Germany Life Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Germany Life Insurance Market Report Overview

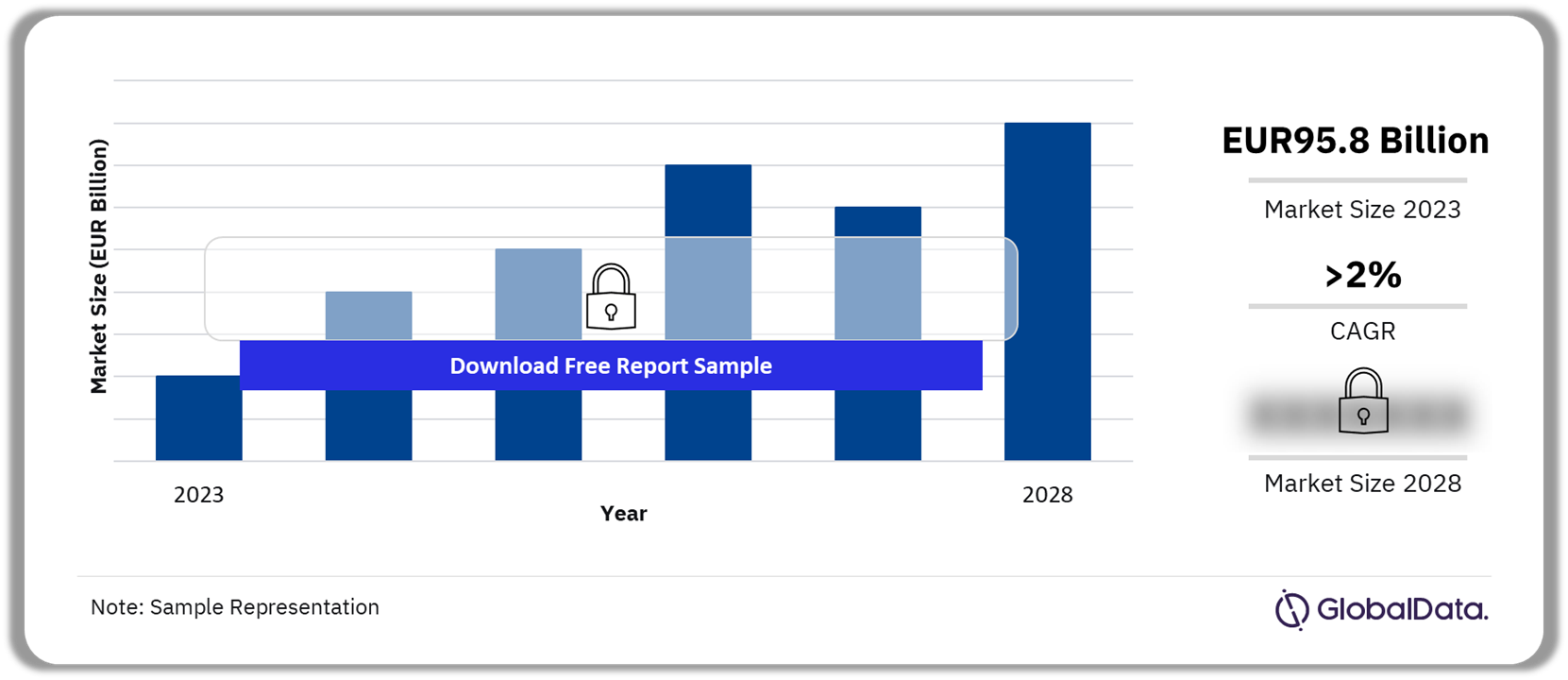

The gross written premium of Germany life insurance market was EUR95.8 billion ($97.8 billion) in 2023 and is expected to achieve a CAGR of more than 2% during 2024-2028. The Germany life insurance market research report provides an in-depth market analysis, including insights into the lines of business in the country’s life insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including direct written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Germany Life Insurance Market Outlook, 2023-2028 (EUR Billion)

Buy the Full Report to Gain More Information about the Germany Life Insurance Market Forecast

The Germany life insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the German economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | EUR95.8 billion ($97.8 billion) |

| CAGR (2024-2028) | >2% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Lines of Business | · Pension

· Endowment · Term Life · Capitalization · Other Life Insurance |

| Key Distribution Channels | · Agencies

· Bancassurance · Insurance Brokers · Direct Marketing |

| Leading Companies | · Allianz Lebensversicherungs

· R+V Lebensversicherung · Generali Deutschland Lebensversicherung · Debeka Lebensversicherungsverein · Zurich Deutscher Herold Lebensversicherung |

| Enquire &Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Germany Life Insurance Market Trends

Digitalization trends in distribution, insurtech partnerships, insurtech funding, integrating artificial intelligence (AI) into insurance operations, and growing focus on ESG are the key trends impacting the German life insurance market.

- Insurers are utilizing web portals to provide services to policyholders. For example, Allianz offers the insurance portal Meine Allianz through its cell phone app and website. Meine Allianz offers various services, including accessing contract periods and tariffs, reporting damages, submitting invoices, and updating bank details. The pension compass helps check coverage for old age and occupational disabilities. Additional services include competitions, discounts, bonuses, and tickets.

- Germany’s insurtech sector is maturing, with digital insurers gaining traction and conventional insurance companies and managing general agents vying for market share. In January 2024, the risk modeling and analytics company Verisk acquired the German-based insurtech provider Rocket Enterprise Solutions, to expand its property claims and underwriting offerings across Europe.

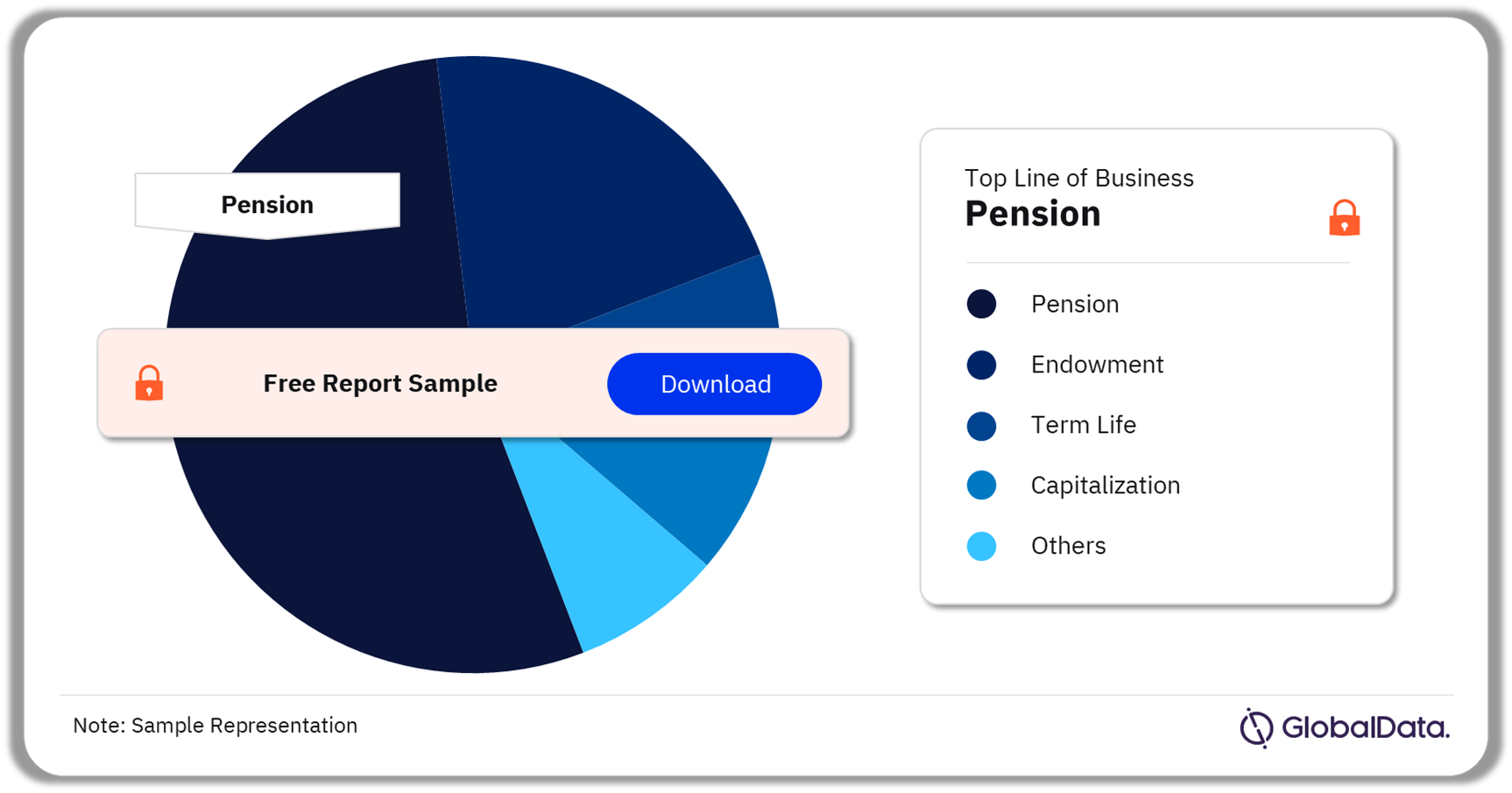

Germany Life Insurance Market Segmentation by Lines of Business

In 2023, pension LoB accounted for the highest share of the Germany life insurance market.

The key lines of business (LoB) in the German life insurance industry are pension, endowment, term life, and capitalization among others. Germany’s Ministry of Finance’s focus group made progress in 2023 on reforming subsidized private pensions, with legislation expected to be passed in 2024. This legislation will enable insurers and retirement product providers to offer new options for German retirees; potentially boosting competition among financial services firms and improving pension benefits. The Federal Government is also considering other pension reforms, including linking retirement age to life expectancy and introducing an Active Pension. This would allow part-time work for retirees and integrate civil servants and the self-employed into the pension system.

Germany Life Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Germany Life Insurance Market

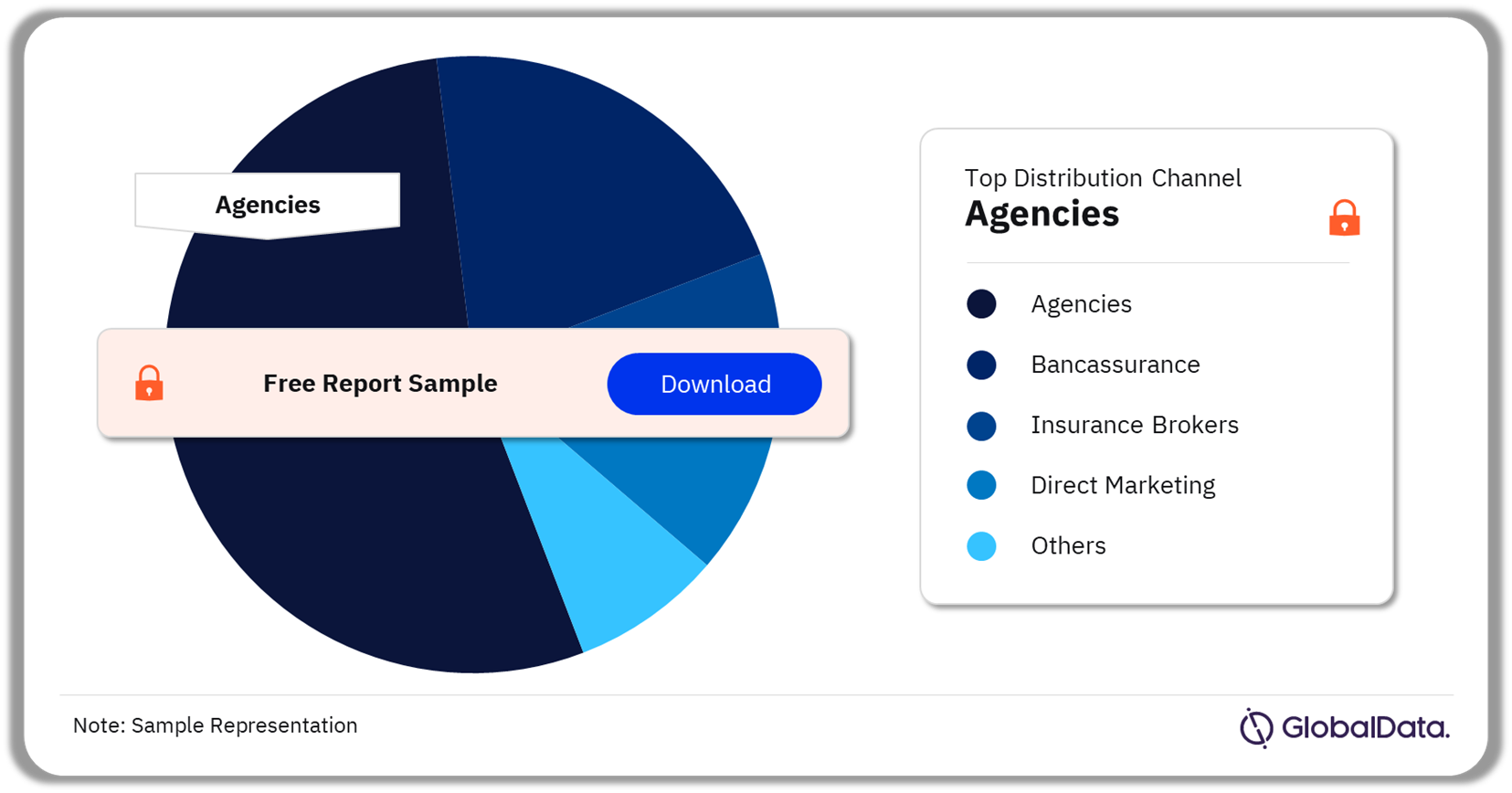

Germany Life Insurance Market Segmentation by Distribution Channels

In 2023, captive agencies and independent brokers accounted for the highest DWP sales in the Germany life insurance market.

A few of the key distribution channels in the German life insurance industry are agencies, bancassurance, insurance brokers, and direct marketing among others. Agencies will remain the leading distribution channel accounting for the highest direct written premium (DWP) sales during the projected period.

Germany Life Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Germany Life Insurance Market

