Cybersecurity – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The cybersecurity industry faces a challenge that is anything but business as usual. The prospect of offensive attacks using artificial intelligence (AI) is prompting increases in cybersecurity budgets as organizations try to understand the impact of generative AI on their security. Hacking groups will likely use large language models (LLMs) trained on malware to target their attacks more effectively. AI is already used for threat detection, and its greater adoption will help offset attacks. However, learning how to counter AI-led attacks will take time, and cybersecurity vendors and users will face a bumpy ride for the next two to three years.

Cybersecurity – Key Trends

The key cybersecurity market trends are classified into three categories: technology trends, macroeconomic trends, and regulatory trends.

- Technology trends: Some of the key technology trends impacting the theme are the impact of ransomware attacks, multi-factor authentication, mobile cybersecurity, cloud security, DevSecOps, and supply chain attacks. For instance, Ransomware attacks are becoming more sophisticated and can devastate companies of all sizes. 2021 was called the “golden era of ransomware” by the EU Agency for Cybersecurity (ENISA). According to ENISA, there was a 150% rise in ransomware attacks from April 2020 to July 2021.

- Macroeconomic trends: The key macroeconomic trends explained in the report are the Ukraine conflict, state-sponsored attacks, cybersecurity skills shortage, IT budgets, cybersecurity culture, and critical national infrastructure threats. For instance, the number of state-sponsored cyberattacks will likely increase in 2023. The conflict in Ukraine, a continuing trade war between the US and China, and high-profile elections create an environment ripe for state-sponsored activity.

- Regulatory trends: Ransomware regulations, EU cybersecurity legislation, mandatory disclosure of cyberattacks, and cooperation on supply chain security are a part of the regulatory trends impacting cybersecurity.

Cybersecurity – Industry Analysis

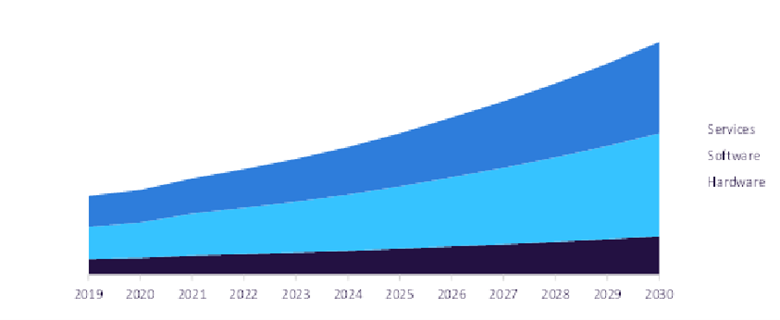

The cybersecurity market is expected to grow at a CAGR of more than 9% between 2022 and 2030. Software-based cybersecurity products will be the largest market segment and managed security services revenues will be the largest single market segment in 2030. They refer to services that have been outsourced to an external vendor or supplier. Companies facing a cybersecurity skills gap and a growing threat will increasingly outsource security services to external experts.

The Cybersecurity industry analysis also covers:

- Timeline

Global Security Revenues 2019-2030 ($ Billion)

For more insights into the cybersecurity revenue forecast, download a free report sample

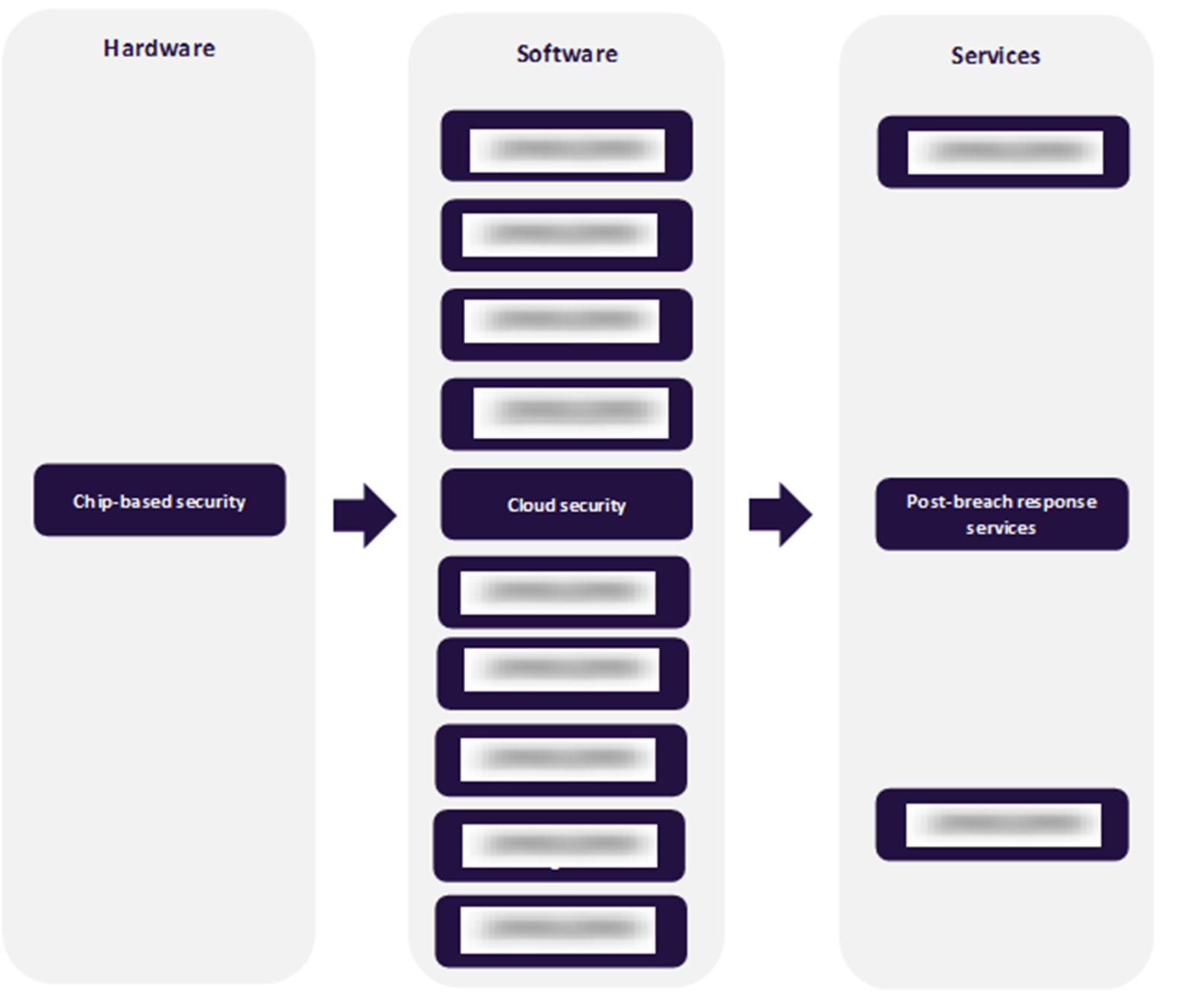

Cybersecurity - Value Chain Analysis

The cybersecurity value chain consists of three main areas: hardware, software, and services.

Cybersecurity hardware: Chips are now being used in mission-critical servers and safety-critical applications. Thus protecting them from cyberattacks is becoming more critical and more expensive. Systems vendors such as Apple and Amazon are increasingly designing their own chips rather than buying commercially developed devices and intellectual property (IP) created by third-party developers. These vendors are developing their own ecosystems and requirements since security is a key concern.

Cybersecurity Value Chain Analysis

For more insights into the cybersecurity value chain, download a free report sample

Leading Public Companies

Some of the leading public companies making their mark within the cybersecurity theme:

- Accenture

- Alphabet (parent company of Google)

- Check Point Software

Leading Private Companies

Some of the leading private companies associated with this theme:

- Cybereason

- Code42

- ForgeRock

To know more about the leading public and private companies in the cybersecurity theme, download a free report sample

Enterprise Security Software Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Enterprise Security Software Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Other sector scorecards provided in the report:

- IT services sector scorecard

Segments Covered in the Report

Cybersecurity Value Chain Outlook (Value, 2022-2030)

- Hardware

- Software

- Services

Scope

This report provides an overview of the cybersecurity theme.

It identifies the key trends impacting growth of the theme over the next 12 to 24 months, split into three categories: technology trends, macroeconomic trends, and regulatory trends.

It includes comprehensive industry analysis, including market size forecasts for cybersecurity and analysis of patents, company filings, and hiring trends.

It contains details of M&A deals driven by the cybersecurity theme, and a timeline highlighting milestones in the development of cybersecurity.

The detailed value chain is split into three main areas: hardware, software, and services. The hardware segment includes chip-based security. The software segment includes identity management, network security, endpoint security, threat detection and response, cloud security, data security, email security, application security, unified threat management, and vulnerability management. The services segment includes managed security services, post-breach response services, and risk and compliance services.

Key Highlights

Cybersecurity budgets will grow in step with IT budgets in 2024 as organizations come to terms with AI's impact on their operations. PwC’s 2024 Global Digital Trust Insights report states that cyber investments will take 14% of the total IT, operational technology (OT), and automation budget in 2024, up from 11% in 2023. Overall, GlobalData forecasts that the cybersecurity market will be worth $290 billion by 2027, growing at a compound annual growth rate of 13% between 2022 and 2027. Managed security services, application security, and identity and access management will be high-growth areas.

Cisco’s $28 billion acquisition of Splunk will be a catalyst for AI-led cybersecurity M&A deals in 2024 and beyond as the cybersecurity industry comes to terms with generative AI-led cyberattacks. Both start-ups and maturing cyber companies will be on the radar of larger cybersecurity companies looking for products and talent. Cybersecurity M&A will likely attract regulators’ interest, particularly as a small group of private equity players are buying up numerous cybersecurity companies.

Reasons to Buy

Cybersecurity is one of the most fertile and fast-moving areas of technology. New exploits are developed daily, and organizations worldwide repel hundreds of attacks each week. This report provides an invaluable guide to this extremely disruptive theme. It includes comprehensive lists of the leading players across all aspects of the cybersecurity value chain, helping companies identify the right partners.

The report also includes a guide to the major threat actors and looks at the main types of cyberattack, from un-targeted attacks like phishing to targeted attacks like distributed denial of service (DDoS).

Abnormal

Accenture

Acronis

Airbus (Stormshield)

Akamai

Alert Logic

Alibaba

Amazon

AMD

Analog Devices

AnyVision

Aon

Appgate

Apple

Aqua Security

Arcon

Arctic Wolf

Arm

AT&T

Atos

Aware

Axiado

BAE Systems

Baidu

Barracuda Networks

BCG

BeyondTrust

BioEnable

Blackberry

BMC Helix

Broadcom

Broadcom (VMware)

BT

Cadence Design Systems

Capgemini

Cato

Cerberus

Check Point Software

Checkmarx

China Telecom

China Unicom

Cisco

Clear Secure

Clearview

Cloudflare

CMITech

Code42

Cognitec

Cognizant

Contrast Security

CrowdStrike

CyberArk

Cyberbit

Cybereason

Cynet

D3 Security

Darktrace

Dashlane

Delinea

Dell

Deloitte

Deutsche Telekom

Duo Security

DXC Technology

ekey

Equifax

Exabeam

Extreme Networks

EY

Eyelock

F5

Fidelis

Forcepoint

Forescout

ForgeRock

Fortinet

Fortra

Foxpass

Fugue

Fujitsu

Gen Digital

Gitlab

GoTo

HCLTech

Herjavec Group

HID Global

Hitachi

Horizon Robotics

HPE

Huawei

IBM

Idemia

iFlytek

Illumio

Impulse

Infineon

Informatica

Infosys

Innovatrics

Intel

Intruder

Invicti

iProov

Iris ID

IriusRisk

Ironscales

Ivanti

JMEM Tek

Jumio

Juniper Networks

Kairos

Keeper Security

KnowBe4

KPMG

Kroll (Resolver)

KT

Lacework

LastPass

Lockheed Martin

Logrhythm

Lookout

Lumen Technologies

ManageEngine

Marsh

Marvell

Megvii

Micro Focus

Micron Semiconductor

Microsoft

Mimecast

NCC

NetApp

Netskope

NordPass

Northrop Grumman

NTT Data

Nvidia

NXP

NXT-ID

Okta

Onapsis

One Identity

OneLogin

OneSpan

Onfido

OpenText

Oracle

Orange

Orca Security

Palantir

Palo Alto Networks

Ping Identity

Portnox

Proofpoint

PwC

Qualcomm

Qualys

Rambus

Rapid7

Raytheon BBN

Renesas

RSA

RTX

Ruckus

SAIC

Sailpoint Technologies

Samsung Electronics

SecureAuth

SecureOne

Secureworks

Securonix

SenseTime

SentinelOne

Siemens

Singtel (Trustwave)

Skybox Security

Skyhigh Security

Snyk

Socure

SonicWall

Sophos

ST Microelectronics

Sumo Logic

Swimlane

Synopsys

Tanium

Tata Consultancy Services

Tech Mahindra

Tech5

Telefonica

Telstra

Tenable

Tessian

Thales

ThreatConnect

Threatmodeler

TitanHQ

Trellix

Trend Micro

TrueFace.AI

Untangle

Varonis

Veracode

Verizon

Versa Networks

WatchGuard

Wipro

Xage

Yoti

Yubico

Zoho (ManageEngine)

Zscaler

Table of Contents

Frequently asked questions

-

What are the components of the cybersecurity value chain?

The cybersecurity value chain consists of hardware, software, and services.

-

What are the key technology trends impacting the cybersecurity theme?

Some of the key technology trends impacting the cybersecurity theme are the impact of ransomware attacks, multi-factor authentication, mobile cybersecurity, cloud security, DevSecOps, and supply chain attacks.

-

Which are the leading public companies in cybersecurity?

Some of the leading public companies in cybersecurity are Accenture, Alphabet (parent company of Google), and Check Point Software.

-

Which are the leading private companies in cybersecurity?

Some of the leading private companies in cybersecurity are Cybereason, Code42, and ForgeRock.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Technology reports