Outlook (Value, 2010-2035, GW)

- Debt Offerings

- Venture Financing

- Equity Offerings

- Partnerships

- Private Equity

Scope

The report includes:

- A brief introduction on global carbon emissions and global primary energy consumption.

- An overview of the country’s power market highlighting installed capacity trends, generation trends, and installed capacity split by various power sources.

- Detailed overview of the country’s nuclear power market with installed capacity and generation trends and major active and upcoming nuclear power projects.

- Deal analysis of the country’s nuclear power market.

- Snapshots of some of the major market participants in the country.

Reasons to Buy

- Enhance your decision-making capability in a more rapid and time-sensitive manner.

- Identify key growth and investment opportunities in the country’s nuclear power market.

- Facilitate decision-making based on strong historical and forecast data for the nuclear power market.

- Position yourself to gain the maximum advantage of the industry’s growth potential.

- Identify key partners and business development avenues.

- Understand and respond to your competitors’ business structure, strategy, and prospects.

China Nuclear Engineering & Construction Corp

TBEA Co Ltd

China National Nuclear Power Co Ltd

CGN Power Co Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What was the cumulative capacity of China's nuclear power market in 2022?

The cumulative capacity for nuclear power in China was 53 GW in 2022.

-

What will the China nuclear power market growth rate be during the forecast period?

The China nuclear power market is expected to grow at a CAGR of more than 6% during 2022-2035.

-

Which was the leading deal type in the China nuclear power market in 2022?

Most of the deals in the Chinese nuclear power market were closed via debt offerings in 2022.

-

Which are the major active reactors in the China nuclear power market?

The major active reactors in the Chinese nuclear power market are Taishan 1, Taishan 2, Sanmen 1, Sanmen 2, Haiyang 1, Haiyang 2, Fangchenggang Phase II (Hongsha) 3, Fuqing 5, Fuqing 6, and Tianwan 3.

-

Which are the leading companies in the Chinese nuclear power market?

The leading companies in the China nuclear power market are TBEA Co Ltd, Shanghai Electric Group Co Ltd, China Nuclear Engineering & Construction Corp, China National Nuclear Power Co Ltd, and CGN Power Co Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.