Enterprise IoT Market Trends and Analysis by Region, Product, Enterprise, Vertical, Connectivity and Segment Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Enterprise IoT report can help:

- Gain a valuable understanding of the current and future state of the market, allowing businesses to make informed decisions about market entry, product development, and investments

- Identify competitors’ capabilities to stay ahead in the market

- Identify segments and get an understanding of various stakeholders across different stages of the entire value chain

- Anticipate changes in demand and adjust the business development strategies

- Identify potential regions and countries for growth opportunities

How is our ‘Enterprise IoT’ report different from other reports in the market?

- The report presents in-depth market sizing and forecast at a segment level for more than 15 countries including historical and forecast analysis for the period 2019-2027 for market assessment.

- Detailed segmentation by:

- Product – IoT Hardware, IoT Software, IoT Services

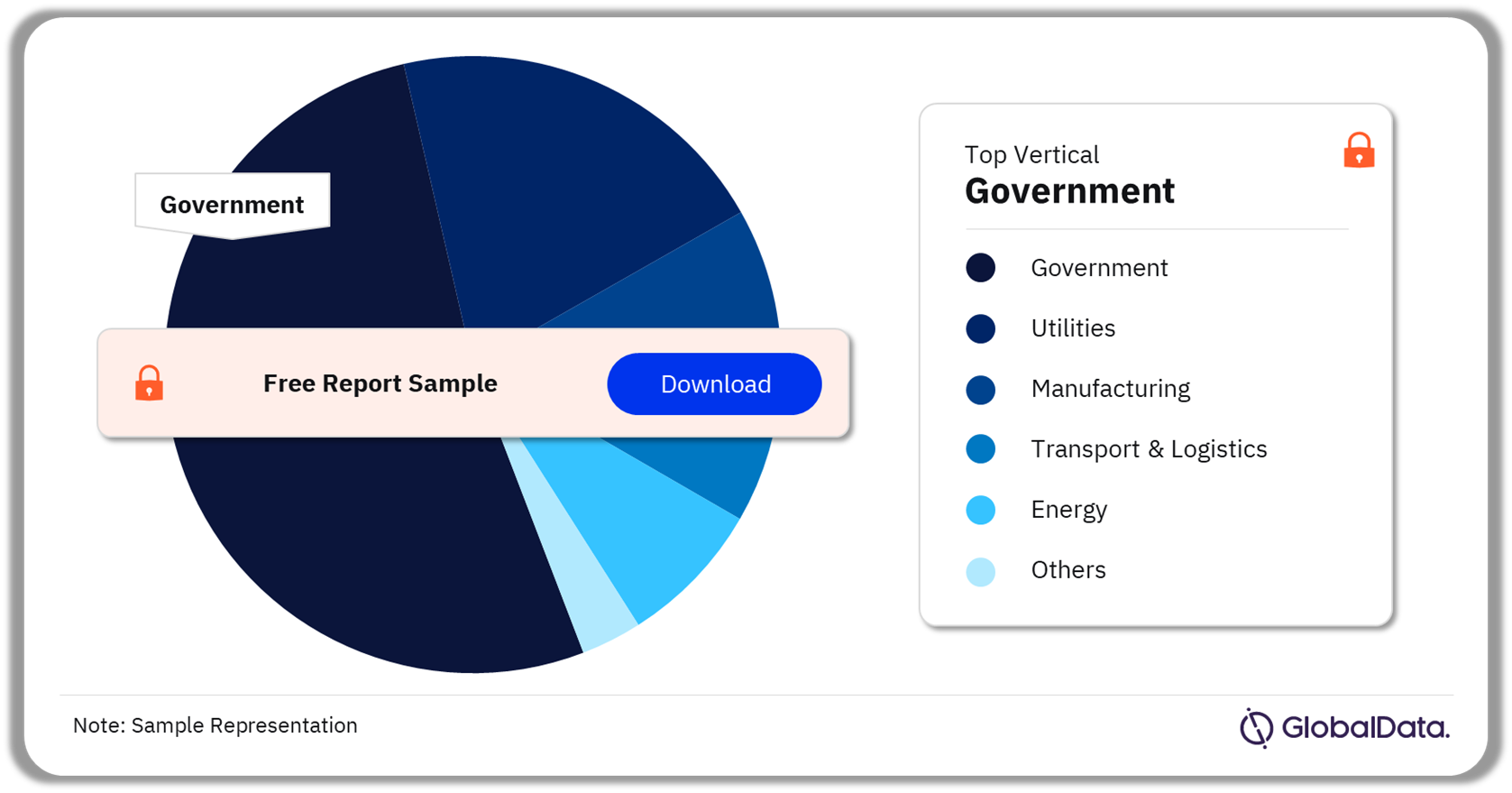

- Vertical – Government, Utilities, Manufacturing, Transport and Logistics, Energy, Insurance, Construction, Retail, Healthcare, Others

