Lebanon Insurance Industry: Key Trends and Opportunities to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

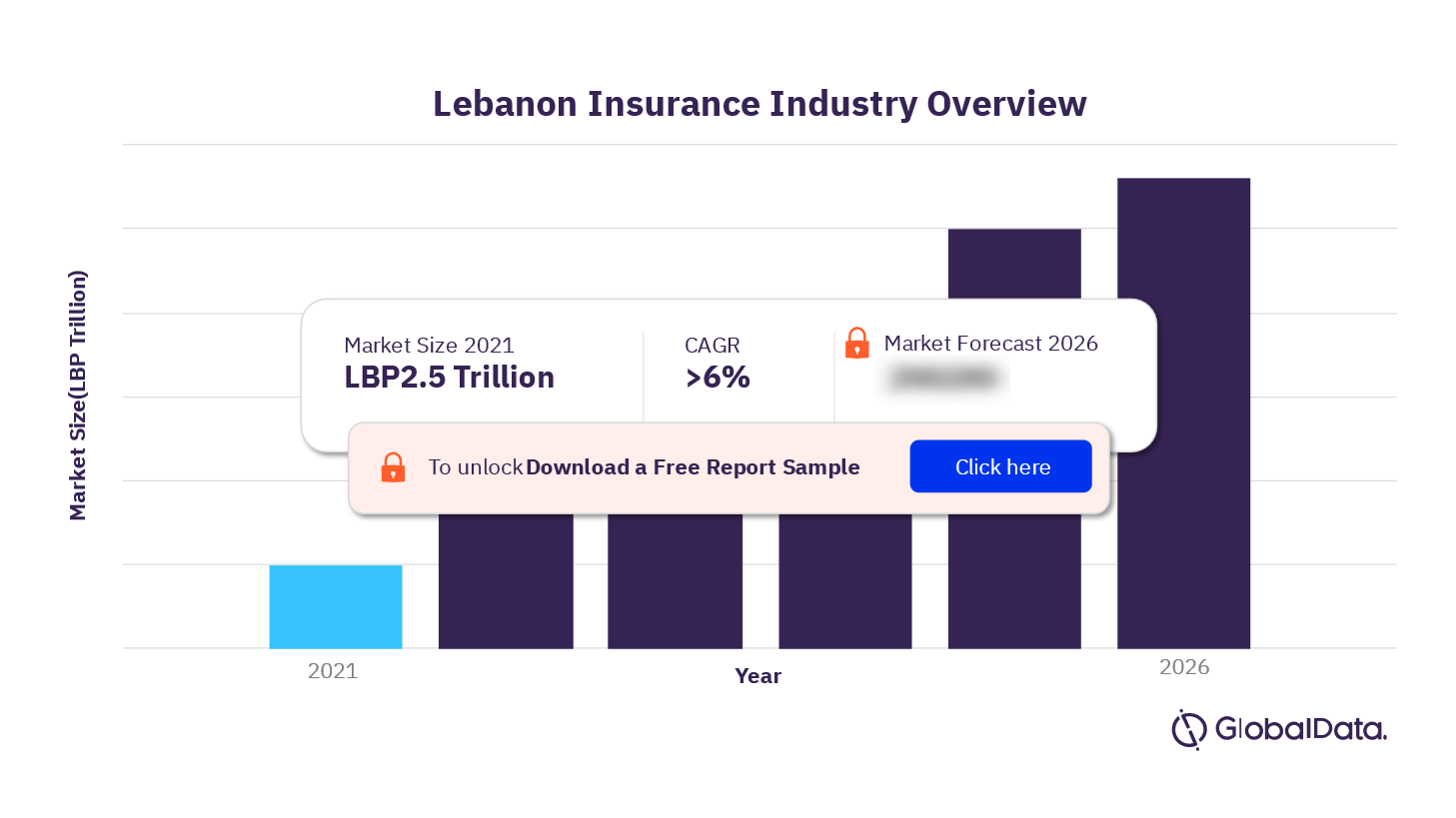

The gross written premium of the Lebanon insurance industry was LBP2.5 trillion ($1.7 billion) in 2021. The market is expected to achieve a CAGR of more than 6% during the forecast period 2021 to 2026. The Lebanon Insurance industry research report provides in-depth market analysis, information, insights, and a detailed outlook by product category of the industry. It provides values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review period and forecast period.

The report also analyzes distribution channels operating in the segment, gives a comprehensive overview of Lebanon’s economy and demographics, and provides detailed information on the competitive landscape in the country. The report gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. The report also includes details of insurance regulations, and recent changes in the regulatory structure.

For more insights on the Lebanon insurance industry forecast, download a free report sample

Lebanon Insurance Industry Trends

Nextcare—a company of Allianz—in partnership with Healthigo launched online appointment-booking services through an app. The app facilitates access to doctors and providers covered under the insurance plan opted for by the policyholder in just a few clicks.

A consortium led by Care France launched the project BASATINE. It stands for Bolstering Agriculture Systems’ Ability to Invest, Nourish, and Employ. BASATINE helps farmers in Lebanon struck with a severe financial and economic crisis causing food insecurity through micro insurance, which helps in boosting the financial skills of targeted farmers and supports financial planning and investment strategies.

Lebanon Insurance Industry Segments

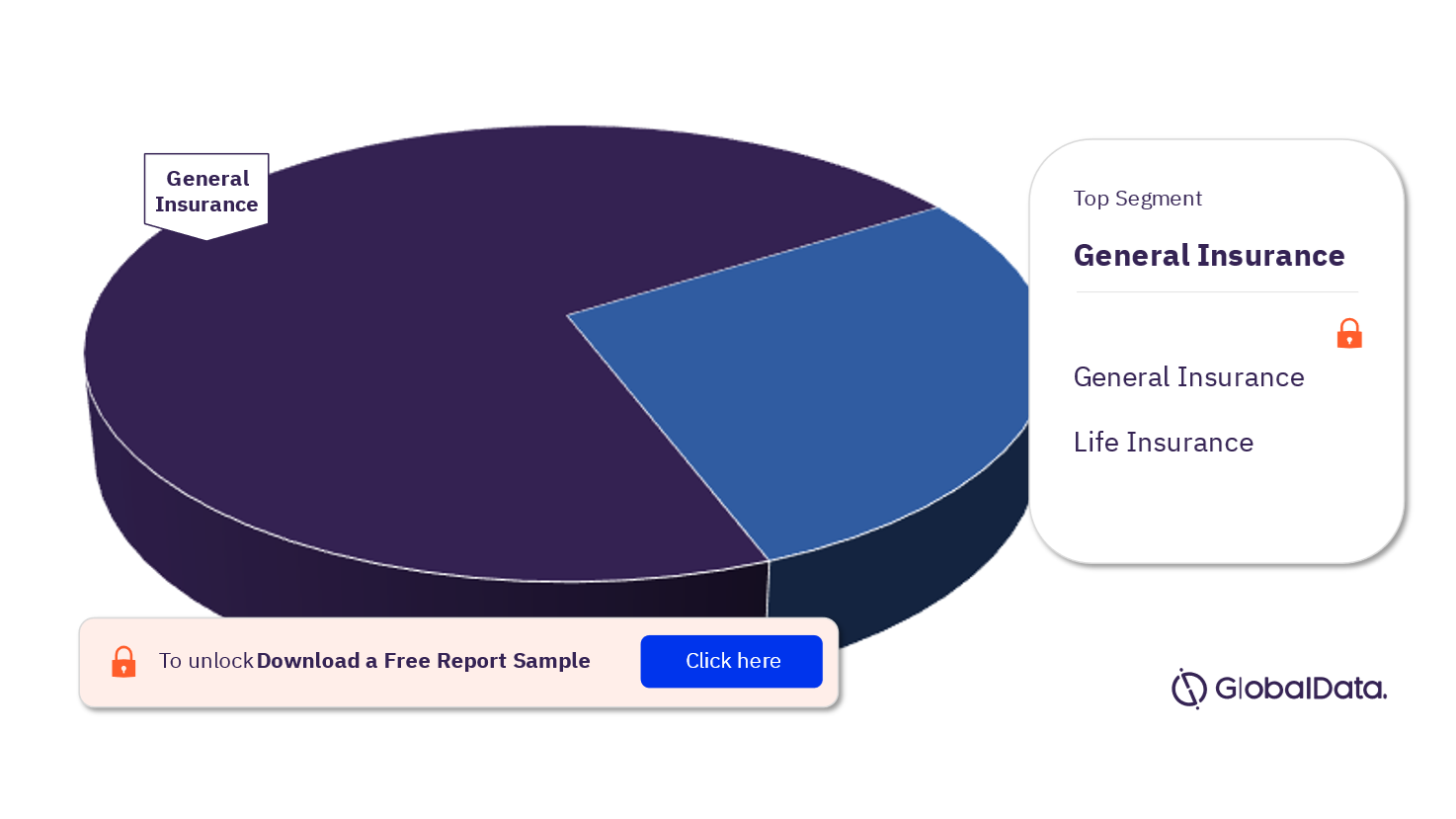

The key segments of the Lebanon insurance industry are general insurance and life insurance. The general insurance segment dominated the total insurance industry.

General Insurance: In 2021, growth in the general insurance segment was driven by the non-life PA&H insurance line and was followed by the motor insurance line. Bankers Assurance SAL was the largest insurer in the general insurance segment.

Life Insurance: The life insurance segment of Lebanon is highly concentrated, with the top five insurers accounting for the majority of GWP in 2021. MetLife Alico Lebanon was the largest life insurer.

Lebanon Insurance Industry Analysis, by Segments

For more segment insights in the Lebanon insurance industry, download a free report sample

Lebanon Insurance Industry - Competitive Landscape

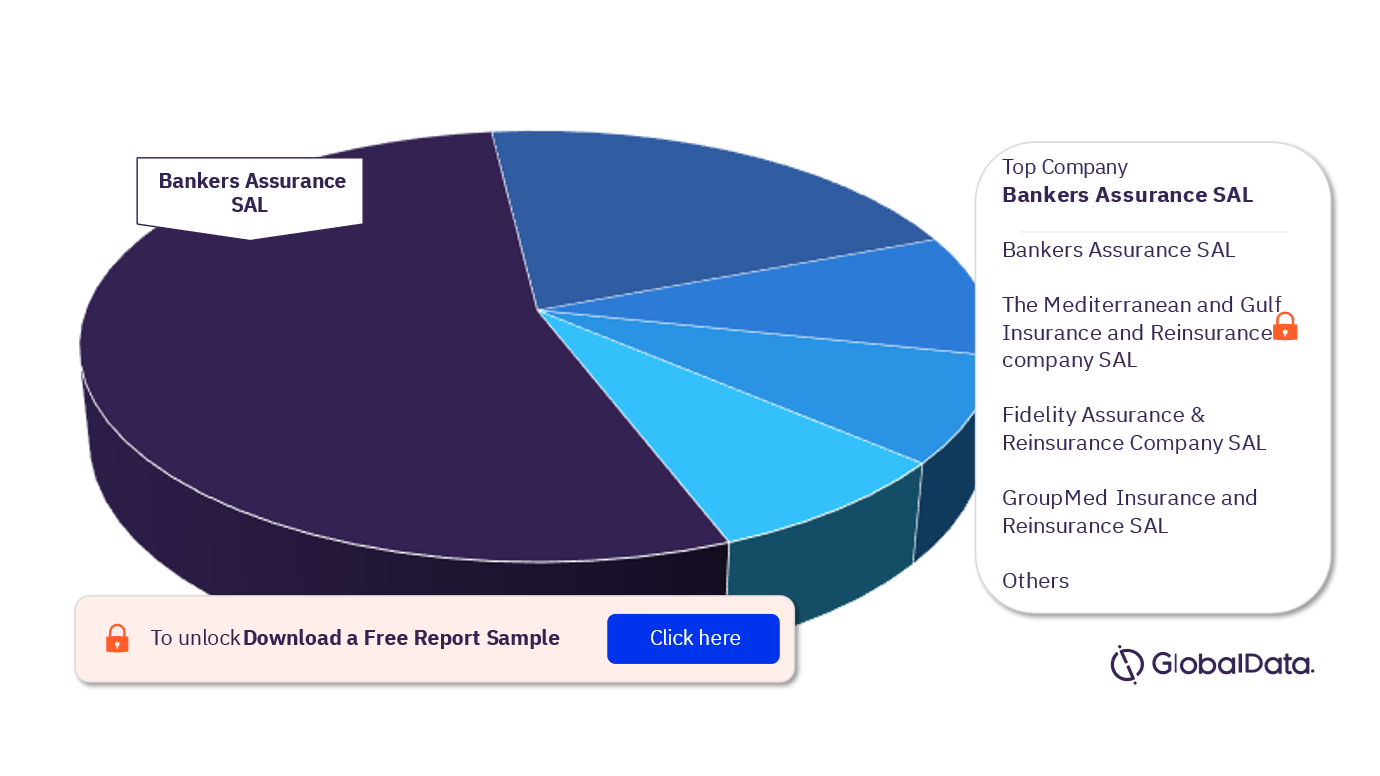

Some of the key insurance companies in the Lebanon insurance industry are Bankers Assurance SAL, The Mediterranean and Gulf Insurance and Reinsurance Company SAL, Fidelity Assurance & Reinsurance Company SAL, GroupMed Insurance and Reinsurance SAL, Allianz SNA (Societe Nationale d’Assurances), MetLife Alico Lebanon, Bancassurance SAL, Adonis Insurance and Reinsurance Company (Lebanon), Burgan Insurance Company SAL, The Capital Insurance and Reinsurance, and Trust Compass Insurance Company SAL. Bankers Assurance SAL was the largest insurer in 2021.

Lebanon Insurance Industry Analysis, by Companies

For more insights on the companies in the Lebanon insurance industry, download a free report sample

Lebanon Insurance Industry Report Overview

| Market Size (2021) | LBP2.5 trillion ($1.7 billion) (GWP) |

| CAGR (2021-2026) | >6% |

| Key Segments | General Insurance and Life Insurance |

| Key Companies | Bankers Assurance SAL, The Mediterranean and Gulf Insurance and Reinsurance Company SAL, Fidelity Assurance & Reinsurance Company SAL, GroupMed Insurance and Reinsurance SAL, Allianz SNA (Societe Nationale d’Assurances), MetLife Alico Lebanon, Bancassurance SAL, Adonis Insurance and Reinsurance Company (Lebanon), Burgan Insurance Company SAL, The Capital Insurance and Reinsurance, and Trust Compass Insurance Company SAL |

Scope

This report provides a comprehensive analysis of the Lebanon insurance industry –

- It provides historical values for the Lebanon insurance industry for the report’s review period, and projected figures for the forecast period.

- It offers a detailed analysis of the key categories in the Lebanon insurance industry, and market forecasts to 2026.

- It profiles the top life insurance companies in Lebanon and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to the Lebanon insurance industry, and each category within it.

- Understand the demand-side dynamics, key market trends, and growth opportunities in the Lebanon insurance industry.

- Assess the competitive dynamics in the Lebanon insurance industry.

- Identify growth opportunities and market dynamics in key product categories.

The Mediterranean and Gulf Insurance and Reinsurance Company SAL

Fidelity Assurance & Reinsurance Company SAL

LIA Assurex

Allianz SNA

AXA Middle East SAL

MetLife Alico Lebanon

Arope Insurance

Table of Contents

Frequently asked questions

-

What was the Lebanon insurance industry gross written premium in 2021?

The gross written premium of the Lebanon insurance industry was LBP2.5 trillion ($1.7 billion) in 2021.

-

What is the Lebanon insurance industry growth rate?

The insurance industry of Lebanon is expected to achieve a CAGR of more than 6% during the forecast period.

-

What are the key segments of the Lebanon insurance industry?

The key segments in the Lebanon insurance industry are general insurance and life insurance.

-

Which are the key companies in the Lebanon insurance industry?

Some of the key insurance companies in Lebanon are Bankers Assurance SAL, The Mediterranean and Gulf Insurance and Reinsurance Company SAL, Fidelity Assurance & Reinsurance Company SAL, GroupMed Insurance and Reinsurance SAL, Allianz SNA (Societe Nationale d’Assurances), MetLife Alico Lebanon, Bancassurance SAL, Adonis Insurance and Reinsurance Company (Lebanon), Burgan Insurance Company SAL, The Capital Insurance and Reinsurance, and Trust Compass Insurance Company SAL.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Financial Services reports