Esports Market Size, Share, Trends and Analysis by Region, Revenue Stream, Gaming Genre and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Esports Market Overview

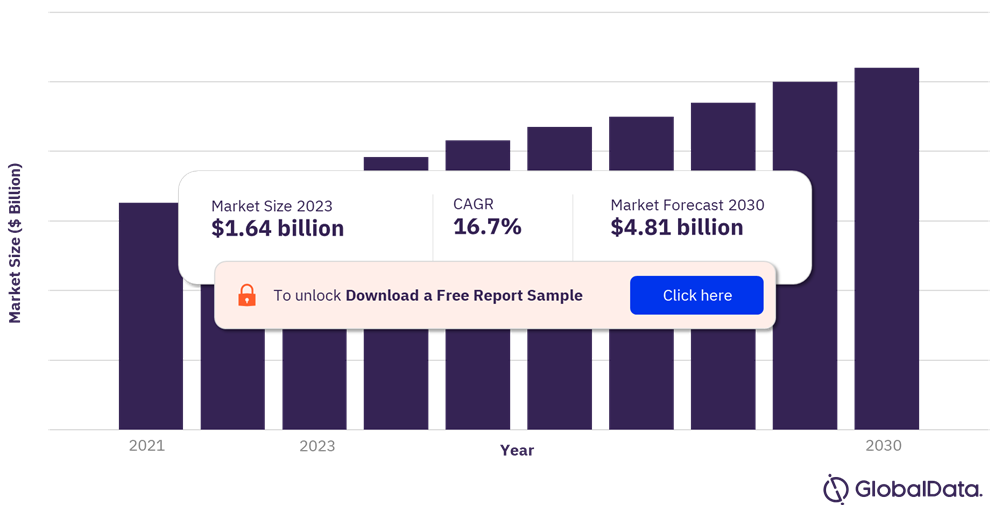

The Esports market size by revenue will be valued at $1.64 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 16.7% over the forecast period. The adoption of Esports will be supported by increasing adoption of mobile and PC gaming, high accessibility and inclusiveness, and the development of the mobile 5G connectivity. Esports is moving from local area network (LAN)-based wired connectivity to 5G-powered wireless connections. Over the next two years, organizers will explore the potential for cross-platform esports competitions using 5G’s low latency and high bandwidth capabilities.

Although the market is gaining traction, it faces serious challenges from unauthorized betting/gambling and match-fixing. Companies offer several types of betting including skin betting, real money betting, social betting, fantasy betting, and challenge betting. Players earn skins in different games through gameplay, but they can also use real money to buy them. Skins can also be traded and sold, which creates a market in which rare skins are more in demand. This has given rise to several websites where players can gamble with their skins to win more valuable ones. These skins can then be sold for a much higher price using real money, leading to losses for game publishers.

Esports Market Outlook, 2021-2030 ($ Billion)

View sample report for additional insights on the esports market size projections, download a free sample

The sector has been able to grow rapidly due to the increasing adoption of PC and mobile gaming among the young population. The proliferation of smartphones has led to a rise in mobile gaming. Free-to-play games such as Player Unknown’s Battlegrounds (PUBG), Clash Royale, Vainglory, Arena of Valor, Free Fire, and Mobile Legends are pioneering the mobile esports revolution. Esports has also made its way into academics. As per a report by ESPN, there are more than 125 colleges that offer esports programs. Caldwell University in New Jersey, Keuka College in New York, George Mason University in Virginia are some of the colleges that offer esports degree courses.

According to the Ericsson Mobility Report, published in November 2020, 22 of the 106 telcos that have launched commercial 5G offerings have announced cloud gaming services. In January 2020, BT partnered with Google Stadia to become its first European 5G provider. Verizon, AT&T, T-Mobile, SK Telecom, China Mobile, KT, and Vodafone have also inked deals with cloud gaming providers. Chipmakers like Samsung, Huawei, Qualcomm, and MediaTek are also investing in 5G to bring console-quality gaming to smartphones. Mobile esports is growing particularly quickly in Southeast Asia and Latin America, driven by the rise of smartphone gaming culture in these regions.

The lack of standardization and regulation of esports competitions is one of the major challenges faced by the industry. In conventional sports a centralized and global entity can easily implement standardization and regulation for a particular sport. In esports ecosystem, the publisher of a game owns the game, while the organizer of the esports tournament or event can also manage the regulations of the game. Industry consortiums such as the International Esports Federation (IESF) and the World Esports Association (WESA) are trying to bring uniformity to esports leagues, but have so far made little progress, and governance remains in a state of flux. Adding to the confusion, several countries (including South Korea, Japan, and India) have also created regulatory bodies to govern their domestic esports industries. The creation of an independent body would be particularly promising in this regard.

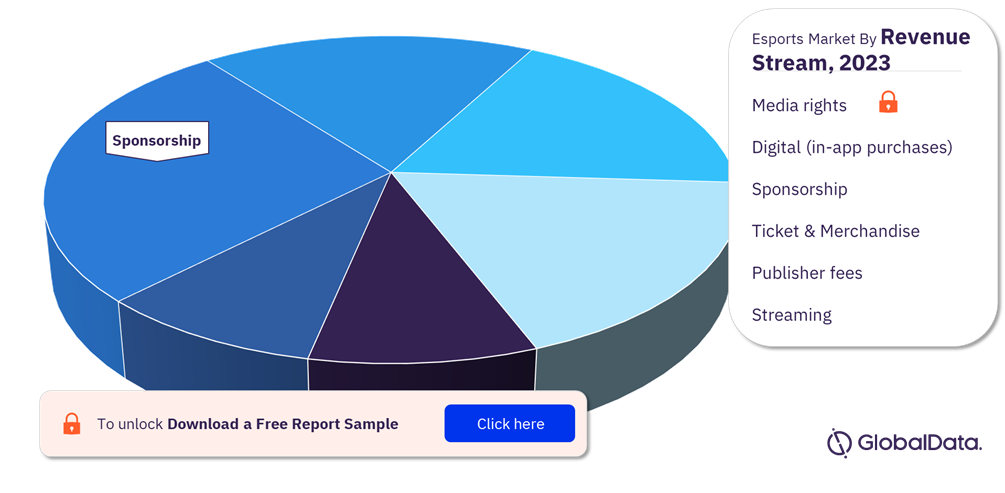

Esports Market Segmentation by Revenue Stream

Esports market by revenue stream includes sponsorship, media rights, digital, tickets & merchandise, publisher fees, and streaming. Sponsorship from non-tech brands is helping esports teams open up new revenue channels (e.g., Cloud9 offers team-branded apparel in partnership with Puma), while the involvement of globally recognized brands like Coca- Cola (the official non-alcoholic beverage of Overwatch League) is legitimizing esports content in the eyes of a wider audience.

Digital, which includes the sale of in-game items associated with team IP or signed player likenesses, will be the fastest-growing revenue stream by 2030. Tencent, in partnership with Chushou, is already developing advertising campaigns to enhance fan engagement in China, which most likely will follow an in-game monetization model. Other companies are likely to follow Tencent’s lead and develop mobile esports-focused in-game revenue models.

Esports Market Share by Revenue Stream, 2023 (%)

Fetch Sample PDF for revenue stream-specific revenues and shares, download a free sample

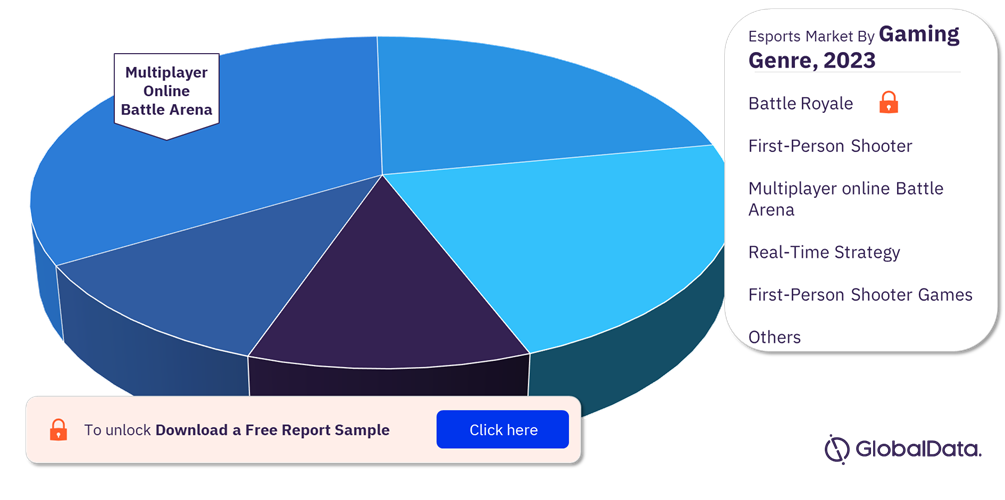

Esports Market Segmentation by Gaming Genre

Esports market by gaming genre includes Multiplayer online Battle Arena, Real-Time Strategy, First-Person Shooter, Battle Royale, Others.

Games spanning a range of genres are driving the popularity of esports. Currently, multiplayer online battle arena (MOBA) games such as Dota 2 and League of Legends, and first-person shooter (FPS) games like Counter-Strike: Global Offensive (CS: GO), Overwatch, and Call of Duty (CoD), along with battle royale games like Fortnite and PlayerUnknown’s Battlegrounds (PUBG), are key revenue generators. Real-time strategy (RTS) games such as StarCraft II and the collectible card game (CCG) Hearthstone are also among the top-grossing esports games. Fighting games such as Super Smash Bros. and Mortal Kombat 11 and sports games like FIFA, NBA 2K, Madden NFL, and Rocket League are also popular.

By gaming genre, the multiplayer online battle arena segment accounted for the largest market share in 2022 and is expected to continue to dominate over the forecast period growing at a CAGR of more than 18% during the forecast period.

Esports Market Share by Gaming Genre, 2023 (%)

Fetch Sample PDF for gaming genre-specific revenues and shares, download a free sample

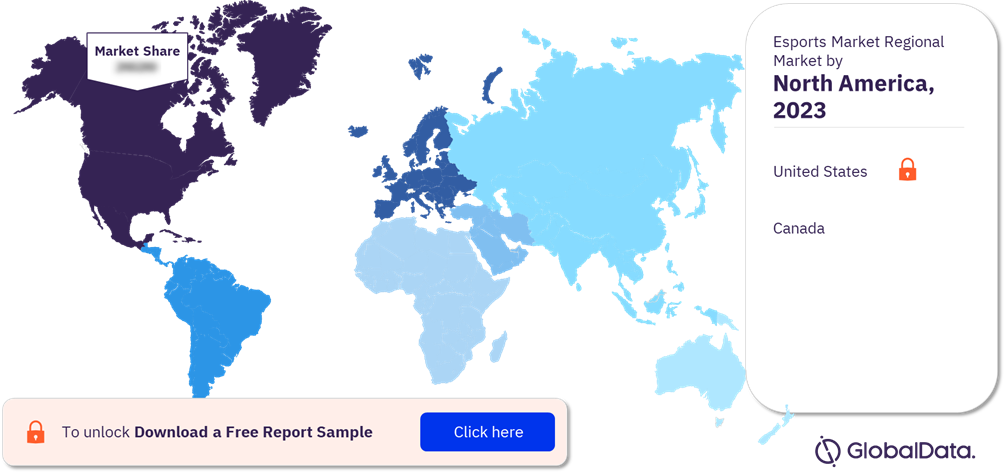

Esports Market by Region

North America Esports market value was the highest in 2022, capturing over 30% of the overall market size. The regional demand was led by the US and China collectively accounting for over 40% of the Esports market in 2022. The adoption of mobile 5G services supported by increasing demand for PC and mobile gaming will drive the regional Esports markets.

North America is projected to retain the largest share by 2030 accounting for over 30% of the global Esports market value, with a forecasted growth rate exceeding 14% from 2022 to 2030. The growing demand and implementation of 5G services will favor the proliferation of the Esports market in Asia Pacific. Apart from the Asia Pacific market, the Middle East and Africa Esports market is also expected to witness growth over the near future, registering a CAGR of more than 13% from 2022 to 2030.

North America Esports Market Share by Country, 2023 (%)

Fetch Sample PDF for region-specific revenues and shares, download a free sample

Esports Market - Competitive Landscape

Consolidation in esports is intensifying, focused on themes like team building, event organizing, and analytics. Esports companies, especially Immortals, are acquiring teams to enter league events and expand their geographical footprint. Companies like Activision Blizzard (a game developer), Torque Esports (a game content producer), and Game (a game distributor) have moved into esports event management through acquisition. Logitech has been an active player in esports consolidation, having acquired Challonge, Streamlabs, and Beyond Entertainment. Advance Publications’ acquisition of The Esports Observer and Newzoo was intended to strengthen its position in esports reporting and analytics.

The leading companies that specialize in esports are Modern Times Group MTG AB, Tencent Holdings Ltd, Activision Blizzard Inc, Electronic Arts Inc, Valve Corporation, Nintendo Co Ltd, Sony Group Corp, Amazon.com Inc, Epic Games Inc., NVIDIA Corp, Meta Platforms Inc, HTC Corp, Alphabet Inc, Intel Corp, and Microsoft Corp.

Leading Players in the Esports Market

- Modern Times Group MTG AB

- Amazon (Twitch)

- HTC Corp

- Meta Platforms Inc

- NVIDIA Corp

- Epic Games Inc

- Alphabet Inc

- Intel Corp

- Valve Corporation

- Sony Group Corp

- Nintendo Co Ltd

- Electronic Arts Inc

- Activision Blizzard Inc

- Tencent Holdings Ltd

- Microsoft Corp

Other Esports Market Vendors Mentioned

Ubisoft Entertainment SA, Warner Bros. Discovery Inc, Samsung Electronics Co Ltd, Envy Gaming LLC, Gfinity Plc, Esports Entertainment Group Inc, Take-Two Interactive Software Inc, Capcom co Ltd, Rovio Entertainment Corp, Mogul Games Group Ltd, and Gameloft SE.

For more information on the leading players in the Esports market, download a free sample

Esports Market Research Scope

| Market Size (2023) | $1.64 billion |

| Market Size (2030) | $4.81 billion |

| CAGR | 16.7% from 2022 to 2030 |

| Forecast Period | 2023-2030 |

| Historic Data | 2021-2022 |

| Report Scope & Coverage | Revenue Forecast, Competitive Index, Company Landscape, Growth Trends |

| Revenue Stream Segment | Sponsorship, Media Rights, Digital, Tickets & Merchandise, Publisher Fees, and Streaming |

| Gaming Genre Segment | Multiplayer Online Battle Arena, Real-Time Strategy, First-Person Shooter, Battle Royale, Others |

| Geography | North America, Europe, Asia Pacific, South & Central America, Middle East & Africa |

| Key Companies | Modern Times Group MTG AB, Tencent Holdings Ltd, Activision Blizzard Inc, Electronic Arts Inc, Valve Corporation, Nintendo Co Ltd, Sony Group Corp, Amazon.com Inc, Epic Games Inc., NVIDIA Corp, Meta Platforms Inc, HTC Corp, Alphabet Inc, Intel Corp, and Microsoft Corp |

Esports Market Segments and Scope

GlobalData Plc has segmented the Global Esports market report by revenue stream, gaming genre, and region:

Esports Market Revenue Stream Outlook (Revenue, USD Million, 2021-2030)

- Sponsorship

- Media rights

- Digital

- Tickets & merchandise

- Publisher fees

- Streaming

Esports Market Gaming Genre Outlook (Revenue, USD Million, 2021-2030)

- Multiplayer online Battle Arena

- Real-Time Strategy

- First-Person Shooter

- Battle Royale

- Others

Esports Market Regional Outlook (Revenue, USD Million, 2021-2030)

- North America

- United States of America

- Canada

- Asia-pacific

- China

- Japan

- South Korea

- Australia

- India

- Rest of Asia Pacific

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Rest of Europe

- South and Central America

- Mexico

- Brazil

- Argentina

- Colombia

- Peru

- Rest of South and Central America

- Middle East and Africa

- Nigeria

- Iran

- Saudi Arabia

- Morocco

- Rest of Middle East and Africa

The market intelligence report provides an in-depth analysis of the following –

- Esports market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the revenue stream, gaming genre, and region segments.

- The competitive landscape: an examination of the positioning of leading players in the Esports market.

- Company snapshots: analysis of the market position of leading players in the Esports market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global Esports market by revenue stream, gaming genre, region, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s Forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in Esports markets.

- With more than 70 charts and tables, the report is designed for an executive-level audience, boasting presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in Esports markets.

- The broad perspective of the report coupled with comprehensive, actionable detail will help Telecom, Media, and Technology (TMT) stakeholders, service providers, and other Esports players succeed in growing the Esports market globally.

Key Players

Modern Times Group MTG ABAmazon (Twitch)

HTC Corp

Meta Platforms Inc

NVIDIA Corp

Epic Games Inc

Alphabet Inc

Intel Corp

Valve Corporation

Sony Group Corp

Nintendo Co Ltd

Electronic Arts Inc

Activision Blizzard Inc

Tencent Holdings Ltd

Microsoft Corp

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the Esports market size in 2023?

The Esports market size will be valued at $1.64 billion in 2023.

-

What is the Esports market growth rate?

The Esports market is expected to grow at a CAGR of 16.7% during the forecast period (2022-2030).

-

What are the key Esports market drivers?

A significant increase in demand for Esports due to an increase in adoption of PC and mobile gaming, high accessibility, and inclusiveness, and increasing penetration of 5G connectivity are stimulating the growth of the Esports market worldwide.

-

What are the key Esports market segments?

Revenue stream Segments: Sponsorship, Media Rights, Digital, Tickets & Merchandise, Publisher Fees, Streaming

Gaming genre segments: Multiplayer online Battle Arena, Real-Time Strategy, First-Person Shooter, Battle Royale, Others

Regions: North America, Europe, Asia Pacific, South and Central America, Middle East and Africa.

-

Which are the leading Esports companies globally?

The leading Esports companies globally are Modern Times Group MTG AB, Tencent Holdings Ltd, Activision Blizzard Inc, Electronic Arts Inc, Valve Corporation, Nintendo Co Ltd, Sony Group Corp, Amazon.com Inc, Epic Games Inc., NVIDIA Corp, Meta Platforms Inc, HTC Corp, Alphabet Inc, Intel Corp, and Microsoft Corp.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.