How Customers Purchase Income Protection Insurance?

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Income protection offers long-term cover if an individual is unable to work due to injury, illness, or redundancy. The policy typically pays out until the client returns to work, retires, or dies. In Q3 2021, there was an increase in new business premiums and contracts as people sought to buy protection policies amid the COVID-19 crisis. This situation made customers think more about unprecedented events and the financial implications they may have in the future.

At a time when COVID-19 is changing consumer behavior, the income protection insurance market report explores how purchasing preferences have changed over time. It discovers what is most influential to customers when purchasing an income protection policy and reveals the most popular providers in the market. New trends and innovations are highlighted, as well as the key factors that will influence the income protection insurance market over the next few years.

What are the key trends in the income protection insurance market?

The COVID-19 crisis has increased awareness of health and wellbeing. Insurers are encouraging customers to make healthier choices and to maintain a good level of well-being. Interest is growing in mental health and well-being products that help consumers reduce health risk factors and assist them in managing or improving health conditions. This presents strong opportunities for income protection insurers to continue to move toward more preventative approaches and make better use of digital tools and activity trackers in their policies to encourage healthy habits.

Insurers continue to adapt income protection policies and communicate the benefits of purchasing them to protect against unforeseen risks. The increase in mortgage lending provides a great opportunity for insurers to target first-time homebuyers, as well as home movers, as they become more aware of their financial vulnerability when things do not go as planned.

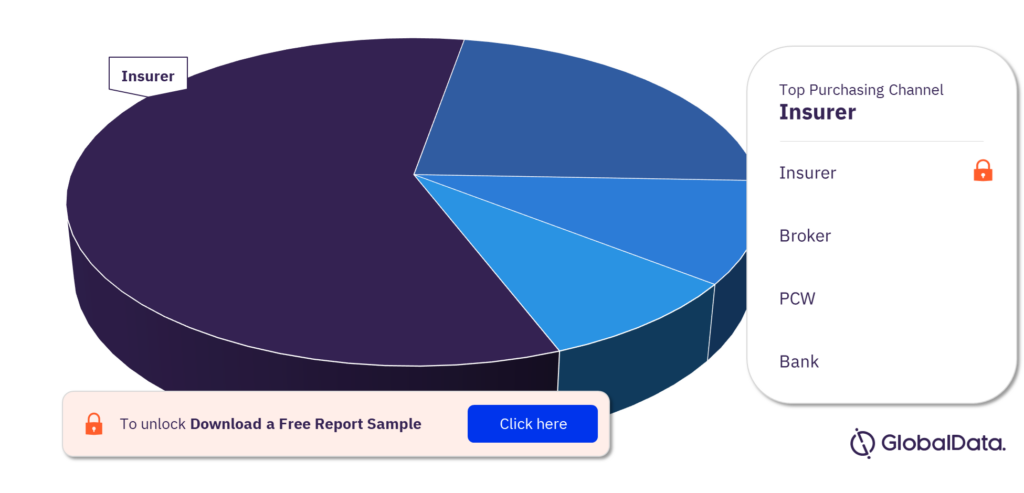

Which major channels were used to purchase income protection insurance policies?

The major channels that were used to purchase income protection insurance policies in 2021 were insurers, brokers, PCW, and banks. Purchasing through the broker and the banking channels increased in 2021. The easing of lockdown measures and consequent reopening of IFA offices and bank branches across the country revived demand for these purchasing methods.

Income Protection Insurance Market Analysis by Purchasing Channels

For more purchasing channel insights, download a free report sample

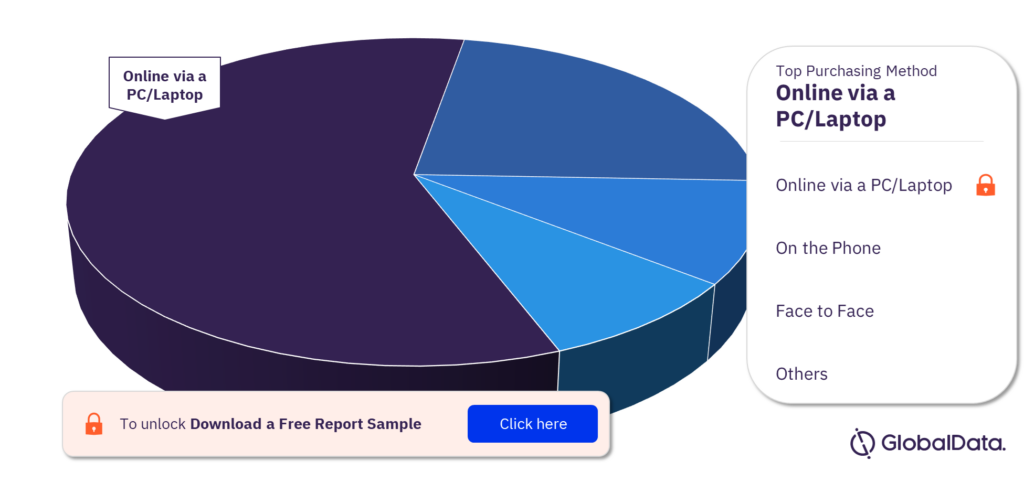

Which major methods were used to purchase income protection insurance policies?

The major methods used to purchase income protection insurance policies in 2021 were online via a pc/laptop, on the phone, online via a smartphone /tablet, by post, face to face, and through the provider’s app. In 2021, online purchasing was widely preferred.

Income Protection Insurance Market Analysis by Purchasing Methods

For more purchasing method insights, download a free report sample

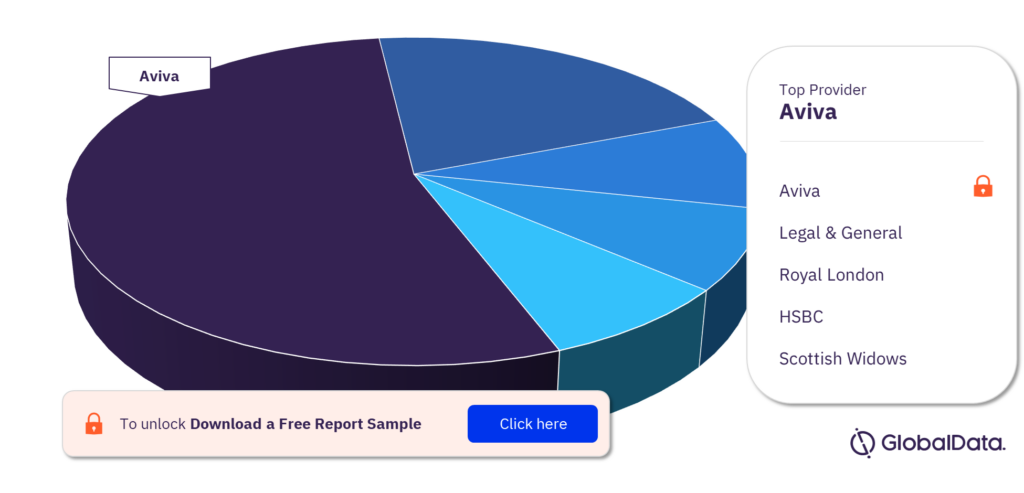

Which are the key providers in the income protection insurance market?

The key providers in the income protection market are Aviva, Legal & General, Royal London, HSBC, and Scottish Widows. Aviva had the highest market share for all IP policies sold in 2021. The insurer’s divestment and portfolio refocus strategy to sell eight non-core businesses in different countries affected profitability in 2021.

Income Protection Insurance Market Analysis by Providers

To know more about key providers, download a free report sample

Market Report Scope

| Major purchasing channels | Insurer, Broker, PCW, and Bank |

| Major purchasing methods | Online via a PC/Laptop, On the Phone, Online via a Smartphone /Tablet, By Post, Face to Face, and Provider’s App |

| Key providers | Aviva, Legal & General, Royal London, HSBC, and Scottish Widows |

Scope

- Visiting a price comparison website remained the most popular pre-purchase activity in 2021.

- Online channels remained the most popular purchasing method in 2021, while phone purchases gained traction.

- Events such as Brexit and the COVID-19 pandemic have caused economic uncertainty and increased unemployment. These events were key triggers for consumers to purchase income protection policies in 2021.

Reasons to Buy

- Understand consumer purchasing decisions and how these will influence the market over the next few years.

- Improve customer engagement by recognizing what is most important to them and how insurers can adapt their products and services to meet their needs.

- Compare the Net Promoter Scores of key insurance providers.

- Discover which providers lead the way in the household insurance space and learn about new product innovations.

- Adapt your distribution strategy to ensure it still meets customer purchasing behaviors.

Legal & General

Royal London

Scottish Widows

HSBC

AIG

BGL Group

Assured Futures

Anthemis

Table of Contents

Frequently asked questions

-

Which major channels were used to purchase income protection insurance policies?

The major channels that were used to purchase income protection insurance policies in 2021 were insurers, brokers, PCW, and banks.

-

Which major methods were used to purchase income protection insurance policies?

The major methods used to purchase income protection insurance policies in 2021 were online via a pc/laptop, on the phone, online via a smartphone /tablet, by post, face to face, and through the provider’s app.

-

Which are the key providers in the income protection insurance market?

The key providers in the income protection market are Aviva, Legal & General, Royal London, HSBC, and Scottish Widows.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Business and Consumer Services reports