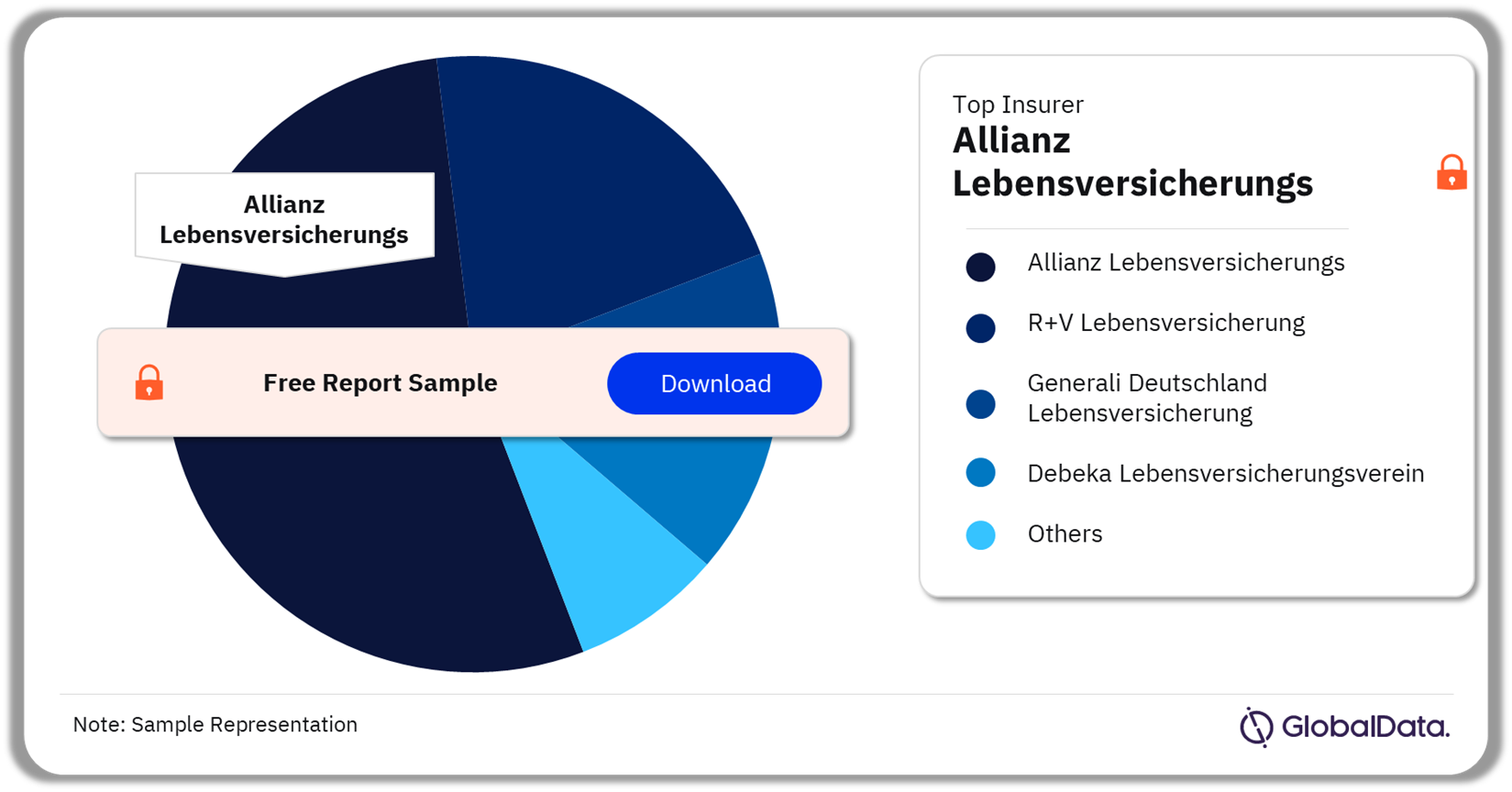

Germany Life Insurance Market - Competitive Landscape

In 2022, Allianz Lebensversicherungs was the largest insurer in Germany

A few of the leading life insurance companies in Germany are:

- Allianz Lebensversicherungs

- R+V Lebensversicherung

- Generali Deutschland Lebensversicherung

- Debeka Lebensversicherungsverein

- Zurich Deutscher Herold Lebensversicherung

Germany Life Insurance Market Analysis by Companies, 2023 (%)

Buy the Full Report to Know More about the Companies in the Germany Life Insurance Market

Germany Life Insurance Market - Latest Developments

- In December 2023, the EU passed a new AI Act intending to ensure the ethical use of AI. The Act introduces a risk-based regulatory framework, particularly affecting industries such as insurance due to AI’s significant role in risk assessment and pricing.

- In January 2024, the Allianz Group introduced Allianz SAMEpath; a dashboard that tracks transition pathways to Net Zero and integrates existing models and scenarios for a convenient reference tool.

Segments Covered in the Report

Germany Life Insurance Lines of Business Outlook (Value, EUR Billion, 2019-2028)

- Pension

- Endowment

- Term Life

- Capitalization

- Other Life Insurance

Germany Life Insurance Distribution Channel Outlook (Value, EUR Billion, 2019-2028)

- Agencies

- Bancassurance

- Insurance Brokers

- Direct Marketing

Scope

This report provides:

- A comprehensive analysis of the life insurance segment in Germany.

- Historical values for the German life insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top life insurance companies in Germany and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Germany’s life insurance segment.

- A comprehensive overview of Germany’s economy, government initiatives, and investment opportunities.

- Germany’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Germany’s life insurance segment’s market structure gives details of lines of business.

- Germany’s life reinsurance business’s market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Germany’s life insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Germany’s life insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Germany’s life insurance segment.

- Assess the competitive dynamics in the life insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

Bayerischer Versicherungsverband Versicherungs

R+V Lebensversicherung

Zurich Deutscher Herold Lebensversicherung

Generali Deutschland Lebensversicherung

Axa Lebensversicherung

Debeka Lebensversicherungsverein

Nurnberger Lebensversicherung

Table of Contents

Frequently asked questions

-

What was the Germany life insurance market gross written premium in 2023?

The gross written premium of the German life insurance market was EUR95.8 billion ($97.8 billion) in 2023.

-

What will the Germany life insurance market growth rate be during the forecast period?

The life insurance market in Germany is expected to achieve a CAGR of more than 2% during 2024-2028.

-

Which line of business held the highest share of the Germany life insurance market in 2023?

Pension LoB accounted for the highest share of the Germany life insurance market in 2023.

-

Which distribution channel was the most preferred in the German life insurance market in 2023?

Agencies channel was the most preferred distribution channel in the German life insurance market in 2023.

-

Which are the key companies operating in the Germany life insurance market?

A few of the leading life insurance companies in Germany are Allianz Lebensversicherungs, R+V Lebensversicherung, Generali Deutschland Lebensversicherung, Debeka Lebensversicherungsverein, and Zurich Deutscher Herold Lebensversicherung among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Life Insurance reports