- Enterprise size – Micro, Small, Medium, Large, Very large

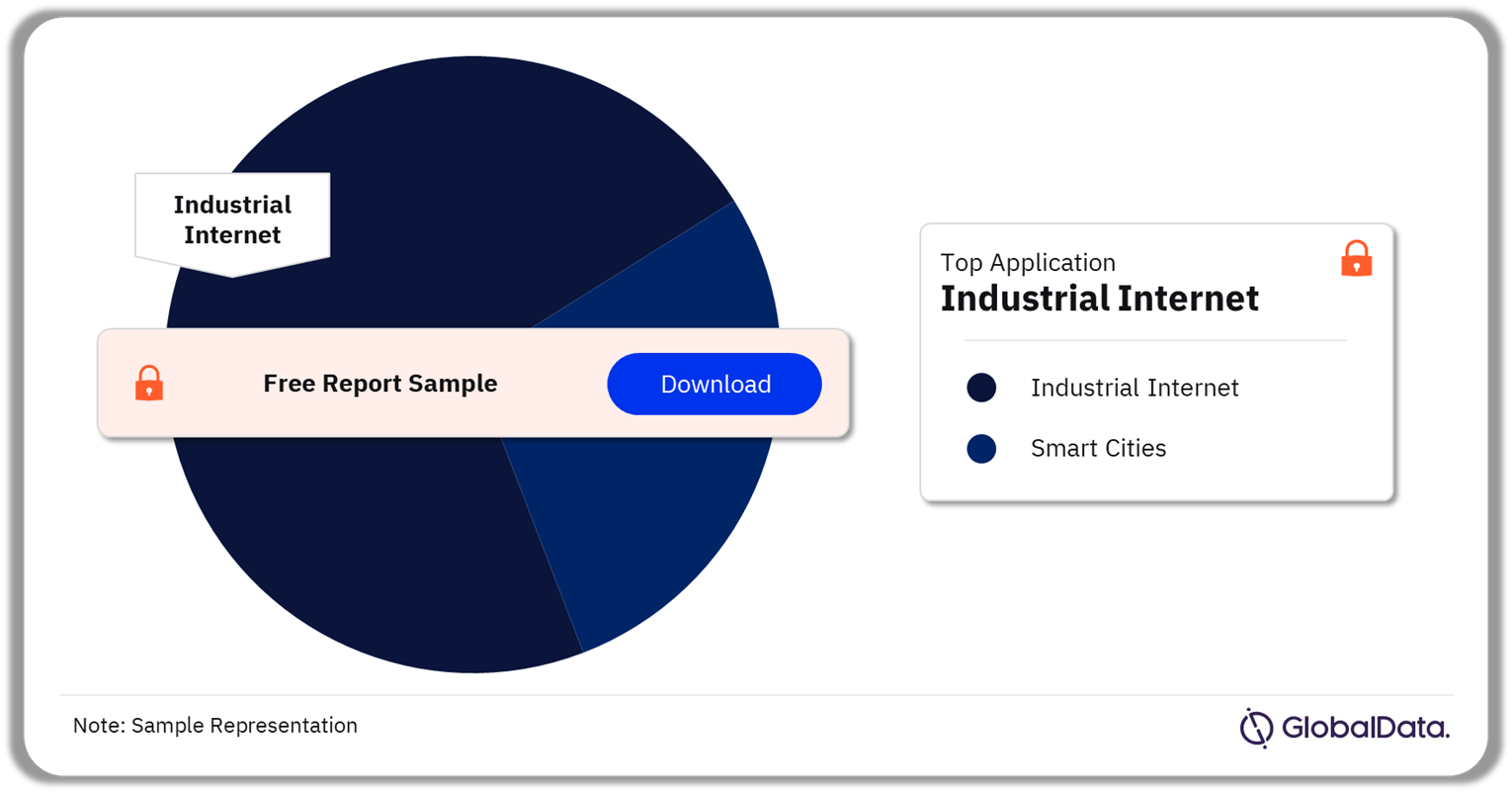

- Application – Industrial Internet (Condition Monitoring, Telematics, Asset Tracking, People & Animal Tracking, Environmental Monitoring, Advanced Automation, Healthcare) and Smart Cities (Smart Metering, Smart City Platforms, Smart Buildings, Smart Signage, and Smart Payment Systems).

- Region – North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa

- The report covers key market drivers and challenges impacting the enterprise IoT market.

- The report includes a detailed Porter’s Analysis.

- The report also covers a Mergers & Acquisitions (M&A) activity dashboard.

- The competitive landscape includes competitive positioning of key companies and company share analysis in the enterprise IoT market that will help the stakeholders in the ongoing process of identifying, researching, and evaluating competitors, to gain insight to form their business strategies.

- Competitive profiling and benchmarking of key companies in the market to provide a deeper understanding of industry competition.

- The report can be a valuable tool for stakeholders to improve their operations, increase customer satisfaction, and maximize profitability by analyzing the latest enterprise IoT trends, tracking market growth and demand, and evaluating the existing competition in the market.

