Data Center IT Infrastructure Market Analysis by Components (Server, Storage, Networking Equipment and DCIM Software), Vertical, Employee Size Band and Region Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Data Center IT Infrastructure Market Report Overview

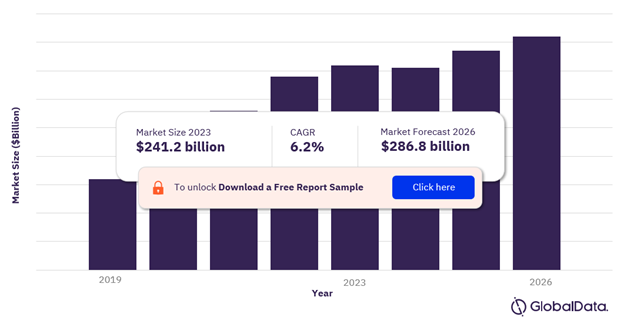

The data center IT infrastructure market size will be valued at $241.2 billion in 2023 and is anticipated to expand at a CAGR of 6.2% over the forecast period. The inevitable proliferation of data centers and continuous public cloud investments will largely drive the data center IT infrastructure market growth.

The data center market recovered from a COVID-induced decline in 2021 to generate $948 billion in revenues by 2030, according to GlobalData forecasts. Most enterprise-generated data will be created and processed in remote data centers or the cloud. As such, the increasing amount of use cases and investments across various sectors is expected to fuel the demand for data center IT infrastructure components over the forecast period. However, security concerns in managing and securing information flow across enterprise networks are expected to pose a challenge to market growth.

Data Center IT Infrastructure Market Outlook, 2019-2026 ($ Billion)

To Gain More Information on the Data Center IT Infrastructure Market Forecast, Download a Free Report Sample

Demand for advanced IT services such as 5G, big data, cloud computing, virtualization, and internet of things (IoT) applications are driving modernization in the data center IT infrastructure industry. In addition, the increasing usage of tablets and smartphones is putting continuous pressure on IT departments and data centers while enhancing power efficiency, storage, and cooling capacity. All these factors are anticipated to favor market growth during the forecast period.

The data center IT infrastructure market report provides an executive-level overview of the current data center IT infrastructure market worldwide, with detailed forecasts of key indicators up to 2026. Published annually, the report provides a detailed analysis of the near-term opportunities, competitive dynamics, and evolution of demand by IT infrastructure components and verticals across the large enterprise and micro, small & medium enterprise (MSME) markets, as well as a review of key market and technology trends.

Data Center IT Infrastructure Market - COVID-19 Impact

Due to COVID-19 pandemic, the increased use of mobile wallets and online banking have encouraged businesses to modernize their back-end infrastructure. This led to the demand for high-density data centers outfitted with cutting-edge hardware and software solutions that will be fueled by society’s increasing reliance on online platforms. The pandemic proved to be the catalyst for a move toward more hybrid work or work from home environments. Technology is the great facilitator of these workplaces – and as demand for new infrastructure and solutions increases, so will the demand for data center IT infrastructure to support them.

Factors Impacting Growth of Data Center IT Infrastructure Components

- Usage of artificial intelligence (AI)

- Data center automation

- Growing demand for colocation services

- Need of hyperscale data centers

- Shift to new architectures and software-defined programmable infrastructures

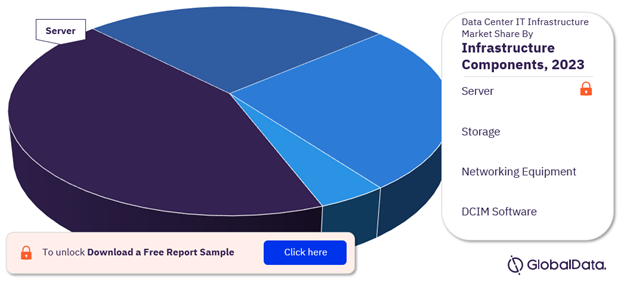

Data Center IT Infrastructure Market Segmentation by IT Infrastructure Components

Based on IT infrastructure core components, the four main components of a data center IT infrastructure are server, storage, networking equipment, and data center infrastructure management (DCIM) software. The DCIM software segment is expected to be the fastest-growing component segment with a CAGR of over 14% over the forecast period. The market growth is driven by products/solutions that offer to boost the performance of a data center’s IT infrastructure, such as increasing uptime and availability while helping machines run efficiently.

Data Center IT Infrastructure Market Share by Infrastructure Components, 2023

For More Insights on Data Center IT Infrastructure Components, Download a Free Report Sample

Furthermore, a key data center architecture component – the servers is expected to dominate the data center IT infrastructure market over the forecast period. The large market share can be attributed to investments by enterprise in IT hardware infrastructure providing that have been at the heart of powering data centers for decades.

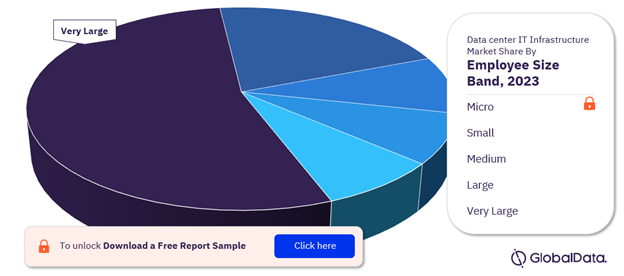

Data Center IT Infrastructure Market Segmentation by Employee Size Band

The Very Large segment encapsulates those enterprises whose workforce strength is over 5,000 headcounts. The segment captures over 25% of the market and continues to dominate over the forecast period. Rapid digital transformation in business operations and high financial capabilities to upgrade network infrastructure to streamline business functions are anticipated to drive the market over the forecast period.

Data Center IT Infrastructure Market Share by Employee Size Band, 2023

Fetch Sample PDF for Analysis by Employee Size Band, Download a Free Report Sample

The Micro segment is expected to grow slightly faster than the remaining segments at a CAGR exceeding 12% over the forecast period. However, considering the current scenario, low seed funding from investors to startups owing to a high degree of uncertainty over the global recession is expected to be one of the bottlenecks for market growth over the forecast period.

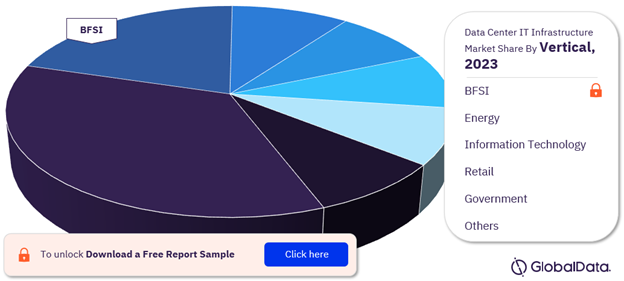

Data Center IT Infrastructure Segmentation by Vertical

Based on the vertical, the data center IT infrastructure market has been categorized into BFSI, manufacturing, retail, energy, information technology, government, and others. The need for businesses across the verticals to reduce costs in terms of network consumption and cloud storage is further expected to accelerate market growth over the forecast period.

Data Center IT Infrastructure Market Share by Vertical, 2023

Data Center IT Infrastructure Market Report with Detailed Vertical Analysis is Available with GlobalData Now! Download a Free Report Sample

The manufacturing segment is also one of the lucrative markets for data center IT infrastructure. Manufacturing companies with the help Internet of Things (IoT) can monitor their power and bandwidth utilization in real time. This not only allows them to plan and pay for their actual usage but also allows them to scale resources economically in case of future demands.

The manufacturing industry is one of the biggest producers of enterprise data in the world. The increasing usage of IoT application areas includes interconnected sensors on factory floors, remote monitoring of equipment, predictive maintenance, and others. The COVID-19 disruptions have further resulted in an increasing number of manufacturing companies shifting their data to the cloud to tackle challenges faced during the pandemic.

Data Center IT Infrastructure Market Analysis by Region

Asia Pacific was valued to be the largest region accounting for over 25% of the market share followed by North America and Western Europe. The rapid expansion of enterprises in the Asia Pacific region has driven a need for increased regional IT data center infrastructure products.

Data Center IT Infrastructure Market Share by Region, 2023

For More Data Center IT Infrastructure Market Insights by Region and Countries, Download a Free Report Sample

GlobalData estimates that the CAGR of China’s data center IT infrastructure market will be 6.4%, with revenues in 2026 totaling over $35 billion. India’s CAGR will be over 6%, and its data center IT infrastructure revenues will hit over $6 billion by 2026. In addition, the South and Central American region is expected to grow the fastest in the forecast period with a CAGR of over 8%.

Data Center IT Infrastructure Market - Competitive Landscape

The data center IT infrastructure landscape is an oligopolistic market characterized by few companies controlling a large chunk of the market share. Globally recognized players such as Dell Technologies, HPE, Lenovo, Inspur and IBM, and Cisco Systems Inc, among others. Strategies and business models are still in the early stages of development and are likely to undergo significant transformation as the market for data center IT infrastructure evolves and matures. The market witnessed an increase in new product launches over the last two years.

For instance, in October 2022, Cisco rolled out new high-end Nexus switches for the data center and one aimed at disaggregated applications. The company also added an 800Gb Ethernet module. Each of the new additions is powered by the company’s advanced Silicon One technology. In April 2022, IBM unveiled the IBM z16 system, with an integrated on-chip AI accelerator that can deliver latency-optimized inferencing, enabling clients to analyze real-time transactions, at scale, for mission-critical workloads such as credit card, healthcare, and financial transactions.

Leading Players in the Data Center IT Infrastructure Market

- Cisco Systems Inc

- Hewlett Packard Enterprise Co

- Huawei Technologies Co Ltd

- International Business Machines Corp

- Dell Technologies Inc

- Vertiv Holdings Co

- Lenovo Group Ltd

- Inspur Information

- Juniper Networks Inc

- Seagate Technology Holdings PLC

Other Data Center IT Infrastructure Companies Include:

Foxconn Industrial Internet Co Ltd, Inventec Corp, Celestica Inc, Western Digital Corp, SK Hynix Inc, Hitachi Ltd, Telefonaktiebolaget LM Ericsson, and others.

To Know More About Leading Data Center IT Infrastructure Market Players, Download a Free Report Sample

Data Center IT Infrastructure Market Research Overview

| Market Size 2023 | $241.2 billion |

| Market Size 2026 | $286.8 billion |

| Forecast Period | 2022-2026 |

| Historic Period | 2019-2021 |

| CAGR (2022-2026) | 6.2% |

| IT Infrastructure Components | Server, Storage, Networking Equipment, and DCIM Software |

| Vertical Segments | BFSI, Manufacturing, Information Technology, Retail, Energy, Government, and Others. |

| Employee Size Band | Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), Very Large (5000+) |

| Leading Companies | Cisco Systems Inc, Hewlett Packard Enterprise Co, Huawei Technologies Co Ltd, International Business Machines Corp, Dell Technologies Inc, Vertiv Holdings Co Lenovo Group Ltd, Inspur Information, Juniper Networks Inc, and Seagate Technology Holdings PLC |

Data Center IT Infrastructure Market Scope

GlobalData Plc has segmented the data center IT infrastructure market report by IT Infrastructure components, vertical, enterprise size band, and region:

Data Center IT Infrastructure Market – Revenue Opportunity Forecast, by Infrastructure Components, 2019-2026 (US$ million)

- Server

- Storage

- Networking Equipment

- Data Center Infrastructure Management (DCIM) Software

Data Center IT Infrastructure Market – Revenue Opportunity Forecast by Vertical Industry Segments, 2019-2026 (US$ million)

- BFSI

- Manufacturing

- Information Technology (including colocation)

- Retail

- Energy

- Government

- Others

Data Center IT Infrastructure Market – Revenue Opportunity Forecast by Employee Size Band, 2019-2026 (US$ million)

- Micro (Less than 50)

- Small (51-250)

- Medium (251-1000)

- Large (1001-4999)

- Very Large (5000+)

Data Center IT Infrastructure Market – Revenue Opportunity Forecast by Regions, 2019-2026 (US$ million)

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Rest of Asia Pacific

- North America

- US

- Canada

- South & Central America

- Brazil

- Mexico

- Argentina

- Rest of South & Central America

- Western Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Western Europe

- Central & Eastern Europe

- Russia

- Turkey

- Rest of Central & Eastern Europe

- Middle East & Africa

- United Arab Emirates

- South Africa

- Saudi Arabia

- Rest of Middle East & Africa

The market intelligence report provides an in-depth analysis of the following –

- Data center IT infrastructure market outlook: analysis as well as historical figures and forecasts of revenue opportunities from IT Infrastructure components (Server, Storage, Networking Equipment, and DCIM Software).

- Porter’s five forces analysis: demonstrates the strength of suppliers and buyers along with market competition in the market.

- Data center IT infrastructure market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the key vertical industry segments.

- Data center IT infrastructure market outlook: analysis as well as historical figures and forecasts of revenue opportunities by employee size band.

- Company snapshots: snapshots of leading companies in the data center IT infrastructure market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the data center IT infrastructure market and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in global data center IT infrastructure markets.

The report also highlights key IT Infrastructure components (Server, Storage, Networking Equipment, and Data Center Infrastructure Management (DCIM) Software), vertical industries (BFSI, Manufacturing, Information Technology, Retail, Energy, Government, Others), and employee size band (Micro, Small, Medium, Large, and Very Large).

- With more than 50 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players that enable executives to quickly get up to speed with the current and emerging trends in Data center IT infrastructure markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help data center IT infrastructure vendors and other players succeed in the growing data center IT infrastructure market globally.

Key Players

Cisco Systems IncHewlett Packard Enterprise Co

Huawei Technologies Co Ltd

International Business Machines Corp

Dell Technologies Inc

Vertiv Holdings Co

Lenovo Group Ltd

Inspur Information

Juniper Networks Inc

Seagate Technology Holdings PLC

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the data center IT infrastructure market size in 2023?

The global data center IT infrastructure market size will be valued at $241.2 billion in 2023.

-

What is the data center IT infrastructure market growth rate?

The data center IT infrastructure market is expected to grow at a CAGR of 6.2% during the forecast period 2021-2026.

-

What are the key data center IT infrastructure market drivers?

A significant increase in the adoption of artificial intelligence (AI), demand for automation across functions, the presence of enterprise colocation options, and the introduction of hyperscale data centers are stimulating the growth of the data center IT infrastructure components in the market.

-

What are the key data center IT infrastructure market segments?

IT Infrastructure Components: Server, Storage, and Networking Equipment, and Data Center Infrastructure Management (DCIM) Software

Vertical Segments: BFSI, Manufacturing, Information Technology, Retail, Energy, Government, and Others.

Employee Size Band: Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), Very Large (5000+)

-

Which are the leading data center IT infrastructure companies?

The leading companies in the data center IT infrastructure market are Cisco Systems Inc, Hewlett Packard Enterprise Co, Huawei Technologies Co Ltd, International Business Machines Corp, Dell Technologies Inc, and Vertiv Holdings Co Lenovo Group Ltd.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.