Japan Baby Food Market Size and Share by Categories, Distribution and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Japan Baby Food Market Report Overview

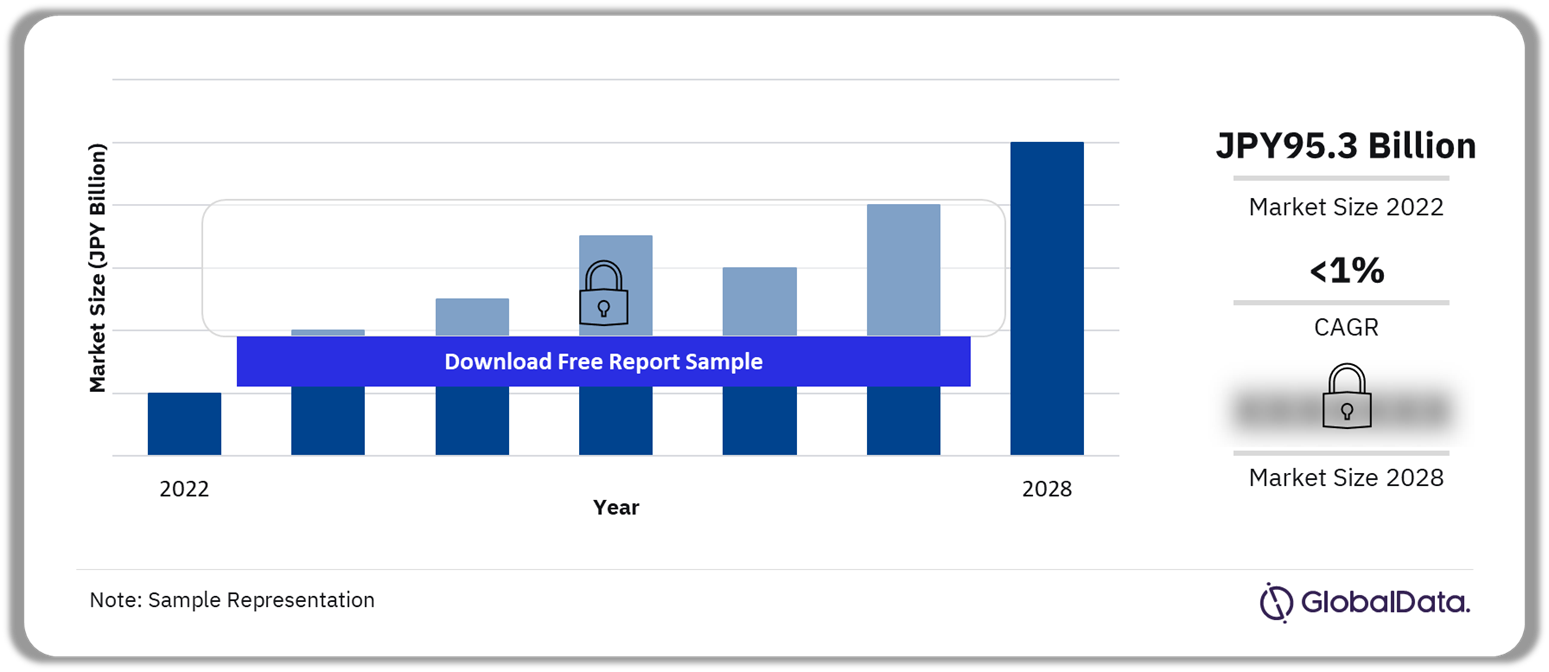

The Japan baby food market size valued at JPY95.3 billion in 2022. The market will record a CAGR of less than 1% during 2022-2028. The Japan baby food market outlook includes demographic and socio-economic trends to aid clients in effective decision-making

Japan Baby Food Market Outlook, 2022-2028 (JPY Billion)

Buy the Full Report for Japan Baby Food Market Revenue,

Download A Free Report Sample

The Japan baby food market insights cover current and future trends that will influence the baby food industry. This report collates multiple data sources to offer a comprehensive baby food sector overview in Japan from 2016 to 2028.

| Market Size (2022) | JPY95.3 billion ($727.2 million) |

| CAGR (2022-2028) | <1% |

| Historical Period | 2016-2022 |

| Forecast Period | 2023-2028 |

| Key Categories | · Baby Milks

· Baby Wet Meals & Other · Baby Cereals & Dry Meals · Baby Drinks · Baby Finger Food |

| Key Distribution Channels | · Hypermarkets and Supermarkets

· Drugstores & Pharmacies · Convenience Stores · E-retailers |

| Leading Manufacturers | · Asahi Group Holdings

· Meiji Holdings Company · Morinaga Milk Industry Company · Kewpie Corporation · Bean Stalk Snow · Pigeon Corporation |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Japan Baby Food Market Trends

There is a decline in birth rates in Japan. The low birth rate and rapidly aging population forced the Japanese government to introduce various measures to increase the birth rate. In 2020, the Japanese government subsidized established or upcoming artificial intelligence (AI) projects run by local governments that are geared toward matchmaking to boost the birth rate. Furthermore, growing economic uncertainty has forced Japanese consumers to restrict their family budgets, resulting in a change in their buying behavior regarding baby care and childcare products. Price-sensitive Japanese consumers are looking for natural and user-friendly products.

Buy the Full Report for Japan Baby Food Trends Analysis, Download PDF Sample

Japan Baby Food Market Segmentation by Categories

Baby milk category witnessed the highest baby food sales in 2022

The key categories in the Japan baby food market are:

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drinks

- Baby Finger Food

The baby food category comprises breast-milk substitutes for infants aged from birth to three years old. Products include first-stage milk and follow-on milk among others.

Buy the Full Report Categorical Japan Baby Food Market Insights, Download PDF Report Sample

Segments Covered in the Report

Japan Baby Food Categories Outlook (Value, JPY Billion, 2016-2028)

- Baby Milks

- Baby Wet Meals & Other

- Baby Cereals & Dry Meals

- Baby Drinks

- Baby Finger Food

Japan Baby Food Distribution Channel Outlook (Value, JPY Billion, 2016-2028)

- Hypermarkets and Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-retailers

Japan Baby Food Market Segmentation by Distribution Channels

Hypermarkets & supermarkets accounted for the highest baby food sales in 2022

The key distribution channels in the Japan baby food market are:

- Hypermarkets & Supermarkets

- Drugstores & Pharmacies

- Convenience Stores

- E-Retailers

- Others

Hypermarkets & supermarkets were the leading distribution channels for baby food in 2022, followed by drugstores & pharmacies and e-retailers.

Buy the Full Report Japan Baby Food Market Insights by Distribution Channel, Download A Free Report Sample

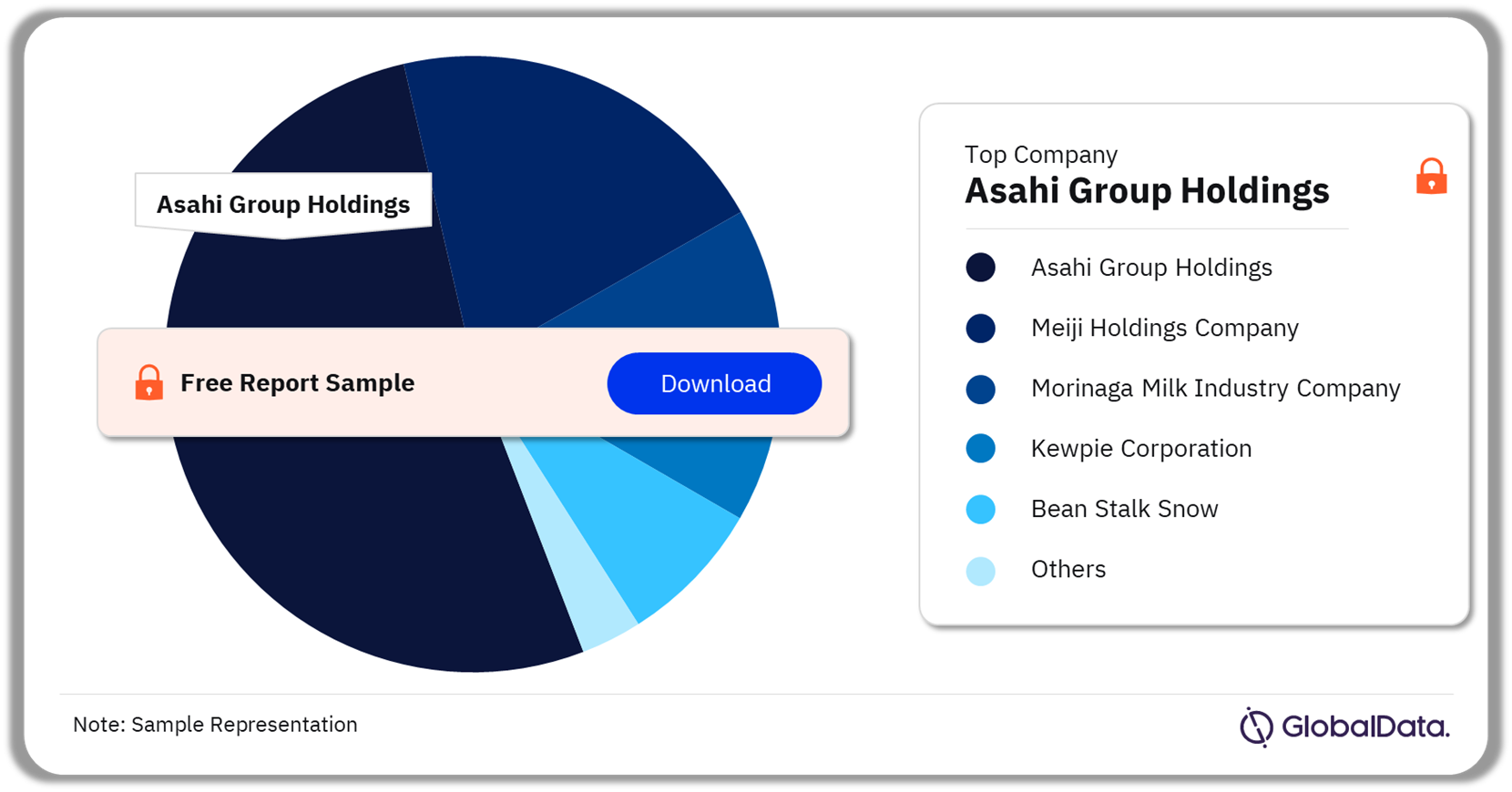

Japan Baby Food Market - Competitive Landscape

Asahi Group Holdings emerged as the leading baby food company in Japan in 2022

The leading companies in the Japan baby food market are:

- Asahi Group Holdings

- Meiji Holdings Company

- Morinaga Milk Industry Company

- Kewpie Corporation

- Bean Stalk Snow

- Pigeon Corporation

Asahi Group Holdings offers baby food products across its key brands including Wakodo, Gun-Gun, and Hai-Hai. Meiji Holdings Company and Morinaga Milk Industry Company followed the lead and garnered significant baby food market share in 2022.

Buy the Full Report for Japan Baby Food Manufacturers,

Download A Free Report Sample

Scope

This report provides:

- Consumption data based upon a unique combination of industry research, fieldwork, market sizing work and our in-house expertise to offer extensive data about the trends and dynamics affecting the industry.

- Detailed profile of the companies operating and new companies considering entry in the industry along with their key focus product sectors.

- Market profile of the various product sectors with the key features & developments, segmentation, per capita trends, and the various manufacturers & brands.

- Overview of baby food retailing with a mention of the major retailers in the country along with the distribution channel.

- Future projections considering various trends that are likely to affect the industry.

Reasons to Buy

- Evaluate important changes in consumer behavior and identify profitable markets and areas for product innovation.

- Analyze current and forecast behavior trends in each category to identify the best opportunities to exploit.

- Understand individual product category consumption to align your sales and marketing efforts with the latest trends in the market.

- Investigate which categories are performing the best and how this is changing market dynamics.

Meiji Holdings Company

Morinaga Milk Industry Company

Kewpie Corporatio

Bean Stalk Snow

Pigeon Corporation

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Japan baby food market size in 2022?

The baby food market size in Japan was valued at JPY95.3 billion in 2022.

-

What is the expected Japan baby food market growth rate during 2022-2028?

The baby food market in Japan will achieve a CAGR of less than 1% during 2022-2028.

-

Which was the leading category in the Japan baby food market in 2022?

Baby milks was the leading category in the Japan baby food market in 2022.

-

Which was the leading distribution channel of the Japan baby food market in 2022?

Hypermarkets & supermarkets were the leading distribution channel of the Japan baby food market in 2022.

-

Which are the leading manufacturers in the Japan baby food market?

The leading manufacturers in the Japan baby food market are Asahi Group Holdings, Meiji Holdings Company, Morinaga Milk Industry Company, Kewpie Corporation, Bean Stalk Snow, and Pigeon Corporation among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.