We recommend this valuable source of information to:

- Companies offering enterprise IoT services/solutions

- Consulting & Professional Services Firms

- Venture Capital/Equity Firms

Get a Snapshot of the Enterprise IoT Market, Download a Free Report Sample

Enterprise IoT Market Overview

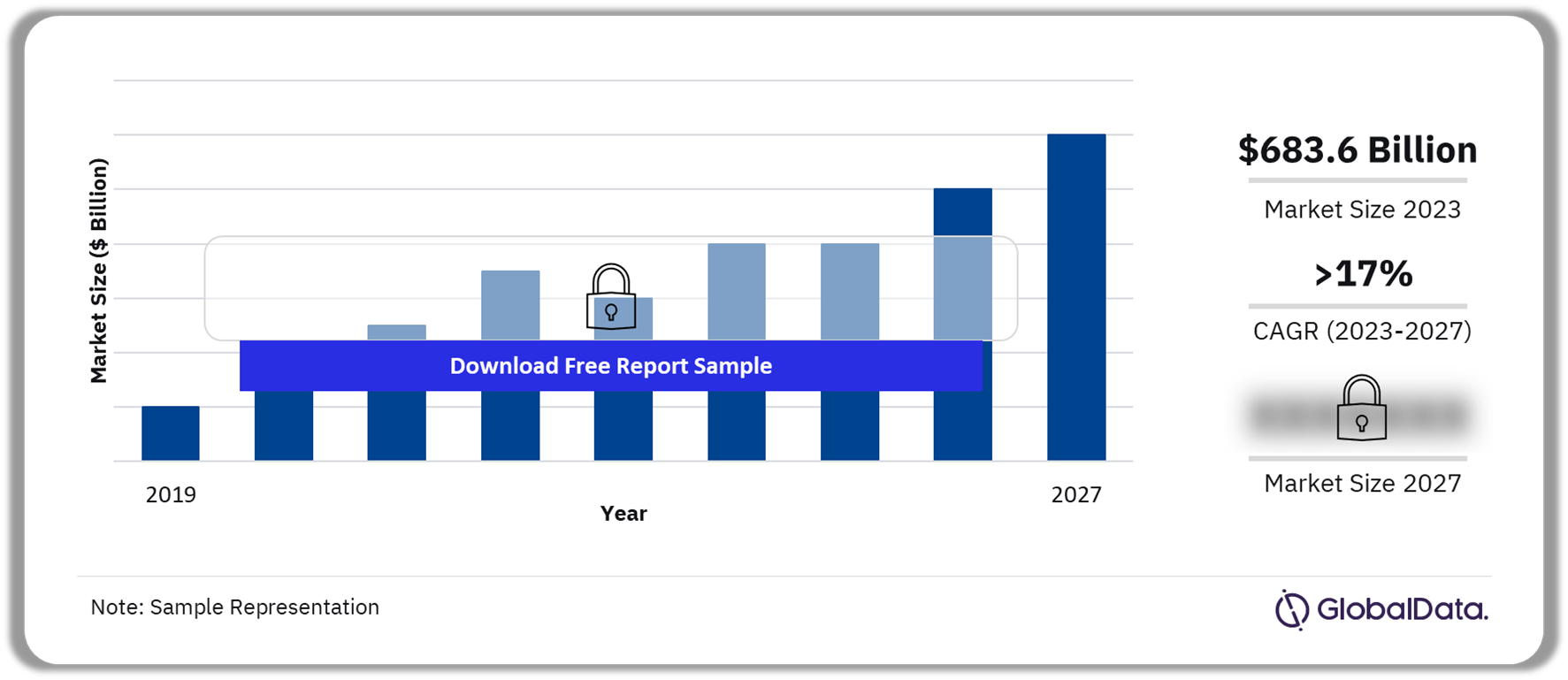

The enterprise Internet of Things (IoT) market size revenue was valued at $683.6 billion in 2023 and will grow at a compound annual growth rate (CAGR) of more than 17% over the forecast period. The integration of Enterprise IoT is poised for significant advancement with the rise of Artificial Intelligence of Things (AIoT), propelled by innovations like ChatGPT. Further, the expanding utilization of smart city technologies, and the evolution of connectivity solutions such as LoRaWAN, Sigfox, and Zigbee are expected to propel growth over the forecast period.

IoT serves as a key facilitator for digital transformation initiatives. When integrated with emerging technologies, like AI, 5G, and cloud computing, it enhances operational efficiency, lowers costs, redefines decision-making, and elevates the customer experience. IoT technology employs interconnected devices to oversee, regulate, and supervise diverse business operations, automating numerous manual tasks and predicting maintenance requirements in advance, thereby boosting productivity.

Enterprise Internet of Things Market Outlook, 2019 – 2027 ($Billion)

Buy the Full Report for Additional Insights on the Enterprise IoT Market Forecast, https://www.globaldata.com/store/talk-to-us/?report=3336076

The sensors within IoT devices generate a lot of data. Analysis of this data can lead to the development of optimized business strategies and improved business processes, enabling managers to make better informed operational decisions. Additionally, user-specific data generated through smart devices can help businesses understand customers’ expectations and behavior better. Analysis of this data can enable sales and marketing teams to target advertising, fine-tune pricing policy, and improve customer services.

COVID-19 has highlighted the crucial role of IoT in our lives. Numerous conventional applications, such as smart city initiatives, were paused as businesses grappled with the economic slowdown brought about by the pandemic. Governments redirected budgets in response to the health crisis, leading to a reprioritization of projects. By contrast, several IoT use cases saw growing adoption during the pandemic, such as using connected thermal cameras to detect potential COVID-19 infections and sensors for monitoring office occupancy levels. These new applications have positively impacted the growth of the IoT market.

Although the market is gaining traction, many companies, particularly small and medium-sized enterprises (SMEs), still lack an understanding of IoT, and actual adoption rates remain low. Hence, increasing awareness should be the top priority for IoT solution providers, achieved through clear messaging, case studies, and proof points showcasing IoT as a competitive advantage. Additionally, wider promotion of IoT products is essential to reach potential adopters.

Another area of concern is enterprise IoT security. The widespread adoption of IoT hinges on establishing a global standard for IoT security. The surge in connected devices has heightened cyberattack vulnerabilities, yet current IoT ecosystems lack sufficient security regulation. IoT security encompasses threats across devices, apps, networks, and data, with a primary focus on endpoint security to safeguard all connected devices.

| Market Size (2023) | $683.6 billion |

| CAGR (2023 – 2027) | >17% |

| Forecast Period | 2023-2027 |

| Historic Data | 2019-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Landscape, Growth Trends |

| Product Segment | IoT Hardware, IoT Software, IoT Services |

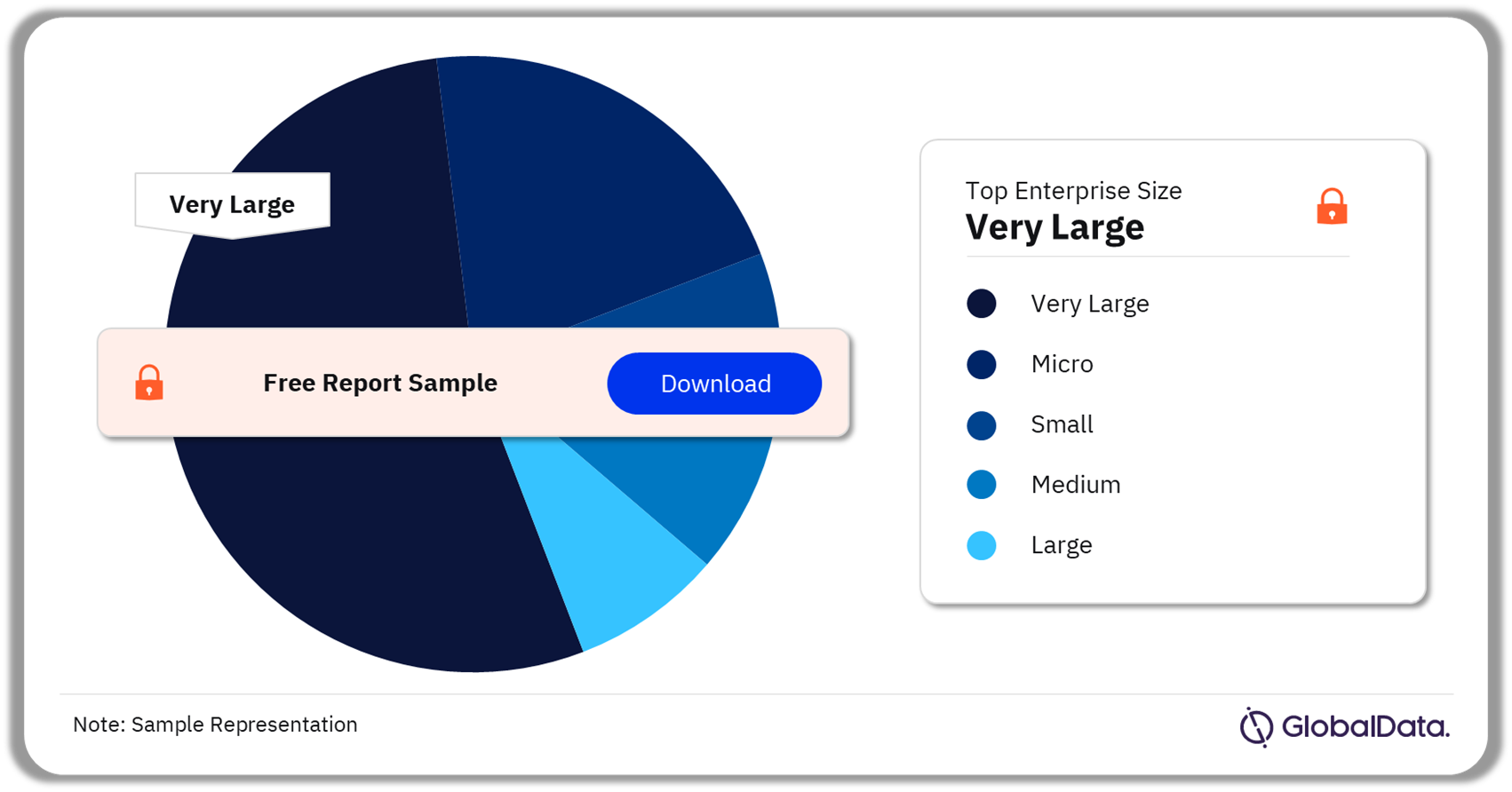

| Enterprise Size Segment | Micro (Less than 50), Small (51-250), Medium (251-1000), Large (1001-4999), and Very Large (5000+) |

| Vertical Segment | Government, Utilities, Manufacturing, Transport and Logistics, Energy, Insurance, Construction, Retail, and Healthcare, among others. |

| Application | Industrial Internet (Condition Monitoring, Telematics, Asset Tracking, People & Animal Tracking, Environmental Monitoring, Advanced Automation, Healthcare) and Smart Cities (Smart Metering, Smart City Platforms, Smart Buildings, Smart Signage, and Smart Payment Systems) |

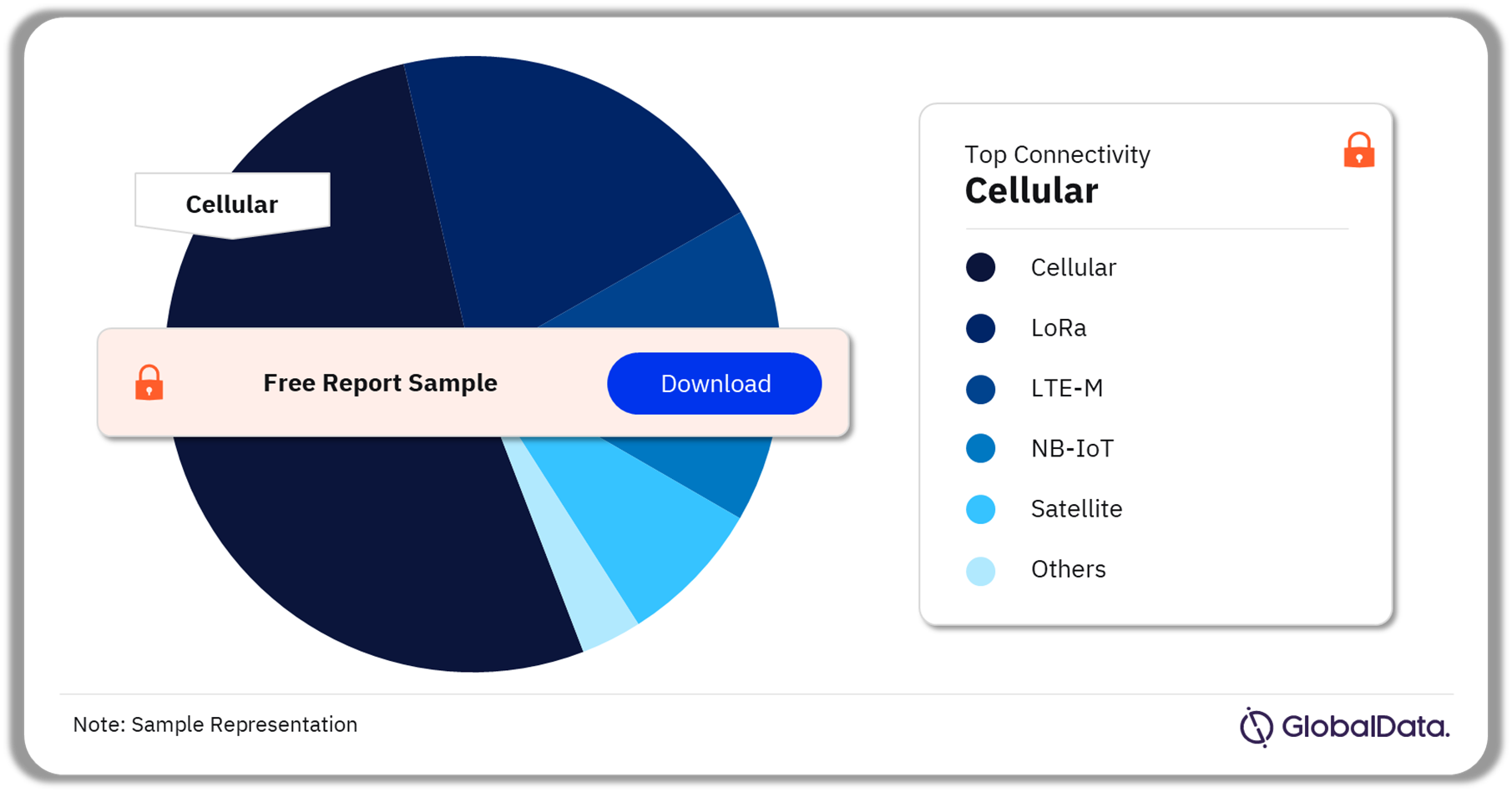

| Connectivity | Cellular, LoRa, LTE-M, NB-IoT, Satellite, Short Range, Sigfox, and Wireline |

| Geography | North America, Europe, Asia Pacific, South & Central America, Middle East & Africa |

| Key Companies | Microsoft, Alphabet, IBM, Samsung, Intel, Qualcomm, Siemens, Amazon, Huawei, and Cisco |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Enterprise IoT Market Segmentation by Product Types

Enterprise IoT solution is implemented through three product types, IoT hardware, IoT software, and IoT services. The IoT hardware segment demand is projected to capture more than 35% of the market by 2027. The IoT hardware market will witness a CAGR of more than 15% over the forecast period.

Enterprise Internet of Things Market Share by Product Types, 2023 (%)

Buy the Full Report for More Information on Product Types in the Enterprise IoT Market

IoT software includes software, applications, and platforms that facilitate the management and functioning of key areas of the connected ecosystem like networking (through platforms, embedded systems, and middleware), data collection, device integration, analysis of data sent/received, etc. One of the major application areas of IoT software is the digital twin. A digital twin is a software representation of physical assets and processes that allows an organization to carry out ‘what if’ simulations. These simulations can spot and avert problems proactively, help prevent downtime, and speed up the development of new products. The advent of digital twin technology will drive the IoT software market.

Enterprise IoT Market Segmentation by Enterprise Size

Based on enterprise size, the enterprise IoT market is segmented into micro, small, medium, large, and very large. In 2023, the very large enterprises market captured a sizeable market share exceeding 35%, and the segment is anticipated to witness strong growth, recording a CAGR surpassing 15% over the forecast period.

Enterprise Internet of Things Market Share by Enterprise Size, 2023 (%)

Buy the Full Report for More Information on the Enterprise IoT Market Enterprise Sizes

Digital transformation throughout enterprises, the execution of industry 4.0 standards, and conventional industries looking for sustainable operational practices will drive the adoption of enterprise IoT. Additionally, concurrent technological developments such as the introduction of 5G networks and the adoption of advanced analytics and AI, allow for fast processing of the data collected at various enterprise IoT nodes and subsequent action on the same. Several manufacturers are utilizing enterprise IoT manufacturing use cases to reduce costs, better facility service, improve worker safety, etc.

Enterprise IoT Market Segmentation by Vertical

The enterprise IoT vertical segment includes government, utilities, manufacturing, transport and logistics, energy, insurance, construction, retail, and healthcare, among others. As of 2023, the market in the government category was the largest, accounting for over 10% of the overall enterprise IoT market size. The government segment includes central, federal, regional, state, and local (county or municipality) governments and other government establishments such as advisory commissions, etc. Increasing investments in smart cities by governments across the globe will drive the market in the government segment.

Enterprise Internet of Things Market Share by Vertical, 2023 (%)

Buy the Full Report for More Information on the Enterprise IoT Market Verticals

Verticals such as utilities, manufacturing, energy, transport and logistics, and retail held a share of over 25% of the global market size in 2023. While the conventional use of IoT in smart cities and traffic management is witnessing a boost in adoption, the development of new applications of IoT in connected and autonomous vehicles, smart packaging, and patient monitoring is also growing.

Enterprise IoT Market Segmentation by Application

Industrial internet and smart cities are the two major segments by application of the enterprise IoT market. In 2023, the Industrial Internet segment captured a sizeable market share exceeding 50% and is anticipated to witness strong growth over the forecast period.

IT services have become an integral part of the Industrial Internet value chain. The necessity to integrate both IT and operational technology (OT) requires the expertise of external consulting services companies, particularly in the growing application of predictive maintenance. A dynamic market exists for smart city design and integration services, which intricately links applications for smart buildings, transportation, infrastructure, and power grids.

Enterprise Internet of Things Market Share by Application, 2023 (%)

Buy the Full Report for More Information on the Enterprise IoT Market Applications

Further, by leveraging smart city data through efficient analysis, cities can automate their infrastructure to enhance the well-being and safety of their residents. AI, for instance, holds the potential to revolutionize energy allocation, optimize the performance of water pipelines, sewage systems, and utilities, as well as predict and minimize maintenance needs.

Enterprise IoT Market Segmentation by Connectivity

In 2023, the cellular was the largest segment in the enterprise IoT market, growing at 15% CAGR over the next few years. The expansion of cellular enterprise IoT is propelled by advancements in cellular technology, exemplified by the rollout of 5G networks. These networks provide heightened bandwidth, reduced latency, and enhanced device density capabilities. Furthermore, the growing adoption of IoT applications across diverse sectors including manufacturing, transportation, healthcare, and agriculture drives the need for cellular connectivity solutions.

Enterprise Internet of Things Market Share, by Connectivity, 2023 (%)

Buy the Full Report for More Information on the Enterprise IoT Market Connectivity

Mobile IoT network standards such as long-term evolution for machines (LTE-M) and narrowband IoT (NB-IoT) will play an important role in the progress of enterprise IoT applications. Various network protocols such as Bluetooth low energy (BLE), Wi-Fi, long-range wide area network (LoRaWAN), Sigfox, and Zigbee have been developed to support the infrastructure for IoT sensors with modest bandwidth requirements and low power consumption.

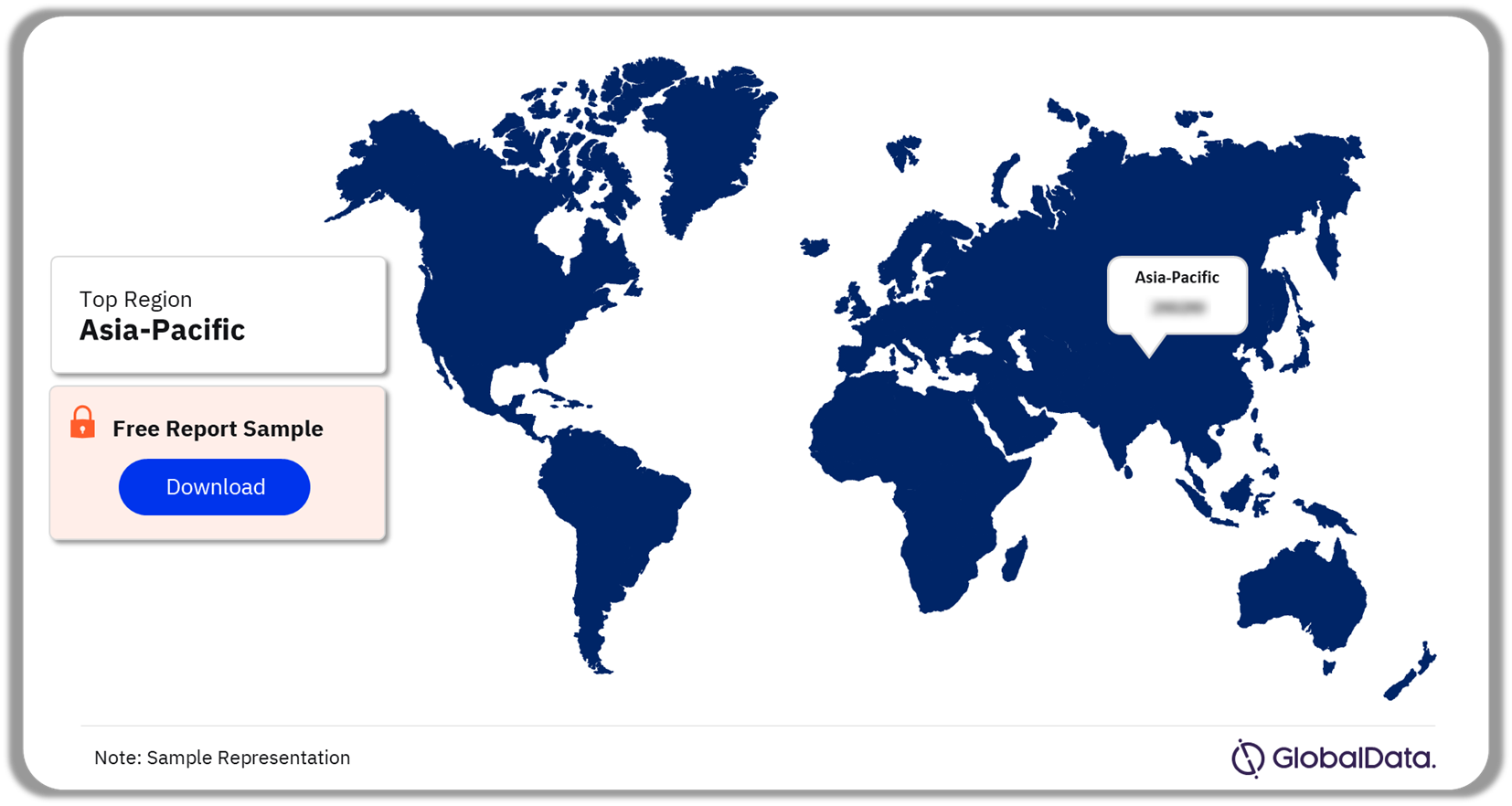

Enterprise IoT Market Analysis by Region

Asia Pacific’s enterprise IoT market value was the highest in 2023. In 2023, the US and China collectively led the regional demand, accounting for over 40% of the enterprise IoT market. The growing penetration of mobile 5G services along with increasing demand for smart cities will drive the regional enterprise IoT markets.

Enterprise Internet of Things Market Share by Region, 2023 (%)

Buy the Full Report for More Regional Insights into the Enterprise IoT Market

The surge in IoT is propelled by several simultaneous advancements. Enterprises’ demand for process enhancements primarily drives the adoption of IoT-monitored conditional monitoring. Additionally, businesses are integrating IoT devices and technologies to enhance sustainability and diminish their ecological impact, following regulatory mandates. The deployment of 5G networks is anticipated to further bolster IoT adoption by providing faster connectivity for improved real-time monitoring. Moreover, the advent of IoT facilitates the rapid processing of extensive data collected at IoT nodes with minimum latency.

Enterprise IoT Market – Competitive Landscape

The overall competitive environment in the enterprise IoT sector is highly fragmented. Many venture capital firms are making substantial investments in innovative startups with cutting-edge capabilities. The consolidation of the enterprise IoT ecosystem through mergers and acquisitions appears to be a beneficial trend in simplifying the overly complex market. However, continued concerns from customers about purchasing and managing distinct components from various vendors potentially act as a threat to sufficient return on investments for key stakeholders.

In January 2024, Vodafone and Microsoft revealed a decade-long collaboration valued at $1.5 billion. The partnership aims to introduce generative AI (Gen AI), digital solutions, enterprise services, and cloud offerings to more than 300 businesses and public sector entities spanning Europe and Africa.

The key companies leading the enterprise IoT market include Microsoft Corp, Alphabet Inc., International Business Machines Corp, Samsung Electronics Co. Ltd., Intel Corp, Qualcomm Inc., Siemens AG, Amazon.com Inc., Huawei Investment & Holding Co Ltd, and Cisco Systems Inc., among others.

Leading Companies in the Enterprise IoT Market

- Microsoft Corp

- Alphabet Inc

- Samsung Electronics Co Ltd

- Intel Corp

- Qualcomm Inc

- Siemens AG

- International Business Machines Corp

- com Inc

- Cisco Systems Inc

- Huawei Investment & Holding Co Ltd

Other Enterprise IoT Market Vendors Mentioned

Schneider Electric SE, Nokia Corp, PTC Inc, SAP SE, NXP Semiconductors NV, STMicroelectronics NV, Accenture Plc, ABB Ltd, NVIDIA Corp, Honeywell International Inc, Dell Technologies Inc, Alibaba Group Holding Ltd, Dassault Systemes SE, and Telefonaktiebolaget LM Ericsson.

Buy the Full Report to Know More About Leading Enterprise IoT Companies Download a Free Report Sample

Enterprise IoT Market Segments

GlobalData Plc has segmented the Enterprise IoT market report by product, vertical, enterprise size, application, connectivity, and region:

Enterprise IoT Market Application Outlook (Revenue, $ Million, 2019-2027)

- Industrial Internet

- Condition Monitoring

- Telematics

- Asset Tracking

- People & Animal Tracking

- Environmental Monitoring

- Advanced Automation

- Healthcare

- Smart Cities

- Smart Metering

- Smart City Platforms

- Smart Buildings

- Smart Signage

- Smart Payment Systems

Enterprise IoT Market Product Outlook (Revenue, $ Million, 2019-2027)

- IoT Hardware

- IoT Software

- IoT Services

Enterprise IoT Market Vertical Outlook (Revenue, $ Million, 2019-2027)

- Government

- Utilities

- Manufacturing

- Transport and Logistics

- Energy

- Insurance

- Construction

- Retail

- Healthcare

- Others

Enterprise IoT Market Enterprise Size Outlook (Revenue, $ Million, 2019-2027)

- Micro (Less than 50)

- Small (51-250)

- Medium (251-1000)

- Large (1001-4999)

- Very Large (5000+)

Enterprise IoT Market Application Outlook (Revenue, $ Million, 2019-2027)

- Condition Monitoring

- Telematics

- Asset Tracking

- People & Animal Tracking

- Environmental Monitoring

- Advanced Automation

- Healthcare

- Smart Metering

- Smart City Platforms

- Smart Buildings

- Smart Signage

- Smart Payment Systems

Enterprise IoT Market Connectivity Outlook (Revenue, $ Million, 2019-2027)

- Cellular

- LoRa

- LTE-M

- NB-IoT

- Satellite

- Short Range

- Sigfox

- Wireline

Enterprise IoT Market Regional Outlook (Revenue, $ Million, 2019-2027)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- The Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Singapore

- South Korea

- Rest of Asia Pacific

- South & Central America

- Brazil

- Argentina

- Rest of South & Central America

- Middle East & Africa

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia (KSA)

- South Africa

- Rest of the Middle East & Africa

Scope

This report provides overview and service addressable market for enterprise IoT.

It identifies the key trends impacting growth of the market over the next 12 to 24 months.

It includes global market forecasts for the Enterprise IoT industry and analysis of patents, company filings, and hiring trends.

It contains details of M&A and VF deals in the Enterprise IoT space.

The detailed value chain consists of five main aspects: IoT device layer, IoT connectivity layer, IoT data layer, IoT services layer, and IoT app layer

Key Highlights

The global enterprise Internet of Things (IoT) market size was valued at $683.6 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.3% during 2023-2027. The adoption of enterprise IoT will be supported by the emergence of Artificial Intelligence of Things (AIoT), mainly driven by advancements such as ChatGPT, increasing adoption of smart cities, and advancements in connectivity technologies like LoRaWAN, Sigfox, and Zigbee.

Reasons to Buy

This market intelligence report offers a thorough, forward-looking analysis of the global enterprise IoT market, product type, vertical, application, connectivity, region, key vendor outlook, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in enterprise IoT market.

With more than 20 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in Enterprise IoT market.

The broad perspective of the report coupled with comprehensive, actionable detail will help enterprise IoT companies, investors, and other stakeholders succeed in the growing enterprise IoT market globally.

Key Players

Microsoft CorpAlphabet Inc

Samsung Electronics Co Ltd

Intel Corp

Qualcomm Inc

Siemens AG

International Business Machines Corp

Amazon.com Inc

Cisco Systems Inc

Huawei Investment & Holding Co Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What was the enterprise Internet of Things market size in 2023?

The enterprise IoT market size was valued at $683.6 billion in 2023.

-

What will the enterprise Internet of Things market growth rate be during the forecast period?

The enterprise IoT market will grow at a CAGR of more than 17% over the forecast period.

-

What is the key enterprise Internet of Things market driver?

The intersection of artificial intelligence (AI) and the Internet of Things (IoT) is significantly impacting technology landscapes. AI advancements such as ChatGPT, are increasingly influencing IoT ecosystems where data is exchanged and analyzed between connected devices.

-

Which is the leading product type in the Enterprise Internet of Things market in 2023?

IoT Hardware is the leading product type in the Enterprise Internet of Things market in 2023.

-

Which is the leading vertical in the Enterprise Internet of Things market in 2023?

The government is the leading vertical in the Enterprise Internet of Things market in 2023.

-

Which is the leading enterprise size for the Enterprise Internet of Things market in 2023?

In 2023, the very large enterprises market captured a sizeable market share.

-

Which is the leading application segment for the Enterprise Internet of Things market in 2023?

Industrial Internet is the leading application segment in the Enterprise Internet of Things market in 2023.

-

Which is the leading connectivity segment for the Enterprise Internet of Things market in 2023?

In 2023, cellular was the largest segment in the enterprise IoT market.

-

Which region accounts for the highest share of the Enterprise Internet of Things market in 2023?

Asia Pacific’s enterprise IoT market value was the highest in 2023, with China and India being the key countries.

-

Which are the leading enterprise Internet of Things companies globally?

The leading enterprise IoT companies are Microsoft, Alphabet, IBM, Samsung, Intel, Qualcomm, Siemens, Amazon, Huawei, and Cisco.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Enterprise IoT reports