Japan Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Japan Cards and Payments Market Report Overview

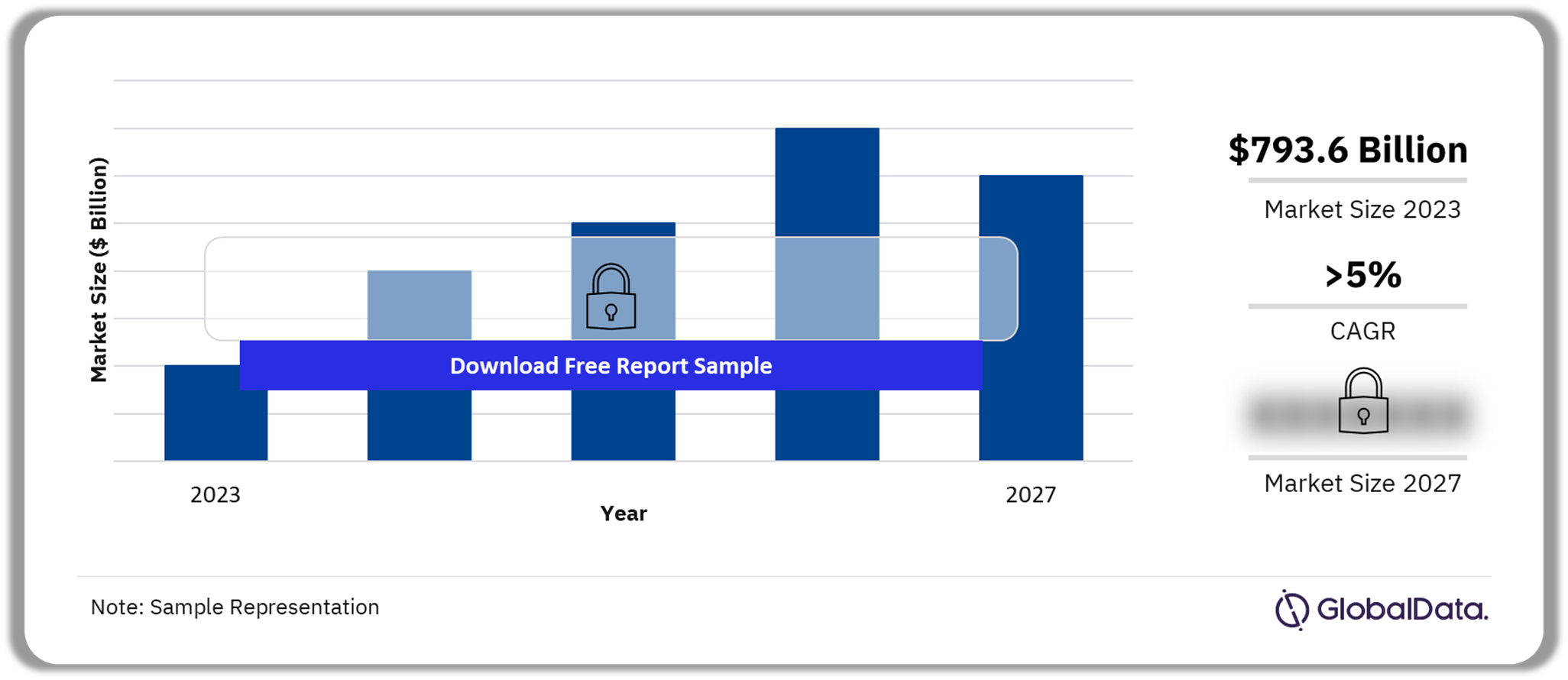

The annual value of card transactions in the Japan cards and payments market was $793.6 billion in 2023. The value is expected to grow at a CAGR of more than 5% during 2023-2027. The growing adoption of contactless card payments for transport services will support card payment growth in the forecast period.

Japan Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Japan Cards and Payments Market Forecast Download a Free Sample Report

The Japan cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Japan cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $793.6 billion |

| CAGR (2023-2027) | >5% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cards

· Credit Transfers · Cash · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments · P2P Payments · Bill Payments · Alternative Payments |

| Leading Players | · Apple Pay

· Google Pay · PayPal · Amazon Pay · Rakuten Pay |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Japan Cards and Payments Market Dynamics

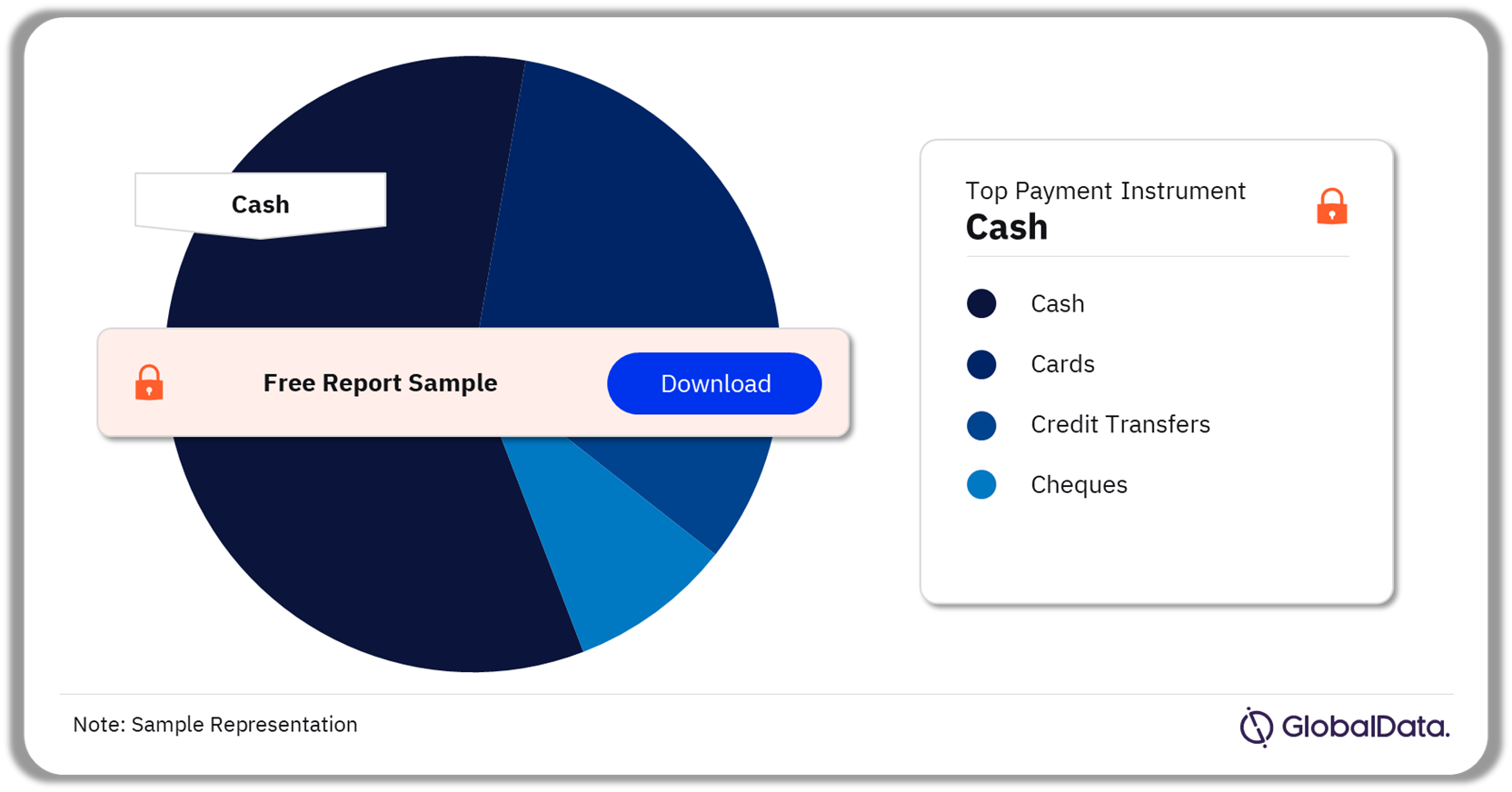

Cash dominates Japan’s payment landscape accounting for more than 60% of overall payment volume in 2023e. However, the cash usage has been in decline with the rise in electronic payments. Payment card penetration in Japan was significant in 2023e owing to the country’s large banked population and high financial awareness.

The government initiatives to promote electronic transactions and improved payment infrastructure have resulted in the growth of the payment card market. Card issuers and payment service providers are focusing on developing payment infrastructure via the expansion of the payment acceptance network. In addition, the market is witnessing new developments encompassing payment card security and convenient payment solutions, with card issuers and technology companies experimenting with advanced technologies such as blockchain and biometrics.

Buy the Full Report to Get Additional Japan Cards and Payments Market Dynamics

Japan Cards and Payments Market Segmentation by Payment Instruments

Cash had the highest transaction volume in the Japan payments space in 2023

The key payment instruments in Japan cards and payments market are cards, credit transfers, cash, and cheques. Cash is largely used for low-value payments. However, cash is gradually losing share due to the shift towards cashless payment.

Japan Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Japan Cards and Payments Market

Japan Cards and Payments Market Segments

Debit cards dominated the payment card market in 2023

The key segments in the Japan cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

Card-Based Payments: Japan remains a cash-dominated society despite strong payment card penetration of more than 6 cards per individual. Despite lower penetration compared with debit cards, credit card is the preferred card type owing to the value-added benefits credit cards offer. The high level of merchant acceptance will also propel the credit card payments market in Japan.

Buy the Full Report for More Market Segment Insights into the Japan Cards and Payments Market

Japan Cards and Payments Market - Competitive Landscape

A few of the leading players in the Japan cards and payments market are:

- Apple Pay

- Google Pay

- PayPal

- Amazon Pay

- Rakuten Pay

Apple Pay: Apple Pay was launched in Japan in October 2016. It can be used to make in-store, in-app, and online payments. Users can store their card details by scanning the front of the card with the app or by entering the information manually. The app also allows users to make payments for public transport via Suica, PASMO, or ICOCA cards saved to the wallet.

Japan Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Japan Cards and Payments Market Download a Free Sample Report

Japan Cards and Payments Market – Latest Developments

- In April 2023, PayPay partnered with Yahoo! Japan, to introduce a face biometrics payment system at convenience stores in the Yoyogi-Uehara district of Tokyo.

- In September 2021, Japan-based fintech EVERING launched a battery-free NFC-based payments ring in collaboration with France-based technology company Thales.

Segments Covered in the Report

Japan Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cards

- Credit Transfers

- Cash

- Cheques

Japan Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

Cash is largely used for low-value payments. However, cash is gradually losing its share of total payments due to the shift towards cashless payment methods. In a bid to promote cashless payments as well as to increase the adoption of mobile wallets, since April 2023 companies in Japan have been allowed to transfer salaries directly to their employees via alternative payment solutions, including mobile wallet brands, in addition to regular credit transfers.

The growing adoption of contactless card payments for transport services will support card payment growth. In August 2023, the Tokyo public transportation system expanded its contactless payment system in metro trains, starting with the Den-en-toshi Line from Shibuya, with the aim of expanding it across all lines by mid-2024. This enables commuters to make contactless payments using credit, debit, and prepaid cards as well as smartphone QR-code-based payments at metro stations.

The proliferation of digital-only banks has helped drive competition in banking, thus boosting debit card holding. In June 2023, digital-only bank Habitto went live. It offers a mobile-only savings account along with Visa debit cards. Meanwhile, digital-only bank Minna Bank is enabling its customers to open a bank account via its website or mobile banking app within a few minutes. They also receive a virtual debit card. To boost debit card usage, the bank is running its “Go! Go! 5x Cashback” campaign, offering discounts of up to 5% to premium customers and discounts of up to 1% for non-premium customers on debit card purchases at partner stores. Since its inception, the bank has served over 600,000 bank accounts.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Japan cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Japan cards and payments industry.

- Assess the competitive dynamics in the Japan cards and payments industry.

- Gain insights into marketing strategies used for various card types in Japan.

- Gain insights into key regulations governing the Japan cards and payments industry.

SMBC

Mizuho Financial Group

MUFG

Resona Holdings

Rakuten Bank

Aeon credit service

Credit Saison

Toyota

Orico

JACCS

AIFUL Corporation

Shinsei Bank

JALCard

JCB

J-debit

Visa

Mastercard

American Express

China UnionPay

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Japan cards and payments market in 2023?

The annual value of card transactions in the Japan cards and payments market was $793.6 billion in 2023.

-

What will the Japan cards market growth rate be during the forecast period?

The Japan annual cards market value is expected to grow at a CAGR of more than 5% during 2023-2027.

-

Which was the leading payment instrument in the Japan cards and payments market in 2023?

Cash was the leading payment instrument in terms of transaction volume in the Japan cards and payments market in 2023.

-

Which are the leading players in the Japan cards and payments market?

A few of the leading players in the Japan cards and payments market are Apple Pay, Google Pay, PayPal, Amazon Pay, and Rakuten Pay, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports