ESG (Environmental, Social and Governance) in Payments – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

ESG in Payments Market Overview

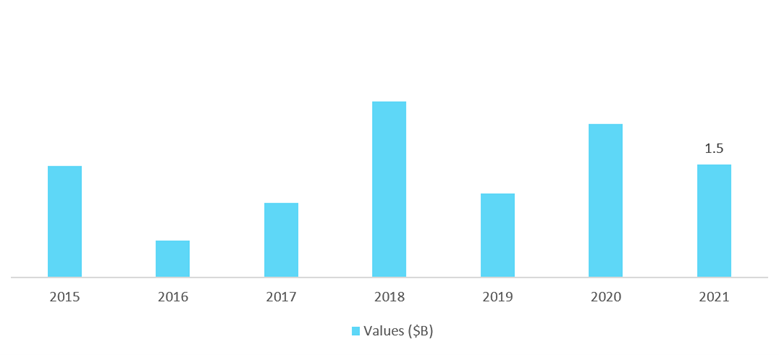

The ESG in payments deals was worth 1.5 billion in 2021. ESG is a growing trend that is affecting all industries, including the payments industry. The interest in ESG increased due to consumers’ and investors’ desire to see companies reflect their values.

Many companies have been recruiting in the sector in the past few years too. For instance, Visa and Mastercard have decided to tie their executive employee compensation to the company’s ESG goals. This should incentivize executives to consider ESG within their business decisions. In 2022, Mastercard decided to make the compensation policy company-wide and apply it to all employees.

The ESG in payments market research report will help to understand the different ESG frameworks currently available to companies and also the different approaches that are taken to integrate ESG within a company. The report also provides key insights on the driver of ESG adoption in the payments industry.

Key Trends

The main trends shaping the ESG theme in the payments industry are technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: The key technology trends impacting the ESG theme are tracking of carbon footprints, the rise in the adoption of digital payments, the use of eco-friendly cards, and the increase in the adoption of open banking ecosystems and sustainable digital finance among others.

Macroeconomic Trends: The key macroeconomic trends impacting the ESG theme are regular ESG reporting by companies, organizations avoiding greenwashing strategies, and payments to offset carbon footprints by planting trees and maintaining forests.

Regulatory Trends: The key regulatory trends impacting the ESG theme include the lack of ESG standards, the development of greenhouse gas (GHG) protocol, and the introduction of a global reporting initiative (GRI) among others.

For more insights on key trends impacting ESG themes in the payments industry, download a free report sample

ESG in Payments – Industry Analysis

The ESG in payment market size was 1.5 billion in 2021 and is expected to witness a significant growth in the coming years. This can be attributed to the growing number of financial institutions that have started integrating ESG within their operations. For example, JPMorgan Chase launched a fully dedicated ESG team, the Green Economy Banking team, in 2021. However, factors such as the lack of standardization of annual reporting make it difficult to objectively assess the measures taken by companies and effectively do a comparison between companies from the same industry.

According to GlobalData’s Deals Database, payment companies have invested heavily in ESG-related deals in the past seven years but those investment deals seem to have stagnated. North America and Europe drive investments in the sector, as they represent the majority of those investments. But with a lack of standardized frameworks and specific guidelines, investments made by payment companies stay relatively small and each company has the discretion to select which areas of ESG they get to prioritize.

The ESG in payments industry analysis also covers:

- Mergers and acquisition

- Case studies

- Timeline

ESG in Payments Deals ($B)

For more insights on ESG in payments industry analysis, download a free report sample

Leading Companies in the ESG in Payments Theme

Some of the leading companies making their mark within ESG theme in the payments industry are ACI Worldwide, Adyen, Affirm, Alibaba Group, American Express, Apple, Block, Danske Bank, FIS, Fiserv, and Alphabet (parent company of Google).

To know more about the leading companies associated with ESG themes in the payment industry, download a free report sample

ESG in Payments Sector Scorecard

GlobalData uses a scorecard approach to predict tomorrow’s leading companies within each sector. The sector scorecards help to determine which companies are best positioned for a future filled with disruptive threats. Each sector scorecard has three screens:

- The thematic screen shows who are the overall leaders in the 10 themes that matter most, based on the thematic engine.

- The valuation screen shows whether publicly listed players appear cheap or expensive relative to their peers, based on consensus forecasts from investment analysts.

- The risk screen shows who the riskiest players in each industry are, based on the assessment of four risk categories: operational risk, financial risk, industry risk, and country risk.

Payments Sector Scorecard – Thematic Screen

To know more about sector scorecards related to the payments industry, download a free report sample

ESG in Payments Thematic Research Overview

| Report Pages | 41 |

| Regions Covered | Global |

| ESG Market Size (2021) | $ 1.5 billion |

| Key Trends | Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Leading Companies | ACI Worldwide, Adyen, Affirm, Alibaba Group, American Express, Apple, Block, Danske Bank, FIS, Fiserv, and Alphabet (parent company of Google) |

Key Highlights

- In the past seven years, more than $9 billion was invested in ESG-related deals globally.

- Visa and Mastercard have both opted to tie executive compensation to ESG targets.

- JPMorgan Chase has a Sustainable Development Target of more than 2 trillion to facilitate and finance ESG projects over 10 years.

Reasons to Buy

- Understand the different ESG frameworks currently available to companies.

- Understand the different approaches taken to integrate ESG within a company.

- Understand what is driving ESG adoption in the payments industry.

- Access case study insights on ESG adoption.

Amazon

American Express

Meta

Apple

Alphabet

Block

Danske

FIS

Fiserv

G+D

Global Payments

Gravity Payments

HSBC

JPMorgan Chase

Klarna

Mastercard

PayPal

Revolut

Ripple

Santander

Stripe

Visa

Worldline

Worldpay

Table of Contents

Frequently asked questions

-

What was the ESG in payments market size in 2021?

The ESG in payments deals was worth 1.5 billion in 2021.

-

What are the key technology trends impacting ESG in the payments industry?

The key technology trends shaping the ESG theme in the payments industry are tracking of carbon footprints, rise in the adoption of digital payments, use of eco-friendly cards, and rise in the adoption of open banking ecosystems and sustainable digital finance among others.

-

What are the key macroeconomic trends impacting ESG in the payments industry?

The key macroeconomic trends impacting the ESG theme are regular ESG reporting by companies, organizations avoiding greenwashing strategies, and payments to offset carbon footprints by planting trees and maintaining forests.

-

What are the key regulatory trends impacting ESG in the payments industry?

The key regulatory trends impacting the ESG theme include the lack of ESG standards, the development of greenhouse gas (GHG) protocol, and the introduction of a global reporting initiative (GRI) among others.

-

Which are the leading companies associated with ESG theme within the payments industry?

Some of the leading companies making their mark within ESG theme in the payments industry are ACI Worldwide, Adyen, Affirm, Alibaba Group, American Express, Apple, Block, Danske Bank, FIS, Fiserv, and Alphabet (parent company of Google).

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports