Former Soviet Union (FSU) Upstream Development Outlook to 2025

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

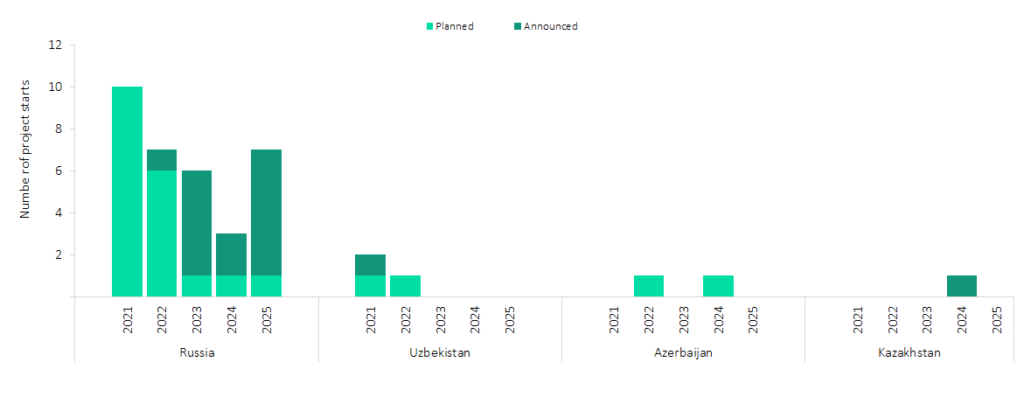

This report indicates that 39 key crude and natural gas production projects are expected to start operations in four countries in the Former Soviet Union (FSU). Among these, 23 represent the number of planned projects with identified development plans and 16 represent the number of early stages announced projects that are undergoing conceptual studies and that are yet to be approved for development.

In terms of the number of planned oil and gas production projects, Russia leads among countries with 19 projects, followed by Uzbekistan, and Azerbaijan with two projects each. Russia also leads in terms of announced projects with 14. Uzbekistan and Kazakhstan follow Russia, with one project each.

Onshore terrain has the highest number of projects with 32, followed by shallow water with six projects.

Major Planned and Announced Production Project Starts by Key Countries, 2021–2025

In the FSU, among projects that are expected to come online by 2025, five projects are likely to be developed with fixed platform, while gravity-based platform and subsea system platforms are used by one project, each. The facility type of the remaining projects is currently unknown.

Scope

FSU oil and gas production outlook by key countries, and key companies for the period 2021-2025

FSU new projects capital expenditure outlook by key countries, key companies, field terrain and facility type for 2021-2025

Key economic metrics of major upcoming oil and gas projects in the FSU

Project economics of oil and gas projects by key countries

Major projects count by key countries, field terrain, and facility type

Details of key upcoming crude and natural gas projects in the region

Reasons to Buy

Understand FSU oil and gas production outlook during the period 2021-2025

Keep abreast of key upcoming production projects in the FSU during the outlook period

Facilitate decision making on the basis of strong oil and gas production data

Develop business strategies with the help of specific insights on the FSU upstream sector

Assess your competitor’s planned oil and gas production projects in the region

Table of Contents

Table

Figures

Frequently asked questions

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.