Greece Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Greece Cards and Payments Market Report Overview

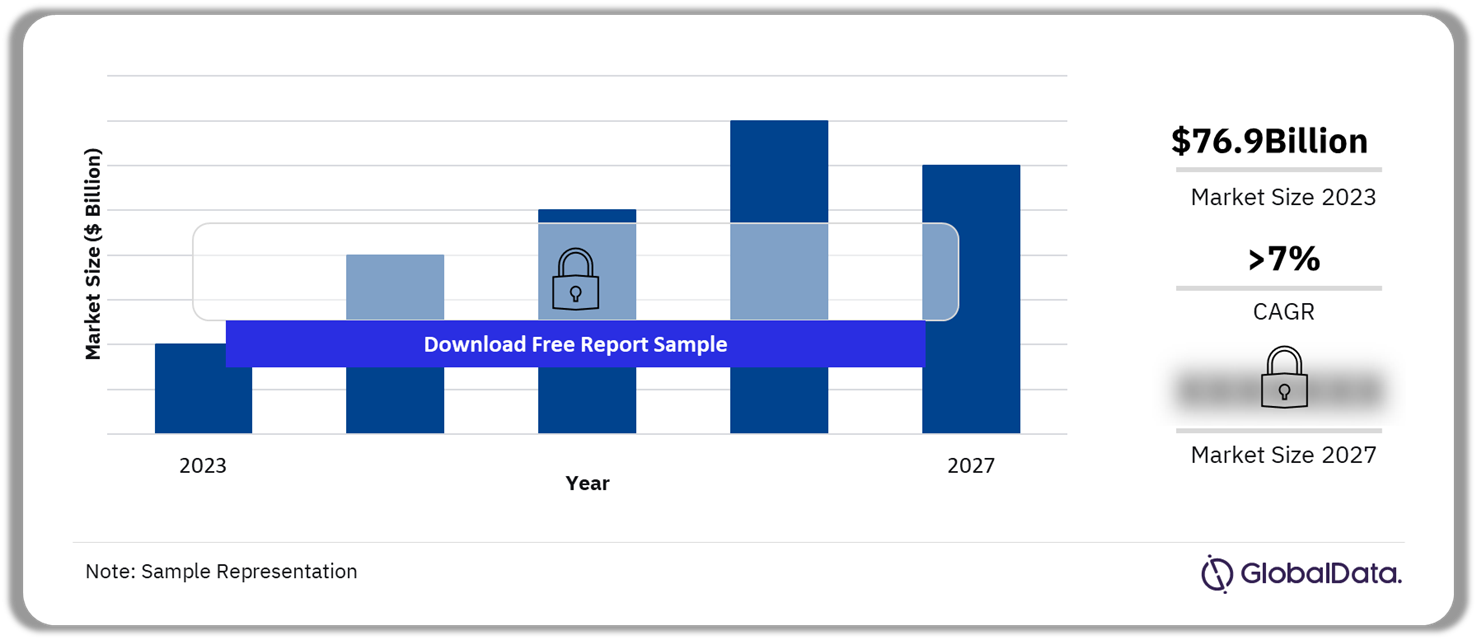

The annual value of card transactions in the Greece cards and payments market was $76.9 billion in 2023. The value is expected to grow at a CAGR of more than 7% during 2023-2027. Cash is the preferred payment method in Greece. However, the government has undertaken various initiatives to boost electronic payments in the country, such as a cap on cash transactions and electronic payment of salaries. Greek consumers are substituting cash payments with debit cards, which dominate card payments by value.

Greece Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Greece Cards and Payments Market Forecast Download a Free Sample Report

The Greece cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Greece cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $76.9 billion |

| CAGR (2023-2027) | >7% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cash

· Cards · Credit Transfers · Direct Debits · Check |

| Key Segments | · Card-Based Payments

· E-commerce Payments · Alternative Payments |

| Leading Players | · Klarna

· PayPal · Apple Pay · Google Wallet · Masterpass |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Greece Cards and Payments Market Dynamics

Electronic payments are set to grow further thanks to emerging technologies such as contactless payments, the launch of digital-only banks, and the adoption of mobile and contactless point-of-sale (POS) terminals among merchants. Meanwhile, the gradual adoption of contactless payments, the emergence of alternative payment solutions, and growth in the e-commerce space mean Greece’s payment card market will grow further going forward.

Buy the Full Report to Get Additional Greece Cards and Payments Market Dynamics

Greece Cards and Payments Market Segmentation by Payment Instruments

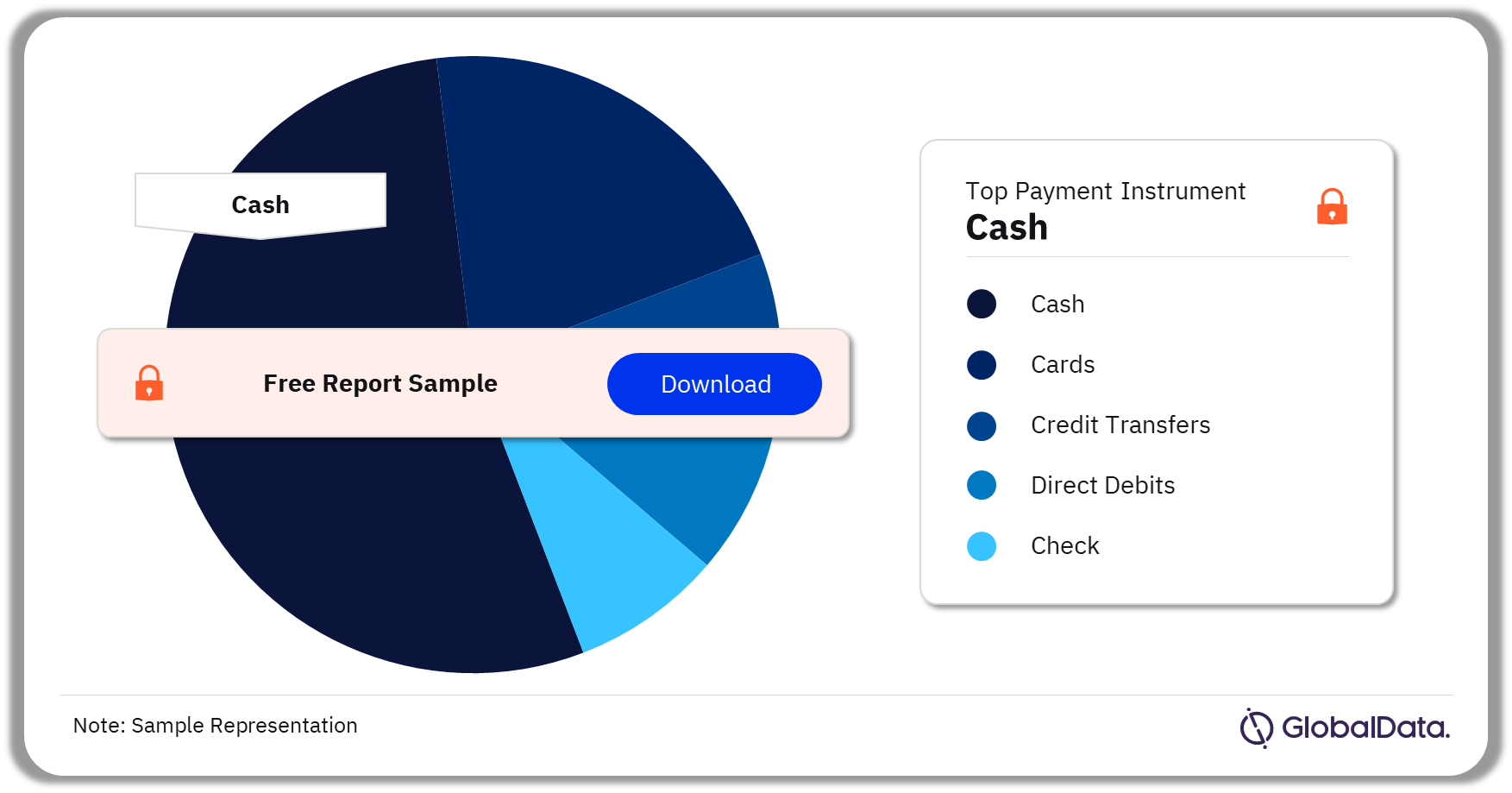

Cash had the highest share of payment transaction volume in 2023

The key payment instruments in the Greek cards and payments market are cash, credit transfers, cards, direct debits, and checks. Cash is steadily losing ground to cards as the preferred means of payment. During the forecast period, card payment will surpass cash as the preferred method. Cash usage will continue to decline amid the growing preference for electronic payments, especially by the younger generation, as well as the improving payment infrastructure.

Greece Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Greece Cards and Payments Market

Greece Cards and Payments Market Segments

Mastercard emerged as the main player in the Greece debit card market

The key segments in the Greece cards and payments market are card-based payments, e-commerce payments, and alternative payments.

Card-Based Payments: Growth in banking penetration and increasing financial awareness have supported the payment card market’s growth in Greece. Government initiatives to promote electronic payments, such as mandating companies to pay salaries through bank accounts and spend their income through electronic methods, have boosted payment card growth. The emergence of contactless technology, the launch of digital-only banks, and rapid e-commerce growth are expected to benefit the payment card market during the forecast period.

Buy the Full Report for More Market Segment Insights into the Greece Cards and Payments Market

Greece Cards and Payments Market - Competitive Landscape

A few of the leading players in the Greece cards and payments market are:

- Klarna

- PayPal

- Apple Pay

- Google Wallet

- Masterpass

Klarna: In September 2022, Sweden-based BNPL provider Klarna was launched in Greece with its Pay in 3 services. It offers both immediate and credit options for e-commerce purchases. With Pay in 3, consumers who choose Klarna at a retail partner’s checkout can split their purchases into three interest-free payments paid every 30 days from the time of purchase.

Greece Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Greece Cards and Payments Market Download a Free Sample Report

Greece Cards and Payments Market – Latest Developments

- In May 2023, KTEL intercity bus service collaborated with Visa and NBG Pay to introduce contactless payments on public buses across 33 cities in Greece. The system allows passengers to pay transit fares using cards, cell phones, and smartwatches by swiping on the ticket machines. Payment can be made by domestic or international cards.

- In January 2023, QR code payments for e-commerce purchases via IRIS Payments were launched. Consumers can pay for online purchases directly from their bank account by scanning a QR code at a merchant’s online checkout.

Segments Covered in the Report

Greece Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cash

- Cards

- Credit Transfers

- Direct Debits

- Check

Greece Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

Scope

Contactless payments are gaining prominence in the country. For example, in May 2023, KTEL intercity bus service collaborated with Visa and NBG Pay to introduce contactless payments on public buses across 33 cities in Greece. The system allows passengers to pay transit fares using cards, cell phones, and smartwatches by swiping on the ticket machines. Payment can be made by domestic or international cards.

While electronic payments are gaining prominence, cash is still used for payments, representing Greek consumers’ high inclination towards cash. To provide easy access to cash, in March 2021, N26 partnered with retailer Bazaar and payment company Viafintech to launch the CASH26 service. Customers can withdraw and deposit cash in 110 Bazaar retail stores by generating a barcode in the N26 app and selecting the withdraw or deposit option.

Innovative payments are also trending in the payment market. For instance, in July 2022, messaging app Viber collaborated with fintech company Rapyd to introduce Viber Pay, an in-chat payment feature enabling users to make payments directly within their conversations. To make payments, users draw on money stored in their Viber Wallet (also available within the Viber app), which can be funded via credit card or bank transfer. All payments must be confirmed using a passcode or biometric identification, with payment confirmations encrypted by default.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data related to the Greek cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in Greece’s cards and payments industry.

- Assess the competitive dynamics in Greece’s cards and payments industry.

- Gain insights into marketing strategies used for various card types in Greece.

- Gain insights into key regulations governing the Greece cards and payments industry.

NBG

Alpha Bank

Eurobank Ergasias

Visa

Mastercard

Diners Club

Hellenic Bank Association

Bank of Greece

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Greece cards and payments market in 2023?

The annual value of card transactions in the Greece cards and payments market was $76.9 billion in 2023.

-

What will the Greece cards market growth rate be during the forecast period?

The Greece annual cards market value is expected to grow at a CAGR of more than 7% during 2023-2027.

-

Which was the leading payment instrument in the Greece cards and payments market in 2023?

Cash was the leading payment instrument in terms of transaction volume in the Greece cards and payments market in 2023.

-

Which are the leading players in the Greece cards and payments market?

A few of the leading players in the Greece cards and payments market are Klarna, PayPal, Apple Pay, Google Wallet, and Masterpass.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports