Ghana Insurance Industry – Key Trends and Opportunities to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Ghana Insurance Market Report Overview

The gross written premium of the Ghana insurance market was GHS6.1 billion ($738 million) in 2022. The market is expected to achieve a CAGR of more than 13% during 2023-2027.

Ghana Insurance Market Outlook, 2022-2027 (GHS Billion)

For more insights into the Ghana insurance market forecast, download a free report sample

The Ghana insurance market research report provides in-depth market analysis, information, and insights into the Ghana insurance industry. It provides values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review period and forecast period.

The report also analyzes distribution channels operating in the segment, gives a comprehensive overview of the Ghana economy and demographics, and provides detailed information on the competitive landscape in the country. The report gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations, and recent changes in the regulatory structure.

| Market Size (2022) | GHS6.1 billion ($738 million) (GWP) |

| CAGR (2023-2027) | >13% |

| Forecast Period | 2023-2027 |

| Historical Period | 2018-2022 |

| Key Segments | Life Insurance and General Insurance |

| Key Distribution Channel | Insurance Brokers, Agencies, Direct Marketing, Bancassurance, and Other Distribution Channel |

| Leading Players | Enterprise Life Assurance, SIC Life Insurance, Starlife Assurance, Prudential Life Insurance, The Hollard Insurance (Ghana), and Glico General Insurance |

Ghana Insurance Market Trends

Parametric insurance and healthcare digitalization are some of the key trends impacting the Ghana insurance market. For instance, in June 2022, the Ghana Ministry of Finance along with the Insurance Development Forum (IDF), the United Nations Development Programme (UNDP), and the German government launched a parametric insurance program under the Tripartite project to transfer risks arising from floods in urban Ghana.

Insurers such as Allianz and Swiss Re are part of this program along with risk consultants HKV, satellite operator ICEYE, and media monitor Flood Tags. The project aims to enhance the response of Ghanaian authorities during flooding.

Ghana Insurance Market by Segments

The key segments in the Ghana insurance market are life insurance and general insurance. The general insurance segment dominated the market in 2022.

Life Insurance: The sector recorded annual growth of more than 20% in 2022 and is set to increase in 2023. Inflation has been on the rise in Ghana in the past year, driving up the prices of policy premiums. However, double-digit growth in life insurance is expected annually until 2027.

General Insurance: Motor insurance was the largest general insurance LOB in 2022. The manufacturing industry of Ghana accounted for more than 28% of the country’s GDP in 2021. This percentage is expected to grow in the coming years, with the automobile sector being at the forefront. This will lead to a higher volume of automobile sales and trickle down to a higher number of policies sold.

Ghana Insurance Market Analysis by Segments, 2022 (%)

For more segment insights into the Ghana insurance market, download a free report sample

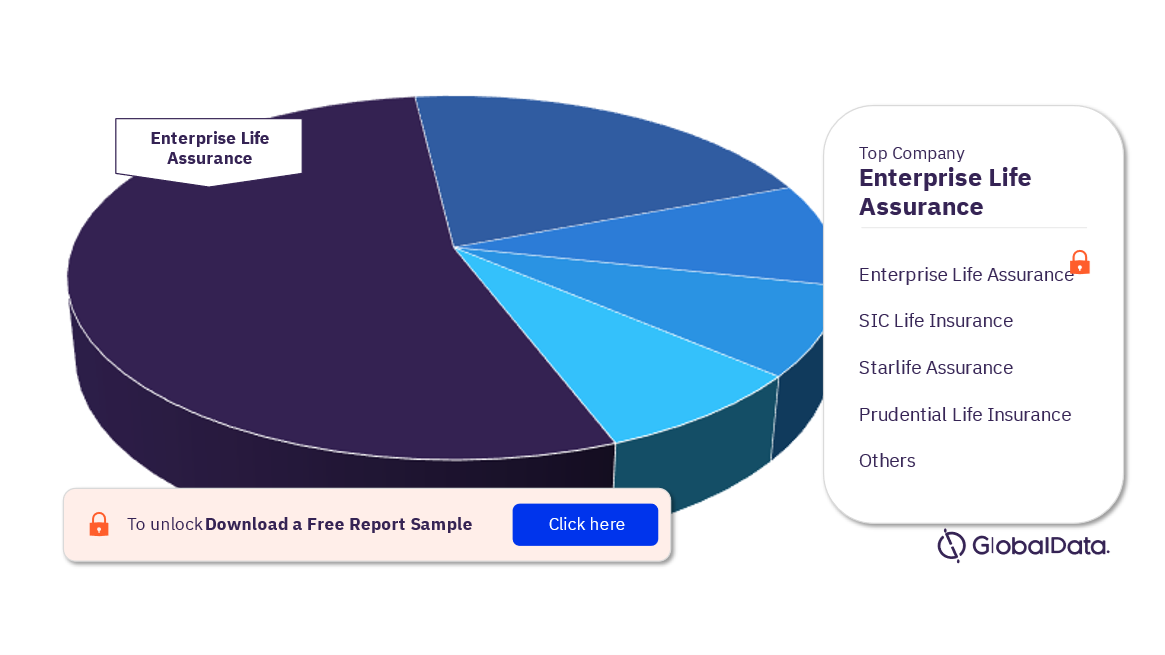

Ghana Insurance Market – Competitive Landscape

The key companies in the Ghana insurance market are Enterprise Life Assurance, SIC Life Insurance, Starlife Assurance, Prudential Life Insurance, The Hollard Insurance (Ghana), and Glico General Insurance among others. Enterprise Life Assurance was the largest insurer in 2022 in terms of GWP in the Ghana insurance market.

Ghana Insurance Market Analysis by Players, 2022 (%)

For more players’ insights into the Ghana insurance market, download a free report sample

Segments Covered in the Report

Ghana Insurance Market Segments Outlook (Value, GHS Billion, 2018-2027)

- Life Insurance

- General Insurance

Ghana Insurance Market Distribution Channels Outlook (Value, GHS Billion, 2018-2027)

- Insurance Brokers

- Agencies

- Direct Marketing

- Bancassurance

- Other Distribution Channel

Scope

This report provides a comprehensive analysis of the Ghana insurance industry –

- It provides historical values for the Ghana insurance industry for the report’s 2018–22 review period and projected figures for the 2023–27 forecast period.

- It offers a detailed analysis of the key categories in the Ghana insurance industry and market forecasts for 2027.

- It profiles the top life insurance companies in Ghana and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of the Ghana insurance industry.

- A comprehensive overview of the Ghana economy, government initiatives, and investment opportunities.

- The Ghana insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- The Ghana insurance industry’s market structure gives details of lines of business.

- Ghana’s reinsurance business’s market structure gives details of premium ceded along with cession rates.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Ghana insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Ghana insurance industry.

- Assess the competitive dynamics in the Ghana insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

SIC Life Insurance

Starlife Assurance

The Hollard Insurance (Ghana)

Old Mutual Assurance Ghana

Ghana Union Assurance

Glico Life Insurance

Prudential Life Insurance Ghana

Table of Contents

Frequently asked questions

-

What was the Ghana insurance market gross written premium in 2022?

The gross written premium of the Ghana insurance market was GHS6.1 billion ($738 million) in 2022.

-

What is the growth rate of the Ghana insurance market?

The insurance market in Ghana is expected to achieve a CAGR of more than 13% during 2023-2027.

-

Which segment dominated the Ghana insurance market in 2022?

The general insurance segment dominated the Ghana insurance market in 2022.

-

Which leading distribution dominated the Ghana general insurance market in 2022?

In 2022, insurance brokers represented the leading distribution channel for general insurance products in the Ghana insurance market.

-

Who are the major players operating in the Ghana insurance market?

The key companies in the Ghana insurance market are Enterprise Life Assurance, SIC Life Insurance, Starlife Assurance, Prudential Life Insurance, The Hollard Insurance (Ghana), and Glico General Insurance.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports