France General Insurance Market Size, Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

France General Insurance Market Report Overview

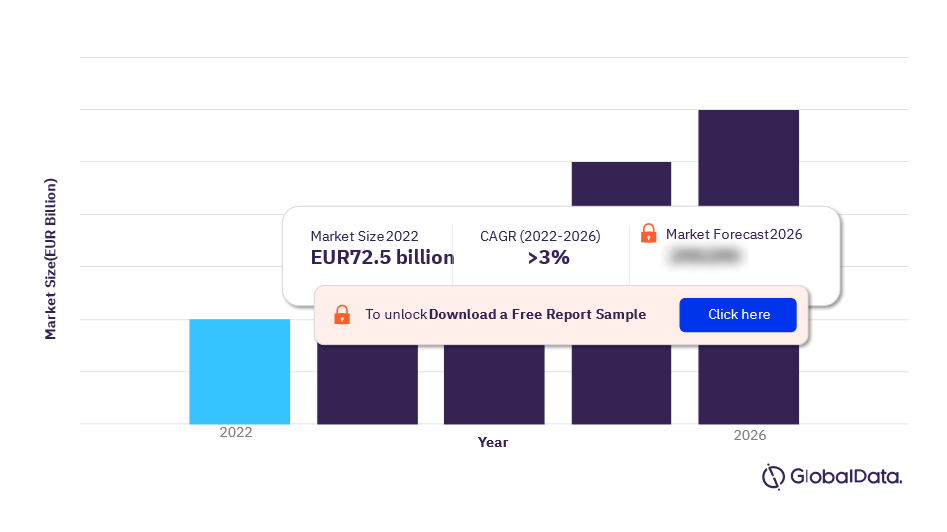

The net earned premium of the France general insurance market was EUR72.5 billion in 2022 and is expected to achieve a CAGR of more than 3% during 2022-2026. The France general insurance market research report provides in-depth market analysis, information, and insights into France’s general insurance segment. It also provides values for key performance indicators such as gross written premium, loss ratio, retail, and commercial split, premium by line of business, and reinsurance premiums during the review period and forecast period.

France General Insurance Market Outlook, 2022-2026 (EUR Billion)

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the France economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | EUR72.5 billion |

| CAGR | >5% |

| Forecast Period | 2022-2026 |

| Historical Period | 2017-2021 |

| Key Lines of Business | Property, Motor, Liability, Financial Lines, MAT, and Non-Life PA&H |

| Key Distribution Channel | Direct From Insurer, Insurance Brokers, Online Aggregator, Bank, And Financial Advisor |

| Leading Companies | Axa France Vie, Axa France IARD, MMA, Pacifica, Allianz, MACIF, Assurances Du Credit Mutuel, Mutuelle Assurance Des Instituteurs De France, Malakoff Humanis Prevoyance, MAAF Assurances, and Others |

France General Insurance Market Trends

Gig economy, pet insurance, personalization and hyper-personalization, Autonomous vehicles (AVs), and digitalization are some of the key trends driving the France GI market.

The highest demand for gig workers arises from food delivery platforms, such as Deliveroo and Uber Eats. Multiple insurers have launched gig insurance, for instance, Deliveroo partnered with the insurtech Qover to provide a pan-European insurance platform for its riders. Qover introduced a bike insurance for Deliveroo delivery riders, which provided a flexible subscription model exclusively for Deliveroo riders, offering yearly and monthly payment options. In 2022, Deliveroo included sickness cover and parental benefits for its gig workers.

In France, there are two different kinds of pet insurance: protection against accidents and protection against illnesses and accidents. The former only pays for medical expenses and costs related to surgery for accidental wounds, such as cuts, bites, and fractured bones. The latter also includes the treatment of pet diseases.

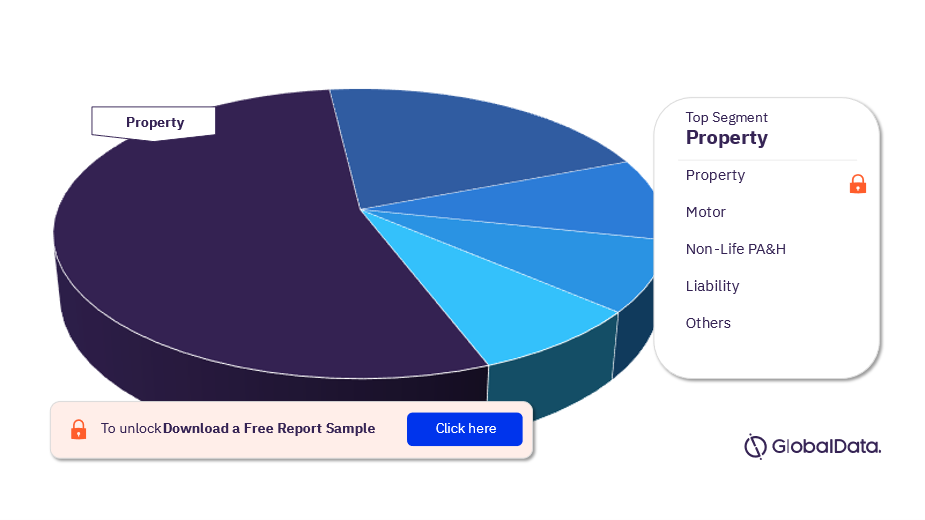

France General Insurance Market Segmentation by Lines of Business

The key lines of business in the France general insurance market are property, motor, liability, financial lines, MAT, and non-life PA&H. In 2021, property segment held the highest share.

France General Insurance Market Analysis by Lines of Business, 2021 (%)

For more lines of business insights into the France general insurance market, download a free report sample

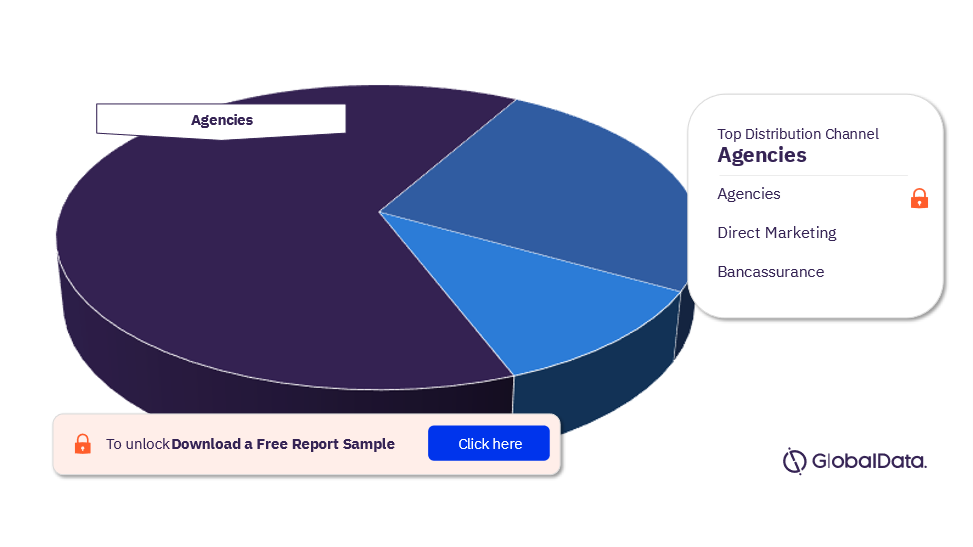

France Life Insurance Market Segmentation by Distribution Channel

The key distribution channels in the France life insurance industry are direct from agencies, direct marketing, and banassurance. Agencies was the most preferred channel for purchasing insurance products in 2021 as it is dependent on the traditional distribution network of agents. Bancassurance has its presence as a distributor for the property and casualty insurance line of business products.

France Life Insurance Market Analysis by Distribution Channel, 2021 (%)

For more distribution channel insights into the France life insurance market, download a free report sample

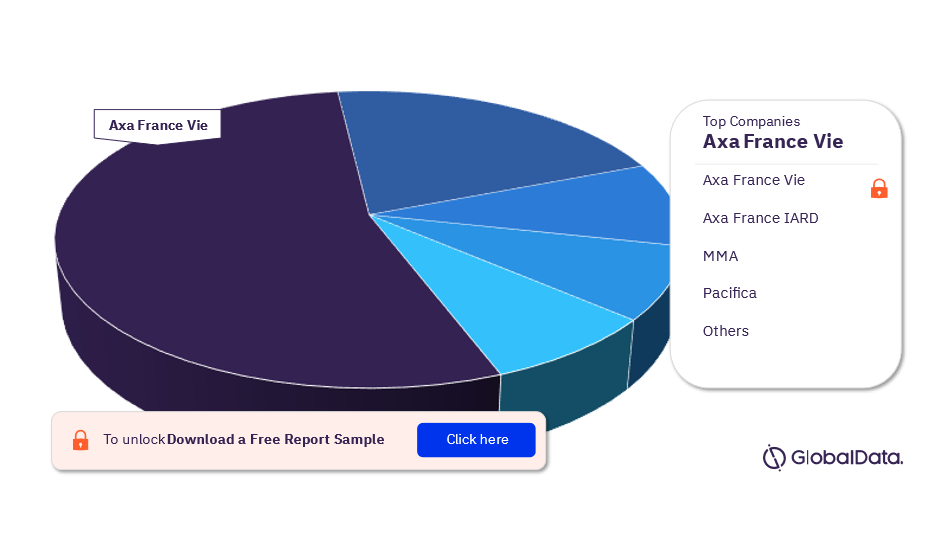

France General Insurance Market - Competitive Landscape

The leading general insurance companies in France are Axa France Vie, Axa France IARD, MMA, Pacifica, Allianz, MACIF, Assurances Du Credit Mutuel, Mutuelle Assurance Des Instituteurs De France, Malakoff Humanis Prevoyance, MAAF Assurances, and Others. In 2021, Axa France Vie was the leading insurer.

France General Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading companies in the France general insurance market, download a free report sample

Segments Covered in the Report

France General Insurance Market Lines of Business Outlook (Value, EUR Billion, 2017-2026)

- Property Insurance

- Motor Insurance

- Liability Insurance

- Financial Lines Insurance

- MAT Insurance

- Non-Life PA&H Insurance

France General Insurance Market Distribution Channel Outlook (Value, EUR Billion, 2017-2026)

- Agencies

- Direct Marketing

- Bancassurance

Scope

This report provides a comprehensive analysis of the general insurance segment in France –

- It provides historical values for the France general insurance segment for the report’s review period and projected figures for the forecast period.

- It offers a detailed analysis of the key categories in France’s general insurance segment and market forecasts until 2026.

- It profiles the top general insurance companies in France and outlines the key regulations affecting them.

Key Highlights

• Key insights and dynamics of the French general insurance segment.

• A comprehensive overview of the French economy, government initiatives and investment opportunities.

• The French insurance regulatory framework’s evolution, key facts, taxation regime, licensing and capital requirements.

• The French general insurance industry’s market structure giving details of lines of business.

• The French general insurance reinsurance business’s market structure giving details of premium ceded along with cession rates.

• Distribution channels deployed by the French general insurers.

• Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the France general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the France general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

- Gain insights into key regulations governing France’s general insurance industry, and their impact on companies and the industry’s future.

CNP Assurances SA

Axa France Vie

Mutuelle Assurance Des Commercants et Industriels de France

Generali IARD

Allianz IARD

Groupama Gan Vie SA

Assurances Du Credit Mutuel IARD SA

Table of Contents

Frequently asked questions

-

What was the France general insurance market net earned premium in 2022?

The net earned premium of the France general insurance market was EUR72.5 billion in 2022.

-

What is the France general insurance market growth rate?

The general insurance market in France is expected to achieve a CAGR of more than 3% during 2021-2026.

-

Which LoB held the highest share of the France general insurance market?

In 2021, property segment held the highest share in the France general insurance market.

-

Which was the most preferred distribution channel in the France life insurance market?

Agencies were the most preferred distribution channel in the France life insurance market.

-

Which are the leading companies in the France general insurance industry?

The leading insurance companies in France’s general insurance industry are Axa France Vie, Axa France IARD, MMA, Pacifica, Allianz, MACIF, Assurances Du Credit Mutuel, Mutuelle Assurance Des Instituteurs De France, Malakoff Humanis Prevoyance, MAAF Assurances, and Others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports