Innovation in Instant Payments – Market Overview and Key Case Studies (India – UPI, Brazil – Pix, Nexus Project, Nordics – P27 and ASEAN Links)

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

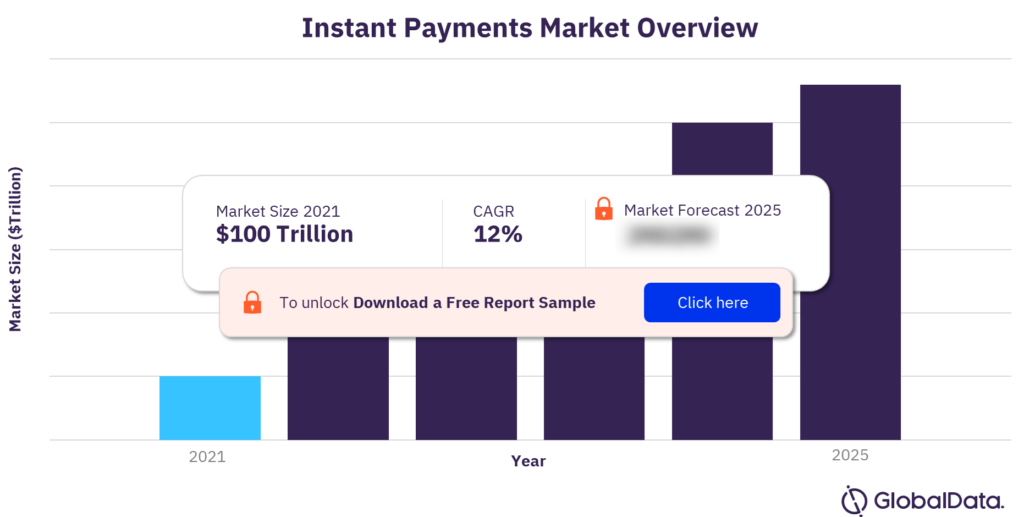

The global instant payments transactions was valued at $100 trillion in 2021. The market is projected to grow at a CAGR of 12% during the forecast period. Instant payments are an innovative payments infrastructure that modernizes payment systems and enables transactions to be settled within 60 seconds. Although it is a natural alternative to card payments, its impact on the cards market varies per region. Countries that have a well-established instant payment infrastructure are actively focusing on driving the interoperability of their platforms with other countries. Linking domestic instant payment platforms should reduce remittance cost for both merchants and consumers and strengthen economic ties among countries.

The instant payments market research report explores domestic instant payment platforms across a number of countries through various case studies. It also explores developments in terms of cross-border instant payment interoperability, including the benefits and challenges of establishing such links.

Instant payment market overview

For more insights on this report, download a free report sample

What are the market dynamics in the instant payment market?

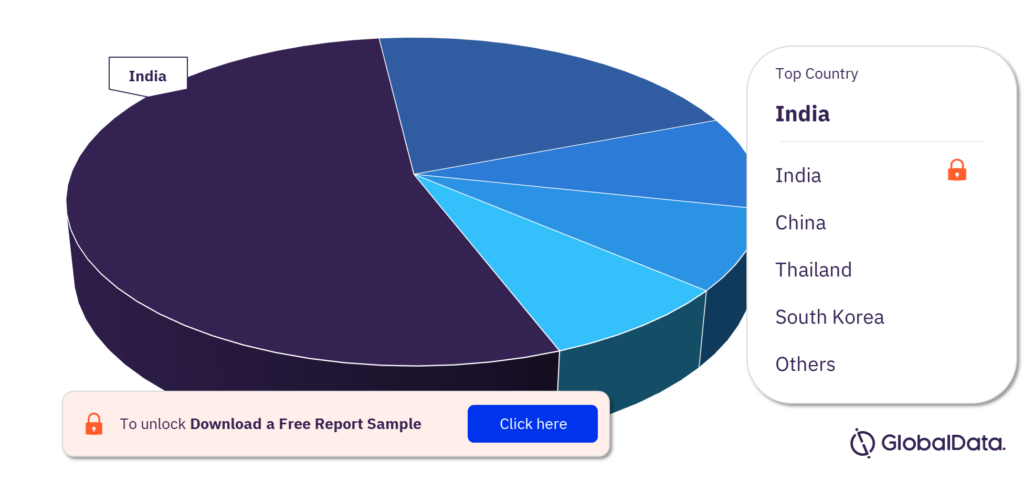

Instant payment technology is gradually being adopted by most countries as an innovative network that improves payment infrastructure by ensuring transactions happen in seconds and without interruption. Some countries such as India see instant payments as an opportunity to create more financial inclusion by simplifying access to digital banking for those who cannot access a bank account. India is leading the adoption of instant payment in the world and is already working on expanding its Unified Payments Interface (UPI) platform to other countries. Countries leading the race to adopt instant payments are now focusing on developing regional instant payment networks that will enable international fund transfers in different currencies.

Instant payment systems reduce the reliance on card scheme networks to enable international transfers, making transactions cheaper. Linkages should stimulate cross-border transactions both for consumers and businesses and thus benefit the growth of regional economies. Linkages will improve data privacy between users of platforms as transactions can be executed with an email address or phone number.

What are the key countries in the instant payment market?

The key countries in the instant payment market are India, China, Thailand, South Korea, the UK, Nigeria, the US, Brazil, Japan, and the Netherlands.

Instant payment market, by countries

For more country insights, download a free report sample

Who are the key players in the instant payment market?

Some of the key players in the instant payment market are PIX, UPI, Bank for International Settlements, Santander, P27, Swish, MobilePay, Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, Swedbank, and PayNow.

Market report scope

| Market size (Year – 2021) | $100 trillion |

| CAGR | 12% |

| Forecast period | 2021-2025 |

| Key countries | India, China, Thailand, South Korea, the UK, Nigeria, the US, Brazil, Japan, and the Netherlands |

| Key players | PIX, UPI, Bank for International Settlements, Santander, P27, Swish, MobilePay, Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, Swedbank, and PayNow |

Reasons to Buy

- Understand the advantages and challenges of instant payment adoption.

- Identify the key players in the space.

- Learn about the different approaches to instant cross-border payments.

UPI

Bank for International Settlements

Santander

P27

Swish

MobilePay

Danske Bank

Handelsbanken

Nordea

OP Financial Group

SEB

Swedbank

PayNow

DuitNow

PromptPay

Table of Contents

Frequently asked questions

-

What was the global instant payment market size in 2021?

The global instant payments market size was valued at $100 trillion in 2021.

-

What is the instant payment market growth rate?

The instant payment market is projected to grow at a CAGR of 12% during the forecast period.

-

What are the key countries in the instant payment market?

The key countries in the instant payment market are India, China, Thailand, South Korea, the UK, Nigeria, the US, Brazil, Japan, and the Netherlands.

-

Who are the key players in the instant payment market?

Some of the key players in the instant payment market are PIX, UPI, Bank for International Settlements, Santander, P27, Swish, MobilePay, Danske Bank, Handelsbanken, Nordea, OP Financial Group, SEB, Swedbank, and PayNow.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports