LNG Liquefaction Terminals Capacity and Capital Expenditure Forecast by Region, Key Countries, Companies and Projects, 2023-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

LNG Liquefaction Terminals Report Overview

The global liquefied natural gas (LNG) liquefaction capacity was 487.3 million tons per annum (mtpa) in 2022. North America is likely to lead the global LNG liquefaction capacity by 2027 with the US leading globally in terms of liquefaction capacity additions, followed by Russia and Qatar.

The LNG liquefaction terminals capacity and capital expenditure market research report provides historical LNG liquefaction capacities data from 2017 to 2022, outlook up to 2027. The report will help to obtain the most up-to-date information available on the LNG liquefaction projects globally and identify growth segments and opportunities in the global LNG industry. This will facilitate decision-making based on strong historical and outlook of LNG liquefaction capacity data.

| Market Size, 2022(million tons per annum) | 487.3 mtpa |

| Key Regions | · North America

· Asia · Europe · Africa · Middle East · Oceania · South America · Former Soviet Union · Caribbean |

| Key Countries | · The US

· Russia · Qatar · Canada · Mexico · Australia · Iran |

| Key Companies | · Novatek

· QatarEnergy · Venture Global Partners LLC · Tellurian Investments Inc · Sempra |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

LNG Liquefaction Market Segmentation by Regions

The key regions in the global LNG liquefaction market are Asia, Europe, Africa, the Middle East, North America, Oceania, South America, the Former Soviet Union, and the Caribbean. North America leads the global LNG liquefaction market in 2022. The market in North America is led by the US.

New projects are announced in the US. For instance, Grand Isle Floating is an announced offshore LNG liquefaction terminal proposed in Louisiana, US. To be owned and operated by Grand Isle LNG Holding Co LLC, the terminal is expected to commence operations in 2026.

Global LNG Liquefaction Market Analysis, by Regions, 2022 (%)

For more regional insights into the global LNG liquefaction market, download a free report sample

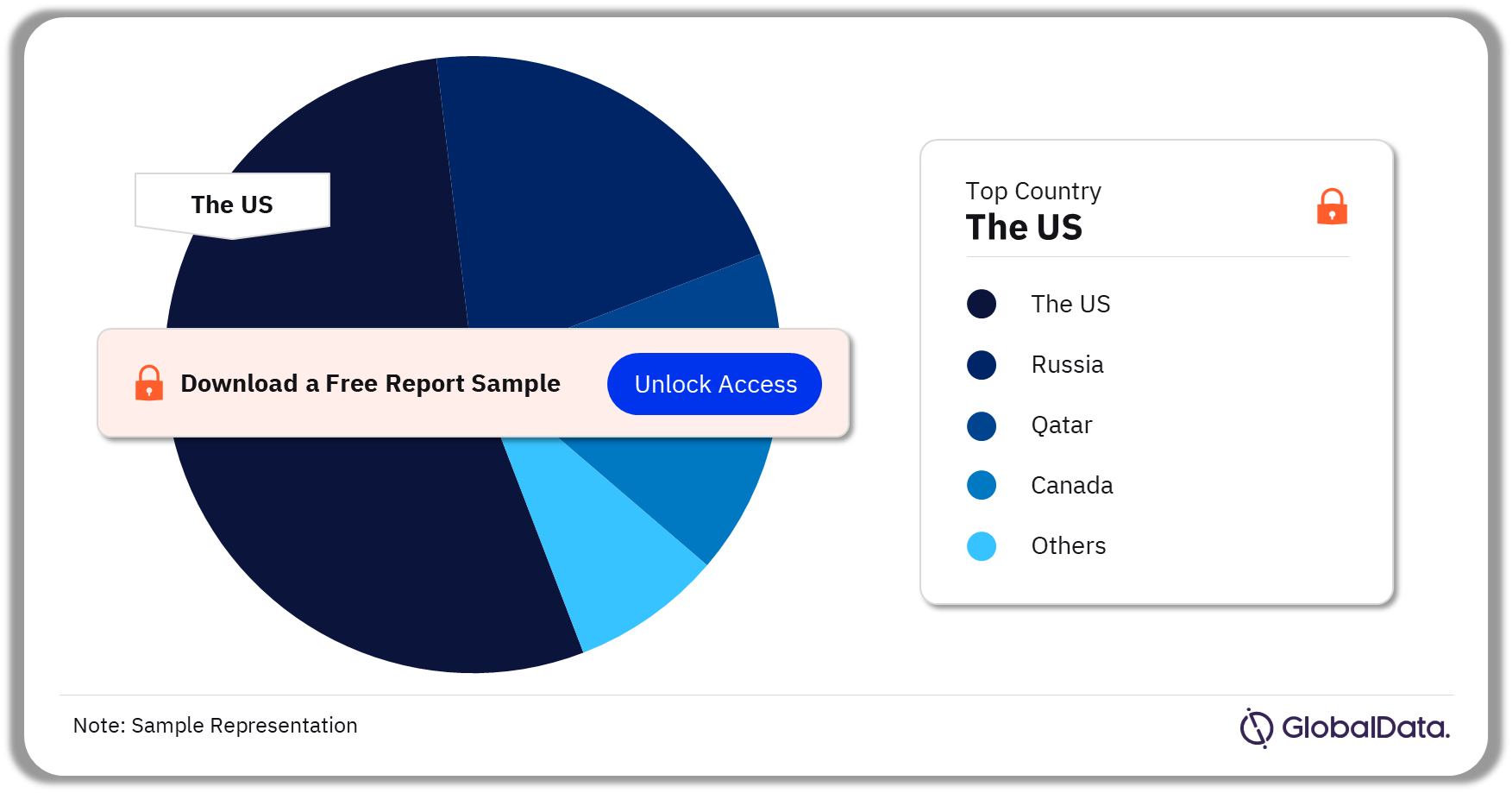

LNG Liquefaction Market Segmentation, by Countries

The key countries in the global LNG liquefaction market are the US, Russia, Qatar, Canada, Mexico, Australia, and Iran. The US leads among all the countries with the highest capacity additions in 2022.

Global LNG Liquefaction Market Analysis, By Countries, 2022 (%)

For more regional insights into the global LNG liquefaction market, download a free report sample

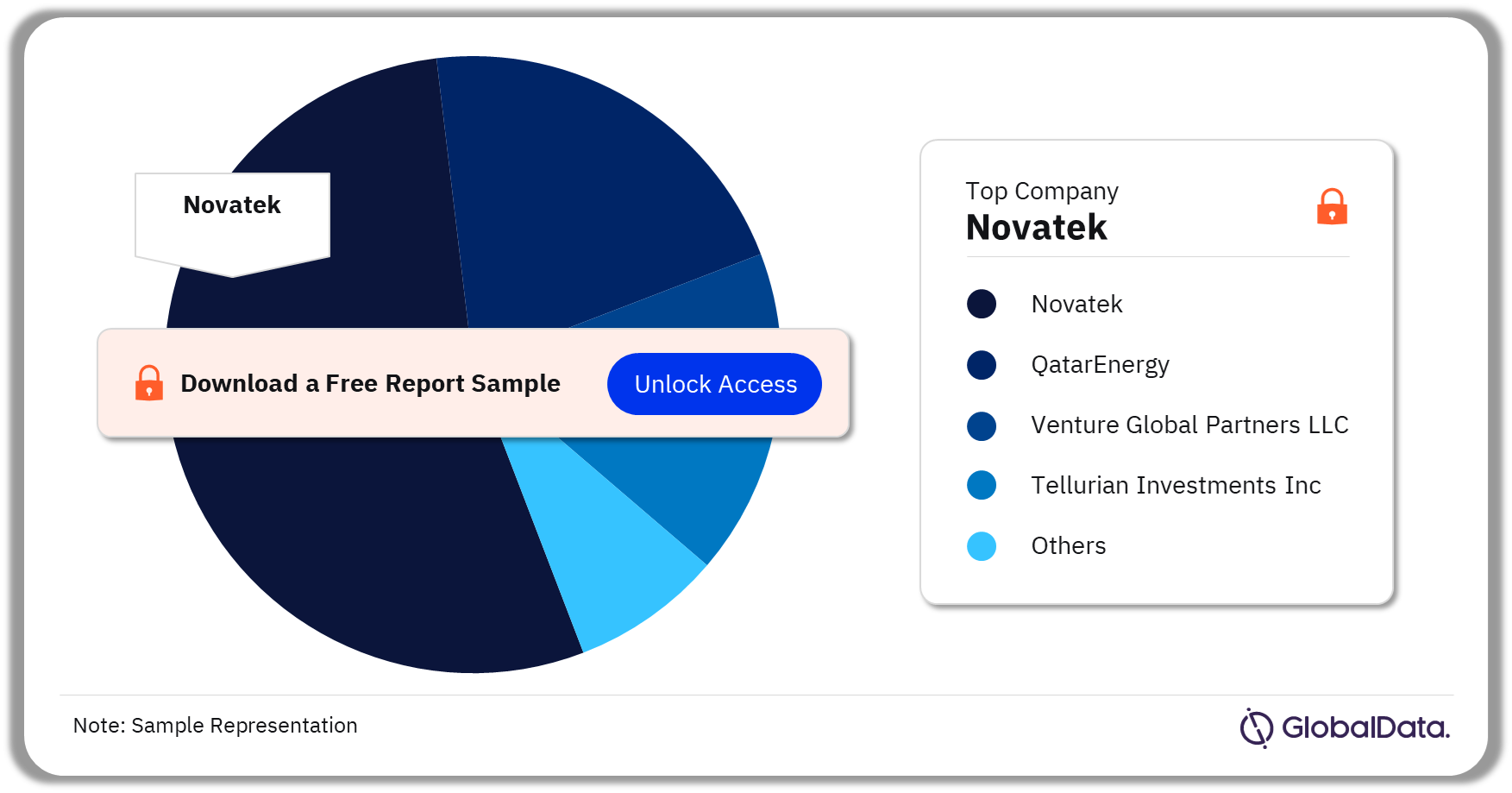

Competitive Landscape - LNG Liquefaction Market

The key companies in the global LNG liquefaction market are Novatek, QatarEnergy, Venture Global Partners LLC, Tellurian Investments Inc, and Sempra among others. Among companies, Novatek leads in terms of total capex on new-build and expansion liquefaction projects during 2023–2027. It is followed by QatarEnergy and Venture Global Partners LLC.

Global LNG Liquefaction Market Analysis, By Companies, 2023-2027 (%)

To know more about companies in the global LNG liquefaction market, download a free report sample

Segments Covered in this Report

LNG Liquefaction Market Regional Outlook (2017-2027)

- Asia

- Europe

- Africa

- Middle East

- North America

- Oceania

- South America

- Former Soviet Union

- Caribbean

LNG Liquefaction Market Countries Outlook (2017-2027)

- US

- Russia

- Qatar

- Canada

- Mexico

- Australia

- Iran

Scope

- Historical LNG liquefaction capacities data from 2017 to 2022, outlook up to 2027

- New build and expansion LNG liquefaction capacity additions by key countries

- New build and expansion capital expenditure outlook by key countries and companies globally

- Total capex of new build and expansion LNG liquefaction projects by region, key countries, and companies

- Details of major planned and announced LNG liquefaction projects globally up to 2027.

Reasons to Buy

- Obtain the most up to date information available on the LNG liquefaction projects globally.

- Identify growth segments and opportunities in the global LNG industry.

- Facilitate decision making based on strong historical and outlook of LNG liquefaction capacity data.

- Develop business strategies with the help of specific insights about LNG liquefaction projects globally.

- Keep abreast of key planned and announced LNG liquefaction projects globally.

- Assess your competitor’s planned and announced LNG liquefaction projects and capacities.

Table of Contents

Table

Figures

Frequently asked questions

-

Which region had the highest share in the LNG liquefaction market in 2022?

North America leads the global LNG liquefaction market in 2022.

-

Which country had the highest share in the LNG liquefaction market in 2022?

The US had the highest share in the LNG liquefaction market in 2022.

-

Which are the key companies in the LNG liquefaction market?

The key companies in the global LNG liquefaction market are Novatek, QatarEnergy, Venture Global Partners LLC, Tellurian Investments Inc, and Sempra among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.