Energy Transition in Oil and Gas – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Energy Transition in Oil and Gas Market Report Overview

The oil & gas industry will feel international pressure acutely, as progress toward an energy transition becomes a particular point of scrutiny. Leading oil & gas players have set themselves decarbonization targets for both the medium and long term, relying on both existing and emerging technologies.

Companies are increasingly investing in renewable power generation, with wind and solar power being a particular area of focus. Some oil & gas majors have already diversified into electric vehicles, low-carbon hydrogen, and biofuels. Moreover, there has been increased interest in carbon capture and circular economy initiatives.

The energy transition in oil & gas thematic research report highlights key industry trends, technology trends, macroeconomic trends, and regulatory trends impacting the energy transition theme. Furthermore, it discusses oil & gas value chains, mergers & acquisitions activities, and major milestones in the energy transition story.

| Key Trends | Industry Trends, Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Value Chains | Upstream, Midstream, Downstream, and End Users |

| Leading Oil & Gas Companies | BP, Chevron, Eni, ExxonMobil, and Equinor |

| Leading Oilfield Equipment & Services Companies | Baker Hughes, Halliburton, National Oilwell Varco, Schlumberger, and Technip Energies |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Energy Transition in Oil & Gas: Key Trends

The key trends that are associated with the energy transition theme can be classified into four categories: industry trends, technology trends, macroeconomic, and regulatory trends.

- Industry trends – The key industry trends impacting the energy transition theme are the circular plastic economy, decarbonization, electric vehicles, gas flaring, hydrogen, and natural gas.

- Technology trends – The key technology trends impacting the energy transition theme include batteries, fuel cells, solar power, and wind power.

- Macroeconomic trends – The key macroeconomic trend that will shape the energy transition theme is the Russia-Ukraine conflict.

- Regulatory trends – The key regulatory trends impacting the energy transition theme include US regulations, EU emission tracking, and Chinese renewable policies.

For more insights on key trends shaping the energy transition theme, download a free report sample

Energy Transition in Oil & Gas – Industry Analysis

The oil & gas industry’s contribution to global warming and its subsequent impact on climate change is well noted in public discourse. There is a growing consensus to transition away from the oil & gas industry for the sake of climate change. This has prompted the industry to limit the impact of its operations. Growing pressure from international bodies such as the UN has prompted oil-producing and consuming nations to switch towards cleaner energy sources.

The energy transition in the oil & gas industry analysis also covers:

- Competitive landscape

- Case studies

- Mergers & acquisitions

- Timeline

Energy Transition in Oil & Gas - Value Chain Analysis

The oil & gas value chain is broadly categorized into upstream, midstream, and downstream sectors. End users also form a prominent vertical that consumes the products produced by the industry. The key energy transition technologies being adopted by the oil & gas industry are CCS, hydrogen, renewable power, energy storage, biofuels, and electric vehicle charging.

Hydrogen: Hydrogen is a buzzword in the energy sector. Conventionally, hydrogen was produced and consumed locally in energy and other heavy industry verticals, largely as a chemical. But the use of hydrogen as a fuel is now being explored in the transportation sector, as well as in residential heating applications.

Oil & Gas Value Chain Analysis

For more insights on the oil & gas value chains, download a free report sample

Leading Oil & Gas Companies Associated with the Energy Transition Theme

Some of the leading oil & gas companies associated with the energy transition theme are BP, Chevron, Eni, ExxonMobil, and Equinor.

BP: BP has set itself a net zero target of 2050 or sooner across its operations. In its energy transition efforts, BP has collaborated with energy companies such as Equinor and ADNOC, as well as technology giants such as Amazon and Microsoft. It has invested in solar and wind energy and has an offshore wind pipeline capacity of about 5.2GW in its US and UK locations.

To know more about the leading oil & gas companies associated with the energy transition theme, download a free report sample

Leading Oilfield Equipment & Services Companies Associated with the Energy Transition Theme

The leading oilfield equipment & services companies making their mark within the energy transition theme are Baker Hughes, Halliburton, National Oilwell Varco, Schlumberger, and Technip Energies.

Baker Hughes: Baker Hughes is aiming to achieve net-zero emissions by 2050 while targeting a 50% reduction in 2030 itself. It seeks to reduce Scope 1 and Scope 2 emissions through the development of energy-efficient oilfields, intelligent asset management solutions, and emission management technologies.

To know more about the leading oilfield equipment & services companies associated with the energy transition theme, download a free report sample

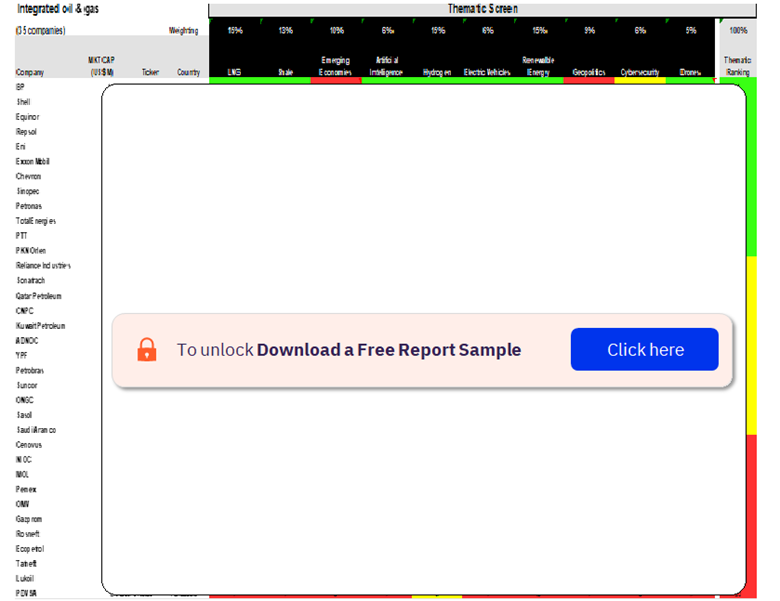

Integrated Oil & Gas Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The integrated oil & gas sector scorecard has three screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- Our risk screen ranks companies within a sector based on overall investment risk.

Integrated Oil & Gas Sector Scorecard – Thematic Screen

To know more about the sector scorecards, download a free report sample

Scope

- This report highlights the urgency for oil and gas companies to pursue an energy transition.

- It discusses the various avenues available for the oil and gas industry to adopt energy transition strategies.

- It analyses the scope for energy transition within the oil and gas value chain and identifies key players across the value chain.

- The report provides an overview of the competitive positions held by oil and gas companies, and equipment and services companies in the energy transition theme.

- It discusses energy transition use cases by the oil and gas players.

- The report includes sector scorecards for integrated oil companies ranking them concerning thematic exposure, market valuation, and overall investment risk.

Reasons to Buy

- To understand GlobalData’s Energy Transition Framework.

- Identify recent industry, technology, regulatory, and macroeconomic trends in the energy transition theme.

- Identify energy transition opportunities within the oil and gas value chain.

- Review of energy transition use cases by the oil and gas players.

- Identify and benchmark key oil and gas companies and their role in the energy transition theme.

- Identify and benchmark key oilfield and services companies participating in the energy transition market.

Table of Contents

Frequently asked questions

-

What key industry trends are shaping the energy transition theme in the oil & gas industry?

The key industry trends shaping the energy transition theme in the oil & gas industry are the circular plastic economy, decarbonization, electric vehicles, gas flaring, hydrogen, and natural gas.

-

What key technology trends are shaping the energy transition theme in the oil & gas industry?

The key technology trends shaping the energy transition theme in the oil & gas industry are batteries, fuel cells, solar power, and wind power.

-

What key macroeconomic trends are shaping the energy transition theme in the oil & gas industry?

The key macroeconomic trend that will shape the energy transition theme in the oil & gas industry is the Russia-Ukraine conflict.

-

What key regulatory trends are shaping the energy transition theme in the oil & gas industry?

The key regulatory trends shaping the energy transition theme in the oil & gas industry include US regulations, EU emission tracking, and Chinese renewable policies.

-

What are the components of the oil & gas value chains?

The oil & gas value chain is broadly categorized into upstream, midstream, and downstream sectors. End users also form a prominent vertical that consumes the products produced by the industry.

-

Which leading oil & gas companies are associated with the energy transition theme?

Some of the leading oil & gas companies that are associated with the energy transition theme are BP, Chevron, Eni, ExxonMobil, and Equinor.

-

Which leading oilfield equipment & services companies are associated with the energy transition theme?

The leading oilfield equipment & services companies that are associated with the energy transition theme are Baker Hughes, Halliburton, National Oilwell Varco, Schlumberger, and Technip Energies.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.