Finland Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Finland Cards and Payments Market Report Overview

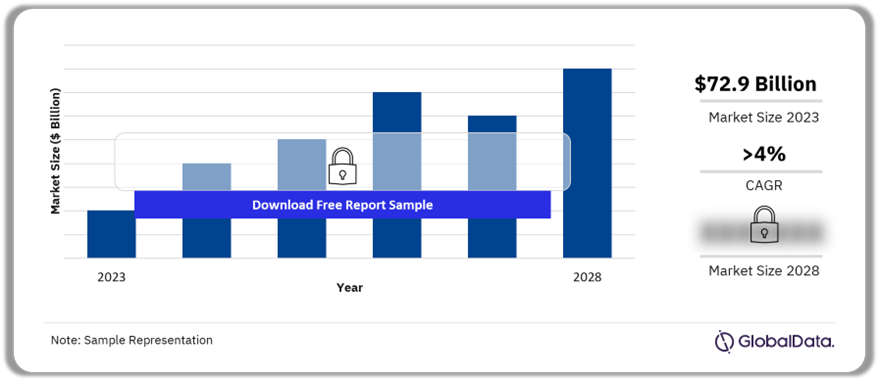

The annual value of card transactions in the Finland cards and payments market was $72.9 billion in 2023. The value is expected to grow at a CAGR of more than 4% during 2024-2028. Finland has a matured digital payments market facilitated by widespread familiarity with electronic payments, a highly banked population, and a well-established payment infrastructure.

Finland Card Transactions Outlook, 2024-2028 ($ Billion)

Buy the Full Report for More Information on the Finland Cards and Payments Market Forecast Download a Free Sample Report

The Finland cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Finland cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $72.9 billion |

| CAGR (2024-2028) | >4% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cards

· Credit Transfers · Direct Debits · Cash · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments |

| Leading Players | · Apple Pay

· Google Pay · PayPal · Pivo · Mobile Pay · Klarna |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Finland Cards and Payments Market Dynamics

The rise of contactless cards and surge in retailer acceptance are significantly boosting electronic transactions, marking a shift towards digitalization. The growth of electronic payments is also being propelled by card and mobile payments, facilitating seamless in-store, online, P2P, and consumer-to-business transactions. Furthermore, the availability of a diverse range of alternative payment solutions (including MobilePay, Pivo, Apple Pay, and Google Pay) is also steering consumers away from cash transactions.

Buy the Full Report to Get Additional Finland Cards and Payments Market Dynamics

Finland Cards and Payments Market Segmentation by Payment Instruments

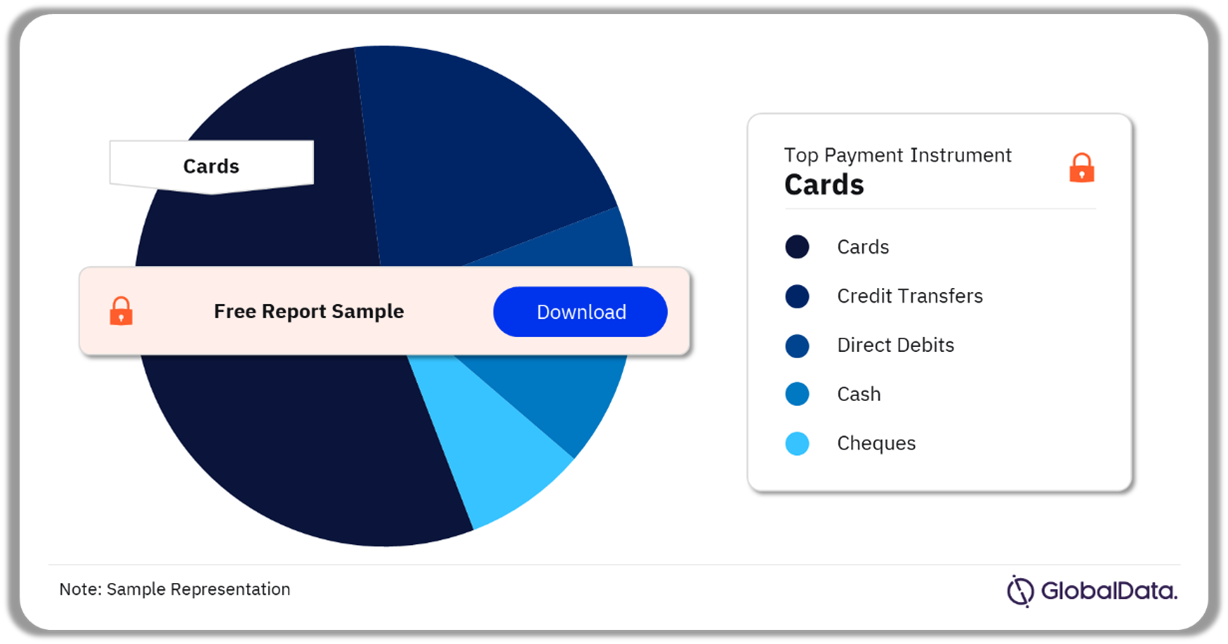

Payment cards had the highest transaction volume in the Finland payments space in 2023

The key payment instruments in the Finland cards and payments market are cards, credit transfers, direct debits, cash, and cheques. Convenience, enhanced security, and the growing adoption of contactless have supported the growth of card-based transactions. Well-developed payment infrastructure and high merchant acceptance have also helped make cards the preferred consumer payment instrument.

Finland Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Finland Cards and Payments Market

Finland Cards and Payments Market Segments

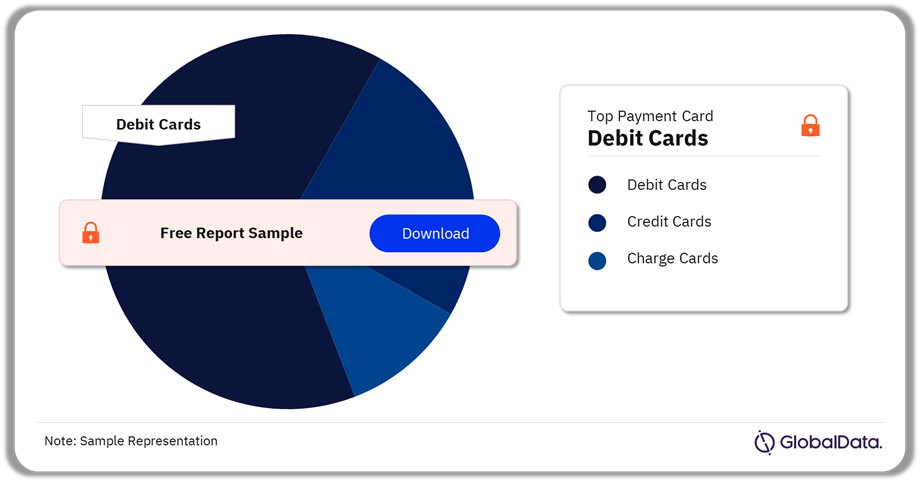

Debit cards led the card-based payments segment in 2023

The key segments in the Finland cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, and mobile payments among others.

Card-Based Payments: Finnish consumers are prolific users of payment cards. The transition from cash to cards is evident in the expanding number of POS terminals and the decline in ATMs across Finland. Incentives such as reward programs and discounts also help drive a robust card payment ecosystem. The Finnish payment card market is dominated by the debit cards category. High banking penetration and consumers’ preference for debit cards help drive this growth.

Finland Card-Based Payments Market Analysis, 2023 (%)

Buy the Full Report for More Market Segment Insights into the Finland Cards and Payments Market

Finland Cards and Payments Market - Competitive Landscape

A few of the leading players in the Finland cards and payments market are:

- Apple Pay

- Google Pay

- PayPal

- Pivo

- Mobile Pay

- Klarna

Apple Pay: Apple Pay is a digital wallet solution launched by Apple in Finland in October 2017. The solution allows users to store debit, credit, prepaid, and store card details within Apple Pay to make payments at merchant outlets. In Finland, the solution supports cards issued by banks and payment services providers including Aktia Bank, American Express, Curve, iCard, Danske Bank, Edenred, Morrow Bank, Monese, N26, Nordea, Revolut, SAS Travel Wallet, and ST1.

Finland Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Finland Cards and Payments Market Download a Free Sample Report

Finland Cards and Payments Market – Latest Developments

- In February 2022, Helsinki Regional Transport enabled open-loop contactless payments on the city’s public transport system, in collaboration with transit payment services provider Littlepay. Commuters can make payments by tapping their contactless payment card or mobile wallet against readers installed on buses.

Segments Covered in the Report

Finland Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2028)

- Cards

- Credit Transfers

- Direct Debits

- Cash

- Check

Finland Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2028)

- Card-Based Payments

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Finnish cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Finnish cards and payments industry.

- Assess the competitive dynamics in the Finnish cards and payments industry.

- Gain insights into marketing strategies used for various card types in Finland.

- Gain insights into key regulations governing the Finnish cards and payments industry.

Frequently asked questions

-

What was the annual value of card transactions in the Finland cards and payments market in 2023?

The annual value of card transactions in the Finland cards and payments market was $72.9 billion in 2023.

-

What will the Finland cards market growth rate be during the forecast period?

The Finland annual cards market value is expected to grow at a CAGR of more than 4% during 2024-2028.

-

Which was the leading payment instrument in the Finland cards and payments market in 2023?

Cards was the leading payment instrument in terms of transaction volume in the Finland cards and payments market in 2023.

-

Which are the leading players in the Finland cards and payments market?

A few of the leading players in the Finland cards and payments market are Apple Pay, Google Pay, PayPal, Pivo, Mobile Pay, and Klarna, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports