Computer Vision Market Size, Share, Trends and Analysis by Region, Industry Vertical and Segment Forecasts to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in our ‘Computer Vision’ report:

- Make informed decisions about investments, partnerships, and product development

- Identify your competitors positioning to stay ahead in the market

- Identify promising areas, growth trends, segments, and markets to expand your product portfolio or successful investment

- Anticipate expected changes in demand and adjust your business development strategies

- Identify potential areas of disruption

How is our ‘Computer Vision’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 15 countries including historical and forecast analysis for the period 2019-2026 for market assessment

- Detailed segmentation by vertical segments (IT & Telecom, BFSI, Healthcare, Government, Retail, Manufacturing, Energy & Utilities, and Others)

- Detailed value chain analysis helping businesses identify areas where they can improve their efficiency and effectiveness, reduce costs, and enhance their competitive advantage

- The growth innovation matrix included in the report, divides the market players in to four categories i.e., flagbearers, contenders, specialists, and experimenters, which will help value chain participants in understanding how competition is performing based on their revenue growth and their R&D efforts

- Competitive profiling and benchmarking of key players in the market to provide deeper understanding of industry competition

We recommend this valuable source of information to anyone involved in:

- Computer Vision Companies

- System Integration Companies

- Semiconductor Companies

- IT Hardware and Software Companies

- Venture Capitalists

- Advisory Firms

To Get a Snapshot of the Computer Vision Market Report, Download a Free Report Sample

Computer Vision Market Report Overview

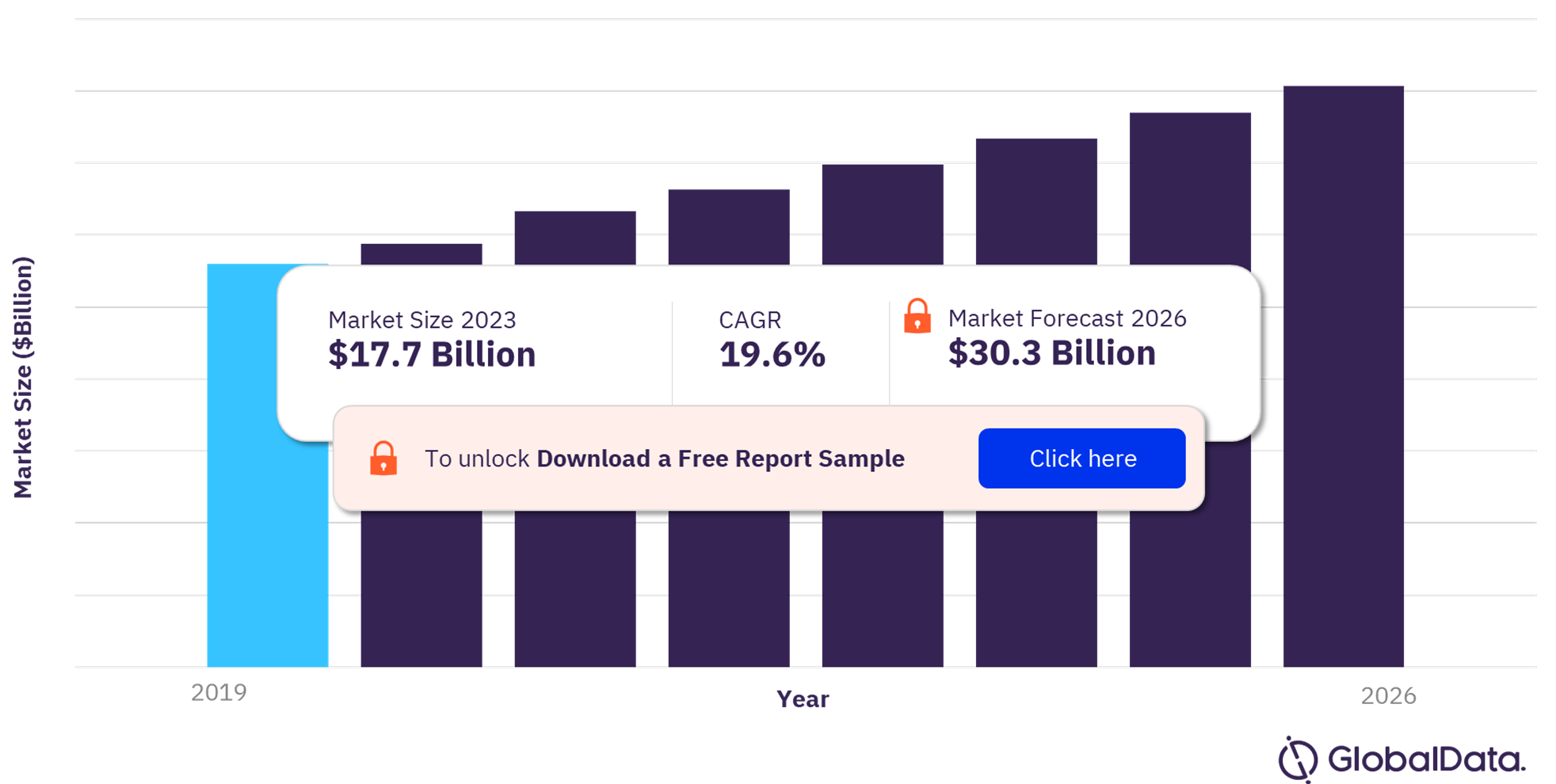

The computer vision market size will be valued at $17.7 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.6% during 2023-2026. An increasing need for automation and optimization of workflows across various sectors, including healthcare, automotive, retail, and BFSI are expected to drive the adoption of computer vision technology. The implementation of technologies such as edge computing, artificial intelligence, the Internet of Things (IoT), and automated machine learning, among others is also expected to drive the deployment of computer vision technology over the coming years.

The growing usage of augmented and virtual reality is anticipated to compel computer vision developers to broaden their expertise to new domains such as developing efficient and intuitive methods for interacting and replicating with real objects in 3D space. Continued refinement and research of the technology are expected to add new capabilities and a wide spectrum of functions. With the integration of edge and synchronization with synthetic databases, computer vision technology is anticipated to deliver accurate results in real-time.

Computer Vision Market Outlook, 2019-2026 ($ Billion)

View Sample Report for Additional Insights on the Computer Vision Market Forecast, Download a Free Sample

Continued advancements in computer vision have helped organizations to move from using the technology to retrieve descriptive diagnostic results to being predictive in their approach. The technology has enabled organizations to deploy prescriptive solutions that deliver real-time actionable insights and outcomes. Further, computer vision technologies such as image recognition (including facial recognition) and video recognition help in improving the security of valuable assets. Such advancements are anticipated to drive the adoption of computer vision systems in the future.

Although the technology has found an increasing number of use cases across various sectors, there are a few challenges, which are expected to hinder computer vision market growth. For example, high cost, inadequate hardware, lack of training data, and complex deployment of the computer vision technology could challenge adoption. The high cost and complex installation also make it difficult for small and medium enterprises to deploy these systems. The computer vision technology requires a set of sample data, including videos and images with tags and labels, which are used for training algorithms. Poor quality or limited amount of training data is prone to produce inaccurate output. Such shortcomings related to computer vision are anticipated to pose a challenge to market growth.

| Market Size (2023) | US$ 17.7 billion |

| Market Size (2026) | US$ 30.3 billion |

| CAGR (2023-2026) | 19.6% |

| Forecast Period | 2023-2026 |

| Historic Data | 2019-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Market Share, and Growth Trends |

| Region Segment | North America, Western Europe, Central & Eastern Europe, APAC, South & Central America, and Middle East & Africa |

| Vertical Segment | IT & Telecom, BFSI, Healthcare, Government, Retail, Manufacturing, Energy & Utilities, and Others. |

| Key Companies | Microsoft Corp, Alphabet Inc, IBM, Intel, Ambarella, Apple Inc, Amazon.com Inc, Hikvision, and Bosch |

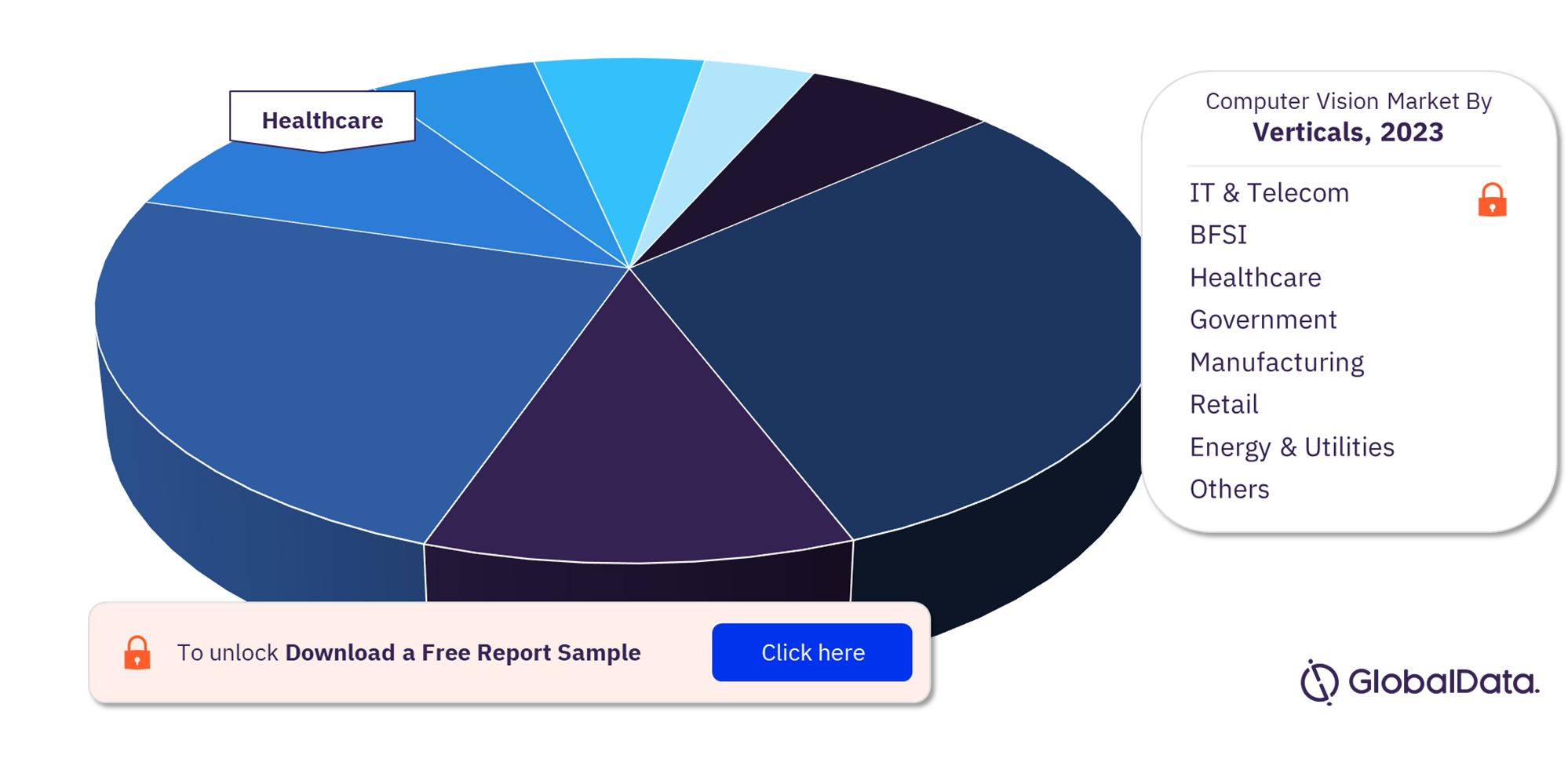

Computer Vision Market Segmentation by Vertical

Computer vision finds applications across verticals such as IT & Telecom, BFSI, healthcare, government, retail, manufacturing, and energy & utilities. The BFSI segment held a significant market share of over 20% in 2022 and is expected to retain its dominance over the forecast period. The BFSI sector is one of the early adopters of this technology, utilizing computer vision to optimize daily operations using customer experience metrics and sentiment analysis for increasing security while mitigating frauds. This helps the financial institutions in increasing the speed and accuracy while automating processes such as KYC, insurance documentation, commercial banking, and more.

Computer Vision Market Share by Vertical, 2023 (%)

Fetch Sample PDF for Segment-specific revenues and shares, Download a Free Sample

The IT & telecom and healthcare verticals captured over 15% of the overall market share in 2023. Computer vision as a service is gaining traction with telecom companies using the technology to offer enhanced response times to customers in government, private businesses, and industries. Telecom companies are offering these services to cater to the increasing need for low-latency and efficient computer vision for IoT and 5G use cases. As such, the proliferation of IoT devices and the roll-out of 5G is anticipated to propel the market growth. Further, computer vision is gaining prominence in the healthcare sector due to its ability to analyze medical imaging with speed and provide more accurate diagnoses than human professionals.

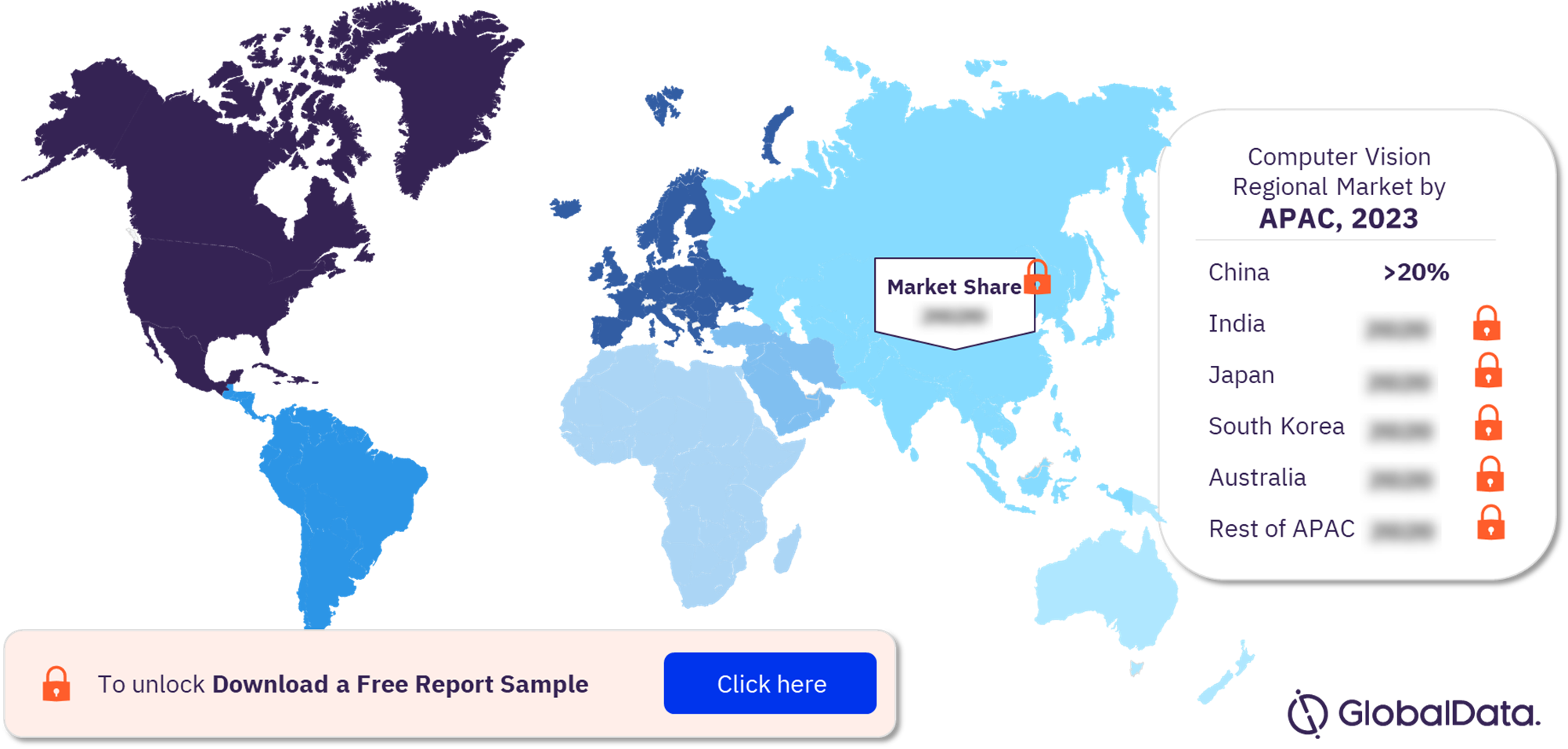

Computer Vision Market Analysis by Region

North America accounted for the highest market share of over 30% of the overall market in 2022. The high market share is attributed to the early adoption of technology in the region and a high number of IoT deployments. Further, the robust IT & Telecom infrastructure across the region and the number of clouds and edge deployments are some factors supporting the adoption of computer vision.

Asia Pacific Computer Vision Market Share by Country, 2023 (%)

View Sample Report for Additional Computer Vision Market Insights, Download a Free Sample

The Asia Pacific is anticipated to register a significant growth exceeding 10% over the forecast period. An increasing number of use cases across diverse verticals is the prime factor expected to propel regional market demand. The adoption of computer vision in the electronics, automotive, and manufacturing industries for improving safety and automating various workflows such as assembly lines, quality inspection, and inventory management, among others, is fueling the demand in the Asia Pacific. These industries are making continued investments in product research and development, which is anticipated to driving the demand for more computer vision systems over the future.

Computer Vision Market – Competitive Landscape

The computer vision market is highly competitive, with several technology players investing in developing innovative computer vision solutions. For instance, in December 2022, Ambarella Inc unveiled the world’s first 4D Imaging Radar Architecture for autonomous vehicles, which will be centrally processed using the company’s highly efficient 5nm CV3 AI Domain Control SoCs and Oculii Adaptive AI Radar Software. This technology is expected to facilitate safer path planning and enhanced environmental perception in L2+ to L5 autonomous driving systems, AI-based ADAS, and autonomous robotics

Companies operating in the market have strong hold in their respective solution offerings. For instance, Khronos Group, Autodesk, Apple Inc, Siemens (DIS) have a strong hold in the software market, whereas the hardware is dominated by Alphabet Inc., Ambarella, Nvidia Corp, and Intel. Companies such as IBM, Baidu, Amazon.com Inc, Hikvision, and Meta are some of the leaders in the delivery side of the value chain.

Leading Players in the Computer Vision Market

- Microsoft Corp

- Alphabet Inc

- Hikvision

- Intel Corp

- Ambarella

- Apple Inc

- IBM

- Amazon.com Inc

- Baidu

- Bosch

Other Computer Vision Market Vendors Mentioned

Megvii Face++, SenseTime, Dahua Technology, Clarifai, Luminar Technologies, Qualcomm, Tesla, Velodyne, ByteDance, Keyence Technologies, Rockwell Automation, NEC, NVIDIA AMD, and Cognex, among others.

To Know More About Leading Computer Vision Market Players, Download a Free Sample

Computer Vision Market Segments and Scope

GlobalData Plc has segmented the computer vision market report by vertical, and region:

Global Computer Vision Market Vertical Outlook (Revenue, USD Million, 2019-2026)

- IT & Telecom

- BFSI

- Healthcare

- Government

- Retail

- Manufacturing

- Energy & Utilities

- Others

Global Computer Vision Regional Outlook (Revenue, USD Million, 2019-2026)

- North America

- US

- Canada

- Mexico

- Western Europe

- Germany

- UK

- Germany

- France

- Italy

- Netherlands

- Rest of Western Europe

- Central & Eastern Europe

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- South & Central America

- Brazil

- Argentina

- Rest of South & Central America

- Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates (UAE)

- Rest of Middle East & Africa

The market intelligence report provides an in-depth analysis of the following –

- Computer vision market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the vertical, and region segments.

- The competitive landscape: an examination of the positioning of leading players in the computer vision market.

- Company snapshots: analysis of the market position of leading service providers in the computer vision market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Scope

This report provides overview and service addressable market for computer vision.

It identifies the key trends impacting growth of the market over the next 12 to 24 months.

It includes global market forecasts for the computer vision industry and analysis of patents, company filings, and hiring trends.

It contains details of M&A and VF deals in the computer vision space.

The detailed value chain consists of three main aspects: Hardware, Software (Foundation Layer, Application Layer), and Delivery

Key Highlights

The global computer vision market size was valued at US$14.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.6% during 2023-2026. The increasing need for automation and optimization of workflows across various sectors, including healthcare, automotive, retail, BFSI, and others, is expected to drive the adoption of computer vision technology.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global computer vision market, product type, key vendor outlook, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in computer vision markets.

With more than 20 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in computer vision markets.

The broad perspective of the report coupled with comprehensive, actionable detail will help Internet of Things players, investors, and other stakeholders succeed in the growing Internet of Things market globally.

Key Players

Microsoft CorpAlphabet Inc

Hikvision

Intel Corp

Ambarella

Apple Inc

International Business Machines Corp

Amazon.com Inc

Baidu

Bosch

Table of Contents

Table

Figures

Frequently asked questions

-

What was the computer vision market size in 2023?

The computer vision market size globally will be valued at $17.7 billion in 2023.

-

What is the computer vision market growth rate?

The computer vision market is expected to grow at a CAGR of 19.6% during the forecast period (2023-2026).

-

What are the key computer vision market drivers?

The increasing number of use cases across diverse sectors and the growing need for automation of business workflows are anticipated to drive computer vision market growth.

-

What are the key computer vision market segments?

Vertical Segments: IT & Telecom, BFSI, Healthcare, Government, Retail, Manufacturing, Energy & Utilities, and Others.

-

Which are the leading computer vision companies?

The leading companies in the computer vision market are Microsoft Corp, Alphabet Inc, IBM, Intel, Ambarella, Apple Inc, Amazon.com Inc, Hikvision, and Bosch.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports