Hydrogen Aircraft – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hydrogen Aircraft Market Analysis Overview

Hydrogen aircraft offer sustainable alternatives for air travel. Hydrogen has significant potential as it can be produced in a way that is carbon-free and when used as a fuel only produces water – making it appealing for states and companies attempting to reduce their climate impact. However, the development of the aircraft faces major challenges in terms of technology as well as infrastructure. Advancements need to be made to facilitate the use of hydrogen in commercial aircraft, and to improve its viability in terms of long distances. Additionally, significant investment in infrastructure is also required to facilitate the production and transportation of hydrogen in sufficient quantities.

The hydrogen aircraft thematic intelligence report provides the key trends impacting the growth of the hydrogen aircraft theme over the next 12 to 24 months. It also offers an analysis of M&A deals in this theme.

| Report Pages | 34 |

| Regions Covered | Global |

| Key Trends | · Technology Trends

· Macroeconomic Trends · Regulatory Trends · Patent Trends |

| Public Companies | · Airbus

· Air Liquide · Air Products and Chemicals (APD) · Boeing |

| Private Companies | · Aeristech

· Alaka’i Technologies · China Commercial Air Group · GKN Aerospace |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Hydrogen Aircraft - Key Trends

The main trends shaping the hydrogen aircraft theme over the next 12 to 24 months are classified into three categories: technology trends, macroeconomic trends, regulatory trends, and patent trends.

- Technology trends: The development of passenger aircraft for the commercial market, R&D on the blended wing body aircraft, developing electrolysis technology, the expansion of hydrogen infrastructure, improvement of hydrogen-powered fuel cells and synfuels, and focus on increased production of green hydrogen are some of the technology trends impacting the hydrogen aircraft theme.

- Macroeconomic trends: The key macroeconomic trends explained in the report are the impact of the COVID-19 pandemic, increased costs associated with the use of hydrogen fuel, infrastructure, and fleet changes, environmental issues on carbon emissions by the aviation sector, government initiatives for alternative fuels, and rising globalization among others.

- Regulatory trends: Growing investment in clean energy, carbon regulations, hydrogen strategies by various governments, and focus on energy efficiency, reducing CO2 emissions by advancing the aircraft sector are part of the regulatory trends impacting the hydrogen aircraft theme.

- Patent Trends: The total number of patents rose significantly from 2015, peaking in 2021. However, the number has been declining since then, which could be either because there is about to be a switch of focus by corporations, having completed much design work, to now focus on implementation, or because the design phase has stalled. There are still plenty of design issues yet to be solved. The biggest of these is the storage issue, so there will be likely many more patents filed as issues like this begin to be solved.

Hydrogen Aircraft – Industry Analysis

Although it is estimated that there may be functioning commercial aircraft powered by hydrogen by 2030, it is unlikely that the technology will be widespread commercial before 2040. Even if hydrogen aircraft are utilized, they will initially be focused on short and medium-term flights, since the technology and cost restraints will facilitate flying short distances only.

The IATA forecasts that the number of global air passengers will double by 2037, and this will require a significant increase in aviation infrastructure. The IATA acknowledges that aviation is one of the hardest sectors to implement alternative fuels due to the power and safety requirements but suggests that the technology is developing in the right direction.

Furthermore, there is a political push for sectors to reduce their carbon emissions but, soon, the aviation sector’s share of global emissions is likely to increase. CO2 emissions per passenger have fallen over the last 30 years but the volume of flights has increased, meaning that overall emissions are up, and this trajectory is likely to increase as the pandemic abates. There will be increasing pressure and regulations to reduce emissions in line with national and international targets.

The hydrogen aircraft industry analysis also covers the following:

- Timeline

For More Insights into The Hydrogen Aircraft Industry Analysis, Download a Free Report Sample

Hydrogen Aircraft – Public Companies

In this section, GlobalData highlights public companies that are making their mark within the hydrogen aircraft theme.

- Airbus

- Air Liquide

- Air Products and Chemicals (APD)

- Boeing

Hydrogen Aircraft – Private Companies

In this section, GlobalData highlights private companies that are making their mark within the hydrogen aircraft theme.

- Aeristech

- Alaka’i Technologies

- China Commercial Air Group

- GKN Aerospace

For More Insights on The Leading Players In The Hydrogen Aircraft Theme, Download a Free Report Sample

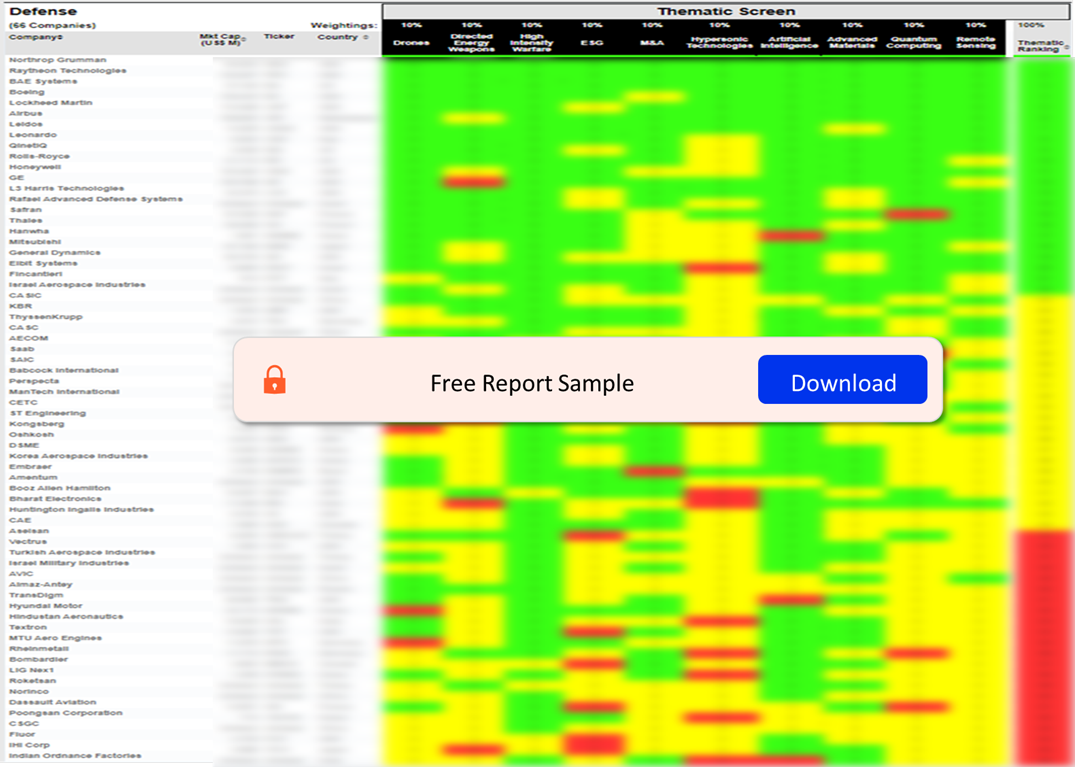

Defense Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Defense Sector Scorecard– Thematic Screen

Buy Full Report to Know More About the Sector Scorecards

Scope

This report is a thematic analysis of the Hydrogen Aircraft market. It provides:

- Key themes in hydrogen development are established, both in terms of aerospace trends, technology trends, and macroeconomic trends.

- Details of the market trends over the next 24 months, outlining which sectors are likely to benefit from increased spending on hydrogen aircraft.

- Access to industry data on market trends, market segmentation, and key companies.

Key Highlights

• Studies of emerging technological trends and their broader impact on the market.

• Analysis of the various hydrogen aircraft programs currently under development, as well historical research initiatives.

Reasons to Buy

- Determine potential investment opportunities based on trend analysis and market projections.

- Gain an understanding of the market surrounding the hydrogen aircraft theme.

- Understanding of how hydrogen aircraft spending will fit into the overall market and what spending areas are being prioritized.

Boeing

ZeroAvia

China Commercial Air Group

Pipistrel

Air Products and Chemicals

Shell

Bloom Energy

Air Liquide

ArianeGroup

EMEC Hydrogen

Norsk E-fuel

MTU Aero Engines

Cummins

H3 Dynamics

KGN Aerospace

ErlingKlinger

RTX Corp

Sagran

Aeristech

Protonex

Bloom Energy

Honda

Aeristech

Alakai Technologies

Textron

Rolls-Royce

Protium

Plug Power

Protonex

Table of Contents

Frequently asked questions

-

What are the key technology trends impacting the hydrogen aircraft theme?

The development of passenger aircraft for the commercial market, R&D on the blended wing body aircraft, developing electrolysis technology, the expansion of hydrogen infrastructure, improvement of hydrogen-powered fuel cells and synfuels, and focus on increased production of green hydrogen are some of the technology trends impacting the hydrogen aircraft theme.

-

What are the key macroeconomic trends impacting the hydrogen aircraft theme?

The key macroeconomic trends explained in the report are the impact of the COVID-19 pandemic, increased costs associated with the use of fuel, infrastructure and fleet changes, environmental issues on carbon emissions by the aviation sector, government initiatives into alternative fuels, and rising globalization among others.

-

What are the key regulatory trends impacting the hydrogen aircraft theme?

Growing investment in clean energy, carbon regulations, hydrogen strategies by various governments, and focus on energy efficiency, reducing CO2 emissions by advancing aircraft are part of the regulatory trends impacting the hydrogen aircraft theme.

-

What the number of patents published since 2021 has decreased?

The number of patents published since 2021 has decreased either because there is about to be a switch of focus by corporations, having completed much design work, to now focus on implementation, or because the design phase has stalled.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace reports