Top Trends in Household Care 2022

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The household care sector saw its biggest annual growth increase between 2019 and 2020 in terms of volume and between 2020 and 2021 in terms of value. This is mostly due to the surge in demands for cleaning and sanitizing products brought about by the outbreak of COVID-19. While the virus will continue to be a significant health concern in at least 2022 if not beyond, the demand in household care will slow as consumers become accustomed to more regular spending on products within the category.

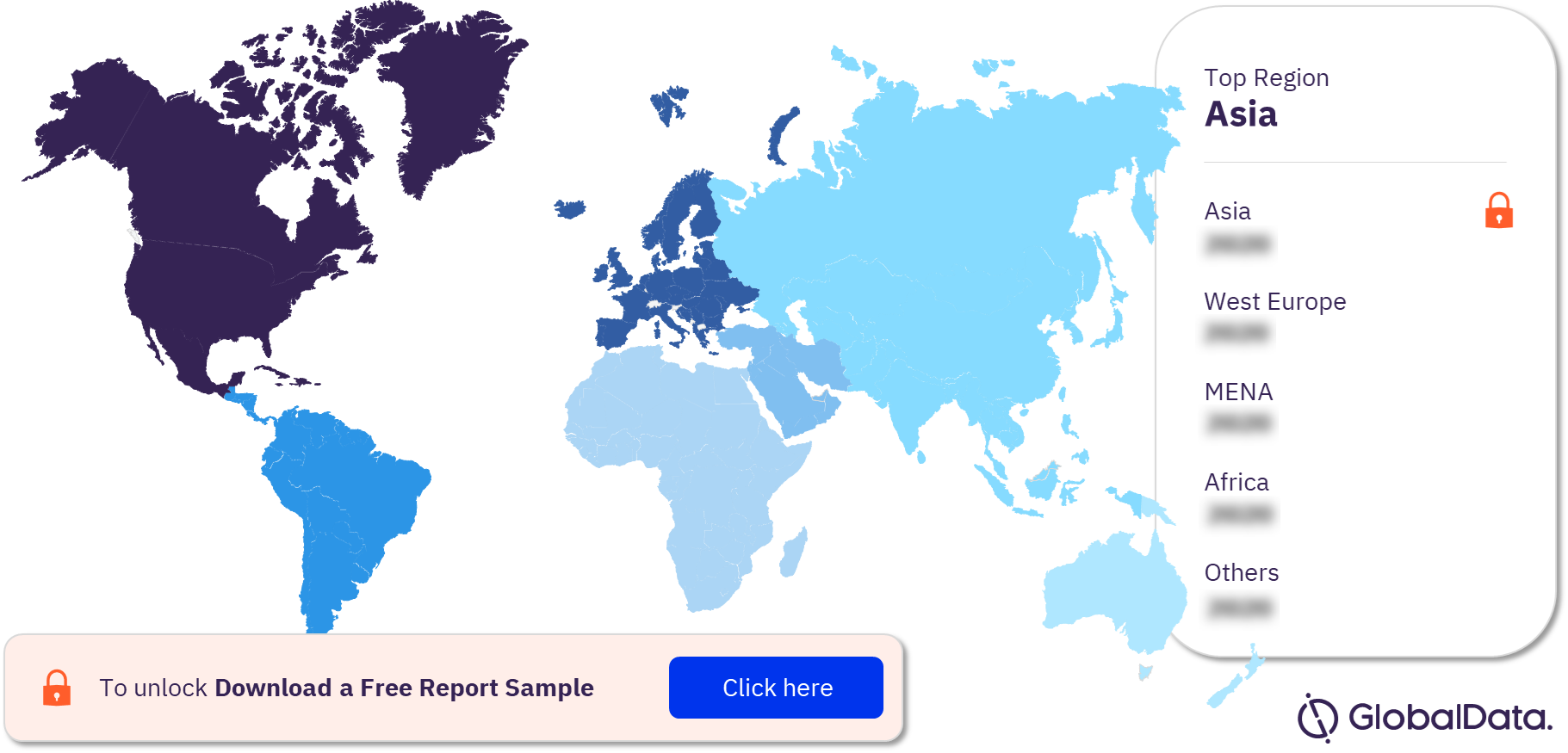

Which are the key regions in the household care market?

The key regions in the household care market are Africa, East Europe, MENA, Asia, Latin America, West Europe, Australasia, and North America. In terms of market size, most regions are consistent between volume and value in household care. Asia has the largest market share and Africa the smallest. However, while Western Europe and North America have a smaller volume size than Latin America, they have higher value shares, suggesting these regions are more profitable for the industry.

Household care market, by regions

For more regional insights, download a free sample

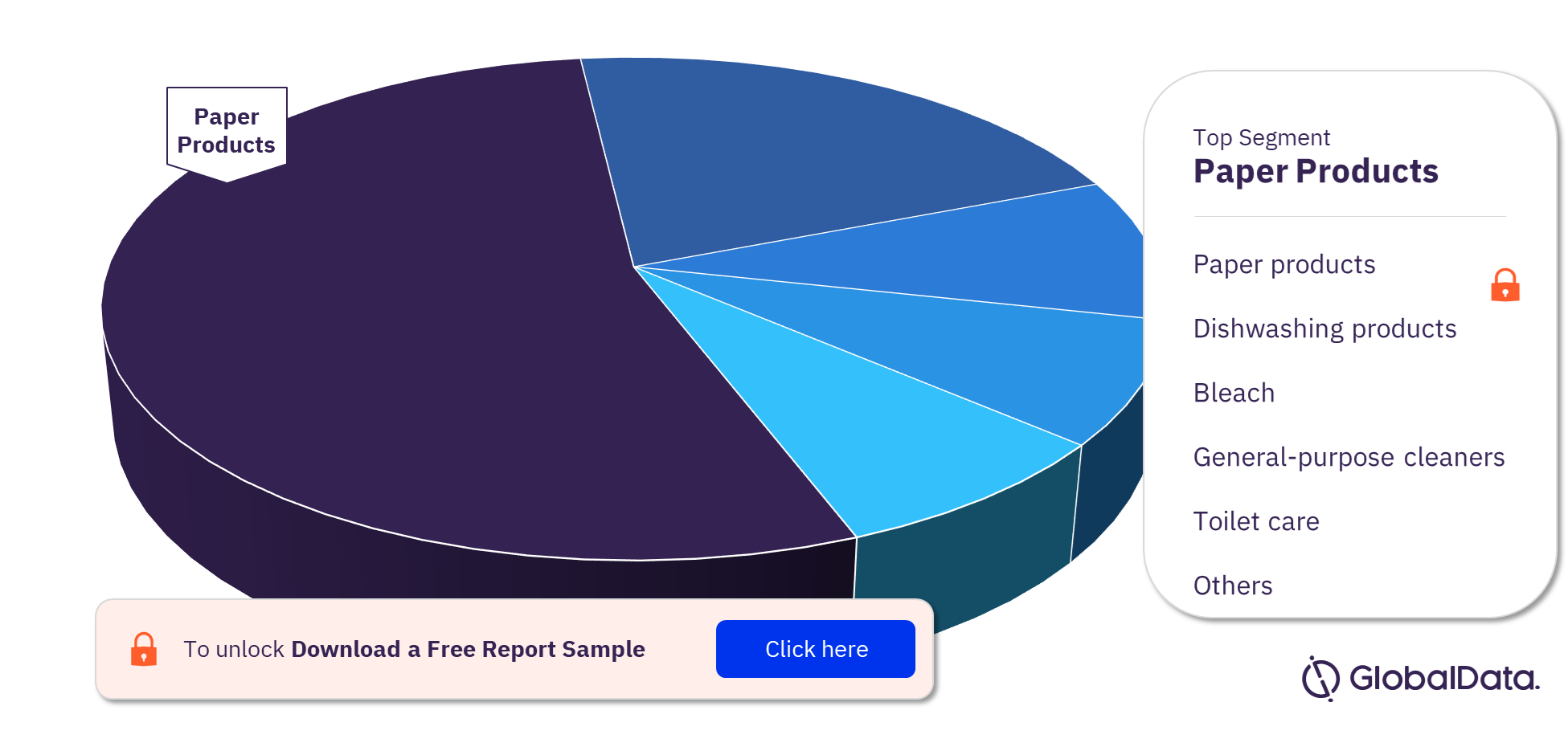

Which are the key categories in the household care market?

The key categories in the household care market are paper products, dishwashing products, bleach, general-purpose cleaners, toilet care, textile washing products, insecticides, furniture and floor polishing, scouring products. Unsurprisingly, the categories of paper products and textile washing (laundry care), which are heavily used by consumers, took the lion’s share of the household care market value in 2021.

Household care market, by categories

For more category insights, download a free sample

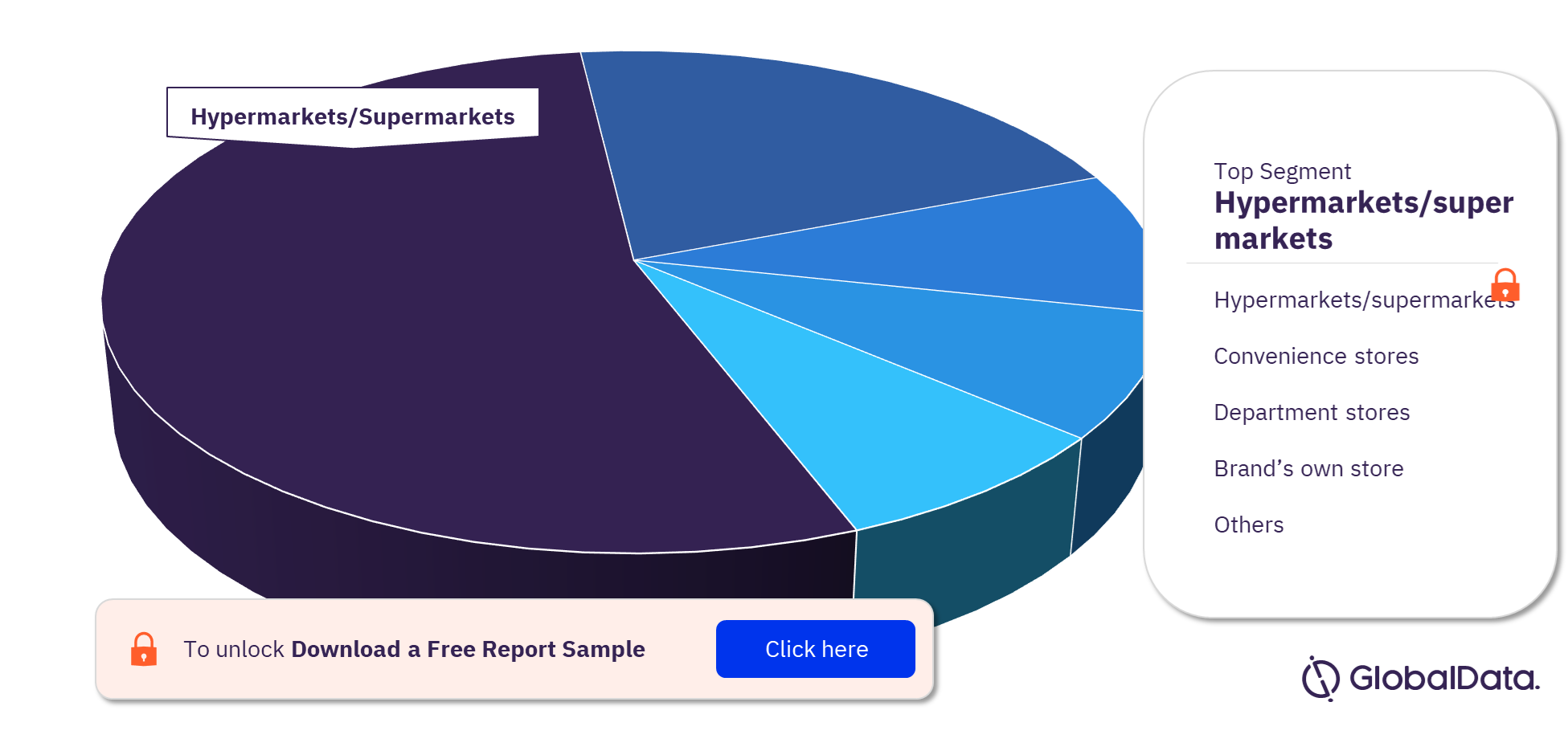

Which are the key channels in the household care sector?

Some of the key channels in the household care sector are hypermarkets/supermarkets, convenience stores, department stores, brand’s own store, online-direct from brand.

Unsurprisingly, the most popular channels for buying household care products are supermarkets and retailers, whether at bricks-and-mortar outlets or online. When shopping for essential categories such as household care, consumers are convenience-led, so a channel offering multiple product categories in one place is desirable. While bricks-and-mortar channels are a more popular choice overall, e-commerce is undoubtedly growing. The second-most popular online channel after retailer websites is direct from the brand. For some consumers it is appealing to by from brand websites as they can offer guidance about their product such as tips on how best to use/clean. Convenience is also driving the q-commerce boom alongside ecommerce so online delivery aggregators are becoming more popular. However, aggregators are dominated by food and drink – household care is still a minor category.

Household care sector, by channels

For more channel insights, download a free sample

Which are the key trends in the household market?

The key trends in the household market are eco solutions, hygiene obsession, chemical versus natural, redefining convenience, and home and away.

Eco solutions

Traditionally, sustainability and environmental issues have been viewed as the preserve of younger generations. Nevertheless, it is clear consumers across all generations are taking an interest in this theme. Media campaigns, documentaries, charities, and celebrities are galvanizing consumers to change their behavior to impact the environment positively. These groups are teaching consumers not only the urgency of the climate crisis but also the complexity of the issue.

Hygiene obsession

COVID-19 has been a huge health worry and household care companies have targeted this with products aiming to reassure consumers of their effectiveness at stopping the spread of the virus. What were initially additional measures are now in people’s regular routines, so the obsession with maintaining better hygiene standards continues into 2022. Increased engagement with a category that was mostly uninteresting pre-pandemic gives companies the chance to premiumize as consumers are more likely to buy the higher quality products.

Chemical versus natural

Bleach and chlorine had the second and third highest number of consumers that said the ingredients were not appealing. However, baking soda had some of the highest numbers of consumers who found it appealing, despite being a man-made chemical. Although it is naturally-derived, lactic acid was unfamiliar to the highest number of consumers.

Redefining convenience

Technology is enhancing the consumer journey beyond just ecommerce. For consumers especially interested in household categories, informed shopping – accessing a variety of information about a product before purchasing in a digital context – is important. This can be engaging with so-called ‘cleanfluencers’ on social media, checking customer reviews, or scanning QR codes to understand more. Companies should improve their own digital platforms in order that these consumers can easily access the information. However, for many consumers household care is an essential category of little interest. For these consumers automated shopping options such as subscription services that require minimal interaction may be appealing.

Home and away

Ordering takeaway had the highest numbers of consumers doing so less frequently. Working from home had the highest numbers of people who had never done this, as certain jobs cannot be carried out remotely. Exercising at home had the largest number of consumers doing so more frequently in Q4.

Which are the key companies in the household care market?

The key companies in the household care market are Unilever, P&G, Henkel, Reckitt, Blueland, Kao, Swania, Roborock, and Clorox.

Market report overview

| Key regions | Africa, East Europe, MENA, Asia, Latin America, West Europe, Australasia, and North America |

| Key channels | Hypermarkets/Supermarkets, Convenience Stores, Department Stores, Brand’s Own Store, Online-Direct From Brand |

| Key trends | Eco Solutions, Hygiene Obsession, Chemical Versus Natural, Redefining Convenience, And Home and Away |

| Key companies | Unilever, P&G, Henkel, Reckitt, Blueland, Kao, Swania, Roborock, and Clorox |

Scope

- Key trends include hygiene obsession, sustainability, technology-driven convenience, the balance of natural and chemical formulations, and the pull between comfort and escapism.

- Household care companies will have to consider how they adhere to these trends within the context of inflationary pressure, increasing ESG restrictions, and the ecommerce boom.

Reasons to Buy

- Understand multiple themes and company responses in order to tap into what is really impacting the industry.

- Gain a broader appreciation of the fast-moving consumer goods industry by gaining insights from both within and outside of your sector.

- Access valuable strategic take-outs to help direct future decision-making and inform new product development.

P&G

Henkel

Reckitt

Blueland

Kao

Swania

Roborock

Clorox

Table of Contents

Frequently asked questions

-

Which are the key regions in the household care market?

The key regions in the household care market are Africa, East Europe, MENA, Asia, Latin America, West Europe, Australasia, and North America.

-

Which are the key channels in the household care market?

Some of the key channels in the household care market are hypermarkets/supermarkets, convenience stores, department stores, brand’s own store, online-direct from brand.

-

Which are the key trends in the household care market?

The key trends in the household care market are eco solutions, hygiene obsession, chemical versus natural, redefining convenience, and home and away.

-

Which are the key companies in the household care market?

The key companies in the household care market are Unilever, P&G, Henkel, Reckitt, Blueland, Kao, Swania, Roborock, and Clorox.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.