Hydrogen Electrolyzers Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hydrogen Electrolyzers Market Report Overview

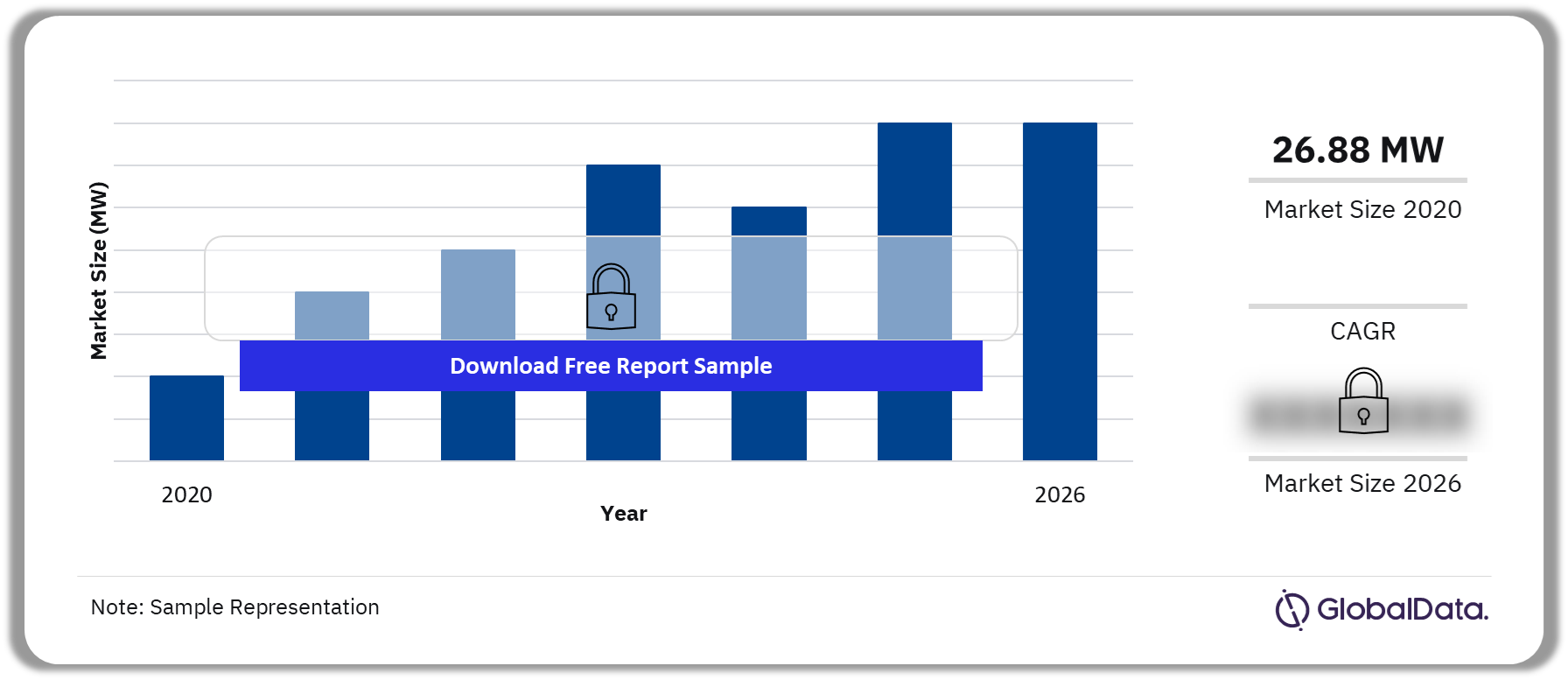

The global electrolyzer capacity was valued at 26.88 MW in 2020. APAC dominated the electrolyzer capacity, followed by EMEA and Americas.

Hydrogen is gaining prominence as a critical component of the energy transition. Significant policy support and the government’s commitment to deep decarbonization continue to spur investments in hydrogen. The momentum that has been built along the entire value chain has accelerated cost reduction in hydrogen production, transmission, distribution, retail, and end applications.

Electrolyzer Market Outlook 2020-2026 (MW)

Buy the Report to Get More Insights on the Hydrogen Electrolyzers Market Forecast

The hydrogen electrolyzers market research report analyzes the current trend and future potential of the hydrogen electrolyzers market in the regional (Americas, Europe, and Asia-Pacific) and key countries (the US, Chile, Canada, Japan, China, Australia, Germany, France, South Africa, UK, Egypt, and Oman) level. It also analyzes the hydrogen electrolyzers market in terms of low carbon hydrogen capacity during the period 2020 – 2028, electrolyzer capacity, and manufacturers by the end of April 2022. Moreover, it provides insight into the major technology trends in the hydrogen industry over the next two to three years, major hydrogen strategies, and major upcoming electrolyzer projects.

| Market size (2020) | 26.88 MW |

| Key regions | · APAC

· EMEA · The Americas |

| Key countries | · United States

· Chile · Canada · Japan · China |

| Major manufacturers | · Siemens Energy

· Hydrogenics Europe NV · NEL ASA · Fusion Fuel Green Plc · ITM Power Plc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Hydrogen Electrolyzers Market Trends

Hydrogen produced using renewable electricity—attained via an electrolyzer—could enable the integration of large volumes of variable renewable energy (also called intermittent renewable energy sources) such as wind and solar PV into the energy system. Electrolyzers could enable the integration of variable renewable energy into the electric power systems, as their electricity consumption could be modified to follow solar PV and wind power generation, wherein hydrogen serves as a source of energy storage for renewable electricity. They provide a flexible load and offer grid balancing services such as ramping up or down frequency regulation, while functioning at optimal capacity to meet the demand for hydrogen from industry, along with the transportation sector, or for injecting into the natural gas grid.

The technological advancements in wind power such as larger wind turbines and longer wind turbine rotor blades, along with the increasing efficiency of solar PV cells, would benefit the deployment of green hydrogen projects. Newer strategies such as power-to-hydrogen-to-power plants and power-to-X are possible because of the declining costs of renewable power generation. In power generation applications, new hydrogen gas turbines are being developed by vendors such as Siemens Energy, GE, and Baker Hughes. Power-to-X strategies are also expected to be streamlined with time and could shape the role of hydrogen as a fuel and/or an energy carrier.

Buy the Report to Get More Insights on the Hydrogen Electrolyzers Market Trends

Hydrogen Electrolyzers Market Segmentation by Regions

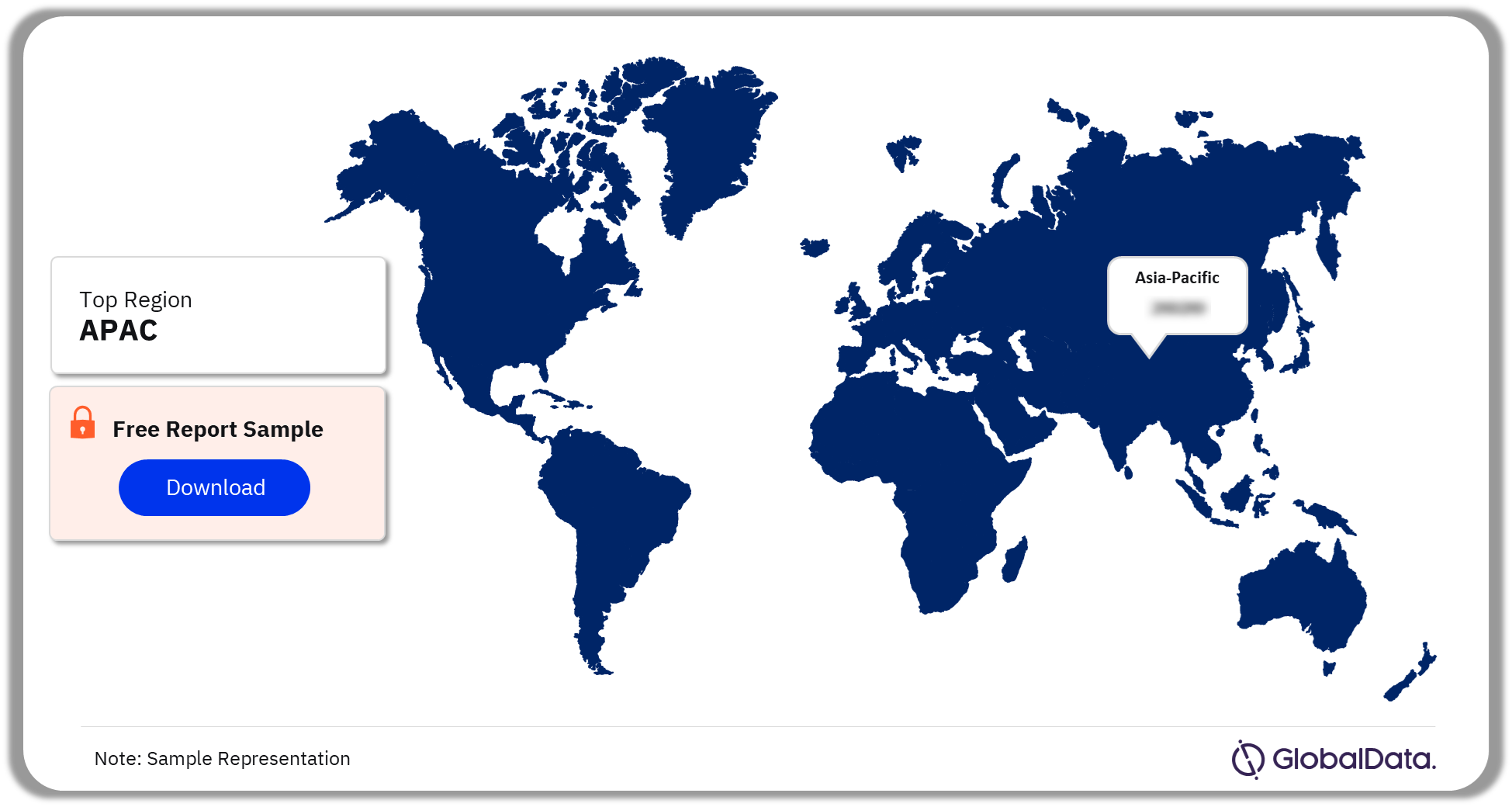

The key regions in the hydrogen electrolyzers market are APAC, EMEA, and the Americas. In 2020, APAC dominated the electrolyzer capacity followed by EMEA and Americas.

Hydrogen Electrolyzers Market Analysis by Regions, 2022 (%)

Buy the Report to Get More Insights on the Regions in the Hydrogen Electrolyzers Market

Hydrogen Electrolyzers Market Segmentation by Countries

The key countries in the hydrogen electrolyzers market are the United States, Chile, Canada, Japan, China, Australia, Germany, France, South Africa, the United Kingdom, Egypt, and Oman.

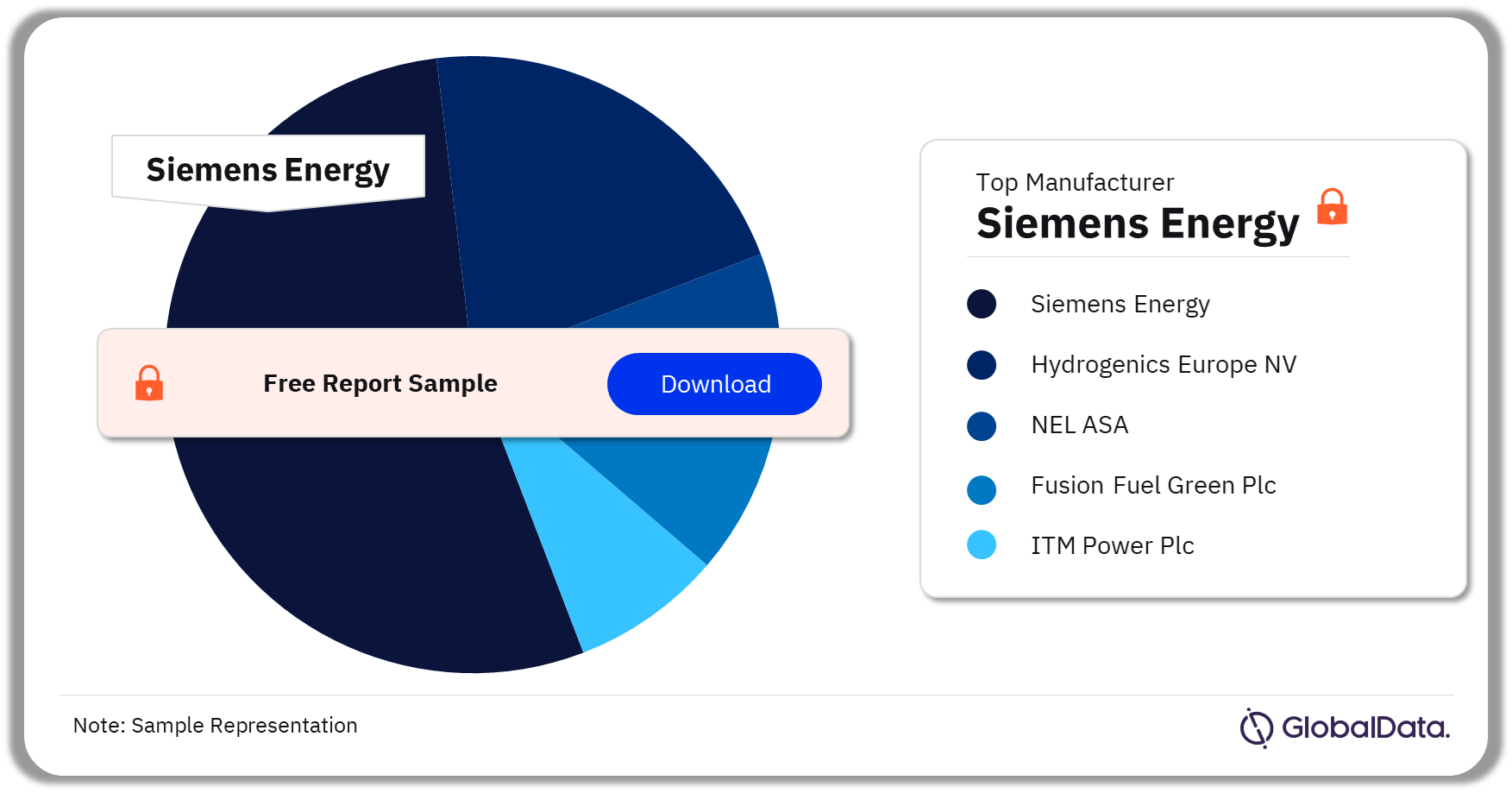

Hydrogen Electrolyzers Market – Competitive Landscape

Some of the major manufacturers in the hydrogen electrolyzers market are Siemens Energy, Hydrogenics Europe NV, NEL ASA, Fusion Fuel Green Plc, ITM Power Plc, McPhy Energy SA, Cummins Inc, ThyssenKrupp Uhde GmbH, Green Hydrogen Systems AS, Sunfire Gmbh, H-TEC Systems GmbH, and HydrogenPro AS. Siemens Energy, Hydrogenics Europe NV, and NEL ASA were the top three global manufacturers of electrolyzers until April 2022.

Hydrogen Electrolyzers Market Analysis by Manufacturers, 2022 (%)

Buy the Report to Get More Insights into the Hydrogen Electrolyzers Market Manufacturers

Scope

The report analyses the hydrogen electrolyzers market. Its scope includes:

- The report provides the hydrogen electrolyzers market analysis at the global, and regional level and key countries including the US, Chile, Canada, Japan, China, Australia, Germany, France, South Africa, UK, Egypt, and Oman.

- The report low carbon hydrogen capacity during the period 2020 – 2028, electrolyzer capacity, and manufacturers by the end of April 2022.

- The report provides insight into the major technology trends in the hydrogen industry over the next two to three years, major hydrogen strategies, and major upcoming electrolyzer projects.

Reasons to Buy

The report will enhance your decision-making capability in a more rapid and time-sensitive manner. It will allow you to:

- Facilitate decision-making by analyzing market data on the hydrogen electrolyzers market

- Develop strategies based on developments in the hydrogen electrolyzers market

- Identify key partners and business-development avenues, based on an understanding of the movements of the major competitors in the hydrogen electrolyzers market

- Respond to your competitors’ business structure, strategies, and prospects

Table of Contents

Table

Figures

Frequently asked questions

-

What was the hydrogen electrolyzers market size in 2020?

The global electrolyzer capacity was valued at 26.88 MW in 2020.

-

Which are the key regions in the hydrogen electrolyzers market?

The key regions in the hydrogen electrolyzers market are APAC, EMEA, and the Americas.

-

Which are the key countries in the hydrogen electrolyzers market?

The key countries in the hydrogen electrolyzers market are the United States, Chile, Canada, Japan, China, Australia, Germany, France, South Africa, the United Kingdom, Egypt, and Oman.

-

Who are the major manufacturers in the hydrogen electrolyzers market?

Some of the major manufacturers in the hydrogen electrolyzers market are Siemens Energy, Hydrogenics Europe NV, NEL ASA, Fusion Fuel Green Plc, ITM Power Plc, McPhy Energy SA, Cummins Inc, ThyssenKrupp Uhde GmbH, Green Hydrogen Systems AS, Sunfire Gmbh, H-TEC Systems GmbH, and HydrogenPro AS.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.